Vietnam Digital Banking and Neobank Apps Market Overview

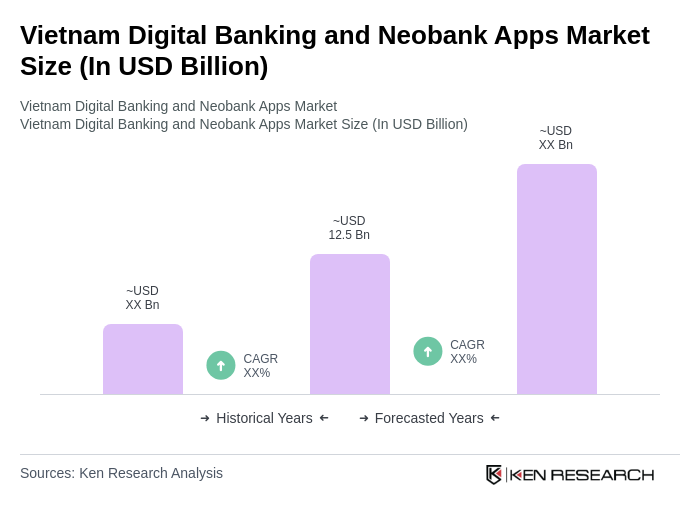

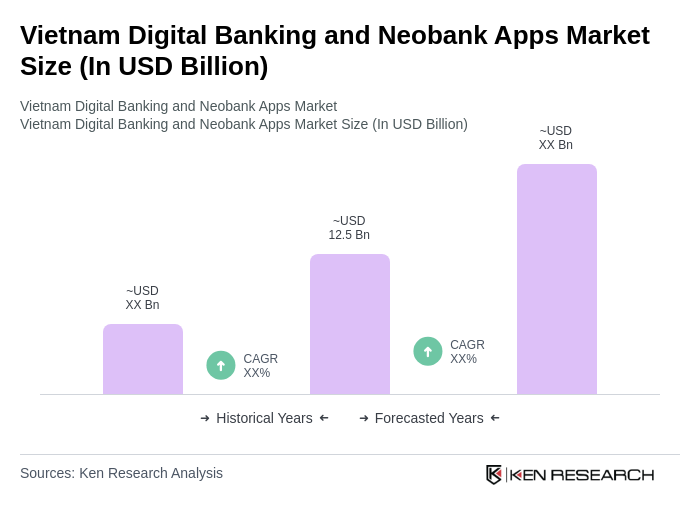

- The Vietnam Digital Banking and Neobank Apps Market is valued at USD 12.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing smartphone penetration (over 72% of adults), rising internet connectivity (66% penetration), and a rapid shift towards cashless transactions, with more than 70% of all financial transactions now conducted digitally. The market is further propelled by robust government support for digital transformation, strong investments in artificial intelligence and cloud-native platforms, and the growing demand for seamless banking experiences, especially among younger and urban consumers .

- Key cities such asHo Chi Minh CityandHanoicontinue to dominate the market due to their high population density, vibrant economic activity, and advanced technological adoption. These urban centers serve as hubs for fintech innovation and digital transformation, attracting both local and international financial technology companies. The concentration of financial institutions, a tech-savvy consumer base, and the presence of leading banks and neobanks further amplify the market's growth potential in these regions .

- In 2023, the State Bank of Vietnam issued theDecision No. 2345/QD-NHNN on Digital Transformation of the Banking Sector, establishing a regulatory framework to enhance security and efficiency in digital banking services. This framework mandates digital identity verification, robust anti-money laundering protocols, and compliance with international standards such as FATF recommendations. Financial institutions are required to implement secure authentication, transaction monitoring, and data protection measures. The regulation aims to foster consumer trust and accelerate the adoption of digital banking services nationwide .

Vietnam Digital Banking and Neobank Apps Market Segmentation

By Type:The market is segmented into various types, including Mobile Banking Apps, Neobank Apps, Digital Wallets, Investment & Wealth Management Apps, Lending & Credit Apps, Payment Processing Apps, Buy Now Pay Later (BNPL) Apps, and Others. Each segment addresses distinct consumer needs, such as instant payments, digital savings, investment management, credit access, and flexible payment options. The proliferation of digital wallets and BNPL solutions reflects the evolving preferences for convenience, speed, and financial inclusion among Vietnamese users .

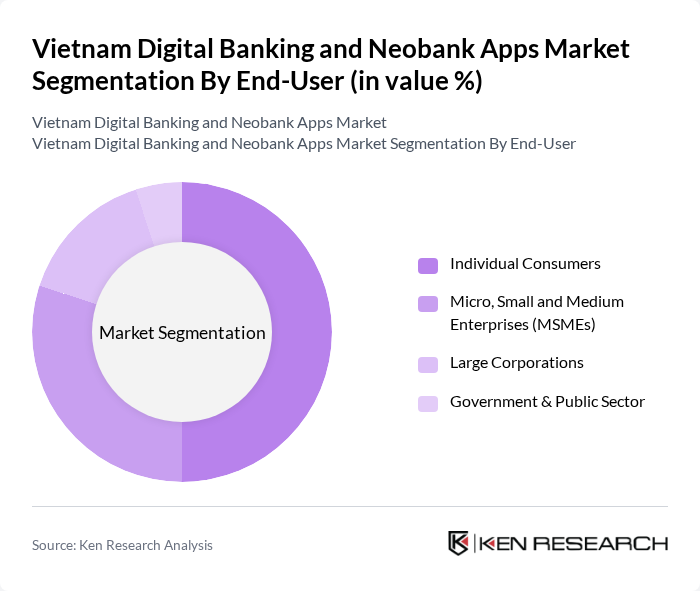

By End-User:The end-user segmentation includes Individual Consumers, Micro, Small and Medium Enterprises (MSMEs), Large Corporations, and Government & Public Sector. Individual consumers represent the largest share, reflecting widespread adoption of mobile banking and digital wallets for daily transactions. MSMEs increasingly leverage digital banking for payments, lending, and business management, while large corporations and the public sector utilize advanced digital solutions for treasury, payroll, and procurement .

Vietnam Digital Banking and Neobank Apps Market Competitive Landscape

The Vietnam Digital Banking and Neobank Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Timo, MoMo, VNPay, ZaloPay, Cake by VPBank, TPBank, Vietcombank, BIDV, Sacombank, Agribank, ACB, MBBank, Shinhan Bank Vietnam, HSBC Vietnam, Standard Chartered Vietnam, VietinBank, Techcombank, VPBank, UOB Vietnam, KBank Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Digital Banking and Neobank Apps Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Vietnam's smartphone penetration rate is projected to reach 85%, with approximately 90 million smartphone users. This surge facilitates access to digital banking services, enabling users to conduct transactions, manage accounts, and access financial products conveniently. The World Bank reports that mobile internet usage in Vietnam has increased by 20% annually, further driving the adoption of digital banking solutions among the population, particularly among the younger demographic.

- Rising Demand for Digital Financial Services:The demand for digital financial services in Vietnam is expected to grow significantly, with an estimated 70% of the population seeking online banking solutions in future. This shift is driven by the increasing need for convenience and efficiency in financial transactions. According to the State Bank of Vietnam, the number of digital transactions has surged to over 1.5 billion annually, reflecting a growing preference for cashless payments and online banking services among consumers.

- Government Initiatives Promoting Cashless Transactions:The Vietnamese government aims to increase cashless transactions to 50% of total payments by future, supported by initiatives such as the National Financial Inclusion Strategy. In future, the government plans to invest approximately $300 million in digital infrastructure to enhance payment systems. This commitment fosters a conducive environment for digital banking and neobanks, encouraging both consumers and businesses to adopt cashless solutions, thereby driving market growth.

Market Challenges

- Regulatory Compliance Complexities:Navigating the regulatory landscape in Vietnam poses significant challenges for digital banking and neobanks. As of future, over 40% of fintech startups report difficulties in meeting compliance requirements set by the State Bank of Vietnam. The evolving regulatory framework necessitates continuous adaptation, which can strain resources and hinder innovation. This complexity can deter new entrants and limit the growth potential of existing players in the market.

- Cybersecurity Threats:The rise in digital banking has also led to increased cybersecurity threats, with reported cyberattacks on financial institutions rising by 50% in future. As of future, the estimated cost of cybercrime in Vietnam is projected to reach $1.5 billion, impacting consumer trust and financial stability. This challenge necessitates robust cybersecurity measures, which can be costly and resource-intensive for neobanks and digital banking platforms, potentially affecting their operational efficiency.

Vietnam Digital Banking and Neobank Apps Market Future Outlook

The future of Vietnam's digital banking and neobank apps market appears promising, driven by technological advancements and changing consumer behaviors. With the increasing integration of artificial intelligence and machine learning, financial institutions are expected to enhance customer experiences and streamline operations. Additionally, the government's commitment to promoting financial inclusion will likely create new opportunities for market players, fostering innovation and competition. As digital literacy improves, more consumers will embrace these services, further propelling market growth in the coming years.

Market Opportunities

- Expansion into Rural Areas:With approximately 80% of Vietnam's population residing in rural areas, there is a significant opportunity for digital banking services to penetrate these markets. In future, initiatives aimed at improving internet connectivity in rural regions are expected to increase access to digital financial services, potentially reaching an additional 30 million users, thereby expanding the customer base for neobanks.

- Development of Personalized Financial Products:The demand for personalized financial products is on the rise, with 75% of consumers expressing interest in tailored banking solutions. By leveraging data analytics, neobanks can create customized offerings that cater to individual financial needs. This approach not only enhances customer satisfaction but also drives customer loyalty, positioning neobanks favorably in a competitive market landscape.