Region:Asia

Author(s):Rebecca

Product Code:KRAB2908

Pages:90

Published On:October 2025

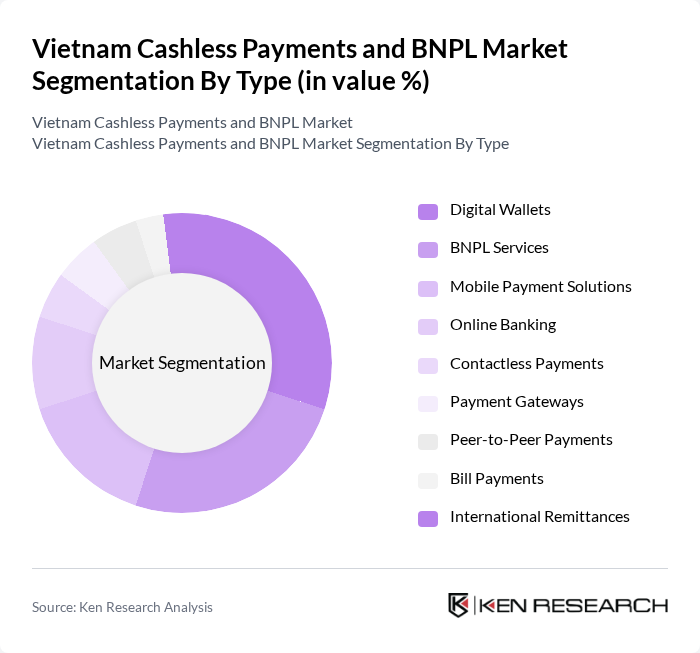

By Type:This segmentation includes various forms of cashless payment solutions and BNPL services that cater to different consumer needs and preferences. The market is characterized by a diverse range of offerings, including digital wallets, BNPL services, mobile payment solutions, QR code payments, contactless cards, online banking, and peer-to-peer transfers. Each sub-segment plays a crucial role in shaping the overall landscape of cashless transactions in Vietnam, with QR code payments and digital wallets leading adoption due to their convenience and widespread merchant acceptance .

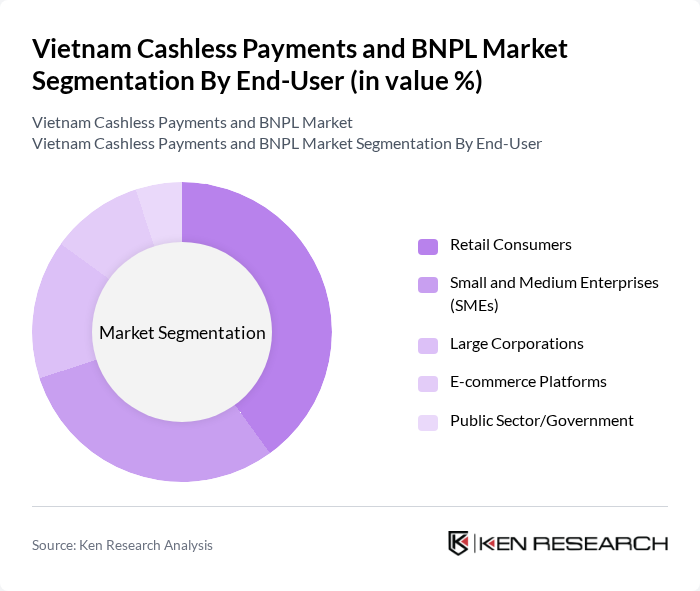

By End-User:This segmentation focuses on the various consumer groups utilizing cashless payment solutions and BNPL services. The end-users range from retail consumers to small and medium enterprises (SMEs) and large corporations, each with distinct needs and preferences that drive their adoption of cashless transactions. Retail consumers represent the largest segment, driven by e-commerce growth and mobile wallet adoption, while SMEs and large corporations leverage these solutions for operational efficiency and improved customer experience .

The Vietnam Cashless Payments and BNPL Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo (M_Service JSC), ZaloPay (VNG Corporation), VNPay (Vietnam Payment Solution JSC), TikiPay (Tiki Corporation), GrabPay by Moca (Moca Technology and Service JSC, in partnership with Grab), ShopeePay (AirPay JSC, part of Sea Group), Payoo (VietUnion Online Services JSC), FPT Pay (FPT Corporation), Home Credit Vietnam, Kredivo Vietnam, Trusting Social, ViettelPay (Viettel Group), BankPlus (Viettel Group in partnership with Vietnamese banks), Easy Credit (EVN Finance JSC), FE Credit (VPBank Finance Company Limited) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's cashless payments and BNPL market appears promising, driven by technological advancements and evolving consumer preferences. As digital wallets gain traction, the integration of AI in payment processing is expected to enhance user experience and security. Additionally, the rise of contactless payment methods will likely reshape consumer behavior, making transactions more convenient. With ongoing government support and increasing investment in fintech, the market is poised for significant growth, fostering a more inclusive financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Wallets BNPL Services Mobile Payment Solutions Online Banking Contactless Payments Payment Gateways Peer-to-Peer Payments Bill Payments International Remittances |

| By End-User | Retail Consumers Small and Medium Enterprises (SMEs) Large Corporations E-commerce Platforms Public Sector/Government |

| By Sales Channel | Online Sales Offline Sales Mobile Applications Third-party Platforms |

| By Payment Method | QR Code Payments NFC Payments Credit Cards Debit Cards Bank Transfers USSD Payments |

| By Consumer Demographics | Age Groups Income Levels Urban vs Rural |

| By Industry | Retail Travel and Hospitality Healthcare Education Utilities |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Public Awareness Campaigns |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cashless Payment Users | 120 | Consumers aged 18-45, frequent online shoppers |

| BNPL Service Users | 80 | Consumers who have used BNPL in the last 12 months |

| Retail Sector Stakeholders | 60 | Retail Managers, E-commerce Directors |

| Fintech Industry Experts | 40 | Executives from payment service providers and fintech startups |

| Regulatory Bodies | 40 | Officials from the State Bank of Vietnam and financial regulators |

The Vietnam Cashless Payments and BNPL Market is valued at approximately USD 47 billion, driven by the increasing adoption of digital payment solutions, e-commerce growth, and consumer preference for convenience.