Region:Asia

Author(s):Rebecca

Product Code:KRAA1353

Pages:93

Published On:August 2025

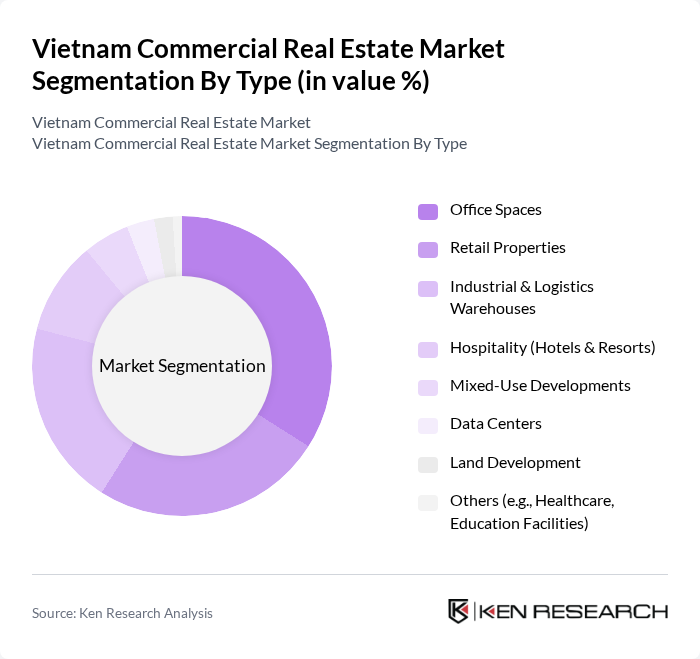

By Type:The commercial real estate market can be segmented into various types, including office spaces, retail properties, industrial and logistics warehouses, hospitality (hotels and resorts), mixed-use developments, data centers, land development, and others such as healthcare and education facilities. Each of these segments caters to different consumer needs and market demands. Office spaces remain the most prominent segment, driven by demand from corporates and multinationals, while retail properties are supported by robust consumer spending and the expansion of modern retail formats. Industrial and logistics warehouses are seeing rapid growth due to e-commerce and export manufacturing, and hospitality assets benefit from the resurgence of tourism. Mixed-use developments and data centers are increasingly relevant as urbanization and digital transformation accelerate .

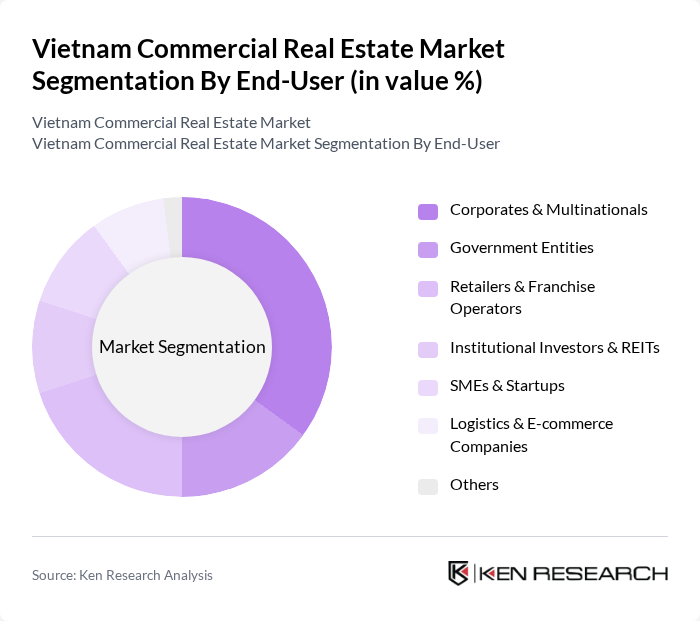

By End-User:The end-user segmentation of the commercial real estate market includes corporates and multinationals, government entities, retailers and franchise operators, institutional investors and REITs, SMEs and startups, logistics and e-commerce companies, and others. Corporates and multinationals dominate the market due to their need for office spaces and operational facilities. The rise of e-commerce has significantly increased demand for logistics and warehousing solutions. Institutional investors and REITs are expanding their portfolios, while SMEs and startups are increasingly seeking flexible office solutions. The government sector remains a stable contributor, and retailers continue to drive demand for prime retail locations .

The Vietnam Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vingroup JSC, Novaland Investment Group Corporation, Phu My Hung Development Corporation, FLC Group Joint Stock Company, Becamex IDC Corporation, Kinh Bac City Development Holding Corporation (KBC), Saigon Newport Corporation, Him Lam Land, Dat Xanh Group Joint Stock Company, Nam Long Investment Corporation, An Phat Holdings, Tan Hoang Minh Group, Sun Group Corporation, Hai Phat Investment Joint Stock Company, C.T Group Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam commercial real estate market is poised for continued growth, driven by urbanization, FDI, and infrastructure development. As the economy expands, the demand for diverse commercial spaces, including logistics and retail, will rise. Additionally, the government's focus on sustainable development and smart city initiatives will shape future investments. The integration of technology in real estate operations will enhance efficiency and attract a new generation of investors, ensuring a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Spaces Retail Properties Industrial & Logistics Warehouses Hospitality (Hotels & Resorts) Mixed-Use Developments Data Centers Land Development Others (e.g., Healthcare, Education Facilities) |

| By End-User | Corporates & Multinationals Government Entities Retailers & Franchise Operators Institutional Investors & REITs SMEs & Startups Logistics & E-commerce Companies Others |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding Real Estate Investment Trusts (REITs) Others |

| By Property Class | Grade A (Premium) Grade B (Mid-tier) Grade C (Economy) Others |

| By Location | Tier 1 Cities (e.g., Ho Chi Minh City, Hanoi) Tier 2 Cities (e.g., Da Nang, Hai Phong, Can Tho) Industrial Zones & Economic Corridors Suburban & Peri-urban Areas Rural Areas Others |

| By Financing Type | Equity Financing Debt Financing Crowdfunding Real Estate Investment Trusts (REITs) Others |

| By Development Stage | Pre-Development Under Construction Completed/Operational Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Market | 100 | Real Estate Agents, Home Buyers, Property Developers |

| Commercial Real Estate Sector | 60 | Commercial Property Managers, Business Owners, Investors |

| Industrial Real Estate Trends | 50 | Manufacturers, Logistics Managers, Industrial Property Developers |

| Real Estate Investment Insights | 40 | Investment Analysts, Financial Advisors, Institutional Investors |

| Urban Development Projects | 40 | Urban Planners, Government Officials, Community Leaders |

The Vietnam Commercial Real Estate Market is valued at approximately USD 45 billion, driven by urbanization, foreign direct investment, and a growing middle class demanding modern commercial spaces.