Region:North America

Author(s):Rebecca

Product Code:KRAB5381

Pages:89

Published On:October 2025

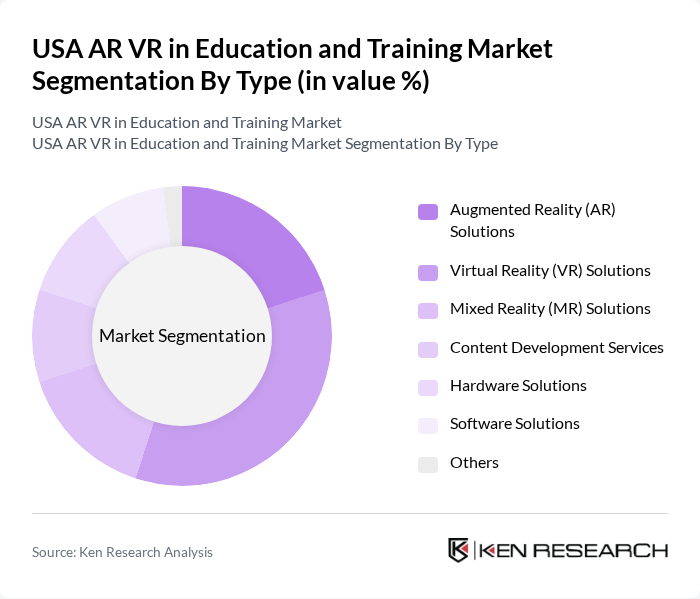

By Type:The market is segmented into various types, including Augmented Reality (AR) Solutions, Virtual Reality (VR) Solutions, Mixed Reality (MR) Solutions, Content Development Services, Hardware Solutions, Software Solutions, and Others. Among these, Virtual Reality (VR) Solutions are currently dominating the market due to their immersive capabilities that provide realistic simulations for learners. The increasing demand for experiential learning and the ability to create engaging training environments are driving the adoption of VR solutions in educational institutions.

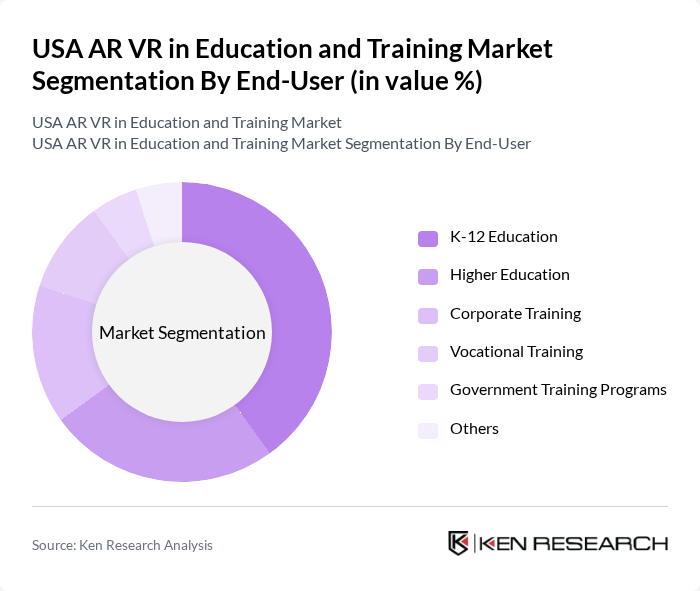

By End-User:The end-user segmentation includes K-12 Education, Higher Education, Corporate Training, Vocational Training, Government Training Programs, and Others. K-12 Education is the leading segment, driven by the increasing integration of AR and VR technologies in classrooms to enhance interactive learning experiences. Schools are increasingly adopting these technologies to improve student engagement and facilitate personalized learning, making K-12 Education a significant contributor to market growth.

The USA AR VR in Education and Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Microsoft Corporation, Oculus VR (Meta Platforms, Inc.), Unity Technologies, Pearson Education, Immersive VR Education, zSpace, Inc., ClassVR, Nearpod, Inc., Engage VR, Prowise, Labster, EON Reality, HTC Corporation, Alchemy VR contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AR/VR education market in the USA appears promising, driven by technological advancements and increasing acceptance among educators. As immersive learning becomes more mainstream, institutions are likely to invest in tailored AR/VR solutions that cater to diverse learning needs. Additionally, the integration of AI with AR/VR technologies is expected to enhance personalized learning experiences, making education more engaging and effective. The ongoing shift towards remote learning will further accelerate the adoption of these innovative tools in educational settings.

| Segment | Sub-Segments |

|---|---|

| By Type | Augmented Reality (AR) Solutions Virtual Reality (VR) Solutions Mixed Reality (MR) Solutions Content Development Services Hardware Solutions Software Solutions Others |

| By End-User | K-12 Education Higher Education Corporate Training Vocational Training Government Training Programs Others |

| By Application | Classroom Learning Remote Learning Simulation Training Assessment and Evaluation Skill Development Others |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers Partnerships with Educational Institutions Others |

| By Content Type | Interactive Learning Modules Educational Games Training Simulations Assessment Tools Others |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium Model Pay-Per-Use Others |

| By User Demographics | Age Group (Children, Teenagers, Adults) Learning Styles (Visual, Auditory, Kinesthetic) Educational Background (Primary, Secondary, Tertiary) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Education AR/VR Implementation | 100 | School Administrators, Technology Coordinators |

| Higher Education AR/VR Usage | 80 | University Professors, IT Directors |

| Corporate Training Programs | 70 | Training Managers, Learning & Development Specialists |

| AR/VR Content Development | 60 | Content Creators, Instructional Designers |

| Student Experience with AR/VR | 90 | Students, Recent Graduates |

The USA AR VR in Education and Training Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of immersive technologies in educational institutions, enhancing student engagement and learning outcomes.