Region:Asia

Author(s):Dev

Product Code:KRAC4768

Pages:96

Published On:October 2025

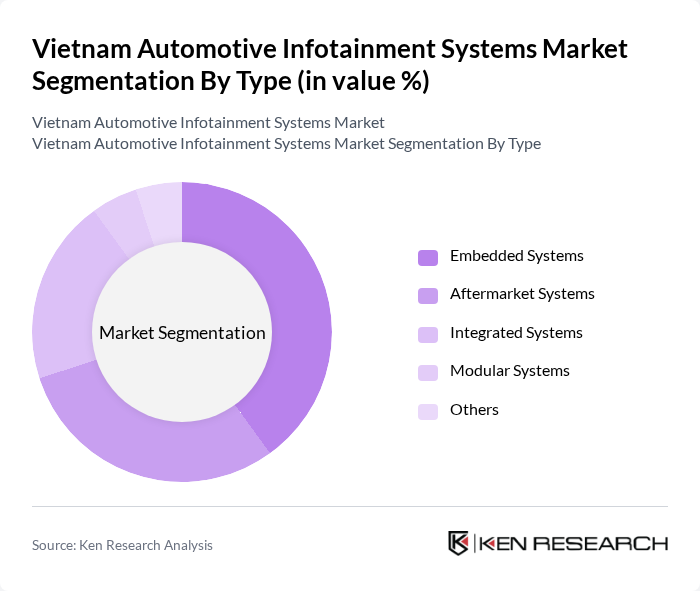

By Type:The market is segmented into Embedded Systems, Aftermarket Systems, Integrated Systems, Modular Systems, and Others.Embedded Systemsare gaining significant traction due to their seamless integration with vehicle architecture, enabling advanced features such as voice recognition, navigation, and real-time diagnostics.Aftermarket Systemsremain popular as consumers seek to retrofit existing vehicles with modern infotainment capabilities.Integrated Systemsare increasingly in demand as manufacturers prioritize all-in-one solutions that combine entertainment, connectivity, and vehicle information management .

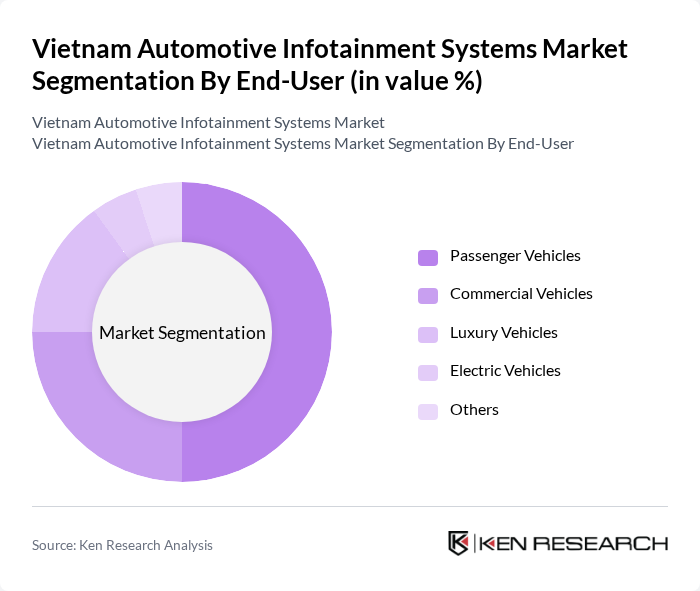

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Luxury Vehicles, Electric Vehicles, and Others.Passenger Vehiclesaccount for the largest share, reflecting the dominance of this segment in Vietnam's automotive market. Rising disposable income and evolving consumer preferences are fueling demand forLuxuryandElectric Vehicles, both of which increasingly feature advanced infotainment systems as standard.Commercial Vehiclesare also witnessing greater infotainment adoption, driven by the need for enhanced driver comfort, navigation, and fleet connectivity .

The Vietnam Automotive Infotainment Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch Automotive, Denso Corporation, Continental AG, Panasonic Corporation, Harman International, Pioneer Corporation, Alpine Electronics, Sony Corporation, JVC Kenwood Corporation, Visteon Corporation, Clarion Co., Ltd., Aisin Seiki Co., Ltd., Valeo SA, ZF Friedrichshafen AG, LG Electronics, VinFast Auto, FPT Software, Hyundai Mobis, Mitsubishi Electric Corporation, Mobis Vietnam Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive infotainment systems market in Vietnam appears promising, driven by technological advancements and increasing consumer expectations. As the market adapts to the growing demand for connected vehicles, automakers are likely to invest in innovative solutions that enhance user experience. Furthermore, the anticipated expansion of 5G networks will facilitate better connectivity, enabling more sophisticated infotainment features. This evolution will likely attract new players and foster collaborations between automotive and technology companies, enhancing the overall market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Embedded Systems Aftermarket Systems Integrated Systems Modular Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Luxury Vehicles Electric Vehicles Others |

| By Component | Display Units Audio Systems Connectivity Modules Control Interfaces Navigation Units Communication Units Others |

| By Sales Channel | OEM Sales Aftermarket Sales Online Sales Retail Sales Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Others |

| By Price Range | Low-End Systems Mid-Range Systems High-End Systems Others |

| By User Experience Features | Voice Control Touchscreen Interfaces Gesture Control Customizable Interfaces Over-the-Air Updates Smartphone Integration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Infotainment Systems | 100 | Product Managers, Automotive Engineers |

| Commercial Vehicle Technology Integration | 60 | Fleet Managers, Technology Officers |

| Aftermarket Infotainment Solutions | 50 | Retail Managers, Automotive Technicians |

| Consumer Preferences in Infotainment Features | 80 | Car Owners, Automotive Enthusiasts |

| Regulatory Impact on Infotainment Systems | 40 | Policy Makers, Compliance Officers |

The Vietnam Automotive Infotainment Systems Market is valued at approximately USD 10 billion, driven by increasing demand for advanced in-car technologies and consumer preferences for enhanced connectivity features.