Region:Asia

Author(s):Rebecca

Product Code:KRAD8179

Pages:85

Published On:December 2025

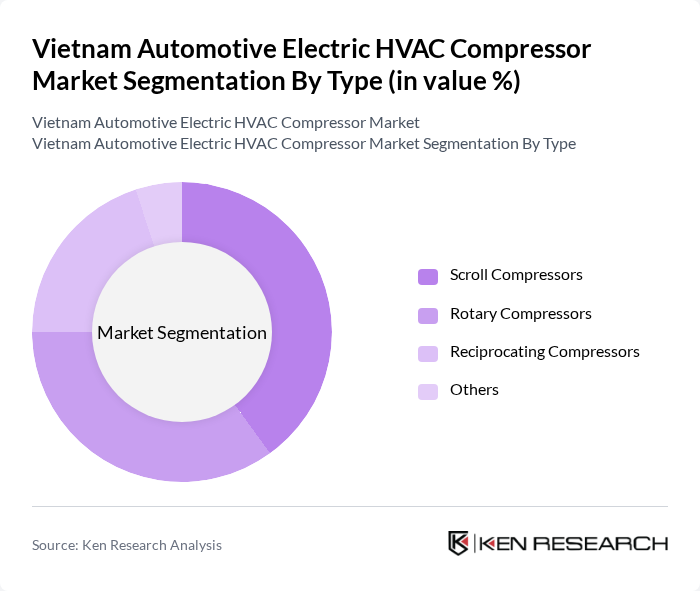

By Type:The market is segmented into various types of compressors, including Scroll Compressors, Rotary Compressors, Reciprocating Compressors, and Others. Among these, Scroll Compressors are gaining traction due to their efficiency and compact design, making them suitable for electric vehicles. Rotary Compressors are also popular for their reliability and performance in various applications. The demand for Reciprocating Compressors remains steady, particularly in traditional vehicles, while the 'Others' category includes emerging technologies that are still being developed.

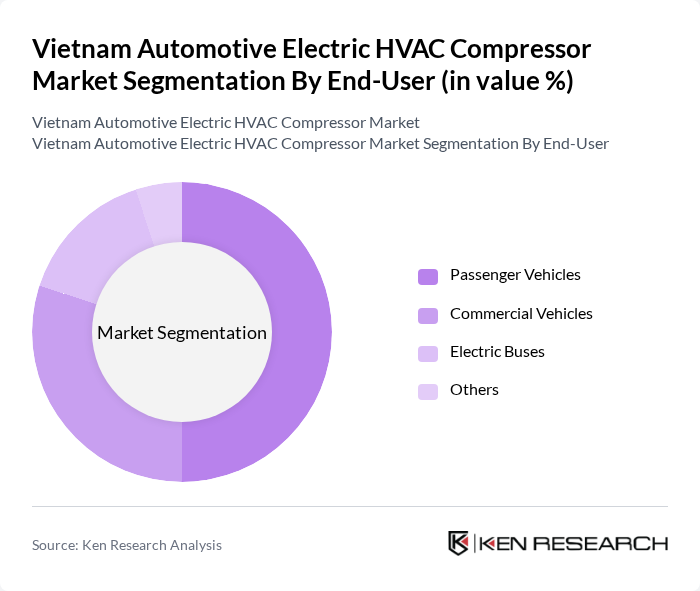

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Electric Buses, and Others. The Passenger Vehicles segment is the largest due to the increasing number of electric and hybrid cars on the road. Commercial Vehicles are also seeing a rise in demand for electric HVAC systems as businesses seek to reduce operational costs. Electric Buses are gaining popularity as cities invest in public transport electrification, while the 'Others' category includes niche applications.

The Vietnam Automotive Electric HVAC Compressor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Corporation, Denso Corporation, Valeo SA, Mahle GmbH, Sanden Corporation, Hanon Systems, Delphi Technologies, Calsonic Kansei Corporation, Sanden International, Aisin Seiki Co., Ltd., Johnson Electric Holdings Limited, Eberspächer Group, BorgWarner Inc., GEA Group AG, ZF Friedrichshafen AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam automotive electric HVAC compressor market appears promising, driven by the increasing adoption of electric vehicles and advancements in HVAC technology. With the government’s commitment to reducing carbon emissions and promoting sustainable transportation, the market is expected to see significant growth. Additionally, the integration of smart technologies in HVAC systems will enhance energy efficiency and user experience, further propelling market expansion. As consumer preferences shift towards eco-friendly solutions, the demand for electric HVAC compressors will likely rise, creating a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Scroll Compressors Rotary Compressors Reciprocating Compressors Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Buses Others |

| By Vehicle Type | Electric Cars Hybrid Vehicles Fuel Cell Vehicles Others |

| By Application | Cabin Cooling Cabin Heating Defrosting Others |

| By Component | Compressors Condensers Evaporators Others |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Others |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for Manufacturers Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| HVAC Manufacturers | 45 | Product Development Managers, Technical Directors |

| Automotive OEMs | 40 | Procurement Managers, Engineering Leads |

| Electric Vehicle Startups | 30 | Founders, R&D Managers |

| Industry Experts | 25 | Consultants, Market Analysts |

| Regulatory Bodies | 10 | Policy Makers, Compliance Officers |

The Vietnam Automotive Electric HVAC Compressor Market is valued at approximately USD 25 million, reflecting a significant growth trend driven by the increasing adoption of electric vehicles and energy-efficient solutions in the automotive sector.