Region:North America

Author(s):Rebecca

Product Code:KRAB5305

Pages:87

Published On:October 2025

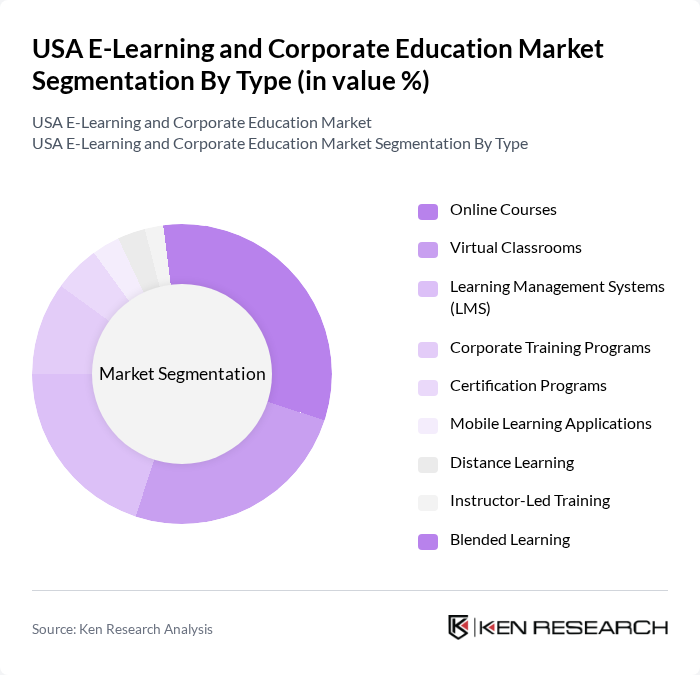

By Type:The market is segmented into Online Courses, Virtual Classrooms, Learning Management Systems (LMS), Corporate Training Programs, Certification Programs, Mobile Learning Applications, Distance Learning, Instructor-Led Training, and Blended Learning. Online Courses have gained significant traction due to their accessibility, self-paced structure, and broad subject coverage, appealing to both individual learners and organizations. Virtual Classrooms are increasingly favored in corporate and academic settings for their ability to facilitate real-time interaction, collaboration, and engagement. The demand for Learning Management Systems (LMS) is rising as organizations and institutions seek to streamline training, automate administrative tasks, and monitor learner progress efficiently. Mobile Learning Applications and microlearning formats are also gaining momentum, driven by the need for on-demand, bite-sized content accessible via smartphones and tablets .

By End-User:The end-user segmentation includes Corporations, Educational Institutions, Government Agencies, Non-Profit Organizations, Individual Learners, and Small and Medium-Sized Enterprises (SMEs). Corporations are the leading end-users, driven by the imperative for continuous employee training, compliance, and leadership development to maintain competitiveness. Educational Institutions are significant adopters, integrating e-learning to supplement traditional curricula and expand access to remote and hybrid learning. Government Agencies increasingly use e-learning for workforce development, compliance training, and public service delivery. Non-Profit Organizations leverage digital platforms for outreach and training, while Individual Learners and SMEs utilize e-learning for skill enhancement and professional growth .

The USA E-Learning and Corporate Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera Inc., Udemy Inc., LinkedIn Learning, Skillsoft Corporation, Pluralsight Inc., edX Inc., Khan Academy, Blackboard Inc., TalentLMS, Docebo Inc., SAP Litmos, Moodle, Google Classroom, Canvas LMS, LearnDash, Adobe, and Microsoft contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA e-learning and corporate education market appears promising, driven by ongoing technological advancements and a shift towards personalized learning experiences. As organizations increasingly recognize the value of upskilling their workforce, investments in innovative training solutions are expected to rise. Furthermore, the integration of AI and machine learning will enhance the effectiveness of training programs, making them more adaptive and engaging for learners, thereby fostering a culture of continuous improvement and development.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Learning Management Systems (LMS) Corporate Training Programs Certification Programs Mobile Learning Applications Distance Learning Instructor-Led Training Blended Learning |

| By End-User | Corporations Educational Institutions Government Agencies Non-Profit Organizations Individual Learners Small and Medium-Sized Enterprises (SMEs) |

| By Content Type | Video-Based Learning Text-Based Learning Interactive Learning Modules Assessment and Evaluation Tools Gamification and Simulation-Based Learning |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Microlearning |

| By Industry | Healthcare Information Technology Finance Manufacturing Retail Energy and Utilities |

| By Geographic Focus | National Programs Regional Initiatives Localized Training Solutions Urban vs. Rural Programs |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Models Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 100 | Training Managers, Learning & Development Directors |

| E-Learning Platform Users | 90 | Employees, HR Professionals |

| Instructional Design Practices | 70 | Instructional Designers, Content Developers |

| Industry-Specific Training Needs | 60 | Sector-Specific Training Coordinators, Compliance Officers |

| Technology Adoption in Learning | 50 | IT Managers, E-Learning Strategists |

The USA E-Learning and Corporate Education Market is valued at approximately USD 130 billion, with the corporate segment alone estimated at over USD 100 billion. This growth reflects the increasing demand for flexible learning solutions and technological advancements in education.