Region:North America

Author(s):Rebecca

Product Code:KRAD8187

Pages:97

Published On:December 2025

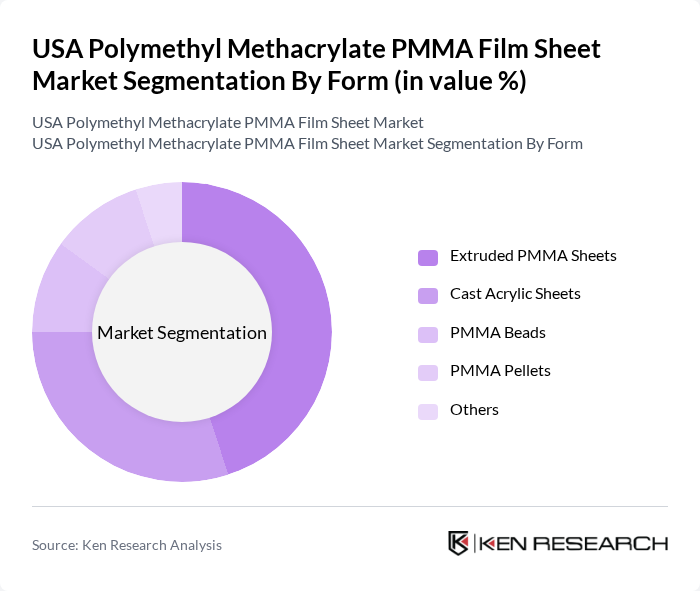

By Form:The PMMA film sheet market can be segmented into various forms, including extruded PMMA sheets, cast acrylic sheets, PMMA beads, PMMA pellets, and others. Among these, extruded PMMA sheets dominate the market due to their widespread use in signage and display applications. Their cost-effectiveness and ease of fabrication make them a preferred choice for manufacturers. Extruded sheets possess high tensile strength and lightweight features, with affordability and accessibility driving widespread adoption. Cast acrylic sheets also hold a significant share, particularly in high-end applications where optical clarity and surface finish are critical. The demand for PMMA beads and pellets is growing, driven by their use in specialized applications such as automotive and electronics.

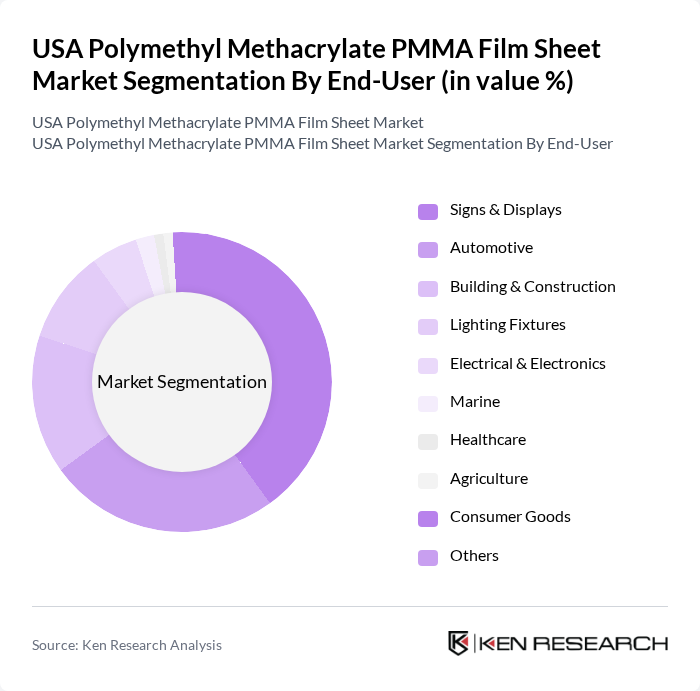

By End-User:The end-user segmentation of the PMMA film sheet market includes signs & displays, automotive, building & construction, lighting fixtures, electrical & electronics, marine, healthcare, agriculture, consumer goods, and others. The signs & displays segment is the largest due to the increasing demand for advertising and promotional materials. PMMA sheets act as clear glass alternatives that are cheaper with greater durability, making them increasingly attractive for signage and display applications. The automotive sector is also a significant contributor, as manufacturers seek lightweight materials to improve fuel efficiency and meet regulatory requirements for emissions reduction. The building & construction segment is growing, driven by the need for durable and aesthetically pleasing materials in architectural applications, as well as demand for glass substitutes that do not shatter under impact and offer protection and safety for building residents.

The USA Polymethyl Methacrylate PMMA Film Sheet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roehm America LLC (Rohm GmbH), Trinseo PLC, Plaskolite, Inc., Evonik Industries AG, Arkema Inc., Fusion Optix, Unigel Group, Plazit-Polygal Group, Avient Corporation, Denka Company Limited, LG Chem, Lucite International contribute to innovation, geographic expansion, and service delivery in this space. Top players including Evonik Industries, Arkema Group, and Lucite International have made significant investments in research and development towards improving production processes by reducing costs and improving efficiency. New projects have also been undertaken for producing bio-PMMA from plant sugars to meet sustainability requirements.

The future of the USA PMMA film sheet market appears promising, driven by increasing demand for sustainable materials and technological advancements. As industries prioritize eco-friendly solutions, PMMA's lightweight and recyclable properties will become more appealing. Additionally, the integration of smart technologies in PMMA applications, such as sensors and displays, is expected to create new market avenues. Companies that invest in research and development will likely lead the market, capitalizing on emerging trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Form | Extruded PMMA Sheets Cast Acrylic Sheets PMMA Beads PMMA Pellets Others |

| By End-User | Signs & Displays Automotive Building & Construction Lighting Fixtures Electrical & Electronics Marine Healthcare Agriculture Consumer Goods Others |

| By Grade | General Purpose Grade Impact-Modified Grade UV-Resistant Grade Specialty Grade |

| By Color | Clear PMMA Colored PMMA Frosted PMMA Others |

| By Region | Northeast Midwest South West |

| By Market Channel | Direct Sales Distributors Online Retail Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive PMMA Applications | 45 | Product Engineers, Procurement Managers |

| Healthcare PMMA Usage | 38 | Medical Device Manufacturers, Quality Assurance Managers |

| Construction Industry PMMA Demand | 42 | Architects, Construction Project Managers |

| Signage and Display PMMA Market | 35 | Marketing Managers, Signage Manufacturers |

| Consumer Goods PMMA Applications | 40 | Product Development Managers, Retail Buyers |

The USA Polymethyl Methacrylate (PMMA) Film Sheet Market is valued at approximately USD 912 million, reflecting a significant growth trend driven by the demand for lightweight and durable materials across various industries, including automotive, construction, and electronics.