Region:Asia

Author(s):Rebecca

Product Code:KRAC4634

Pages:95

Published On:October 2025

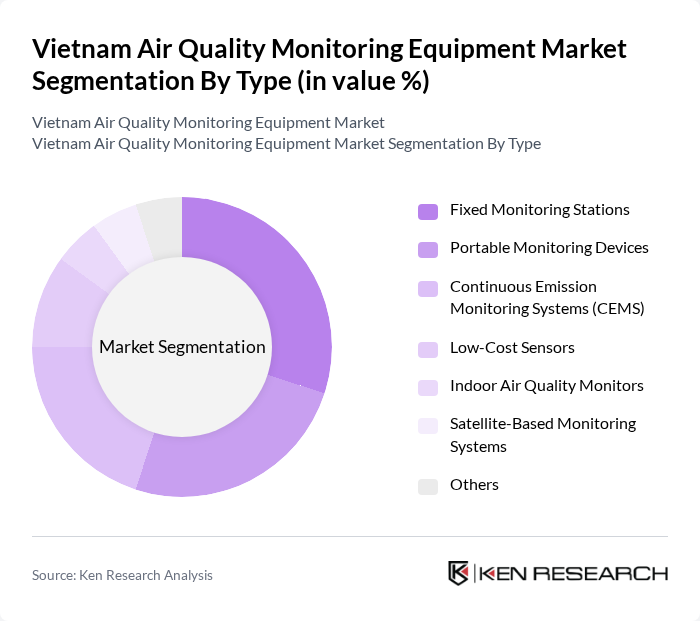

By Type:The market is segmented into various types of air quality monitoring equipment, including Fixed Monitoring Stations, Portable Monitoring Devices, Continuous Emission Monitoring Systems (CEMS), Low-Cost Sensors, Indoor Air Quality Monitors, Satellite-Based Monitoring Systems, and Others. Each type serves distinct purposes, catering to different user needs and applications.

The Fixed Monitoring Stations segment leads the market due to their reliability and comprehensive data collection capabilities. These stations are strategically placed in urban areas to provide continuous air quality data, which is essential for regulatory compliance and public health assessments. The demand for accurate and real-time data has driven investments in these stations, making them a preferred choice for government agencies and environmental organizations.

By End-User:The market is segmented by end-users, including Government Agencies (e.g., MONRE, DoNRE), Educational & Research Institutions, Industrial Sector (Manufacturing, Power Generation, Petrochemicals), Environmental NGOs, Commercial & Residential Buildings, and Others. Each end-user category has unique requirements and applications for air quality monitoring equipment.

The Government Agencies segment is the largest end-user, driven by the need for regulatory compliance and public health monitoring. These agencies utilize air quality monitoring equipment to assess pollution levels, enforce environmental regulations, and inform the public about air quality issues. The increasing focus on environmental sustainability and public health initiatives has led to significant investments in monitoring technologies by government bodies.

The Vietnam Air Quality Monitoring Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aeroqual Limited, Thermo Fisher Scientific Inc., Horiba Ltd., Teledyne Technologies Incorporated, 3M Company, Siemens AG, Envirosuite Limited, RKI Instruments, Inc., YSI Inc., Acoem Group, Ecotech Pty Ltd, Skye Instruments Ltd., Kestrel Meters, Honeywell International Inc., Merck KGaA, Kimoto Electric Co., Ltd., Công ty C? ph?n Công ngh? D&L (D&L Technology JSC, Vietnam), Công ty TNHH MTV Môi Tr??ng ?ô Th? Hà N?i (URENCO, Vietnam), Công ty TNHH Thi?t b? Khoa h?c Vi?t Nam (VietNam Scientific Equipment Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam air quality monitoring equipment market appears promising, driven by increasing urbanization and government support for environmental initiatives. As cities expand, the demand for real-time air quality data will grow, prompting investments in innovative monitoring technologies. Additionally, the integration of IoT and data analytics will enhance monitoring capabilities, providing actionable insights for policymakers and the public. This trend is expected to foster a more proactive approach to air quality management, ultimately improving public health outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Monitoring Stations Portable Monitoring Devices Continuous Emission Monitoring Systems (CEMS) Low-Cost Sensors Indoor Air Quality Monitors Satellite-Based Monitoring Systems Others |

| By End-User | Government Agencies (e.g., MONRE, DoNRE) Educational & Research Institutions Industrial Sector (Manufacturing, Power Generation, Petrochemicals) Environmental NGOs Commercial & Residential Buildings Others |

| By Application | Urban Ambient Air Quality Monitoring Industrial Emission Monitoring Indoor Air Quality Monitoring Research and Development Occupational Health & Safety Monitoring Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Resellers Government Procurement Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Urban Areas Rural Areas |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices Others |

| By Technology | Optical Sensors Electrochemical Sensors Laser-Based Sensors Gravimetric & Filter-Based Methods IoT-Enabled Monitoring Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Environmental Agencies | 60 | Environmental Policy Makers, Air Quality Analysts |

| Manufacturers of Air Quality Equipment | 40 | Product Managers, Sales Directors |

| Research Institutions and Universities | 50 | Environmental Scientists, Academic Researchers |

| Industrial Sector Users | 45 | Environmental Compliance Officers, Facility Managers |

| NGOs Focused on Environmental Issues | 40 | Program Directors, Advocacy Coordinators |

The Vietnam Air Quality Monitoring Equipment Market is valued at approximately USD 65 million, reflecting significant growth driven by urbanization, industrialization, and increased public awareness of air pollution's health impacts.