Region:Asia

Author(s):Geetanshi

Product Code:KRAD7175

Pages:85

Published On:December 2025

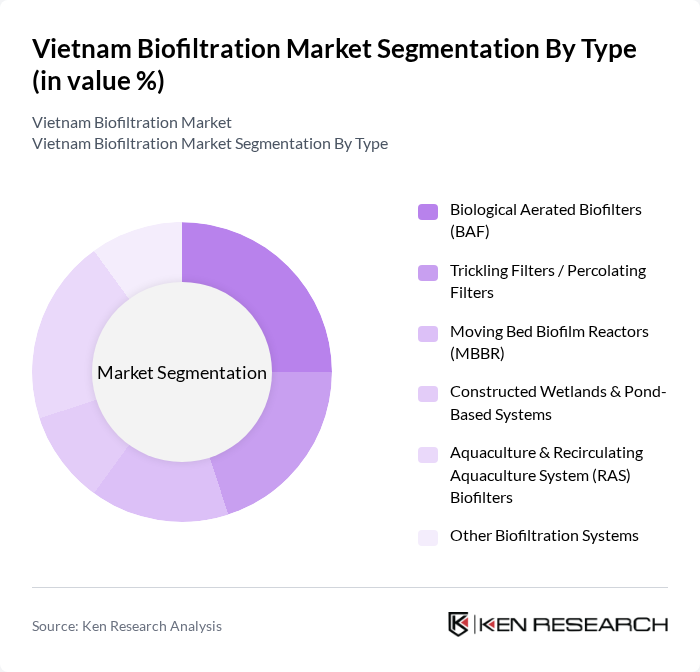

By Type:The biofiltration market can be segmented into various types, including Biological Aerated Biofilters (BAF), Trickling Filters / Percolating Filters, Moving Bed Biofilm Reactors (MBBR), Constructed Wetlands & Pond-Based Systems, Aquaculture & Recirculating Aquaculture System (RAS) Biofilters, and Other Biofiltration Systems. Each of these types serves specific applications and industries, contributing to the overall market dynamics.

By End-User:The end-user segmentation includes Municipal Wastewater & Sewerage Utilities, Industrial (Food & Beverage, Pulp & Paper, Chemicals, etc.), Aquaculture & Fisheries, Buildings & Commercial (Odor / Air Treatment), and Others. Each end-user category has distinct requirements and applications for biofiltration technologies, influencing market trends and growth.

The Vietnam Biofiltration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Water Supply and Sewerage Association (VWSA), Saigon Water Corporation (SAWACO), Hanoi Water Limited Company (HAWACO), Vietnam Water and Environment Investment Corporation – JSC (VIWASEEN), Center for Environmental Technology and Management – CETM (under Institute of Environmental Technology, VAST), Công ty C? ph?n K? thu?t Môi tr??ng CEEP (CEEP Environment Engineering JSC), Công ty C? ph?n Công ngh? Môi tr??ng Bình Minh (Binh Minh Environment Technology JSC), Công ty TNHH X? lý N??c & Môi tr??ng Vi?t An (Viet An Water & Environment Co., Ltd.), Công ty TNHH K? thu?t Môi tr??ng NTS (NTS Environmental Engineering Co., Ltd.), Công ty C? ph?n K? thu?t SEEN (SEEN Engineering JSC), Veolia Vietnam, SUEZ Vietnam, Kurita Water Industries – Vietnam, Organica Water – Vietnam Projects, and other emerging local biofiltration solution providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam biofiltration market appears promising, driven by increasing environmental awareness and technological advancements. As urbanization accelerates, the demand for efficient wastewater treatment solutions will rise, prompting further investment in biofiltration technologies. Additionally, the integration of IoT in biofiltration systems is expected to enhance operational efficiency and monitoring capabilities, making these systems more attractive to industries. Overall, the market is poised for significant growth as stakeholders recognize the long-term benefits of sustainable practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Biological Aerated Biofilters (BAF) Trickling Filters / Percolating Filters Moving Bed Biofilm Reactors (MBBR) Constructed Wetlands & Pond-Based Systems Aquaculture & Recirculating Aquaculture System (RAS) Biofilters Other Biofiltration Systems |

| By End-User | Municipal Wastewater & Sewerage Utilities Industrial (Food & Beverage, Pulp & Paper, Chemicals, etc.) Aquaculture & Fisheries Buildings & Commercial (Odor / Air Treatment) Others |

| By Application | Municipal Wastewater & Sewage Treatment Industrial Effluent Treatment Aquaculture Water Treatment Air & Odor Biofiltration (Industrial & Solid Waste) Stormwater & Urban Runoff Management Others |

| By Material Used | Organic Media (Compost, Wood Chips, Peat, etc.) Inorganic Media (Ceramic Rings, Gravel, Expanded Clay, etc.) Synthetic & Plastic Media (Bio-balls, Structured Packings) Integrated / Composite Media Others |

| By Technology | Fixed-Film Biofiltration Systems Suspended-Growth & Hybrid Biofilm Systems Membrane-Coupled Biofiltration (e.g., MBR with Biofilm Stage) Nature-Based Solutions (Constructed Wetlands, Bio-swales, Green Infrastructure) Others |

| By Region | Northern Vietnam (Including Hanoi & Red River Delta) Central Vietnam (Including Da Nang & Coastal Provinces) Southern Vietnam (Including Ho Chi Minh City & Mekong Delta) Others |

| By Policy Support | National Programs for Urban Wastewater Treatment Industrial Pollution Control & Compliance Incentives Support Schemes for Aquaculture & Coastal Environmental Protection Grants for Pilot Projects & Demonstration of Green Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 120 | Facility Managers, Environmental Compliance Officers |

| Industrial Wastewater Treatment Plants | 90 | Operations Managers, Environmental Engineers |

| Research Institutions Focused on Environmental Technologies | 60 | Research Scientists, Academic Professors |

| Private Sector Biofiltration Technology Providers | 80 | Product Managers, Sales Directors |

| Government Regulatory Bodies | 70 | Policy Makers, Environmental Analysts |

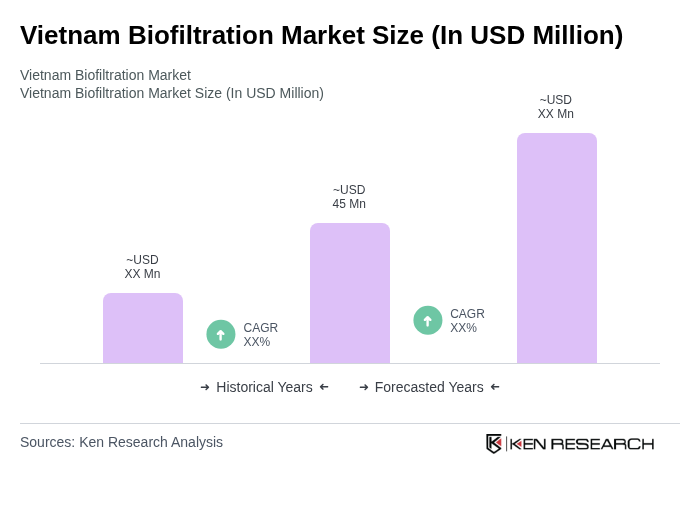

The Vietnam Biofiltration Market is valued at approximately USD 45 million, driven by factors such as increasing environmental regulations, urbanization, and the need for sustainable wastewater treatment solutions.