Region:North America

Author(s):Rebecca

Product Code:KRAB5973

Pages:95

Published On:October 2025

By Type:The facility management market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Facility Management Software, Consulting Services, Maintenance Services, and Others. Among these, Hard Services, which encompass essential maintenance and repair tasks, dominate the market due to the critical need for operational efficiency in tech campuses. The increasing complexity of facilities and the demand for high-quality service delivery further enhance the significance of Hard Services.

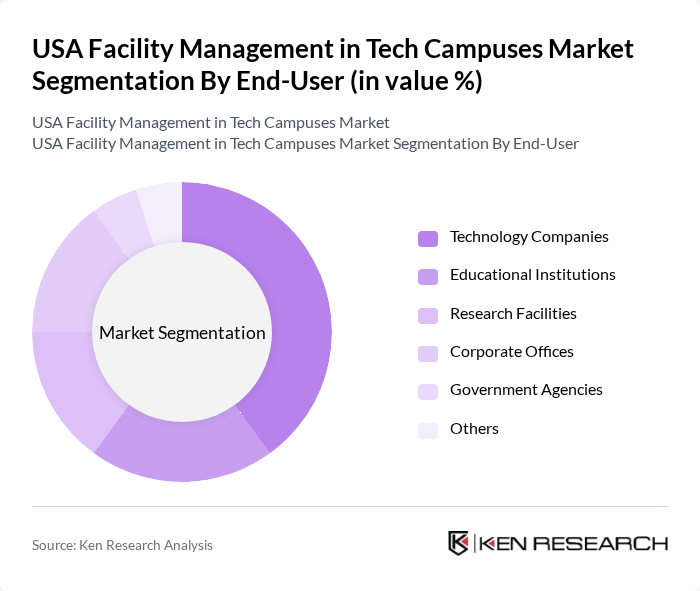

By End-User:The end-user segmentation includes Technology Companies, Educational Institutions, Research Facilities, Corporate Offices, Government Agencies, and Others. Technology Companies are the leading end-users, driven by the need for specialized facility management to support their dynamic environments. The rapid growth of tech firms and their focus on innovation necessitate tailored services that enhance operational efficiency and employee satisfaction.

The USA Facility Management in Tech Campuses Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., JLL (Jones Lang LaSalle), Cushman & Wakefield, ISS Facility Services, Aramark, Sodexo, ABM Industries Incorporated, GDI Integrated Facility Services, EMCOR Group, Inc., Mitie Group plc, Hines, C&W Services, Brookfield Properties, VTS, Inc., Planon contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in tech campuses is poised for transformation, driven by digital innovation and sustainability initiatives. As organizations increasingly prioritize employee well-being and operational efficiency, the integration of smart technologies and data analytics will become essential. Furthermore, the shift towards hybrid work models will necessitate flexible facility management solutions, ensuring that spaces are optimized for both in-office and remote work. This evolution will create new opportunities for service providers to enhance their offerings and adapt to changing market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Facility Management Software Consulting Services Maintenance Services Others |

| By End-User | Technology Companies Educational Institutions Research Facilities Corporate Offices Government Agencies Others |

| By Service Model | Outsourced Services In-House Services Hybrid Services |

| By Geographic Presence | Urban Campuses Suburban Campuses Rural Campuses |

| By Technology Integration | IoT-Enabled Solutions AI and Machine Learning Applications Cloud-Based Management Systems |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Performance-Based Contracts |

| By Policy Support | Subsidies for Green Initiatives Tax Incentives for Facility Upgrades Grants for Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Facility Management in Tech Campuses | 150 | Facility Managers, Operations Directors |

| IT Infrastructure Management | 100 | IT Managers, Network Administrators |

| Sustainability Practices in Facilities | 80 | Sustainability Officers, Environmental Managers |

| Security Services in Tech Campuses | 70 | Security Managers, Risk Assessment Officers |

| Cleaning and Maintenance Services | 90 | Maintenance Supervisors, Cleaning Service Providers |

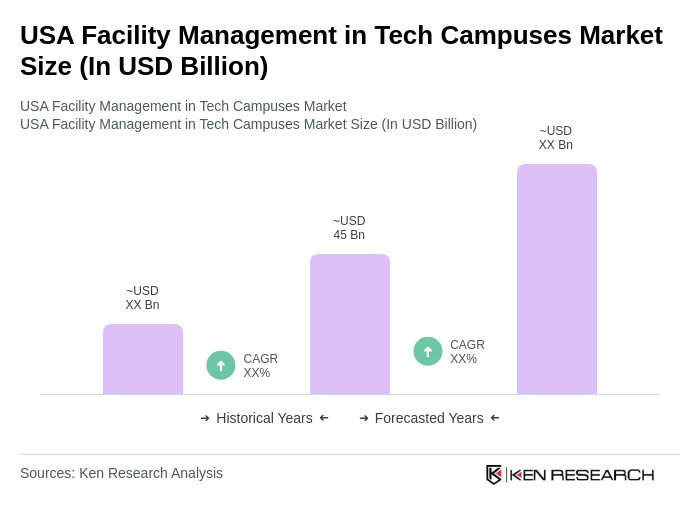

The USA Facility Management in Tech Campuses Market is valued at approximately USD 45 billion, reflecting a significant growth driven by the demand for efficient management, smart buildings, and advanced technologies in facility operations.