Vietnam Digital Advertising Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD6985

November 2024

92

About the Report

Vietnam Digital Advertising Market Overview

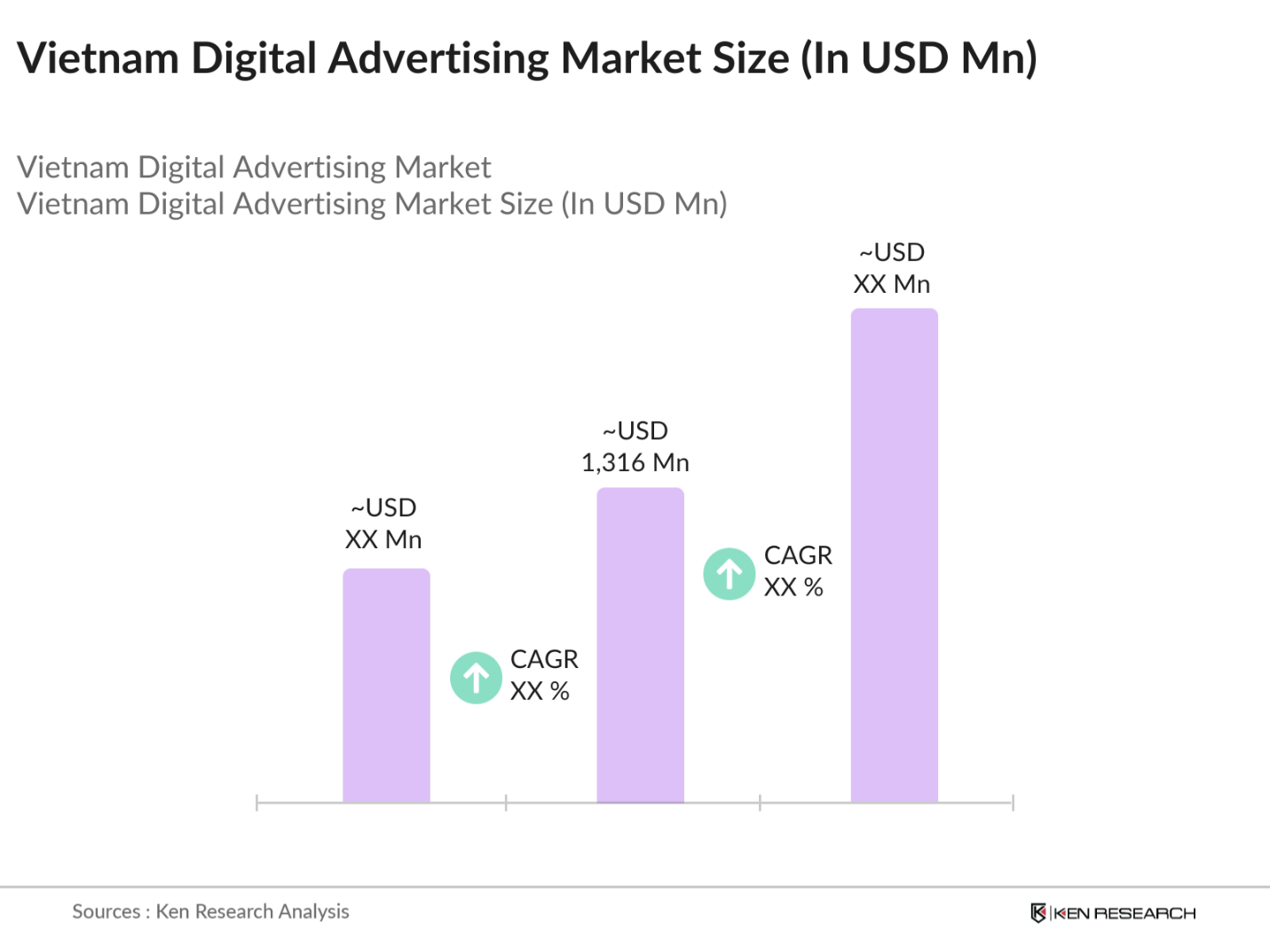

- The Vietnam Digital Advertising market is valued at USD 1,316 million, based on a five-year historical analysis. The market's growth is primarily driven by the rapid increase in internet penetration and mobile usage. Vietnam has a high smartphone adoption rate, which directly impacts the demand for mobile advertisements. Additionally, the expansion of e-commerce and the rise of digital platforms like YouTube and social media are fueling growth in the digital ad space, with businesses increasingly allocating larger portions of their marketing budgets to digital channels.

- Ho Chi Minh City and Hanoi dominate the Vietnam Digital Advertising market. These cities are Vietnam's economic powerhouses, housing a large portion of businesses and high-income consumers. Additionally, their technological infrastructure is more developed, leading to higher internet penetration and digital ad consumption. Global digital giants such as Google, Facebook, and local players like Zalo thrive in these cities due to the substantial user base and business opportunities available in these urban hubs.

- Vietnam has adopted strict advertising standards aimed at curbing false or misleading content. Under the Law on Advertising, brands must adhere to guidelines ensuring truthful and ethical practices in digital advertising. In 2023, the government introduced more stringent measures to regulate influencer marketing, requiring full disclosure of paid partnerships to avoid misleading consumers.

Vietnam Digital Advertising Market Segmentation

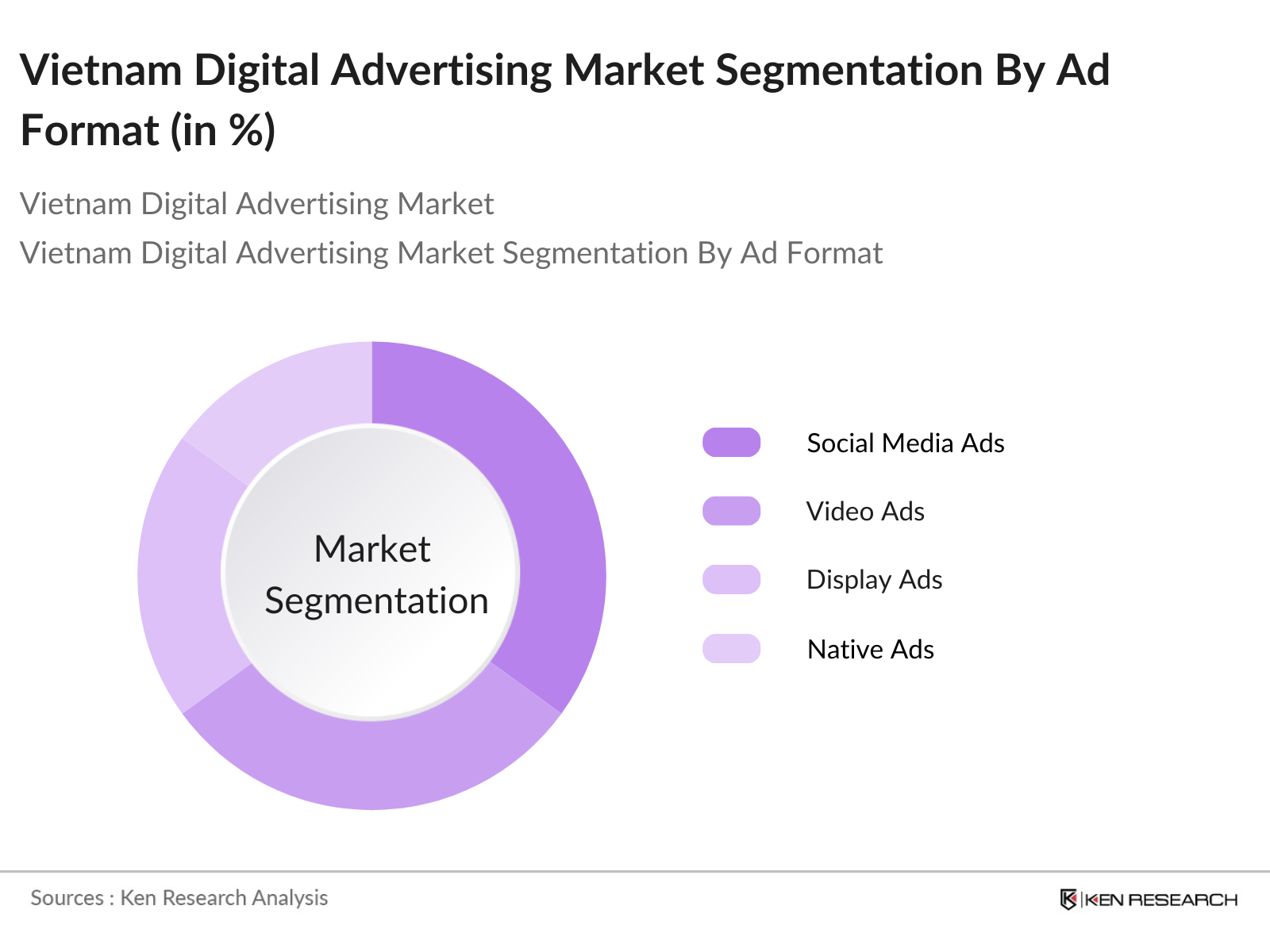

By Ad Format: Vietnams Digital Advertising market is segmented by ad format into display ads, video ads, social media ads, and native ads. In 2023, social media ads have taken the dominant market share in terms of ad format, driven by the vast popularity of platforms like Facebook, Instagram, and TikTok. Social medias advanced targeting capabilities, coupled with its wide reach among younger demographics, have made it a primary choice for advertisers seeking higher engagement rates.

By Industry Vertical: The Vietnam Digital Advertising market is also segmented by industry vertical into e-commerce, consumer goods, financial services, telecommunications, and automotive. Among these, e-commerce commands the largest share of digital ad spend in 2023, mainly due to the sectors heavy reliance on online platforms to drive traffic and sales.

Vietnam Digital Advertising Market Competitive Landscape

The Vietnam Digital Advertising market is dominated by global giants like Google and Facebook, alongside strong local players like Zalo and VCCorp. These companies hold a significant influence in the market due to their extensive reach and technological capabilities. Local platforms like Zalo are thriving due to their alignment with local cultural trends and consumer behaviors, while global players leverage their superior targeting algorithms and vast network.

Vietnam Digital Advertising Industry Analysis

Growth Drivers

- Rising Internet Penetration (Urban-Rural Internet Usage): Vietnams internet penetration reached 72 million users in 2023, with the majority of growth seen in rural areas. The governments push to improve digital infrastructure has resulted in expanded fiber-optic and 4G coverage, increasing accessibility for rural populations. Urban regions boast an 80% internet penetration rate, while rural areas saw rapid growth, now representing around 65% of total internet users. This expanding user base provides a fertile ground for digital advertisers.

- E-commerce Expansion (Online Shopping Behavior): Vietnams e-commerce market is growing exponentially, driven by a booming digital economy valued at USD 20 billion in 2022. Online transactions continue to increase, with more than 60 million online shoppers in 2023. The expansion of platforms like Shopee and Tiki has encouraged digital advertisers to target the growing number of consumers preferring online shopping.

- Increased Social Media Usage (Platform-Specific User Base): Social media usage in Vietnam is one of the highest globally, with over 70 million active users in 2023, covering more than 70% of the population. Platforms like Facebook, YouTube, and TikTok lead with large, engaged user bases, making social media advertising crucial for reaching a broad audience. YouTube alone saw over 45 million active users in 2023, providing video advertisers with a vast audience.

Market Challenges

- High Ad Blocker Usage (Ad Effectiveness Reduction): Ad blocker usage in Vietnam is among the highest in Southeast Asia, with an estimated 32 million users actively blocking digital ads in 2023. This trend is limiting the reach of digital campaigns, significantly reducing ad effectiveness. Advertisers face challenges in reaching audiences due to an increasing consumer preference for an ad-free experience.

- Fragmented Consumer Preferences (Localized Content Needs): Vietnam's diverse cultural landscape leads to fragmented consumer preferences, with stark differences between urban and rural audiences. Advertisers must create highly localized content tailored to specific regions to resonate with diverse demographics. Rural consumers often prefer traditional values, while urban youth gravitate toward global trends.

Vietnam Digital Advertising Market Future Outlook

Over the next five years, the Vietnam Digital Advertising market is expected to witness significant growth. This is driven by continuous advancements in digital technologies, increasing mobile internet penetration, and the rapid expansion of e-commerce. With consumers spending more time online, advertisers will continue to shift their focus to digital channels, leading to greater investments in programmatic advertising and social media campaigns.

Market Opportunities

- Growth in Mobile Advertising (Smartphone Penetration Rates): Vietnam had 93 million smartphone users in 2023, creating a booming market for mobile advertising. With over 80% of internet traffic generated via mobile devices, businesses are increasingly shifting their digital ad budgets toward mobile platforms. This shift allows advertisers to capture the attention of a highly mobile population, especially in urban centers where smartphone penetration is nearly universal.

- Adoption of Video Advertising (YouTube, OTT Platforms): Video advertising in Vietnam has surged, with YouTube having 45 million active users as of 2023. The rise of OTT platforms such as VTV Go and FPT Play has also contributed to the increased consumption of video content. Advertisers are capitalizing on this trend by creating more engaging video ads, which boast higher user engagement rates compared to static ads.

Scope of the Report

|

Ad Format |

Display Ads Video Ads Search Ads Social Media Ads Native Ads |

|

Platform |

Mobile Desktop Tablet |

|

Industry Vertical |

E-commerce Consumer Goods Financial Services Telecommunications Automotive |

|

Targeting Type |

Behavioral Targeting Contextual Targeting Demographic Targeting |

|

Region |

Hanoi Ho Chi Minh City Central Vietnam Mekong Delta |

Products

Key Target Audience

Digital Advertising Agencies

E-commerce Companies

Consumer Goods Companies

Financial Services Firms

Telecommunications Companies

Automotive Brands

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Information and Communications)

Companies

Players Mentioned in the Report

Google Vietnam

Facebook/Meta Vietnam

Zalo (VNG Corporation)

VCCorp

Shopee Vietnam

Lazada Vietnam

TikTok Vietnam

Grab Vietnam

Appota Group

Admicro (VCCorp)

Table of Contents

1. Vietnam Digital Advertising Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Digital Advertising Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Digital Advertising Market Analysis

3.1. Growth Drivers

3.1.1. Rising Internet Penetration (Urban-Rural Internet Usage)

3.1.2. E-commerce Expansion (Online Shopping Behavior)

3.1.3. Increased Social Media Usage (Platform-Specific User Base)

3.1.4. Government Support for Digital Economy (Public-Private Collaborations)

3.2. Market Challenges

3.2.1. High Ad Blocker Usage (Ad Effectiveness Reduction)

3.2.2. Fragmented Consumer Preferences (Localized Content Needs)

3.2.3. Data Privacy Regulations (Impact on Targeted Advertising)

3.3. Opportunities

3.3.1. Growth in Mobile Advertising (Smartphone Penetration Rates)

3.3.2. Adoption of Video Advertising (YouTube, OTT Platforms)

3.3.3. Rise in Programmatic Advertising (Automation of Ad Buying)

3.4. Trends

3.4.1. Increased Use of AI in Advertising (Personalization, Chatbots)

3.4.2. Rise of Influencer Marketing (Social Media Influencers)

3.4.3. Growth of Native Advertising (Seamless Ad Integration)

3.5. Government Regulation

3.5.1. Cybersecurity Law Impact on Advertising (Data and Content Controls)

3.5.2. Ad Standards and Regulations (Ethical Advertising Practices)

3.5.3. Taxation of Digital Advertising (VAT on Online Ads)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Digital Advertising Market Segmentation

4.1. By Ad Format (In Value %)

4.1.1. Display Ads

4.1.2. Video Ads

4.1.3. Search Ads

4.1.4. Social Media Ads

4.1.5. Native Ads

4.2. By Platform (In Value %)

4.2.1. Mobile

4.2.2. Desktop

4.2.3. Tablet

4.3. By Industry Vertical (In Value %)

4.3.1. E-commerce

4.3.2. Consumer Goods

4.3.3. Financial Services

4.3.4. Telecommunications

4.3.5. Automotive

4.4. By Targeting Type (In Value %)

4.4.1. Behavioral Targeting

4.4.2. Contextual Targeting

4.4.3. Demographic Targeting

4.5. By Region (In Value %)

4.5.1. Hanoi

4.5.2. Ho Chi Minh City

4.5.3. Central Vietnam

4.5.4. Mekong Delta

5. Vietnam Digital Advertising Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Google Vietnam

5.1.2. Facebook/Meta Vietnam

5.1.3. YouTube

5.1.4. Zalo (VNG Corporation)

5.1.5. VCCorp

5.1.6. Tiki.vn

5.1.7. Shopee Vietnam

5.1.8. Lazada Vietnam

5.1.9. Admicro (VCCorp)

5.1.10. Appota Group

5.1.11. Grab Vietnam

5.1.12. TikTok Vietnam

5.1.13. FPT Online

5.1.14. OOH Media Vietnam

5.1.15. CleverAds Vietnam

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Headquarters, Market Share, Ad Inventory, Technology Adoption, Platform Engagement, Local vs Global Players)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Digital Advertising Market Regulatory Framework

6.1. Data Privacy Laws

6.2. Compliance with International Standards (GDPR Alignment)

6.3. Content Moderation Guidelines

6.4. Certification Processes for Digital Advertisers

7. Vietnam Digital Advertising Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Digital Advertising Future Market Segmentation

8.1. By Ad Format (In Value %)

8.2. By Platform (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Targeting Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Digital Advertising Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Content Localization Strategy

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the digital advertising ecosystem in Vietnam. We conducted desk research, leveraging secondary and proprietary databases, to identify critical market variables like consumer behavior, ad format preferences, and technology adoption levels.

Step 2: Market Analysis and Construction

In this step, we analyzed historical data on digital ad spending and market penetration. This analysis included assessing advertising trends across platforms, industries, and regions, allowing us to establish accurate market revenue estimates and growth trends.

Step 3: Hypothesis Validation and Expert Consultation

We developed hypotheses regarding the growth drivers and challenges of the digital advertising market. These were validated through interviews with industry experts, including executives from digital advertising agencies and e-commerce platforms. Their insights helped refine our market forecasts.

Step 4: Research Synthesis and Final Output

Finally, we synthesized the data collected from desk research and expert consultations to produce a comprehensive analysis of the Vietnam Digital Advertising market. This bottom-up approach ensured the accuracy of the market size and growth estimates.

Frequently Asked Questions

01. How big is the Vietnam Digital Advertising Market?

The Vietnam Digital Advertising market is valued at USD 1,316 million, based on a five-year historical analysis. The market's growth is primarily driven by the rapid increase in internet penetration and mobile usage.

02. What are the challenges in the Vietnam Digital Advertising Market?

Challenges include high ad blocker usage, fragmented consumer preferences, and increasing data privacy regulations, all of which complicate targeted advertising efforts and reduce ad effectiveness.

03. Who are the major players in the Vietnam Digital Advertising Market?

Key players include Google Vietnam, Facebook/Meta Vietnam, Zalo (VNG Corporation), VCCorp, and Shopee Vietnam. These companies dominate due to their extensive reach, superior technology, and strong local presence.

04. What are the growth drivers of the Vietnam Digital Advertising Market?

The market is propelled by rapid internet penetration, the rise of mobile advertising, and the expansion of e-commerce. Increasing social media usage and advancements in programmatic ad technologies are also boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.