Region:North America

Author(s):Dev

Product Code:KRAB3624

Pages:84

Published On:October 2025

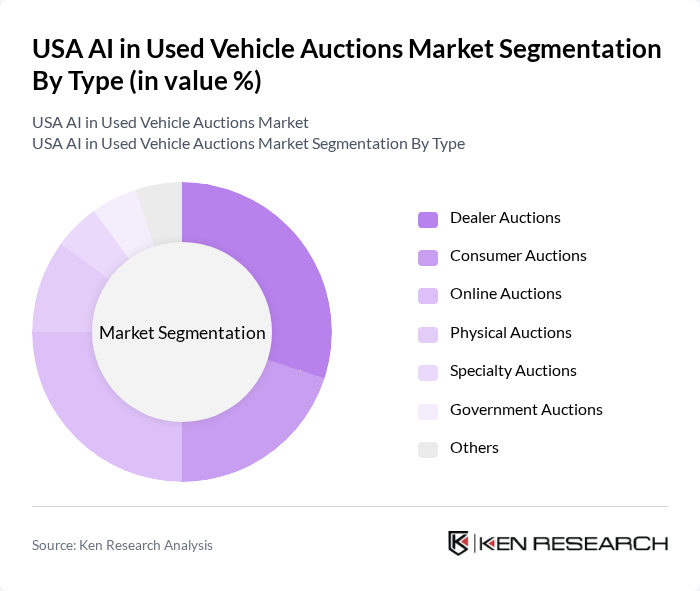

By Type:The market is segmented into various types, including Dealer Auctions, Consumer Auctions, Online Auctions, Physical Auctions, Specialty Auctions, Government Auctions, and Others. Each of these segments caters to different buyer preferences and operational models, reflecting the diverse landscape of used vehicle auctions.

The Dealer Auctions segment is currently leading the market due to the established relationships between dealers and their customers, which facilitate smoother transactions. This segment benefits from the trust and reliability associated with established dealerships, making it a preferred choice for many buyers. Additionally, the growing trend of trade-ins and dealer-to-dealer sales further bolsters this segment's dominance. Online Auctions are also gaining traction, particularly among tech-savvy consumers who prefer the convenience of bidding from home.

Individual Buyers represent the largest segment in the market, driven by the increasing number of consumers seeking affordable vehicle options. The rise of online platforms has made it easier for individuals to participate in auctions, thus expanding this segment. Car Dealerships follow closely, leveraging their networks to acquire vehicles for resale. Fleet Management Companies are also significant players, often purchasing in bulk to maintain their vehicle inventories.

The USA AI in Used Vehicle Auctions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Manheim, Copart, IAA, Inc., ADESA, Auction123, Cars.com, VAuto, CarGurus, TrueCar, AutoTrader, eBay Motors, Bring a Trailer, Carvana, Shift Technologies, Tred contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA AI in used vehicle auctions market appears promising, driven by technological advancements and evolving consumer preferences. As AI capabilities expand, auction platforms will increasingly leverage predictive analytics to enhance pricing strategies and inventory management. Additionally, the shift towards mobile auction applications is expected to facilitate greater accessibility and convenience for users. These trends indicate a dynamic market landscape, where innovation will play a crucial role in shaping competitive strategies and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Dealer Auctions Consumer Auctions Online Auctions Physical Auctions Specialty Auctions Government Auctions Others |

| By End-User | Individual Buyers Car Dealerships Fleet Management Companies Rental Services Exporters Others |

| By Auction Format | Live Auctions Online Auctions Hybrid Auctions Sealed Bid Auctions Others |

| By Vehicle Condition | Certified Pre-Owned Used Vehicles Salvage Vehicles Others |

| By Price Range | Below $10,000 $10,000 - $20,000 $20,000 - $30,000 Above $30,000 Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage Others |

| By Payment Method | Cash Payments Financing Options Trade-Ins Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Vehicle Auction Participants | 150 | Buyers, Sellers, Auction House Representatives |

| Automotive Industry Experts | 100 | Market Analysts, Economists, Industry Consultants |

| Consumer Behavior Insights | 120 | Recent Buyers of Used Vehicles, Auction Participants |

| Dealership Perspectives | 80 | Used Vehicle Dealers, Franchise Owners |

| Regulatory Impact Assessment | 60 | Policy Makers, Regulatory Agency Officials |

The USA AI in Used Vehicle Auctions Market is valued at approximately USD 15 billion, reflecting significant growth driven by the adoption of artificial intelligence technologies in the automotive sector, enhancing auction efficiency and transparency.