Region:North America

Author(s):Rebecca

Product Code:KRAB5343

Pages:93

Published On:October 2025

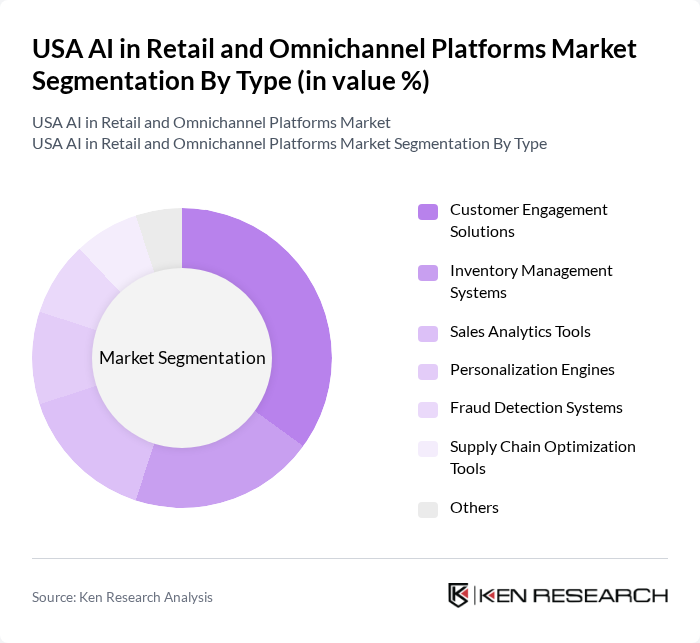

By Type:The market is segmented into various types of AI solutions that cater to different aspects of retail operations. The subsegments include Customer Engagement Solutions, Inventory Management Systems, Sales Analytics Tools, Personalization Engines, Fraud Detection Systems, Supply Chain Optimization Tools, and Others. Among these, Customer Engagement Solutions are leading the market due to the increasing demand for personalized shopping experiences and enhanced customer interactions.

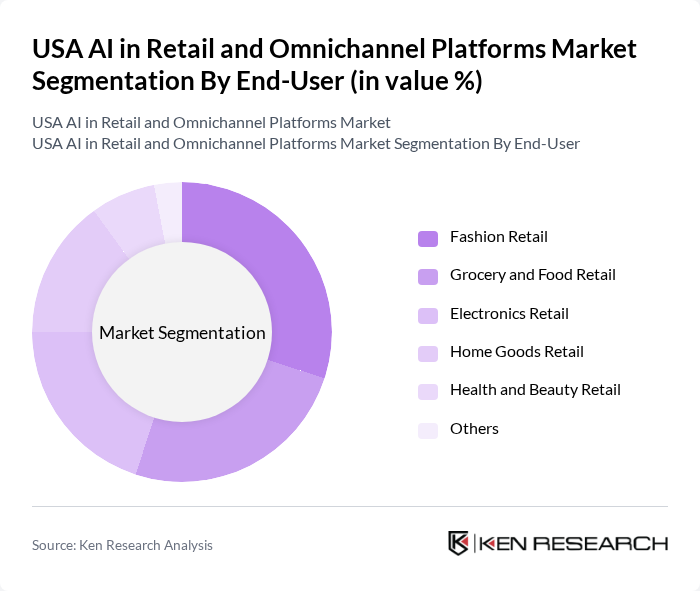

By End-User:The end-user segmentation includes various retail sectors such as Fashion Retail, Grocery and Food Retail, Electronics Retail, Home Goods Retail, Health and Beauty Retail, and Others. Fashion Retail is currently the dominant segment, driven by the rapid adoption of AI for trend analysis, inventory management, and personalized marketing strategies that cater to consumer preferences.

The USA AI in Retail and Omnichannel Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.com, Inc., Walmart Inc., Target Corporation, The Home Depot, Inc., Best Buy Co., Inc., Macy's, Inc., Lowe's Companies, Inc., Alibaba Group Holding Limited, eBay Inc., Shopify Inc., Kroger Co., Costco Wholesale Corporation, CVS Health Corporation, Nordstrom, Inc., Wayfair Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA AI in retail and omnichannel platforms market appears promising, driven by technological advancements and evolving consumer preferences. As retailers increasingly adopt AI solutions, they will enhance operational efficiencies and customer experiences. The focus on sustainability and ethical AI practices will shape industry standards, encouraging innovation. Additionally, the integration of AI with emerging technologies like blockchain and IoT will further transform retail operations, creating new avenues for growth and competitive advantage in the marketplace.

| Segment | Sub-Segments |

|---|---|

| By Type | Customer Engagement Solutions Inventory Management Systems Sales Analytics Tools Personalization Engines Fraud Detection Systems Supply Chain Optimization Tools Others |

| By End-User | Fashion Retail Grocery and Food Retail Electronics Retail Home Goods Retail Health and Beauty Retail Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Mobile Applications Social Media Platforms Others |

| By Customer Segment | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) Others |

| By Geographic Presence | National Chains Regional Retailers Local Boutiques Others |

| By Product Category | Apparel Electronics Home Appliances Beauty Products Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Adoption in Fashion Retail | 100 | Chief Technology Officers, Retail Managers |

| Omnichannel Strategies in Electronics | 80 | Marketing Directors, E-commerce Managers |

| Customer Experience Enhancement in Groceries | 70 | Operations Managers, Customer Experience Officers |

| Data Analytics in Home Goods Retail | 60 | Data Analysts, IT Managers |

| Supply Chain Optimization in Retail | 90 | Supply Chain Directors, Logistics Managers |

The USA AI in Retail and Omnichannel Platforms Market is valued at approximately USD 15 billion, reflecting significant growth driven by the adoption of AI technologies to enhance customer experiences and streamline retail operations.