Region:North America

Author(s):Dev

Product Code:KRAA1590

Pages:96

Published On:August 2025

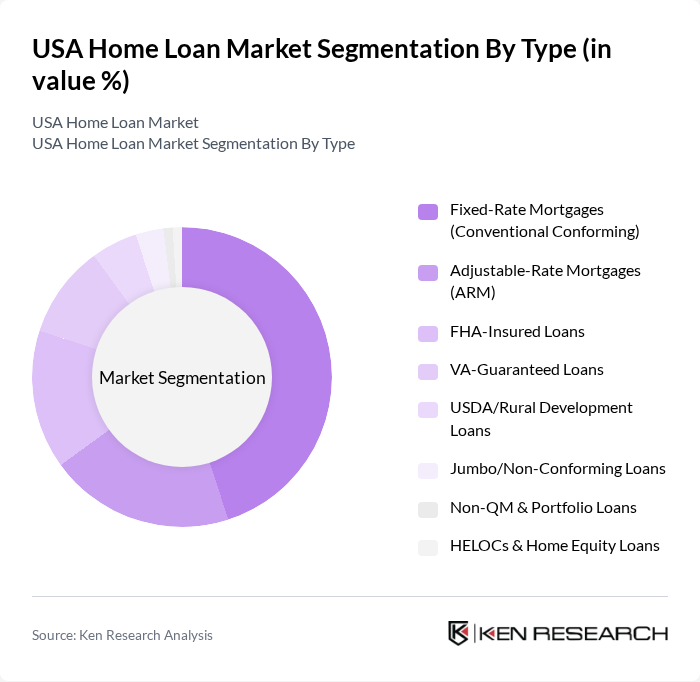

By Type:The market is segmented into various types of home loans, including Fixed-Rate Mortgages, Adjustable-Rate Mortgages, FHA-Insured Loans, VA-Guaranteed Loans, USDA/Rural Development Loans, Jumbo/Non-Conforming Loans, Non-QM & Portfolio Loans, and HELOCs & Home Equity Loans. Among these, Fixed-Rate Mortgages are the most popular due to their stability and predictability, appealing to first-time homebuyers and those looking for long-term financial security. Recent data indicates fixed-rate loans continue to dominate originations, while ARMs remain a smaller share amid a relatively flat/inverted yield curve; refinance and HELOC activity have risen in relative mix during rate pullbacks and for equity extraction.

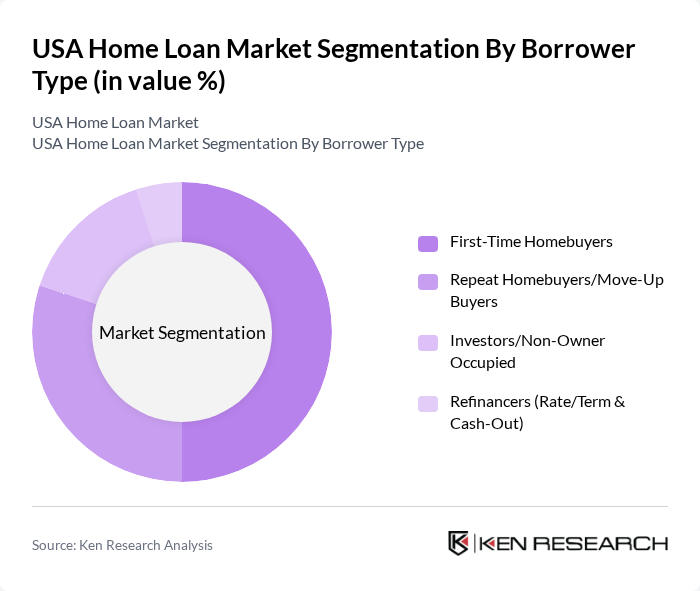

By Borrower Type:The borrower type segmentation includes First-Time Homebuyers, Repeat Homebuyers/Move-Up Buyers, Investors/Non-Owner Occupied, and Refinancers (Rate/Term & Cash-Out). First-Time Homebuyers have been supported by down-payment assistance and lower-down-payment programs (FHA/VA), though affordability pressures have limited overall purchase volumes; refinance activity’s share has grown at times due to episodic rate declines and equity tapping.

The USA Home Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rocket Mortgage (formerly Quicken Loans), Wells Fargo Home Lending, JPMorgan Chase Home Lending, Bank of America Home Loans, U.S. Bank Home Mortgage, Citi Mortgage, Caliber Home Loans, Guaranteed Rate, loanDepot, Flagstar Bank, Pennymac, New American Funding, Movement Mortgage, Fairway Independent Mortgage, Mr. Cooper, United Wholesale Mortgage (UWM), Guild Mortgage, Navy Federal Credit Union, Truist Mortgage, PNC Mortgage contribute to innovation, geographic expansion, and service delivery in this space.

The USA home loan market is poised for continued evolution, driven by technological advancements and changing consumer preferences. The integration of digital platforms is expected to streamline the loan application process, enhancing customer experience. Additionally, as sustainability becomes a priority, lenders may increasingly offer green mortgage options. The ongoing demand for affordable housing solutions will likely prompt innovative financing models, ensuring that the market remains dynamic and responsive to consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Rate Mortgages (Conventional Conforming) Adjustable-Rate Mortgages (ARM) FHA-Insured Loans VA-Guaranteed Loans USDA/Rural Development Loans Jumbo/Non-Conforming Loans Non-QM & Portfolio Loans HELOCs & Home Equity Loans |

| By Borrower Type | First-Time Homebuyers Repeat Homebuyers/Move-Up Buyers Investors/Non-Owner Occupied Refinancers (Rate/Term & Cash-Out) |

| By Loan Purpose | Purchase Rate/Term Refinance Cash-Out Refinance Home Improvement |

| By Credit Tier (FICO) | Super-Prime (720+) Prime (660–719) Near-Prime (620–659) Subprime (<620) |

| By Loan Amount Band | Under $150,000 $150,000 – $300,000 $300,000 – $500,000 $500,000 – Conforming Limit Above Conforming (Jumbo) |

| By Region | Northeast Midwest South West |

| By Loan Term | –15-Year Fixed Year Fixed Year Fixed Hybrid ARMs (e.g., 5/6, 7/6, 10/6) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| First-Time Homebuyers | 120 | Individuals aged 25-35, seeking mortgage options |

| Real Estate Agents | 90 | Agents with 3+ years of experience in residential sales |

| Mortgage Brokers | 80 | Professionals with expertise in various loan products |

| Homeowners Refinancing | 110 | Homeowners looking to refinance existing mortgages |

| Investors in Rental Properties | 70 | Individuals or entities owning multiple rental properties |

The USA Home Loan Market is valued at approximately USD 14.014.5 trillion, influenced by factors such as interest rate cycles, home price appreciation, and credit availability. Recent trends show a softening in purchase originations amid higher rates, while refinancing and home-equity borrowing have gained traction.