Region:Asia

Author(s):Rebecca

Product Code:KRAC3229

Pages:88

Published On:October 2025

Market.png)

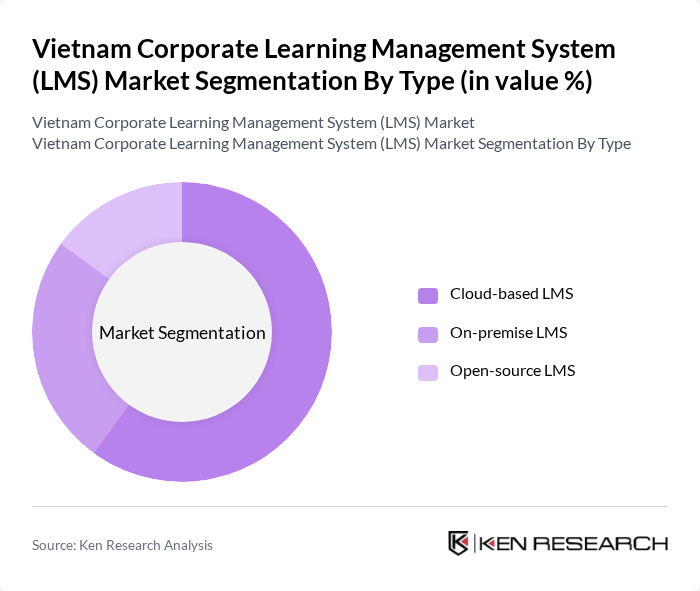

By Type:The market is segmented into three types: Cloud-based LMS, On-premise LMS, and Open-source LMS. Each type caters to different organizational needs, with cloud-based solutions gaining significant traction due to their flexibility and cost-effectiveness.

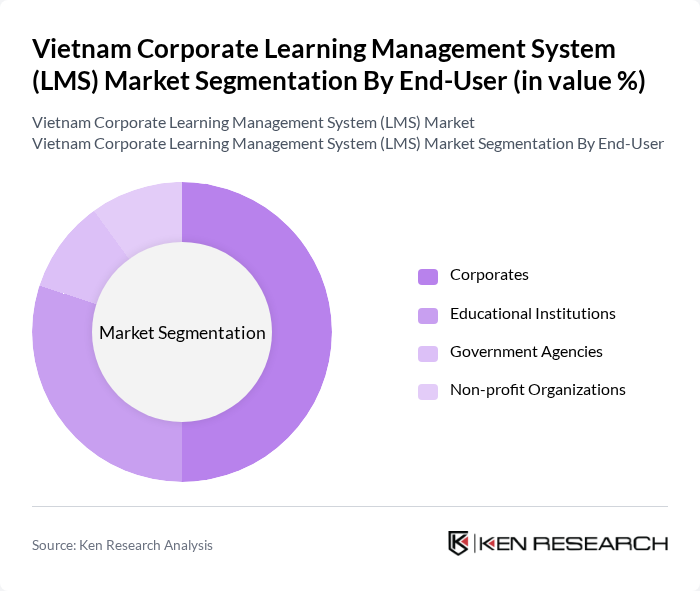

By End-User:The end-user segmentation includes Corporates, Educational Institutions, Government Agencies, and Non-profit Organizations. Corporates are the leading end-users, driven by the need for employee training and development in a competitive business environment.

The Vietnam Corporate Learning Management System (LMS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Topica Edtech Group, Kyna.vn, Edumall, Hocmai.vn, VnEdu (VNPT Group), Unica, MindX, FPT University/FPT Education, Viettel Group, Innotech Vietnam Corporation, TalentLMS, Moodle, SAP Litmos, Docebo, Cornerstone OnDemand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam Corporate Learning Management System (LMS) market appears promising, driven by technological advancements and a growing emphasis on employee development. As organizations increasingly adopt personalized learning experiences and microlearning modules, the demand for innovative LMS solutions is expected to rise. Additionally, the integration of AI and analytics will enhance training effectiveness, enabling companies to tailor programs to individual needs, thereby improving overall workforce performance and engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based LMS On-premise LMS Open-source LMS |

| By End-User | Corporates Educational Institutions Government Agencies Non-profit Organizations |

| By Industry | IT and Software Manufacturing Healthcare Retail Banking, Financial Services, and Insurance (BFSI) Telecommunications |

| By Learning Mode | Synchronous Learning Asynchronous Learning Blended Learning |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By User Type | Administrators Instructors Learners |

| By Pricing Model | Subscription-based One-time License Fee Freemium Pay-per-user |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Managers | 60 | HR Managers, Learning & Development Heads |

| IT Managers in Corporates | 50 | IT Directors, System Administrators |

| Employees Using LMS | 100 | Staff from various departments, Trainees |

| Educational Institutions Offering LMS | 40 | Deans, Program Coordinators |

| Corporate Executives on Training Needs | 50 | CEOs, Business Unit Leaders |

The Vietnam Corporate Learning Management System (LMS) market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing demand for digital learning solutions, particularly accelerated by the COVID-19 pandemic.