Region:North America

Author(s):Geetanshi

Product Code:KRAB5818

Pages:83

Published On:October 2025

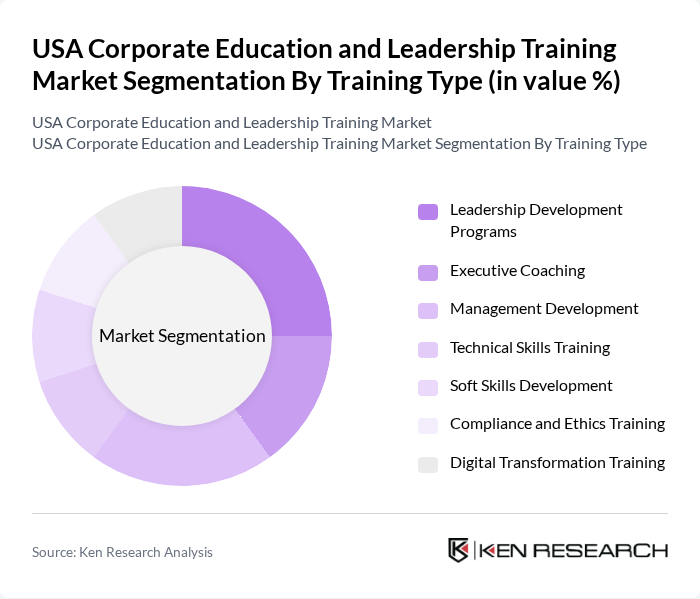

By Training Type:The training type segmentation includes various subsegments such as Leadership Development Programs, Executive Coaching, Management Development, Technical Skills Training, Soft Skills Development, Compliance and Ethics Training, and Digital Transformation Training. Each of these subsegments plays a crucial role in addressing the diverse training needs of organizations.

The Leadership Development Programs subsegment is currently dominating the market due to the increasing emphasis on cultivating effective leaders within organizations. Companies recognize that strong leadership is essential for driving performance and fostering a positive workplace culture. As a result, organizations are investing heavily in tailored leadership training initiatives that align with their strategic goals. This trend is further supported by the growing awareness of the importance of emotional intelligence and adaptive leadership in navigating complex business environments.

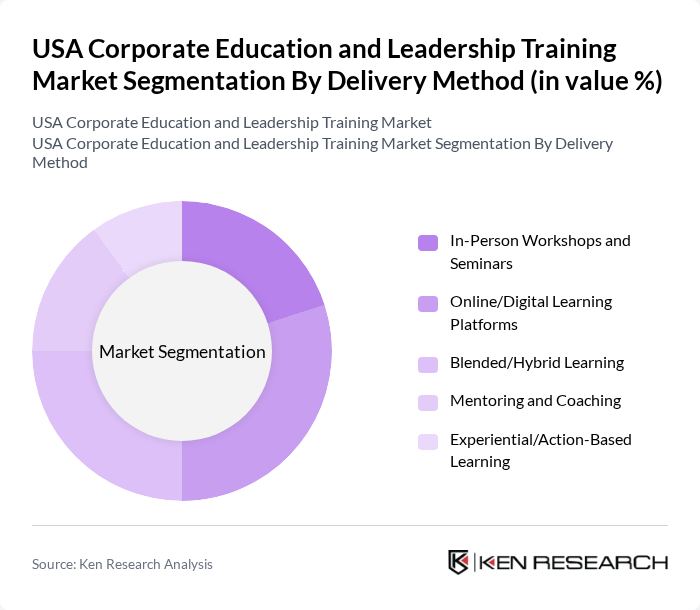

By Delivery Method:The delivery method segmentation encompasses In-Person Workshops and Seminars, Online/Digital Learning Platforms, Blended/Hybrid Learning, Mentoring and Coaching, and Experiential/Action-Based Learning. Each method offers unique advantages, catering to different learning preferences and organizational needs.

Online/Digital Learning Platforms are leading the market due to their flexibility and accessibility, allowing employees to engage in training at their own pace and convenience. The COVID-19 pandemic accelerated the adoption of digital learning solutions, and organizations have continued to leverage these platforms for ongoing training and development. This shift has also led to the emergence of innovative learning technologies, such as gamification and virtual reality, which enhance the learning experience and improve knowledge retention. The integration of AI-driven adaptive learning tools and the growing preference for mobile learning are additional trends shaping the market.

The USA Corporate Education and Leadership Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Harvard Business School Executive Education, Dale Carnegie Training, FranklinCovey, Center for Creative Leadership (CCL), Korn Ferry, Skillsoft Corporation, LinkedIn Learning (Microsoft), Coursera for Business, Udemy Business, GP Strategies Corporation, D2L Corporation, Development Dimensions International (DDI), The Ken Blanchard Companies, Wilson Learning Worldwide, BTS Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA corporate education and leadership training market appears promising, driven by technological advancements and evolving workforce needs. As organizations increasingly embrace digital transformation, the integration of AI and personalized learning experiences will reshape training methodologies. Furthermore, the emphasis on soft skills and employee wellness programs is expected to gain traction, fostering a more holistic approach to employee development. These trends will likely enhance engagement and retention, positioning companies for long-term success in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Training Type | Leadership Development Programs Executive Coaching Management Development Technical Skills Training Soft Skills Development Compliance and Ethics Training Digital Transformation Training |

| By Delivery Method | In-Person Workshops and Seminars Online/Digital Learning Platforms Blended/Hybrid Learning Mentoring and Coaching Experiential/Action-Based Learning |

| By Industry Vertical | Healthcare Technology Financial Services Manufacturing Retail and Consumer Goods Government and Public Sector |

| By Organization Size | Large Enterprises (1000+ employees) Mid-Market Companies (100-999 employees) Small and Medium Enterprises (SMEs) |

| By Training Duration | Short-Term Programs (1-5 days) Medium-Term Programs (1-6 months) Long-Term Programs (6+ months) |

| By Provider Type | Corporate Universities External Training Providers Business Schools and Academic Institutions Consulting Firms |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Site Licenses Custom Enterprise Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Leadership Training Programs | 100 | HR Managers, Training Managers |

| Employee Development Initiatives | 60 | Learning and Development Specialists, Team Leaders |

| Executive Coaching Services | 40 | Executive Coaches, Senior Executives |

| Online Learning Platforms | 80 | eLearning Developers, Corporate Trainers |

| Workforce Upskilling Programs | 50 | Training Program Managers, Skill Development Officers |

The USA Corporate Education and Leadership Training Market is valued at approximately USD 66 billion, driven by the increasing demand for skilled workforce development and the rise of digital learning platforms.