Region:North America

Author(s):Dev

Product Code:KRAA8356

Pages:98

Published On:November 2025

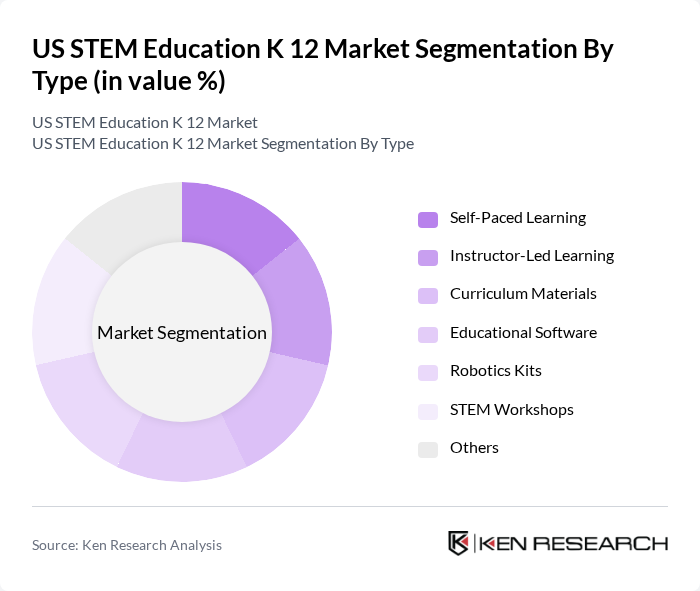

By Type:The market is segmented into various types, including Self-Paced Learning, Instructor-Led Learning, Curriculum Materials, Educational Software, Robotics Kits, STEM Workshops, and Others. Among these, Self-Paced Learning currently holds the largest share, driven by its flexibility, scalability, and compatibility with digital platforms. However, Instructor-Led Learning is experiencing the fastest growth due to rising demand for interactive and structured STEM instruction. The demand for interactive and adaptive learning solutions remains strong, making Educational Software a critical component of the STEM education landscape .

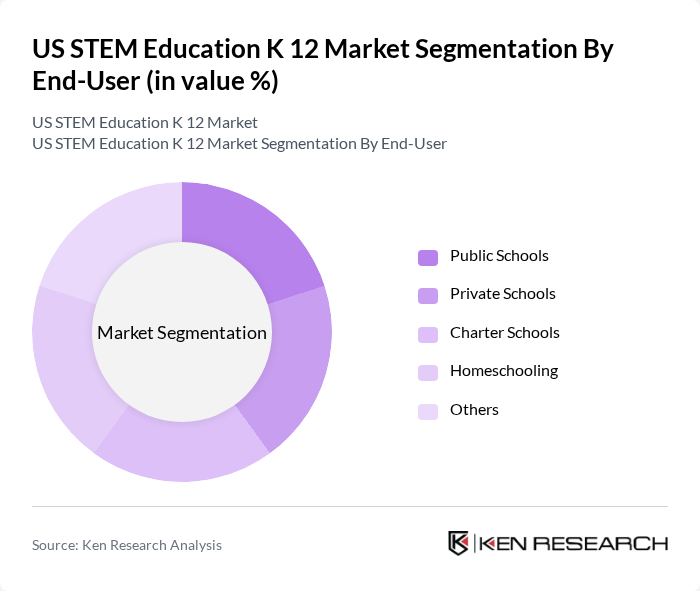

By End-User:This segmentation includes Public Schools, Private Schools, Charter Schools, Homeschooling, and Others. Public Schools dominate the market, accounting for the largest share due to their extensive student populations and sustained government funding. The increasing focus on STEM education in public school curricula, along with state and federal initiatives, has led to a surge in the adoption of STEM programs and resources, making them the primary end-users in this sector .

The US STEM Education K 12 Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pearson Education, McGraw-Hill Education, Houghton Mifflin Harcourt, Discovery Education, STEMscopes (Accelerate Learning Inc.), Code.org, Tynker, LEGO Education, National Geographic Learning (Cengage), Edmentum, Amplify, BrainPOP, Nearpod, Stride, Inc. (formerly K12 Inc.), Zearn, BYJU'S, MEL Science, edX LLC, STEM Learning Ltd., Stemi Education contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. STEM education K-12 market appears promising, driven by ongoing investments in technology and curriculum development. As educational institutions increasingly adopt innovative teaching methods, such as project-based learning and gamification, student engagement is expected to rise. Furthermore, the emphasis on diversity and inclusion will likely lead to broader participation in STEM fields, fostering a more equitable educational landscape. These trends indicate a robust evolution in STEM education, aligning with workforce demands and societal needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Self-Paced Learning Instructor-Led Learning Curriculum Materials Educational Software Robotics Kits STEM Workshops Others |

| By End-User | Public Schools Private Schools Charter Schools Homeschooling Others |

| By Grade Level | Elementary School (K-5) Middle School (6-8) High School (9-12) Others |

| By Subject Area | Science Technology Engineering Mathematics Others |

| By Delivery Method | In-Person Learning Online Learning Hybrid Learning Others |

| By Funding Source | Government Grants Private Investments Non-Profit Organizations Others |

| By Technology Integration | Virtual Reality Augmented Reality Artificial Intelligence Robotics Gamified Learning Platforms Others |

| By Region | North America Europe Asia-Pacific Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 STEM Curriculum Implementation | 60 | STEM Coordinators, Curriculum Developers |

| Teacher Training Programs for STEM | 50 | Professional Development Leaders, Educators |

| Student Engagement in STEM Activities | 70 | Students, Parents, School Counselors |

| Partnerships with Tech Companies | 40 | School Administrators, Industry Representatives |

| Impact of STEM on Student Outcomes | 45 | Education Researchers, Assessment Analysts |

The US STEM Education K-12 market is valued at approximately USD 14 billion, reflecting significant growth driven by increased investments in STEM initiatives, the demand for digital learning tools, and the integration of technology in educational settings.