Region:North America

Author(s):Dev

Product Code:KRAD1655

Pages:97

Published On:November 2025

By Product Type:The product type segmentation of the women wear market includes various categories such as tops, bottom wear, dresses, outerwear, activewear, intimates, swimwear, maternity wear, plus-size clothing, and others. Among these, tops—including blouses, t-shirts, sweaters, and cardigans—dominate the market due to their versatility and frequent use in everyday fashion. Bottom wear, including jeans and trousers, also holds a significant share as consumers prioritize comfort, fit, and style in their choices. The growing popularity of athleisure and activewear reflects the increasing emphasis on health, wellness, and casual dressing, while demand for plus-size and inclusive apparel is rising as brands expand their offerings to cater to diverse body types .

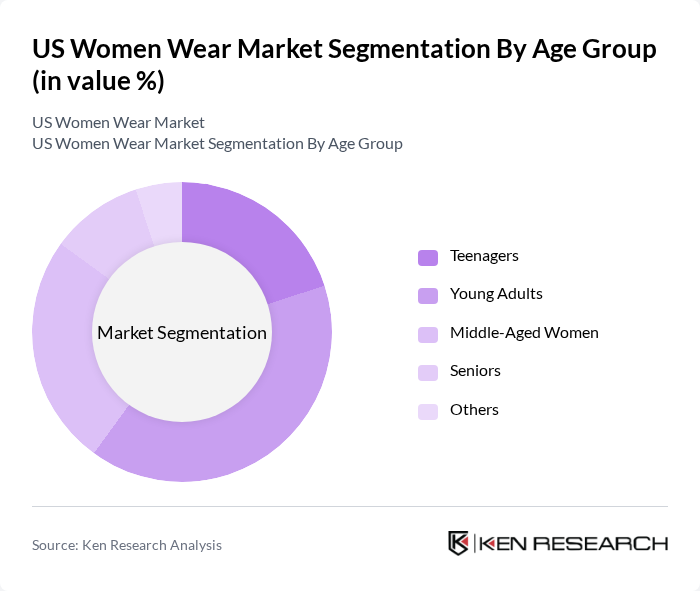

By Age Group:The age group segmentation includes teenagers, young adults, middle-aged women, seniors, and others. Young adults represent the largest segment, driven by their fashion-forward mindset, willingness to experiment with styles, and high engagement with digital shopping platforms. Teenagers also contribute significantly to the market, influenced by social media trends, celebrity endorsements, and fast fashion. Middle-aged women are increasingly seeking stylish yet comfortable options, while seniors focus on practicality, comfort, and ease of wear. Brands are expanding their product lines to address the needs of all age groups, with targeted marketing and inclusive sizing .

The US Women Wear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Lululemon Athletica Inc., Gap Inc., Levi Strauss & Co., Under Armour, Inc., VF Corporation (The North Face, Vans, Timberland), H&M Hennes & Mauritz AB, Zara (Inditex), American Eagle Outfitters, Inc., ASOS plc, Forever 21, Anthropologie (URBN, Inc.), Free People (URBN, Inc.), Aerie (American Eagle Outfitters, Inc.), Madewell (J.Crew Group, Inc.), J.Crew Group, Inc., Macy's, Inc., Nordstrom, Inc., Target Corporation, Walmart Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US women wear market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize eco-friendly practices are likely to thrive. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement. The rise of social commerce will further reshape the retail landscape, enabling brands to connect with consumers in innovative ways, ensuring a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Tops (Blouses, T-shirts, Sweaters, Cardigans) Bottom Wear (Jeans, Trousers, Skirts, Leggings) Dresses Outerwear (Coats, Jackets, Suits) Activewear/Sportswear Intimates & Sleepwear Swimwear Maternity Wear Plus-Size Clothing Others |

| By Age Group | Teenagers Young Adults Middle-Aged Women Seniors Others |

| By Occasion | Everyday Wear Workwear/Formal Wear Party/Evening Wear Sports and Fitness Others |

| By Fabric Type | Cotton Polyester Silk Wool Blends Others |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Discount Stores Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Women's Wear Sales | 150 | Store Managers, Regional Buyers |

| Consumer Preferences in Women's Fashion | 120 | Female Consumers aged 18-45 |

| Online Shopping Behavior for Women's Apparel | 100 | eCommerce Managers, Digital Marketing Specialists |

| Sustainability Trends in Women's Wear | 80 | Sustainability Officers, Product Development Managers |

| Fashion Influencers and Their Impact | 40 | Fashion Bloggers, Social Media Influencers |

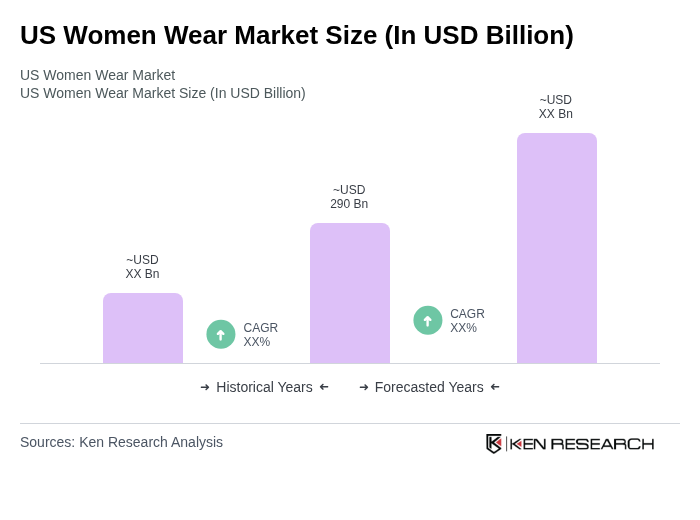

The US Women Wear Market is valued at approximately USD 290 billion, reflecting significant growth driven by consumer demand for fashionable and comfortable clothing, the rise of e-commerce, and a focus on sustainability and ethical fashion practices.