Region:North America

Author(s):Geetanshi

Product Code:KRAB5768

Pages:82

Published On:October 2025

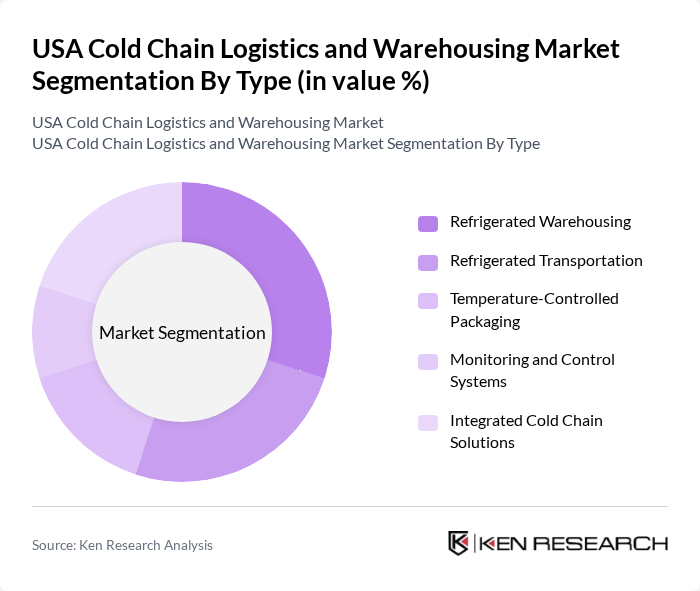

By Type:The cold chain logistics and warehousing market can be segmented into various types, including Refrigerated Warehousing, Refrigerated Transportation, Temperature-Controlled Packaging, Monitoring and Control Systems, and Integrated Cold Chain Solutions. Each of these segments plays a crucial role in ensuring the safe and efficient handling of temperature-sensitive goods. Refrigerated transportation and warehousing are experiencing robust growth due to the increased movement of perishable foods and pharmaceuticals, while monitoring and control systems are gaining traction for real-time temperature and compliance management .

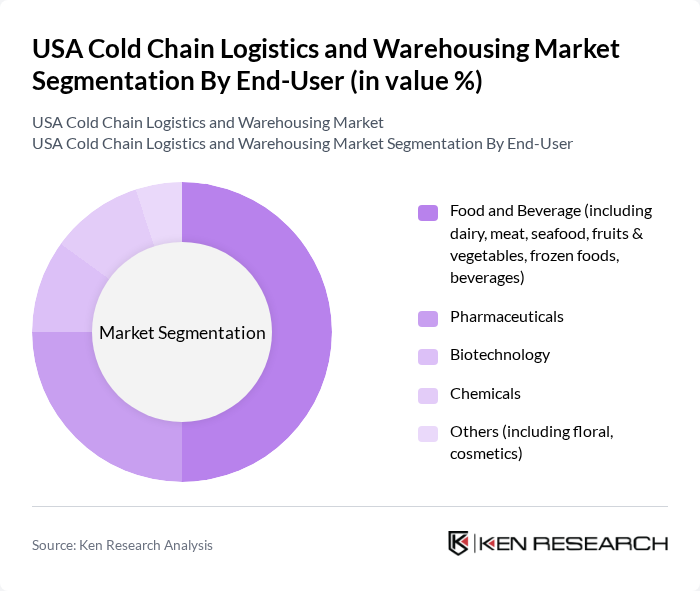

By End-User:The end-user segmentation of the cold chain logistics and warehousing market includes Food and Beverage, Pharmaceuticals, Biotechnology, Chemicals, and Others. The food and beverage sector is particularly significant due to the high demand for fresh and frozen products, which require stringent temperature controls during storage and transportation. Pharmaceuticals and biotechnology are also expanding rapidly, driven by the need for specialized storage and distribution of vaccines, biologics, and temperature-sensitive drugs .

The USA Cold Chain Logistics and Warehousing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americold Realty Trust, Lineage Logistics Holdings, LLC, United States Cold Storage, Inc., NewCold Advanced Cold Logistics, Cold Chain Technologies, LLC, VersaCold Logistics Services, XPO Logistics, Inc., DHL Supply Chain (Deutsche Post DHL Group), C.H. Robinson Worldwide, Inc., Sysco Corporation, McLane Company, Inc., Penske Logistics, A.P. Moller - Maersk, Kuehne + Nagel International AG, DB Schenker contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA cold chain logistics market appears promising, driven by increasing consumer demand for fresh and safe food products. As e-commerce continues to expand, logistics providers are likely to invest in advanced technologies, such as IoT and AI, to enhance operational efficiency. Additionally, sustainability initiatives will play a crucial role, as companies seek to reduce their carbon footprint while meeting regulatory requirements. The focus on last-mile delivery solutions will also intensify, ensuring timely and efficient distribution of perishable goods.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehousing Refrigerated Transportation Temperature-Controlled Packaging Monitoring and Control Systems Integrated Cold Chain Solutions |

| By End-User | Food and Beverage (including dairy, meat, seafood, fruits & vegetables, frozen foods, beverages) Pharmaceuticals Biotechnology Chemicals Others (including floral, cosmetics) |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Others |

| By Application | Food Storage Pharmaceutical Storage Chemical Storage Others |

| By Service Type | Transportation Services (road, rail, air, sea) Warehousing Services Packaging Services Integrated Services |

| By Temperature Range | Chilled (0°C to 8°C) Frozen (-18°C to 0°C) Ultra-Low Temperature (below -18°C) Ambient (15°C to 25°C) Others |

| By Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 100 | Logistics Managers, Quality Assurance Officers |

| Food and Beverage Cold Storage | 110 | Warehouse Supervisors, Supply Chain Directors |

| Retail Cold Chain Logistics | 80 | Operations Managers, Inventory Control Specialists |

| Temperature-Sensitive Product Distribution | 90 | Distribution Managers, Fleet Operations Heads |

| Emerging Technologies in Cold Chain | 60 | IT Managers, Innovation Leads |

The USA Cold Chain Logistics and Warehousing Market is valued at approximately USD 91 billion, reflecting significant growth driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the rise of e-commerce.