Region:Asia

Author(s):Shubham

Product Code:KRAB3277

Pages:99

Published On:October 2025

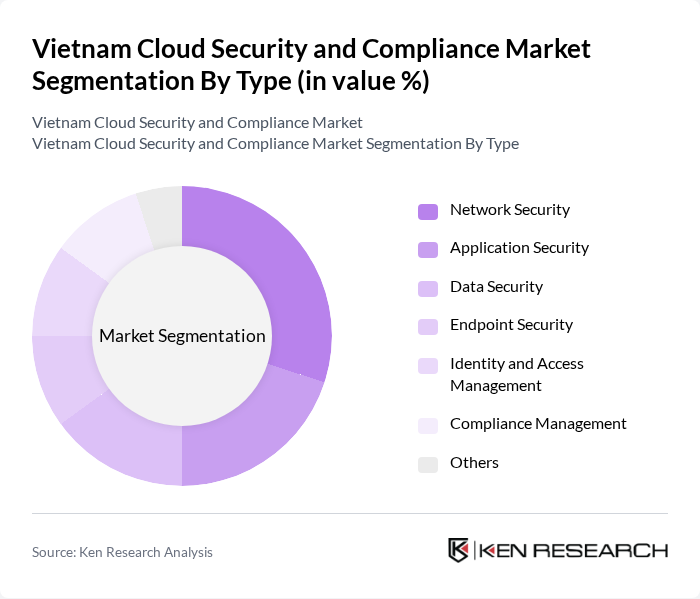

By Type:The market is segmented into various types, including Network Security, Application Security, Data Security, Endpoint Security, Identity and Access Management, Compliance Management, and Others. Among these, Network Security is currently the leading sub-segment due to the increasing number of cyber threats and the need for organizations to protect their networks from unauthorized access and attacks. The growing reliance on cloud infrastructure has further amplified the demand for robust network security solutions.

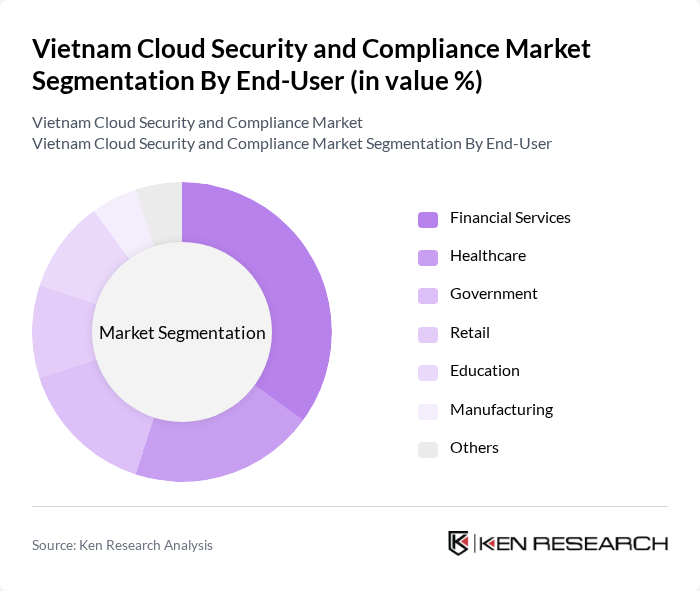

By End-User:The end-user segmentation includes Financial Services, Healthcare, Government, Retail, Education, Manufacturing, and Others. The Financial Services sector is the dominant segment, driven by stringent regulatory requirements and the need for secure transactions. Financial institutions are increasingly adopting cloud security solutions to protect sensitive customer data and comply with regulations, making this sector a key driver of market growth.

The Vietnam Cloud Security and Compliance Market is characterized by a dynamic mix of regional and international players. Leading participants such as FPT Corporation, VNPT Security, CMC Telecom, Bkav Corporation, SecureNet, VSEC, CyberAgent, Viettel Cyber Security, MobiFone, IBM Vietnam, Microsoft Vietnam, Cisco Vietnam, Palo Alto Networks Vietnam, Check Point Software Technologies, and Fortinet Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam cloud security and compliance market appears promising, driven by increasing digitalization and a heightened focus on cybersecurity. As businesses continue to embrace cloud technologies, the demand for advanced security solutions will grow. Additionally, the government's commitment to enhancing digital infrastructure and regulatory frameworks will further support market expansion. The integration of innovative technologies, such as artificial intelligence and machine learning, will also play a crucial role in shaping the future landscape of cloud security in Vietnam.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Data Security Endpoint Security Identity and Access Management Compliance Management Others |

| By End-User | Financial Services Healthcare Government Retail Education Manufacturing Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud |

| By Compliance Standard | ISO 27001 GDPR PCI DSS HIPAA |

| By Service Model | IaaS PaaS SaaS |

| By Industry Vertical | Telecommunications Energy and Utilities Transportation and Logistics Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cloud Security | 100 | IT Security Managers, Compliance Officers |

| Healthcare Cloud Compliance | 80 | Data Protection Officers, IT Administrators |

| E-commerce Cloud Solutions | 90 | Operations Managers, IT Directors |

| Government Cloud Security Initiatives | 70 | Policy Makers, IT Security Analysts |

| SME Cloud Adoption Trends | 60 | Business Owners, IT Consultants |

The Vietnam Cloud Security and Compliance Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of cloud services, awareness of cybersecurity threats, and the need for compliance with international standards.