Vietnam Alcoholic Beverages Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD3087

December 2024

80

About the Report

Vietnam Alcoholic Beverages Market Overview

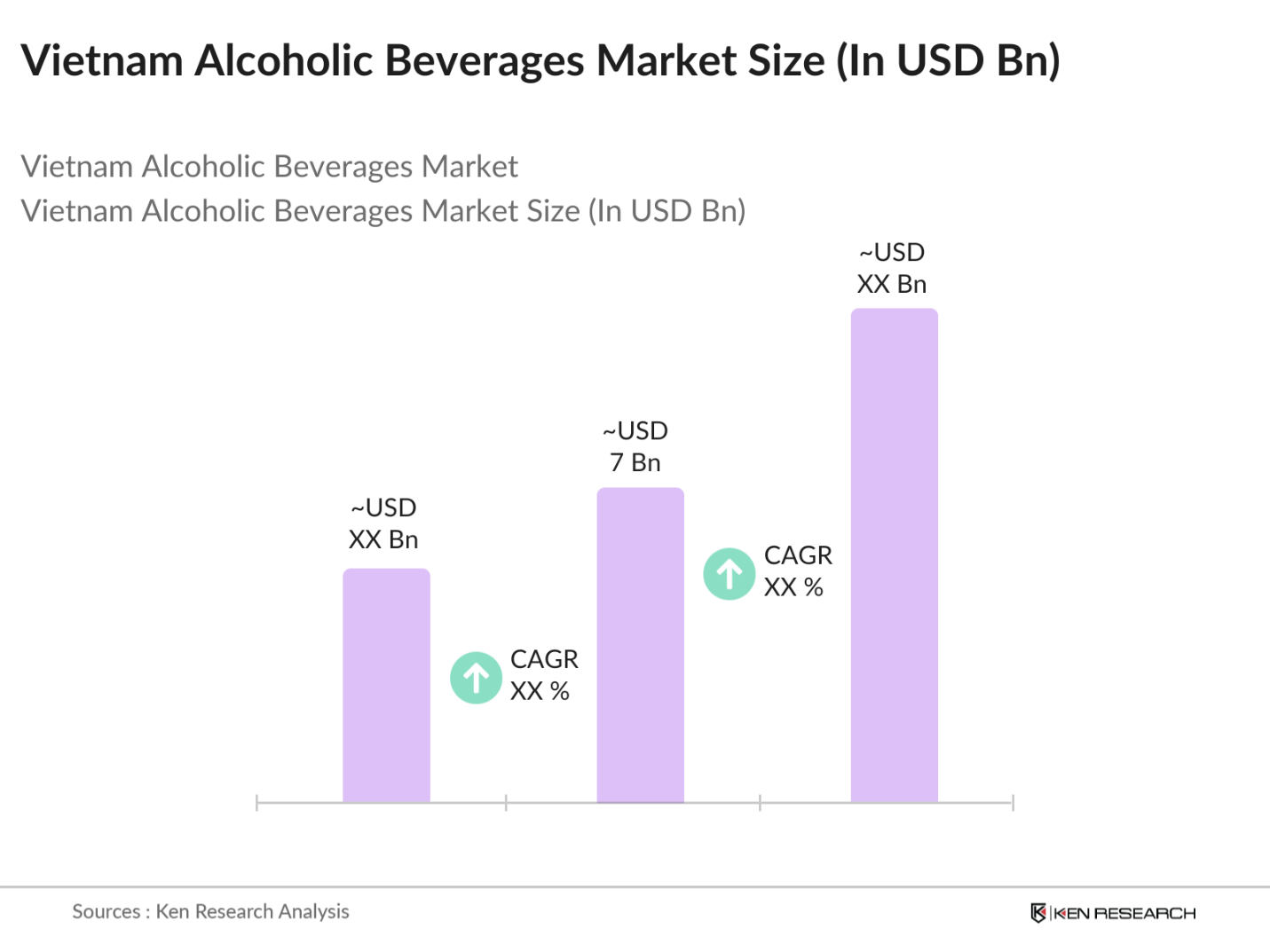

- The Vietnam Alcoholic Beverages market is valued at USD 7 billion based on a five-year historical analysis. The market's growth is driven primarily by rising disposable incomes, evolving consumer preferences towards premium and craft beverages, and the growing influence of Western drinking culture. Additionally, the market is supported by an expanding urban population, which favors on-trade sales in cities like Hanoi and Ho Chi Minh City, where a vibrant nightlife and social drinking culture contribute to market demand.

- Hanoi and Ho Chi Minh City dominate the market, being the two largest and most economically active regions in Vietnam. These cities lead in alcohol consumption due to their dense populations, higher average incomes, and a more developed hospitality sector. International and local brands have capitalized on the urban youths increasing demand for trendy alcoholic beverages, particularly beer and premium spirits, which are associated with social status and lifestyle preferences.

- Vietnam has enforced high excise taxes on alcoholic beverages, with the current rate standing at 65%. This taxation policy has had a substantial impact on retail prices, pushing the cost of alcohol higher, which in turn has affected consumer purchasing behavior. The excise tax revenue collected from alcoholic beverages contributes significantly to the national budget, exceeding $2 billion annually.

Vietnam Alcoholic Beverages Market Segmentation

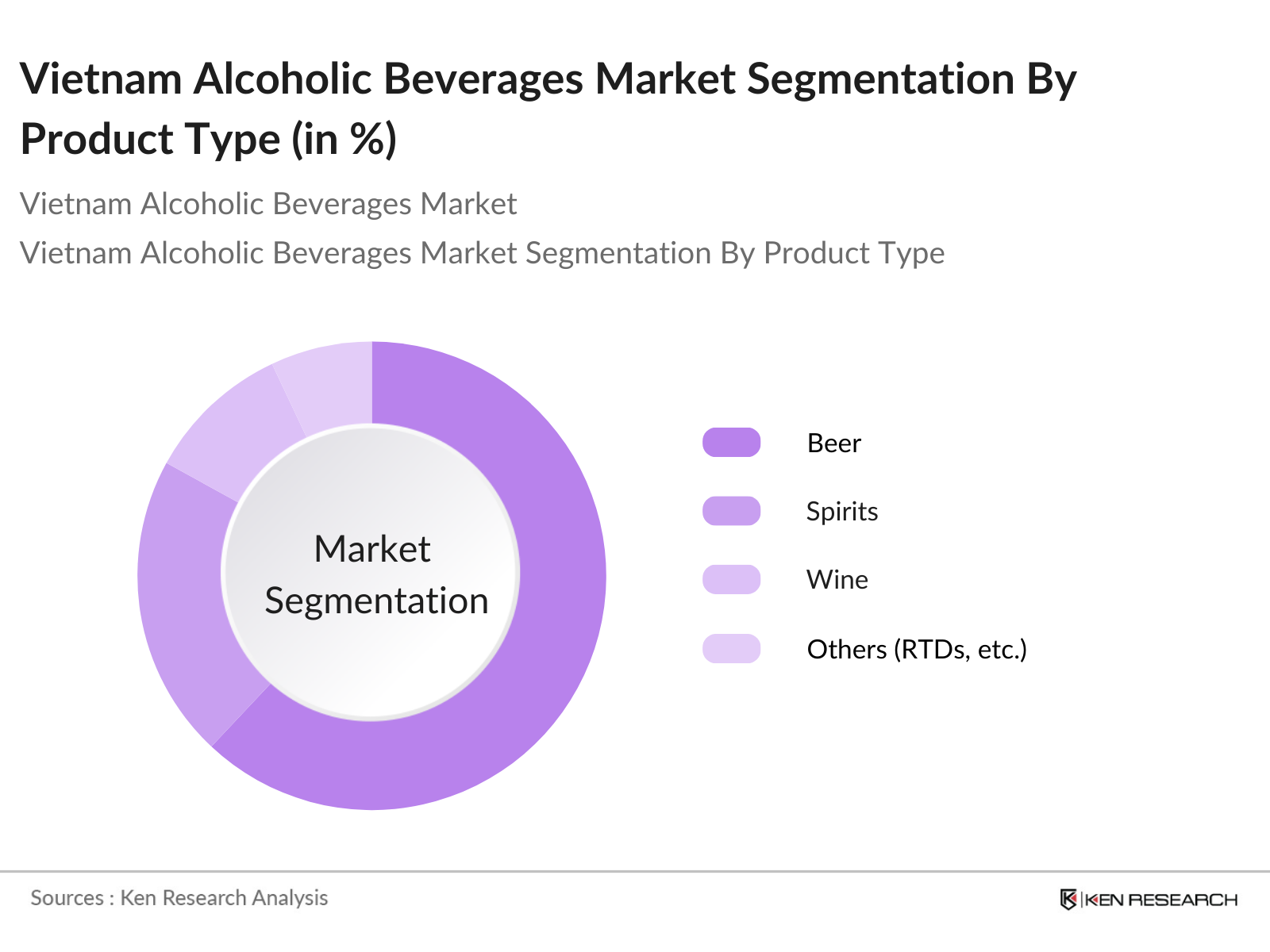

By Product Type: The market is segmented by product type into beer, spirits (whisky, vodka, rum, etc.), wine, and other products like ready-to-drink (RTDs) beverages and cocktails. Recently, beer has dominated the market share due to its cultural significance and affordability. Vietnam is one of the world's largest beer-consuming nations, with brands like Sabeco and Heineken leading in market presence.

By Distribution Channel: The market is also segmented by distribution channel into on-trade (bars, restaurants, and clubs) and off-trade (supermarkets, liquor stores, and online retailers). Off-trade sales, particularly through supermarkets and liquor stores, account for a significant portion of the market due to their accessibility and wide product variety.

Vietnam Alcoholic Beverages Market Competitive Landscape

The Vietnam Alcoholic Beverages market is dominated by a combination of local powerhouses and global brands. Local manufacturers such as Sabeco and Habeco have built strong reputations in the beer market, while international brands like Heineken and Diageo dominate premium alcohol segments, including spirits and wine. The consolidation in the market highlights the strong influence of these key players, who often benefit from established distribution networks, marketing budgets, and consumer loyalty.

Vietnam Alcoholic Beverages Industry Analysis

Growth Drivers

- Rising Disposable Income: Vietnam has seen a rise in disposable income, driven by strong economic performance, with the average monthly income per capita reaching approximately $380 in 2024 according to the World Bank. This increase in purchasing power has led to higher consumer spending on non-essential goods like alcoholic beverages. The growing middle class, projected at nearly 50 million people, is further boosting consumption trends, especially among urban populations.

- Growing Urbanization: With 40% of Vietnams population now residing in urban areas, urbanization is playing a pivotal role in increasing demand for alcoholic beverages. Cities like Ho Chi Minh and Hanoi have seen a rise in nightlife and social drinking culture, making them major consumption hubs. Urban households in these cities have an average annual income of over $5,000, significantly higher than rural areas, supporting a growing appetite for premium and mid-range alcoholic products.

- Shifts in Consumer Preferences: Vietnamese consumers are shifting towards premium alcoholic beverages, driven by lifestyle changes and increasing brand awareness. In 2024, the demand for premium products surged in urban centers where consumers are willing to pay more for quality and branded spirits. For example, imported whiskey, vodka, and craft beers have seen double-digit growth in sales volumes.

Market Challenges

- Health Consciousness Trends: Increasing health awareness among Vietnamese consumers is impacting the alcoholic beverage industry. Reports indicate that nearly 60% of Vietnamese adults are becoming more health-conscious, choosing to reduce their alcohol intake or opt for low-alcohol alternatives. This trend is driven by rising rates of lifestyle diseases, including liver conditions and heart disease, with approximately 2.5 million cases of liver diseases reported annually.

- Fluctuating Raw Material Costs: The alcoholic beverage industry in Vietnam is facing challenges due to fluctuating raw material costs. For example, the price of barley, a key ingredient in beer production, increased by 20% in the past year due to global supply chain disruptions. Additionally, the local sugar industry, critical for spirits production, has experienced cost volatility, with sugar prices hitting a 10-year high.

Vietnam Alcoholic Beverages Market Future Outlook

Over the next five years, the Vietnam Alcoholic Beverages market is expected to witness consistent growth, driven by evolving consumer preferences, increasing disposable incomes, and the expansion of urbanization. Rising demand for premium beverages, including craft beer and high-end spirits, coupled with a greater presence of international brands, will significantly shape market dynamics.

Market Opportunities

- Growing Tourism Industry: Vietnams tourism sector, which attracted over 18 million international visitors in 2023, presents a significant opportunity for the alcoholic beverages market. Tourists, particularly from countries like South Korea, Japan, and China, are driving demand for alcoholic beverages, especially beer and spirits, in tourist hotspots such as Ho Chi Minh City, Hanoi, and Da Nang.

- Expansion of Premium Alcoholic Beverages Segment: The premium alcoholic beverages segment is expanding rapidly in Vietnam, driven by affluent consumers who are willing to pay more for luxury brands. In 2024, the segment saw significant growth, especially in cities like Hanoi and Ho Chi Minh City, where the demand for premium wine and spirits surged. With an estimated 1.6 million high-net-worth individuals in Vietnam, the appetite for premium products such as imported whiskies, cognacs, and wines is rising, creating vast opportunities for international and local brands to tap into.

Scope of the Report

|

Product Type |

Beer Spirits (Whisky, Vodka, Rum) Wine Others (RTDs, Cocktails) |

|

Distribution Channel |

On-Trade (Bars, Restaurants, Clubs) Off-Trade (Supermarkets, Liquor Stores, Online Retailers) |

|

Alcohol Content |

Low-Alcohol (Under 5%) Standard Alcohol (5%-20%) High-Alcohol (Above 20%) |

|

Packaging Type |

Bottles (Glass, Plastic) Cans Tetra Packs |

|

Region |

North Vietnam Central Vietnam South Vietnam |

Products

Key Target Audience

Government and Regulatory Bodies (Vietnam Ministry of Industry and Trade, Vietnam Alcohol and Tobacco Association)

Alcoholic Beverage Manufacturers

On-Trade Distribution Channels (Restaurants, Bars, Clubs)

Off-Trade Distribution Channels (Supermarkets, Liquor Stores, Online Retailers)

Alcoholic Beverage Importers and Exporters

E-commerce Platforms for Alcohol Sales

Investments and Venture Capitalist Firms

Hospitality and Tourism Industry Stakeholders

Companies

Players Mentioned in the Report

Sabeco (Saigon Beer-Alcohol-Beverage Corporation)

Habeco (Hanoi Beer-Alcohol-Beverage Corporation)

Heineken Vietnam

Pernod Ricard Vietnam

Diageo Vietnam

Carlsberg Vietnam

San Miguel Vietnam

Molson Coors Vietnam

Sapporo Vietnam

Tiger Beer (Asia Pacific Breweries)

Table of Contents

1. Vietnam Alcoholic Beverages Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Alcoholic Beverages Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Alcoholic Beverages Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Growing Urbanization

3.1.3. Shifts in Consumer Preferences

3.1.4. Government Regulations on Alcohol Consumption

3.2. Market Challenges

3.2.1. Stringent Advertising Laws

3.2.2. Health Consciousness Trends

3.2.3. Fluctuating Raw Material Costs

3.3. Opportunities

3.3.1. Growing Tourism Industry

3.3.2. Expansion of Premium Alcoholic Beverages Segment

3.3.3. Adoption of E-Commerce Distribution Channels

3.4. Trends

3.4.1. Rise in Craft Beer Production

3.4.2. Increasing Demand for Low-Alcohol and Non-Alcoholic Alternatives

3.4.3. Influence of Global Brands in Local Market

3.5. Government Regulation

3.5.1. Excise Tax Laws

3.5.2. Alcohol Sales Regulation in Provinces

3.5.3. Legal Drinking Age and Consumption Policies

3.5.4. Public Health Initiatives on Alcohol Consumption

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Alcoholic Beverages Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Beer

4.1.2. Spirits (Whisky, Vodka, Rum, etc.)

4.1.3. Wine

4.1.4. Others (RTDs, Cocktails, etc.)

4.2. By Distribution Channel (In Value %)

4.2.1. On-Trade (Bars, Restaurants, Clubs)

4.2.2. Off-Trade (Supermarkets, Liquor Stores, Online Retailers)

4.3. By Alcohol Content (In Value %)

4.3.1. Low-Alcohol (Under 5%)

4.3.2. Standard Alcohol (5%-20%)

4.3.3. High-Alcohol (Above 20%)

4.4. By Packaging Type (In Value %)

4.4.1. Bottles (Glass, Plastic)

4.4.2. Cans

4.4.3. Tetra Packs

4.5. By Region (In Value %)

4.5.1. North Vietnam

4.5.2. Central Vietnam

4.5.3. South Vietnam

5. Vietnam Alcoholic Beverages Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sabeco (Saigon Beer-Alcohol-Beverage Corporation)

5.1.2. Habeco (Hanoi Beer-Alcohol-Beverage Corporation)

5.1.3. Carlsberg Vietnam

5.1.4. Heineken Vietnam

5.1.5. Pernod Ricard Vietnam

5.1.6. Diageo Vietnam

5.1.7. San Miguel Vietnam

5.1.8. Molson Coors Vietnam

5.1.9. Tiger Beer (Asia Pacific Breweries)

5.1.10. Red River Beverage Group

5.1.11. Sapporo Vietnam

5.1.12. Belgo Craft Beer Brewery

5.1.13. Thirsty Craft Beer Vietnam

5.1.14. Vietnam Wine & Spirit

5.1.15. Mekong Brewing Company

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Alcohol Content Specialization, Regional Dominance, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Alcoholic Beverages Market Regulatory Framework

6.1. Alcohol Advertising and Marketing Restrictions

6.2. Licensing and Distribution Laws

6.3. Import Tariffs on Foreign Alcoholic Beverages

6.4. Certification and Compliance Requirements

7. Vietnam Alcoholic Beverages Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Alcoholic Beverages Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Alcohol Content (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Alcoholic Beverages Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

9.5. Market Entry Strategies for New Entrants

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves the identification of critical market variables influencing the Vietnam Alcoholic Beverages Market, such as product type preferences, alcohol consumption behavior, and regulatory frameworks. This is achieved through comprehensive desk research and analysis of industry reports.

Step 2: Market Analysis and Construction

Historical data from government sources and industry databases is analyzed to assess market size, growth rates, and market penetration. This step provides foundational insights into revenue generation and consumption trends across product types and regions.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts, including manufacturers, distributors, and retailers, are conducted to validate the data. These consultations provide operational and financial insights that enhance the accuracy of the revenue estimates and market trends.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all gathered data, incorporating expert insights, and generating comprehensive market insights. This ensures that the analysis is accurate and relevant for business professionals seeking to enter or expand in the Vietnam Alcoholic Beverages Market.

Frequently Asked Questions

01. How big is the Vietnam Alcoholic Beverages Market?

The Vietnam Alcoholic Beverages market is valued at USD 7 billion, driven by an increase in disposable incomes, shifting consumer preferences towards premium alcohol, and the growing urban population.

02. What are the challenges in the Vietnam Alcoholic Beverages Market?

Challenges include stringent government regulations on alcohol advertising, fluctuating raw material costs, and growing health consciousness among consumers, which could slow down growth in certain segments.

03. Who are the major players in the Vietnam Alcoholic Beverages Market?

Key players in the market include Sabeco, Habeco, Heineken Vietnam, Diageo Vietnam, and Pernod Ricard. These companies dominate due to their extensive distribution networks, strong brand presence, and competitive pricing.

04. What are the growth drivers of the Vietnam Alcoholic Beverages Market?

Growth drivers include rising disposable incomes, increasing demand for premium alcoholic beverages, the expansion of the tourism industry, and urbanization, especially in cities like Hanoi and Ho Chi Minh City.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.