Region:North America

Author(s):Rebecca

Product Code:KRAB5907

Pages:92

Published On:October 2025

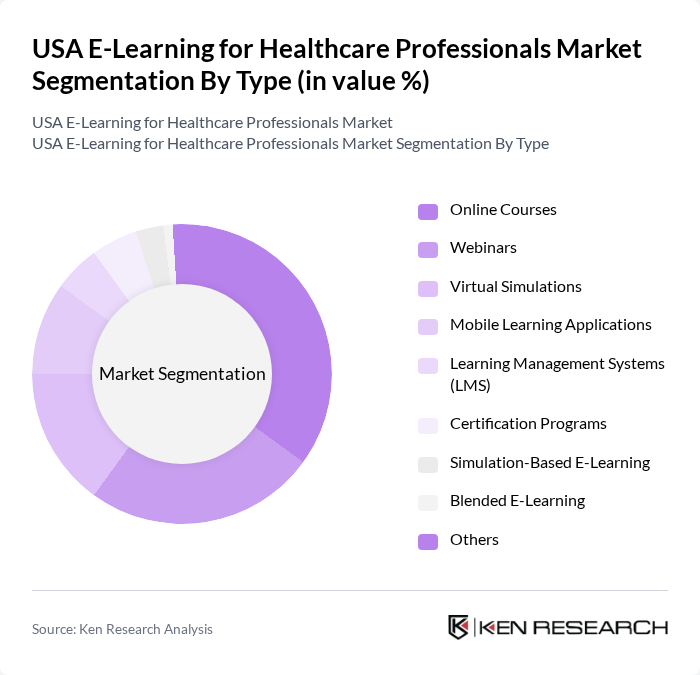

By Type:The market is segmented into various types of e-learning solutions, including Online Courses, Webinars, Virtual Simulations, Mobile Learning Applications, Learning Management Systems (LMS), Certification Programs, Simulation-Based E-Learning, Blended E-Learning, and Others. Among these, Online Courses and Webinars are particularly popular due to their accessibility and flexibility, allowing healthcare professionals to learn at their own pace and convenience. The demand for Virtual Simulations is also growing, as they provide realistic training experiences that enhance practical skills. LMS platforms are increasingly adopted for centralized training and compliance management, while simulation-based and blended learning formats are gaining traction for their interactive and scenario-based training capabilities .

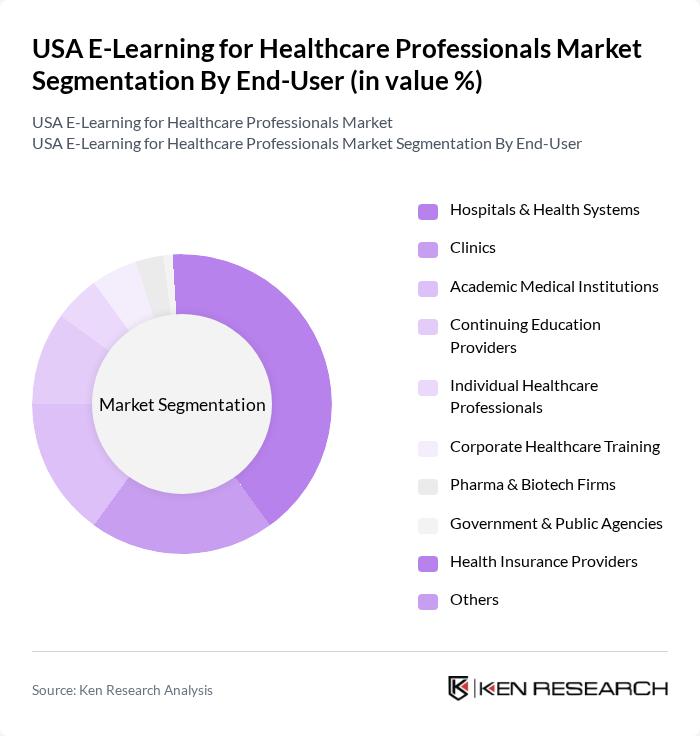

By End-User:This segmentation includes Hospitals & Health Systems, Clinics, Academic Medical Institutions, Continuing Education Providers, Individual Healthcare Professionals, Corporate Healthcare Training, Pharma & Biotech Firms, Government & Public Agencies, Health Insurance Providers, and Others. Hospitals & Health Systems are the leading end-users, driven by the need for ongoing staff training and compliance with regulatory requirements. Individual Healthcare Professionals also represent a significant segment, as they seek to enhance their skills and knowledge through flexible learning options. Academic medical institutions and continuing education providers play a pivotal role in delivering accredited programs, while corporate healthcare training and pharma firms increasingly utilize e-learning for workforce development and compliance .

The USA E-Learning for Healthcare Professionals Market is characterized by a dynamic mix of regional and international players. Leading participants such as HealthStream, Inc., Relias LLC, MedTrainer, Inc., AcademyOcean, iSpring Solutions, Cadmium, LLC (EthosCE), Docebo S.p.A., Cornerstone OnDemand, Inc., Absorb Software Inc., Coursera, Inc., Medscape (WebMD Health Corp.), Elsevier, MedPage Today, Wolters Kluwer (UpToDate, Lippincott), Kaplan, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-learning market for healthcare professionals in the U.S. appears promising, driven by technological innovations and increasing demand for flexible learning solutions. As healthcare continues to evolve, the integration of AI and personalized learning experiences will likely enhance educational outcomes. Furthermore, the expansion of partnerships between e-learning providers and healthcare institutions will facilitate access to specialized training, ensuring that professionals are equipped with the latest knowledge and skills necessary for effective patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Webinars Virtual Simulations Mobile Learning Applications Learning Management Systems (LMS) Certification Programs Simulation-Based E-Learning Blended E-Learning Others |

| By End-User | Hospitals & Health Systems Clinics Academic Medical Institutions Continuing Education Providers Individual Healthcare Professionals Corporate Healthcare Training Pharma & Biotech Firms Government & Public Agencies Health Insurance Providers Others |

| By Content Type | Clinical Training Modules Non-Clinical Modules Medical Knowledge Clinical Skills Soft Skills Training Compliance Training Specialty Training Others |

| By Delivery Mode | Self-Paced Learning Instructor-Led Virtual Training Blended Learning Simulation-Based E-Learning Synchronous Learning Asynchronous Learning Others |

| By Certification Type | Professional Certifications Continuing Medical Education (CME) Specialty Board Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| By Geographic Focus | National Programs Regional Programs Localized Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nursing Education Programs | 100 | Nursing Educators, Program Directors |

| Continuing Medical Education (CME) | 90 | Physicians, CME Coordinators |

| Allied Health Training | 80 | Allied Health Instructors, Training Managers |

| Telehealth Training Modules | 60 | Telehealth Coordinators, IT Managers |

| Healthcare Compliance Training | 50 | Compliance Officers, Risk Management Professionals |

The USA E-Learning for Healthcare Professionals Market is valued at approximately USD 4.4 billion, reflecting significant growth driven by the increasing demand for continuous education and the rapid digital transformation in healthcare.