Vietnam Digital Payments and E-Wallets Market Overview

- The Vietnam Digital Payments and E-Wallets Market is valued at USD 520 million, based on a five-year historical analysis. This growth is primarily driven by the rapid adoption of smartphones, increased internet penetration, and a shift towards cashless transactions among consumers. The rise of e-commerce and digital services has further fueled the demand for digital payment solutions, making them an integral part of everyday transactions. Government initiatives promoting digitalization and the National Digital Transformation Program have significantly accelerated this transition.

- Key cities such as Ho Chi Minh City and Hanoi dominate the market due to their high population density, urbanization, and economic activity. These cities serve as hubs for technology and innovation, attracting both local and international players in the digital payments space. The concentration of businesses and consumers in these urban areas creates a conducive environment for the growth of e-wallets and digital payment platforms. Foreign direct investment in technology sectors has been instrumental in transforming Vietnam's payment infrastructure, positioning the country as a leader in digital payments within Southeast Asia.

- The Vietnamese government has implemented the Circular No. 23/2019/TT-NHNN on Payment Services, 2019 issued by the State Bank of Vietnam. This comprehensive regulatory framework establishes licensing requirements for payment service providers, mandates compliance with anti-money laundering and counter-terrorism financing regulations, sets operational standards for e-wallet providers including transaction limits and security protocols, and requires regular reporting to regulatory authorities. The framework covers all digital payment services including mobile wallets, online payment gateways, and remittance services, thereby fostering consumer trust and promoting the growth of the digital payments ecosystem.

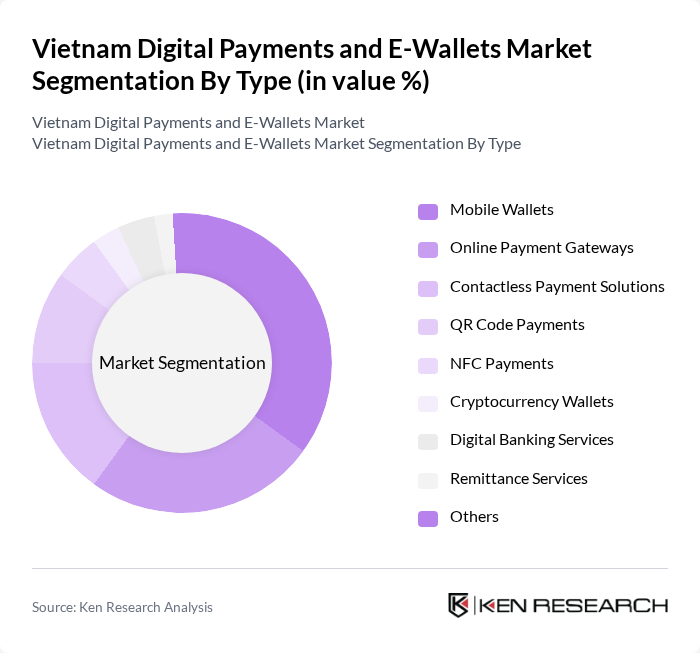

Vietnam Digital Payments and E-Wallets Market Segmentation

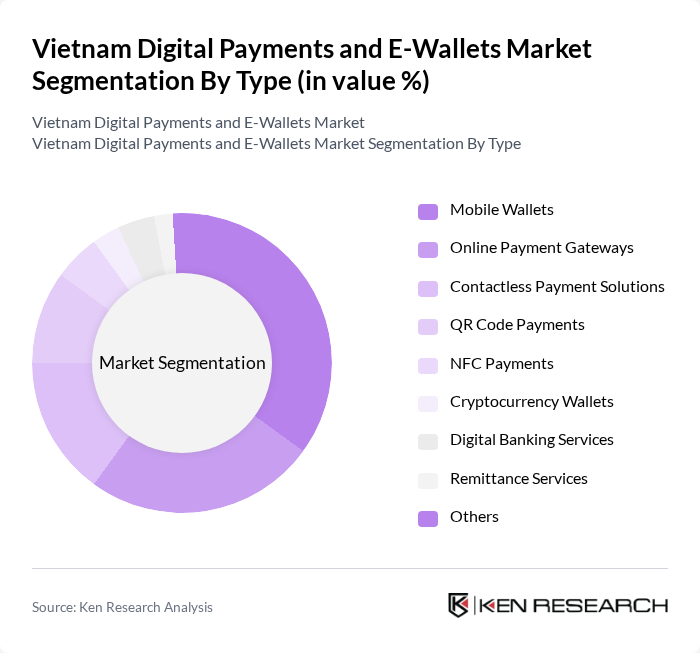

By Type:The market can be segmented into various types of digital payment solutions, including mobile wallets, online payment gateways, contactless payment solutions, QR code payments, NFC payments, cryptocurrency wallets, digital banking services, remittance services, and others. Each of these sub-segments caters to different consumer needs and preferences, contributing to the overall growth of the market. Mobile wallets have emerged as the dominant segment, with platforms like MoMo, ZaloPay, and ViettelPay experiencing significant user base expansion.

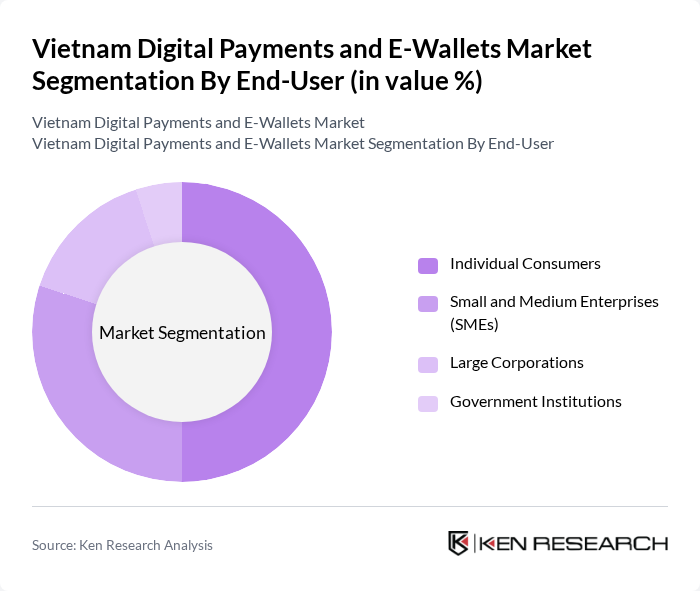

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and government institutions. Each of these user groups has distinct requirements and preferences for digital payment solutions, influencing their adoption rates and usage patterns. Individual consumers represent the largest segment, driven by the young, tech-savvy population and increasing smartphone penetration across both urban and rural areas.

Vietnam Digital Payments and E-Wallets Market Competitive Landscape

The Vietnam Digital Payments and E-Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo, ZaloPay, ViettelPay, Payoo, VNPay, GrabPay by Moca, ShopeePay, Timo, TrustPay, SmartPay, Moca, VTC Pay, B?o Kim, Ngân L??ng, Sacombank Pay contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Digital Payments and E-Wallets Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Vietnam's smartphone penetration rate is projected to reach approximately75 million users, representing approximately73% of the population. This surge in smartphone usage facilitates access to digital payment platforms, enabling consumers to conduct transactions conveniently. The World Bank reports that mobile phone subscriptions in Vietnam have increased toover 150 million, further supporting the growth of e-wallets and digital payment solutions, as users increasingly rely on their devices for financial transactions.

- Rising Internet Connectivity:Vietnam's internet penetration is expected to exceed75%, with over77 million active internet users. This connectivity fosters an environment conducive to digital payments, as consumers can easily access e-wallet services. The International Telecommunication Union (ITU) indicates that Vietnam's internet infrastructure has improved significantly, with broadband subscriptions reachingover 21 million, enhancing the overall digital payment ecosystem and encouraging more users to adopt cashless solutions.

- Government Initiatives Promoting Cashless Transactions:The Vietnamese government aims to increase cashless transactions to50% of total payments in future. Initiatives such as the National Payment Strategy and the Law on Cyber Information Security are designed to enhance the regulatory framework for digital payments. The State Bank of Vietnam reported that cashless transactions grew byover 30%, reflecting the effectiveness of these initiatives in promoting e-wallet adoption and digital payment solutions across the country.

Market Challenges

- Security Concerns Regarding Digital Transactions:Security remains a significant challenge in Vietnam's digital payments landscape, with cybercrime incidents reportedly increasing byover 25%. The Ministry of Public Security reported thatover 10,000 cases of online fraudwere recorded recently, leading to consumer hesitance in adopting e-wallets. This growing concern necessitates enhanced security measures and consumer education to build trust in digital payment systems and mitigate risks associated with online transactions.

- Limited Financial Literacy Among Users:Approximately60% of the Vietnamese populationlacks adequate financial literacy, which hampers the adoption of digital payment solutions. The Asian Development Bank (ADB) highlights that many consumers are unfamiliar with e-wallet functionalities and security protocols. This knowledge gap poses a barrier to widespread acceptance of digital payments, as users may be reluctant to engage with unfamiliar technologies without proper understanding and guidance.

Vietnam Digital Payments and E-Wallets Market Future Outlook

The future of Vietnam's digital payments and e-wallets market appears promising, driven by technological advancements and increasing consumer acceptance. As smartphone and internet penetration continue to rise, more users are expected to embrace cashless transactions. Additionally, the government's commitment to enhancing the regulatory framework will likely foster a secure environment for digital payments. Innovations in payment technologies, such as biometric authentication and AI integration, will further streamline transactions, making them more efficient and user-friendly, thus encouraging broader adoption.

Market Opportunities

- Expansion of E-Commerce Platforms:The e-commerce sector in Vietnam is estimated to be valued atUSD 20 billion, creating significant opportunities for digital payment solutions. As online shopping becomes increasingly popular, e-wallets can facilitate seamless transactions, enhancing customer experiences and driving sales for e-commerce businesses. This growth presents a lucrative opportunity for payment providers to integrate their services with e-commerce platforms.

- Partnerships with Retail and Service Providers:Collaborations between e-wallet providers and retail businesses are expected to flourish, withover 50% of retailersplanning to adopt digital payment solutions in future. These partnerships can enhance customer engagement and streamline payment processes, making it easier for consumers to transact. Such strategic alliances will not only expand the reach of e-wallets but also promote cashless transactions in everyday retail environments.