Region:Asia

Author(s):Rebecca

Product Code:KRAB3498

Pages:94

Published On:October 2025

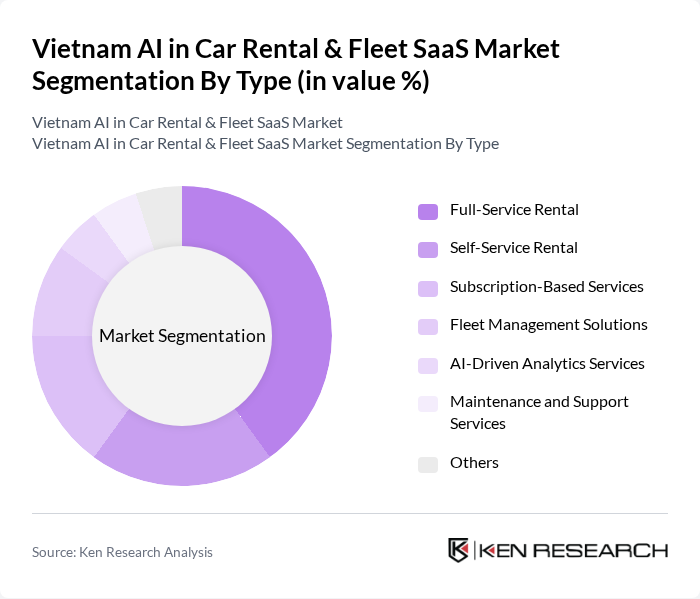

By Type:The market is segmented into various types, including Full-Service Rental, Self-Service Rental, Subscription-Based Services, Fleet Management Solutions, AI-Driven Analytics Services, Maintenance and Support Services, and Others. Each of these segments caters to different consumer needs and preferences, with Full-Service Rental being the most popular due to its comprehensive offerings and value-added services such as insurance, maintenance, and 24/7 support. The increasing adoption of AI-driven analytics and fleet management solutions is also notable, as operators seek to optimize vehicle utilization, reduce operational costs, and enhance customer experience .

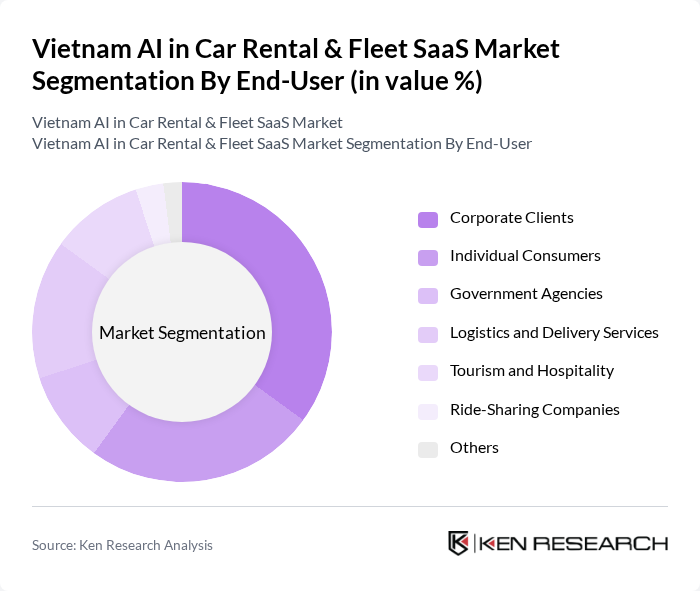

By End-User:The end-user segmentation includes Corporate Clients, Individual Consumers, Government Agencies, Logistics and Delivery Services, Tourism and Hospitality, Ride-Sharing Companies, and Others. Corporate Clients dominate the market due to their need for reliable transportation solutions for employees and business operations. The logistics and delivery segment is also expanding rapidly, driven by the growth of e-commerce and last-mile delivery services. Tourism and hospitality remain key demand drivers, especially in major urban centers .

The Vietnam AI in Car Rental & Fleet SaaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinasun Corporation, Mai Linh Group, Grab Holdings Inc., Be Group JSC, Thuexe247, FastGo Vietnam, TMG (Thang Long Group), Viettel Group, FPT Corporation, Gojek Vietnam, Avis Vietnam, Hertz Vietnam, UBER Technologies Inc., TNG Holdings Vietnam, TCT Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam AI in car rental and fleet SaaS market appears promising, driven by technological advancements and changing consumer preferences. As urbanization accelerates, the demand for efficient mobility solutions will continue to rise. Additionally, the integration of electric vehicles and IoT technologies is expected to reshape fleet management practices. Companies that embrace these innovations will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Rental Self-Service Rental Subscription-Based Services Fleet Management Solutions AI-Driven Analytics Services Maintenance and Support Services Others |

| By End-User | Corporate Clients Individual Consumers Government Agencies Logistics and Delivery Services Tourism and Hospitality Ride-Sharing Companies Others |

| By Fleet Size | Small Fleets (1-10 vehicles) Medium Fleets (11-50 vehicles) Large Fleets (51+ vehicles) Others |

| By Service Model | Pay-Per-Use Subscription-Based On-Demand Services Others |

| By Geographic Coverage | Ho Chi Minh City Hanoi Da Nang Other Urban Areas Suburban Areas Rural Areas Others |

| By Vehicle Type | Sedans SUVs Vans Electric Vehicles Luxury Vehicles Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Rental Companies | 80 | Fleet Managers, Operations Directors |

| AI Technology Providers | 50 | Product Managers, Software Engineers |

| Logistics and Fleet Management Consultants | 40 | Consultants, Industry Analysts |

| Government Transportation Officials | 40 | Policy Makers, Regulatory Affairs Managers |

| End-Users of Car Rental Services | 100 | Frequent Renters, Business Travelers |

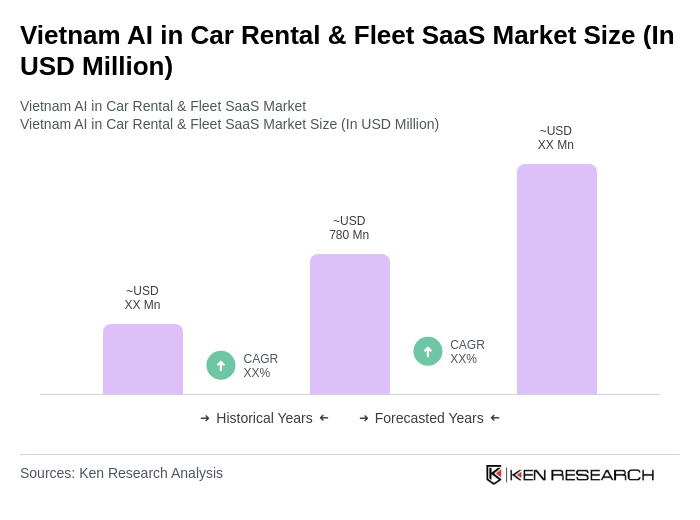

The Vietnam AI in Car Rental & Fleet SaaS Market is valued at approximately USD 780 million, driven by the increasing adoption of digital booking platforms and AI-driven solutions for fleet management efficiency.