Region:Asia

Author(s):Rebecca

Product Code:KRAC8622

Pages:100

Published On:November 2025

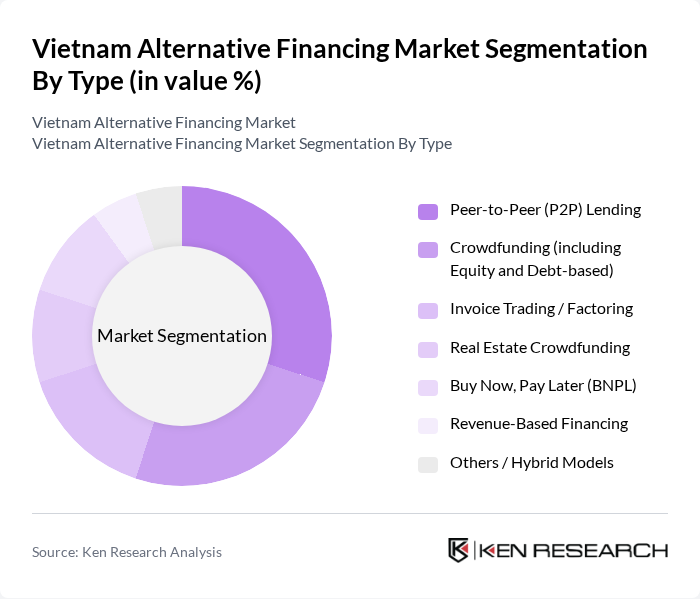

By Type:The alternative financing market in Vietnam is segmented into various types, including Peer-to-Peer (P2P) Lending, Crowdfunding (including Equity and Debt-based), Invoice Trading / Factoring, Real Estate Crowdfunding, Buy Now, Pay Later (BNPL), Revenue-Based Financing, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of financing options available in the country.

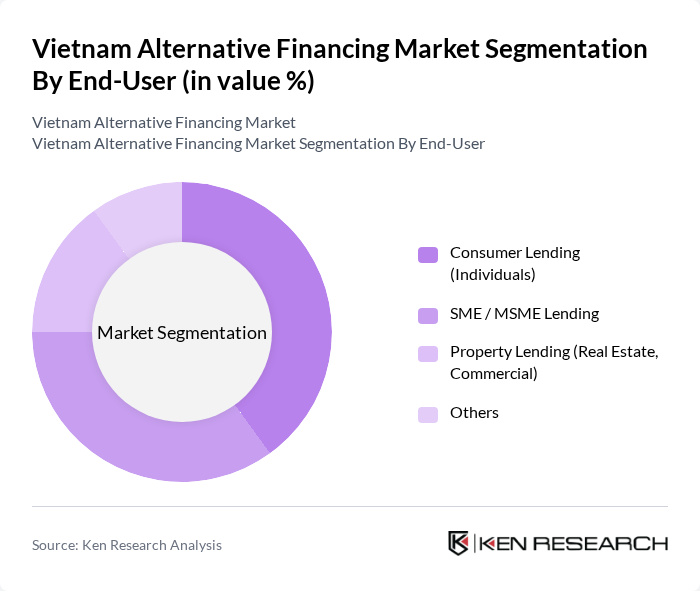

By End-User:The end-user segmentation of the alternative financing market includes Consumer Lending (Individuals), SME / MSME Lending, Property Lending (Real Estate, Commercial), and Others. This segmentation highlights the various target audiences for alternative financing solutions, each with unique requirements and financial behaviors.

The Vietnam Alternative Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo, Tima, Fundiin, VayMuon, Lendbiz, VayVND, Trusting Social, VayOnline, FiinGroup, VNDIRECT, FE Credit, Viettel Money, MFast, Finhay, Kilala contribute to innovation, geographic expansion, and service delivery in this space.

The future of the alternative financing market in Vietnam appears promising, driven by technological advancements and increasing consumer demand for accessible financial solutions. As the digital economy expands, more individuals and small businesses will seek innovative financing options. Additionally, the government's commitment to fostering a supportive regulatory environment will likely enhance investor confidence. However, addressing challenges such as regulatory uncertainties and financial literacy will be crucial for sustainable growth in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type (P2P Lending, Crowdfunding, Invoice Trading, Real Estate Crowdfunding, BNPL, Revenue-Based Financing, Others) | Peer-to-Peer (P2P) Lending Crowdfunding (including Equity and Debt-based) Invoice Trading / Factoring Real Estate Crowdfunding Buy Now, Pay Later (BNPL) Revenue-Based Financing Others / Hybrid Models |

| By End-User (Consumer Lending, SME/MSME Lending, Property Lending, Others) | Consumer Lending (Individuals) SME / MSME Lending Property Lending (Real Estate, Commercial) Others |

| By Investment Source (Domestic Investors, Foreign Investors, Institutional Investors, Others) | Domestic Investors Foreign Investors Institutional Investors Others |

| By Risk Profile (Low Risk, Medium Risk, High Risk, Others) | Low Risk Medium Risk High Risk Others |

| By Duration (Short-term, Medium-term, Long-term, Others) | Short-term (e.g., BNPL, Payday, Invoice Financing) Medium-term Long-term Others |

| By Purpose (Personal Loans, Payroll Advance, Home Improvement, Education Loans, Business Loans, Working Capital, Equipment Loans, Investment Loans, Others) | Personal Loans Payroll Advance Home Improvement Loans Education / Student Loans Business Loans (Working Capital, Equipment, Expansion) Investment Loans Others |

| By Regulatory Compliance (Licensed, Unlicensed, Others) | Licensed Unlicensed Others |

| By Distribution Channel (Branch/Physical, Direct Digital, Agent/Broker) | Branch / Physical Direct Digital Lending Agent / Broker Channel Others |

| By Payment Instrument (Credit Transfer, Debit Card, E-Money, Cash, Cheques, Direct Debits, Credit Card, Others) | Credit Transfer Debit Card E-Money Cash Cheques Direct Debits Credit Card Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Financing Needs Assessment | 120 | Business Owners, Financial Managers |

| Consumer Awareness of Alternative Financing | 95 | Individual Borrowers, Young Professionals |

| Fintech Platform User Experience | 75 | Active Users, Platform Managers |

| Investor Sentiment in Alternative Financing | 65 | Venture Capitalists, Angel Investors |

| Regulatory Impact on Alternative Financing | 55 | Policy Makers, Legal Advisors |

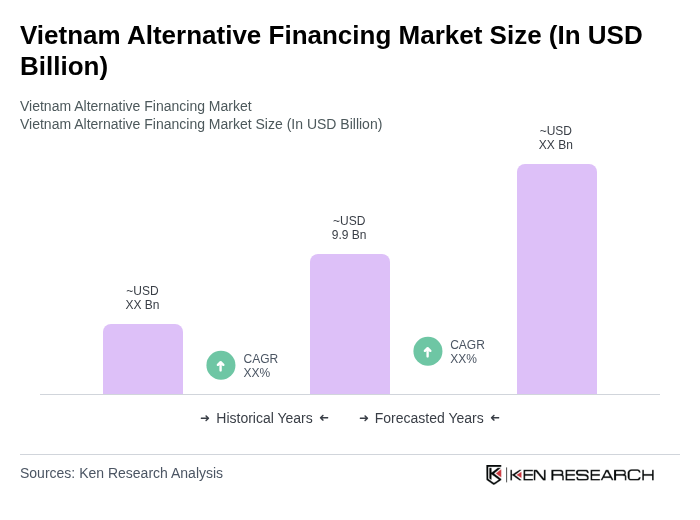

The Vietnam Alternative Financing Market is valued at approximately USD 9.9 billion, reflecting significant growth driven by increasing demand for flexible financing options and the rapid digitalization of financial services.