Region:Asia

Author(s):Geetanshi

Product Code:KRAA1211

Pages:91

Published On:August 2025

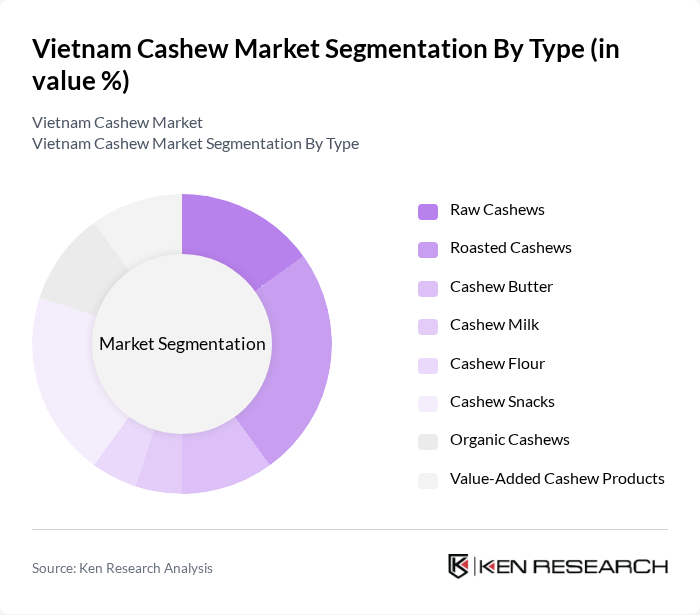

By Type:The Vietnam cashew market is segmented into raw cashews, roasted cashews, cashew butter, cashew milk, cashew flour, cashew snacks, organic cashews, and value-added cashew products. Roasted cashews and cashew snacks are particularly popular due to their convenience, taste, and rising consumer preference for healthy, plant-based snacks. The market is also witnessing growth in value-added products such as flavored nuts, cashew butter, and cashew-based dairy alternatives, driven by innovation and evolving dietary trends .

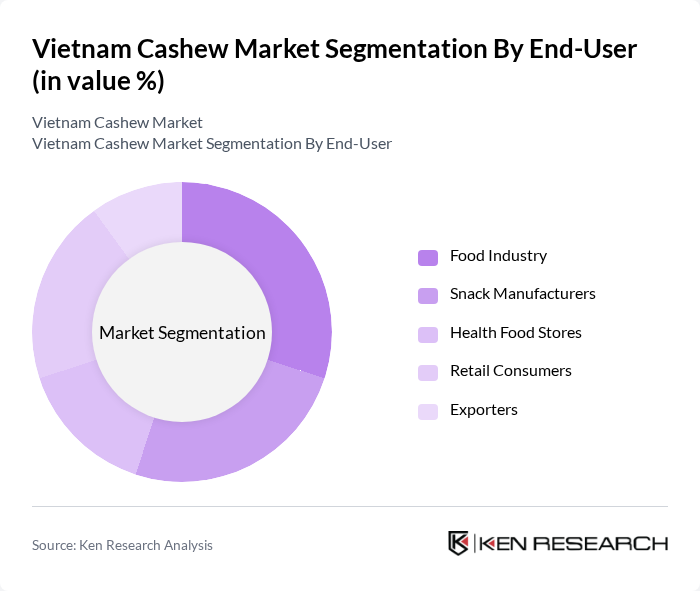

By End-User:The end-user segmentation comprises the food industry, snack manufacturers, health food stores, retail consumers, and exporters. The food industry and snack manufacturers are the leading segments, propelled by the growing trend of healthy snacking and the integration of cashews into a wide array of food products, including bakery, confectionery, and dairy alternatives. Health food stores and retail consumers are also significant contributors, reflecting the rising demand for nutritious and plant-based foods .

The Vietnam Cashew Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Cashew Association (VINACAS), Long Son Joint Stock Company, Hoang Son 1 Company Limited, Cao Phat Co., Ltd., Tan Long Group, Phuc Thinh Cashew Processing Co., Ltd., Donafoods (Dong Nai Food Industrial Corporation), Binh Phuoc Import Export Production Company (Bipexco), An Viet Phat Holdings, Phuc An Cashew Company, Quang Huy Cashew Company, Gia Lai Cashew Company, Dak Lak Cashew Company, Southern Cashew Company, and Central Highlands Cashew Company contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam cashew market is poised for continued growth, driven by increasing global demand and the expansion of export markets. As consumer preferences shift towards healthier snack options, the demand for cashews is expected to rise. Additionally, government initiatives aimed at supporting farmers and promoting sustainable practices will likely enhance production efficiency. However, addressing challenges such as price volatility and environmental sustainability will be crucial for maintaining competitiveness in the global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Raw Cashews Roasted Cashews Cashew Butter Cashew Milk Cashew Flour Cashew Snacks Organic Cashews Value-Added Cashew Products |

| By End-User | Food Industry Snack Manufacturers Health Food Stores Retail Consumers Exporters |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales Export Channels |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Price Range | Premium Mid-Range Budget |

| By Geographic Distribution | Mekong River Delta Southeast Region South Central Coast Urban Areas Rural Areas |

| By Product Form | Whole Cashews Chopped Cashews Cashew Pieces Cashew Kernels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cashew Farmers | 100 | Farm Owners, Agricultural Technicians |

| Processing Plant Managers | 60 | Operations Managers, Quality Control Supervisors |

| Exporters | 50 | Export Managers, Sales Directors |

| Retail Buyers | 40 | Procurement Officers, Category Managers |

| Industry Experts | 40 | Market Analysts, Agricultural Economists |

The Vietnam Cashew Market is valued at approximately USD 4.1 billion, driven by increasing global demand for cashew nuts, particularly in the snack and health food sectors, along with advancements in processing technology and quality focus.