Vietnam Data Analytics Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD9978

November 2024

90

About the Report

Vietnam Data Analytics Market Overview

- The Vietnam data analytics market is valued at USD 4 billion, driven by rapid digitization across various industries such as banking, retail, and healthcare. Increasing adoption of big data technologies and cloud solutions is enhancing operational efficiency and driving market demand. Government initiatives promoting digital transformation and investments in cloud infrastructure also significantly contribute to this growth.

- Ho Chi Minh City and Hanoi are the dominant regions in the Vietnam data analytics market due to their higher concentration of technology firms and financial institutions. These cities act as tech hubs, with a well-developed infrastructure supporting large-scale adoption of data analytics solutions. Their prominence is further solidified by the presence of government-backed tech parks and innovation centers, making them the epicenter of technological advancements in the country.

- The National Digital Transformation Program, initiated by the Vietnamese government, is designed to drive digital adoption across all sectors by 2025. By 2024, the government had allocated $860 million towards initiatives that support the implementation of advanced analytics solutions. This program has been instrumental in encouraging both public and private sectors to embrace data analytics as part of their digital transformation strategies.

Vietnam Data Analytics Market Segmentation

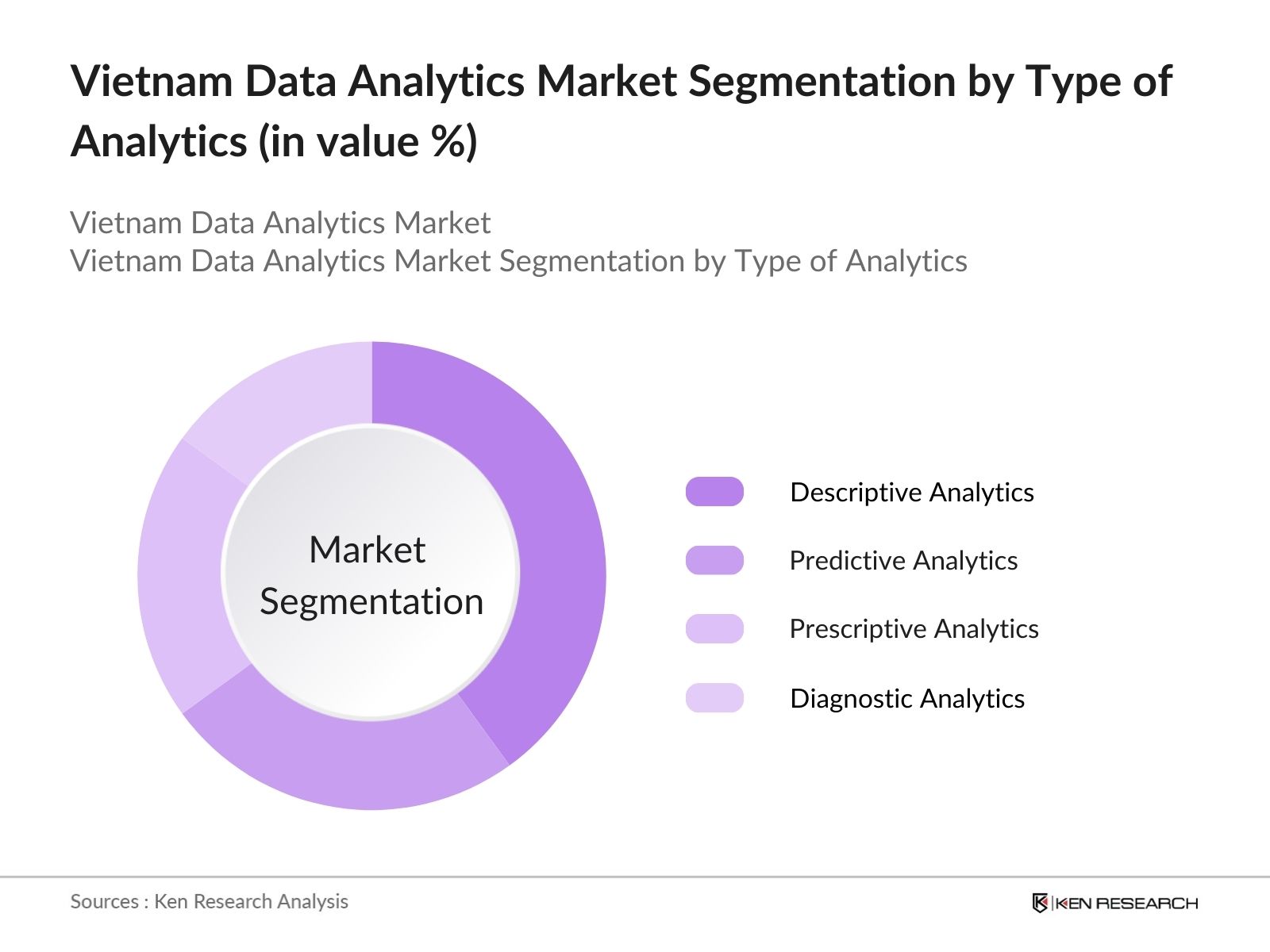

By Type of Analytics; Vietnams data analytics market is segmented by type of analytics into descriptive, predictive, prescriptive, and diagnostic analytics. Descriptive analytics dominates the market due to its wide application in summarizing historical data to help companies understand trends. Organizations in retail and financial sectors rely on descriptive analytics to create detailed reports on past sales, customer behaviors, and financial trends, enabling better decision-making processes.

By Deployment Mode: The market is further segmented by deployment mode into on-premise and cloud-based solutions. Cloud-based deployment holds a dominant market share due to its cost-effectiveness, scalability, and flexibility. The rapid growth of cloud infrastructure in Vietnam, coupled with lower upfront costs compared to on-premise systems, has encouraged enterprises of all sizes to opt for cloud-based data analytics. Additionally, the cloud-based model supports remote access, which has become essential for businesses transitioning to hybrid work environments post-pandemic.

By Deployment Mode: The market is further segmented by deployment mode into on-premise and cloud-based solutions. Cloud-based deployment holds a dominant market share due to its cost-effectiveness, scalability, and flexibility. The rapid growth of cloud infrastructure in Vietnam, coupled with lower upfront costs compared to on-premise systems, has encouraged enterprises of all sizes to opt for cloud-based data analytics. Additionally, the cloud-based model supports remote access, which has become essential for businesses transitioning to hybrid work environments post-pandemic.

Vietnam Data Analytics Market Competitive Landscape

Vietnam Data Analytics Market Competitive Landscape

The Vietnam data analytics market is dominated by a few major players, both local and international, offering a variety of analytics solutions. Companies like FPT Corporation and Viettel Group have established strong local presence with robust partnerships, while global firms like IBM and Microsoft have secured significant market positions through cutting-edge technological innovations. The market is characterized by collaborations between local IT firms and global giants to offer advanced analytics solutions.

Vietnam Data Analytics Market Analysis

Growth Drivers

- Increased Adoption of Big Data Solutions: The rapid adoption of big data solutions in Vietnam is a key growth driver. Vietnam's IT sector, supported by robust government initiatives, is experiencing a significant shift towards big data solutions for industries such as manufacturing, banking, and e-commerce. In 2023, the digital economy in Vietnam reached $23 billion, reflecting the extensive data generation from various sectors, which is increasing the demand for big data analytics.

- Digital Transformation Initiatives: Vietnam's digital transformation journey, under the National Digital Transformation Program, has been a key enabler of the data analytics market. The government has allocated over $43 million in 2024 to accelerate digital transformation across public and private sectors. This initiative includes the adoption of advanced analytics tools to support the digital economy and enhance productivity. Enterprises, particularly in finance and retail, are increasingly relying on analytics to drive digital strategies and operational efficiency, further propelling the demand for data analytics solutions.

- Proliferation of IoT Devices: The proliferation of IoT devices in Vietnam is generating vast amounts of data, which is driving the need for advanced analytics solutions. By 2025, it is estimated that Vietnam will have over 96 million IoT devices in use across industries such as agriculture, healthcare, and smart cities. This surge in IoT adoption, supported by government-backed projects like smart city initiatives in Hanoi and Ho Chi Minh City, is fueling the demand for real-time analytics to process the massive data generated, ensuring more informed decision-making and optimized operations.

Challenges

- Data Privacy and Security Concerns: Data privacy and security concerns are a growing challenge in Vietnam, especially with the implementation of the Decree 13/2023 on Personal Data Protection. Companies are now required to comply with stringent regulations on data storage, processing, and sharing, leading to increased compliance costs. As of 2024, nearly 60% of businesses have reported difficulties in ensuring full compliance with these regulations, particularly in sectors like banking and healthcare, where data security is critical.

- High Implementation Costs: The cost of implementing advanced data analytics solutions remains a significant barrier, particularly for small and medium enterprises (SMEs) in Vietnam. In 2024, it is estimated that the average cost for deploying a comprehensive analytics platform can range from $12,900 to $43,000, depending on the complexity and scale. This high upfront cost is preventing many businesses from adopting data analytics technologies, especially those with limited IT budgets.

Vietnam Data Analytics Market Future Outlook

Vietnam data analytics market is expected to see substantial growth, driven by increasing demand for real-time data insights, expansion of cloud infrastructure, and growing adoption of AI-driven analytics solutions. Government-backed digital transformation programs will further accelerate the deployment of analytics across key sectors like healthcare, finance, and manufacturing. Moreover, businesses will increasingly leverage data analytics to enhance customer experience and improve operational efficiency.

Market Opportunities

- Expansion of Cloud Computing Solutions: The expansion of cloud computing in Vietnam is creating opportunities for the growth of the data analytics market. By 2024, cloud adoption in Vietnam is expected to reach 60%, driven by major players like AWS and Google Cloud expanding their presence in the country. The flexibility and scalability offered by cloud solutions are enabling businesses to deploy advanced analytics tools without the need for heavy infrastructure investments. This is particularly beneficial for SMEs, which can now leverage cloud-based analytics at a fraction of the cost of on-premises solutions.

- Emerging AI and Machine Learning Use Cases: AI and machine learning (ML) are opening new opportunities in Vietnams data analytics market. By 2024, it is anticipated that over 40% of large enterprises will incorporate AI-driven analytics solutions to automate processes such as customer segmentation, predictive maintenance, and fraud detection. These technologies are being used to enhance operational efficiency and accuracy, especially in industries like finance and retail, where real-time, data-driven decision-making is critical.

Scope of the Report

|

Segments |

Sub-segments |

|

By Type of Analytics |

Descriptive Analytics |

|

Predictive Analytics |

|

|

Prescriptive Analytics |

|

|

Diagnostic Analytics |

|

|

By Deployment Mode |

On-Premise |

|

Cloud-Based |

|

|

By End-Use Industry |

Banking, Financial Services, and Insurance |

|

Government |

|

|

IT & Telecommunications |

|

|

Retail |

|

|

Healthcare |

|

|

By Organization Size |

Small and Medium-Sized Enterprises (SMEs) |

|

Large Enterprises |

|

|

By Region |

Northern |

|

Central |

|

|

Southern |

Products

Key Target Audience

Cloud Service Providers

Data Analytics Solution Providers

Banking and Financial Institutions

Retail and E-commerce Companies

Large-Scale Enterprises in Healthcare and Telecommunications

IT Infrastructure Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Information and Communications, National Cybersecurity Center)

Companies

Players Mentioned in the Report

FPT Corporation

Viettel Group

IBM Vietnam

Microsoft Vietnam

Oracle Vietnam

Hitachi Vantara Vietnam

DXC Technology Vietnam

SAS Vietnam

SAP Vietnam

Teradata Vietnam

Table of Contents

1. Vietnam Data Analytics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Data Analytics Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Data Analytics Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of Big Data Solutions (Industry Penetration)

3.1.2. Digital Transformation Initiatives (Government and Enterprise)

3.1.3. Proliferation of IoT Devices (Data Generation)

3.1.4. Growing Demand for Real-Time Analytics (Decision-Making Efficiency)

3.2. Market Challenges

3.2.1. Lack of Skilled Workforce (Talent Gap)

3.2.2. Data Privacy and Security Concerns (Regulatory Compliance)

3.2.3. High Implementation Costs (Budget Constraints)

3.2.4. Fragmented IT Infrastructure (Integration Issues)

3.3. Opportunities

3.3.1. Expansion of Cloud Computing Solutions (Infrastructure Flexibility)

3.3.2. Emerging AI and Machine Learning Use Cases (Automated Analytics)

3.3.3. International Collaborations for Technological Advancements (Market Expansion)

3.3.4. Rising Adoption of Data-Driven Decision-Making in SMEs (New Market Penetration)

3.4. Trends

3.4.1. Integration of Analytics with IoT (Enhanced Predictive Capabilities)

3.4.2. Increased Focus on Data Governance (Compliance and Data Quality)

3.4.3. Adoption of Data-as-a-Service (DaaS) Models (Subscription-based Solutions)

3.4.4. Growing Use of Advanced Visualization Tools (User Experience Enhancement)

3.5. Government Regulations

3.5.1. Data Privacy Regulations (Decree 13/2023 on Personal Data Protection)

3.5.2. National Digital Transformation Program (Support for Analytics Adoption)

3.5.3. Cybersecurity Law (Impact on Data Storage and Handling)

3.5.4. Open Data Initiatives (Encouraging Public Data Access for Enterprises)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (End-Users, Providers, and Integrators)

3.8. Porters Five Forces Analysis (Industry Dynamics)

3.9. Competitive Landscape (Maturity, Innovation, and Strategic Partnerships)

4. Vietnam Data Analytics Market Segmentation

4.1. By Type of Analytics (In Value %)

4.1.1. Descriptive Analytics

4.1.2. Predictive Analytics

4.1.3. Prescriptive Analytics

4.1.4. Diagnostic Analytics

4.2. By Deployment Mode (In Value %)

4.2.1. On-Premise

4.2.2. Cloud-Based

4.3. By End-Use Industry (In Value %)

4.3.1. Banking, Financial Services, and Insurance (BFSI)

4.3.2. Government

4.3.3. IT & Telecommunications

4.3.4. Retail

4.3.5. Healthcare

4.4. By Organization Size (In Value %)

4.4.1. Small and Medium-Sized Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Data Analytics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. FPT Corporation

5.1.2. Viettel Group

5.1.3. IBM Vietnam

5.1.4. Microsoft Vietnam

5.1.5. Oracle Vietnam

5.1.6. Hitachi Vantara Vietnam

5.1.7. DXC Technology Vietnam

5.1.8. SAS Vietnam

5.1.9. SAP Vietnam

5.1.10. Teradata Vietnam

5.2. Cross Comparison Parameters (Revenue, Number of Analytics Solutions, Regional Coverage, Cloud Deployment Models, Industry Focus, Strategic Partnerships, R&D Investment, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Incentives for Analytics Adoption

5.8. Private Equity and Venture Capital Investments

6. Vietnam Data Analytics Market Regulatory Framework

6.1. Data Security Standards

6.2. Data Sovereignty and Localization Laws

6.3. Compliance with International Data Regulations (GDPR, HIPAA)

7. Vietnam Data Analytics Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Data Analytics Future Market Segmentation

8.1. By Type of Analytics (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Organization Size (In Value %)

8.5. By Region (In Value %)

9. Vietnam Data Analytics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Targeting Strategies

9.3. Go-to-Market Strategies for New Entrants

9.4. Innovation Roadmap for Data Analytics Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involves mapping the entire data analytics ecosystem in Vietnam. This includes identifying key variables such as market players, industry verticals, technology platforms, and regulatory guidelines that impact the market.

Step 2: Market Analysis and Construction

During this step, historical data is analyzed to understand market trends, adoption rates, and the revenue generated by different segments. Industry reports, government publications, and proprietary databases are used to validate market insights.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses related to market growth, technology integration, and future trends are validated through interviews with industry experts. These consultations offer critical insights into market dynamics from professionals who operate within the analytics space.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing research findings and engaging with major analytics providers in Vietnam to validate data on sales performance, customer adoption, and market growth projections. This ensures that the final report is accurate, comprehensive, and validated by industry stakeholders.

Frequently Asked Questions

1. How big is the Vietnam Data Analytics Market?

The Vietnam data analytics market is valued at USD 4 billion, driven by the increasing need for digital transformation across industries and the rapid growth of IoT applications in business operations.

2. What are the challenges in the Vietnam Data Analytics Market?

Challenges in Vietnam data analytics market include a lack of skilled professionals, concerns around data privacy and security, and high implementation costs associated with deploying advanced analytics systems.

3. Who are the major players in the Vietnam Data Analytics Market?

Key players in Vietnam data analytics market include FPT Corporation, Viettel Group, IBM Vietnam, Microsoft Vietnam, and Oracle Vietnam, which dominate due to their strong local presence and technological expertise.

4. What are the growth drivers for the Vietnam Data Analytics Market?

Vietnam data analytics market is propelled by factors such as increased adoption of big data technologies, government-led digital transformation programs, and the rising demand for real-time data insights in business operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.