Region:North America

Author(s):Rebecca

Product Code:KRAD5018

Pages:91

Published On:December 2025

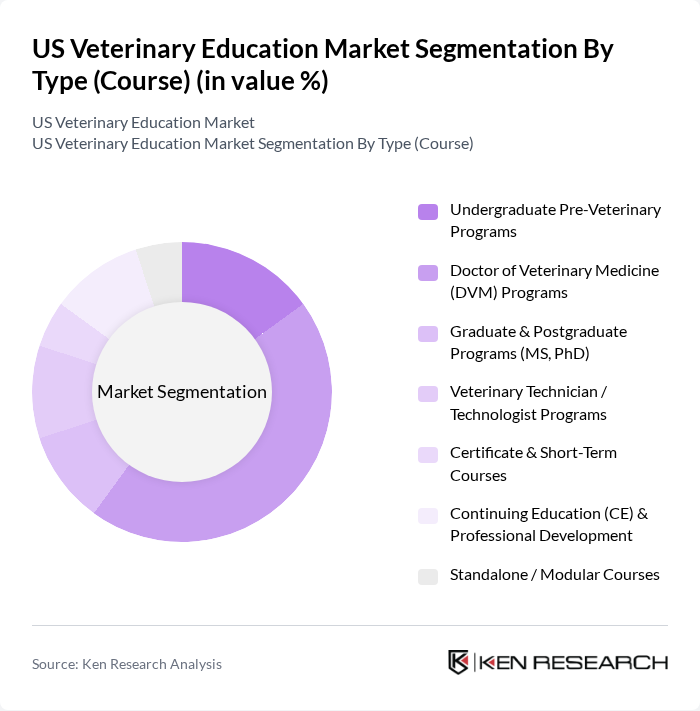

By Type (Course):The veterinary education market is segmented into various types of courses that cater to different educational needs and career paths within the veterinary field. The subsegments include Undergraduate Pre-Veterinary Programs, Doctor of Veterinary Medicine (DVM) Programs, Graduate & Postgraduate Programs (MS, PhD), Veterinary Technician / Technologist Programs, Certificate & Short-Term Courses, Continuing Education (CE) & Professional Development, and Standalone / Modular Courses. Among these, the Doctor of Veterinary Medicine (DVM) Programs dominate the market in value terms, as the professional DVM degree is the core qualification required for licensure as a veterinarian in the United States and carries the highest tuition and fee levels. The increasing complexity of animal healthcare, growing demand for specialized veterinary services, and strong employment growth for veterinarians have supported steady enrollment in DVM programs and associated graduate-level training pathways.

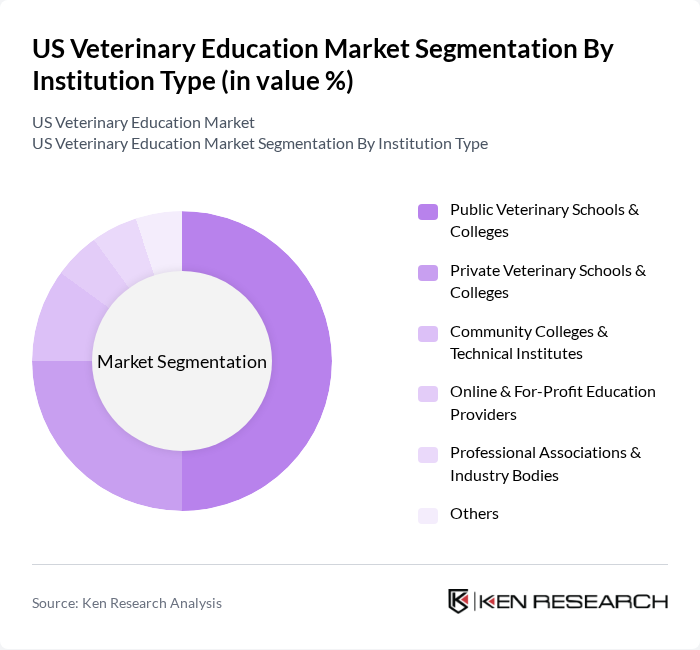

By Institution Type:This segmentation focuses on the various types of institutions that provide veterinary education. The subsegments include Public Veterinary Schools & Colleges, Private Veterinary Schools & Colleges, Community Colleges & Technical Institutes, Online & For-Profit Education Providers, Professional Associations & Industry Bodies, and Others. Public Veterinary Schools & Colleges lead the market due to their established reputation, broad program offerings in clinical and research training, and often lower in?state tuition costs compared to private institutions. These schools typically receive state funding and federal research support, allowing them to invest in advanced teaching hospitals, simulation labs, and specialty services, which attracts a larger student body and supports higher overall revenue contribution to the veterinary education market.

The US Veterinary Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of California, Davis – School of Veterinary Medicine, Cornell University College of Veterinary Medicine, Colorado State University College of Veterinary Medicine and Biomedical Sciences, Texas A&M University School of Veterinary Medicine and Biomedical Sciences, The Ohio State University College of Veterinary Medicine, University of Florida College of Veterinary Medicine, North Carolina State University College of Veterinary Medicine, University of Wisconsin–Madison School of Veterinary Medicine, Washington State University College of Veterinary Medicine, University of Illinois Urbana?Champaign College of Veterinary Medicine, Purdue University College of Veterinary Medicine, University of Minnesota College of Veterinary Medicine, Michigan State University College of Veterinary Medicine, University of Georgia College of Veterinary Medicine, Cummings School of Veterinary Medicine at Tufts University contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. veterinary education market appears promising, driven by technological advancements and evolving pet care needs. As the integration of telemedicine and digital tools becomes more prevalent, veterinary programs will likely adapt to include these innovations in their curricula. Additionally, the increasing focus on animal welfare and mental health will create new educational pathways, ensuring that veterinary professionals are well-equipped to meet the diverse needs of pet owners and their animals in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Course) | Undergraduate Pre-Veterinary Programs Doctor of Veterinary Medicine (DVM) Programs Graduate & Postgraduate Programs (MS, PhD) Veterinary Technician / Technologist Programs Certificate & Short-Term Courses Continuing Education (CE) & Professional Development Standalone / Modular Courses |

| By Institution Type | Public Veterinary Schools & Colleges Private Veterinary Schools & Colleges Community Colleges & Technical Institutes Online & For?Profit Education Providers Professional Associations & Industry Bodies Others |

| By Program Duration | Less than 1 Year –2 Years –4 Years More than 4 Years Self?Paced / On?Demand |

| By Specialization | Veterinary Medicine (General Practice & Clinical Medicine) Veterinary Surgery Veterinary Nursing / Technology Animal Grooming & Companion Animal Services Public Health, Food Safety & Epidemiology Diagnostic Imaging, Pathology & Laboratory Medicine Other Specialties (Oncology, Cardiology, etc.) |

| By Delivery Mode | Classroom?Based / On?Campus Learning E?Learning / Online Courses Hybrid / Blended Learning Simulation?Based & Experiential Training |

| By End Customer | New Students (First?Time Entrants) Practicing Veterinarians Veterinary Technicians & Nurses Other Animal Health Professionals Corporate & Institutional Buyers |

| By Funding Source | Federal & State Funding / Grants Institutional & Endowment Funding Tuition & Student Fees Private Scholarships & Philanthropy Employer & Industry?Sponsored Education Student Loans & Financial Aid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary College Deans | 40 | Deans, Program Directors |

| Current Veterinary Students | 150 | Undergraduate and Graduate Veterinary Students |

| Veterinary Educators | 75 | Faculty Members, Curriculum Developers |

| Veterinary Industry Professionals | 100 | Veterinarians, Practice Managers |

| Veterinary Licensing Board Officials | 40 | Regulatory Board Members, Licensing Officials |

The US Veterinary Education Market is valued at approximately USD 750 million, reflecting a significant growth driven by increasing demand for veterinary services, rising pet ownership, and the need for advanced veterinary education to address complex animal healthcare challenges.