Region:Asia

Author(s):Geetanshi

Product Code:KRAD7147

Pages:89

Published On:December 2025

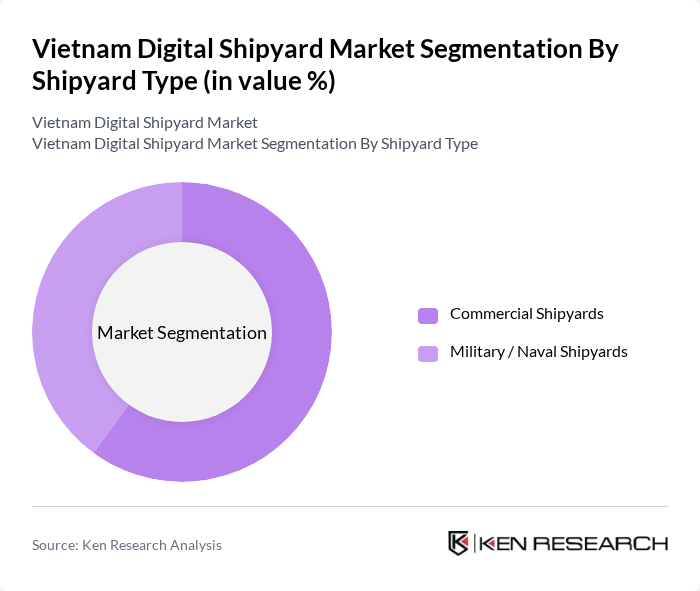

By Shipyard Type:The shipyard type segmentation includes Commercial Shipyards and Military / Naval Shipyards, reflecting how global digital shipyard solutions are structured across commercial and defense segments. Commercial shipyards in Vietnam are primarily focused on building and repairing general cargo vessels, container ships, tankers, and specialized offshore support vessels for export and domestic demand, while military/naval shipyards cater to patrol boats, auxiliary vessels, and other defense-related projects under the Ministry of National Defence. The demand for commercial shipyards is supported by growing maritime trade, Vietnam’s fleet expansion targets, and increasing orders for higher value-added vessels, whereas military shipyards benefit from sustained government defense budgets and modernization programs for the naval fleet.

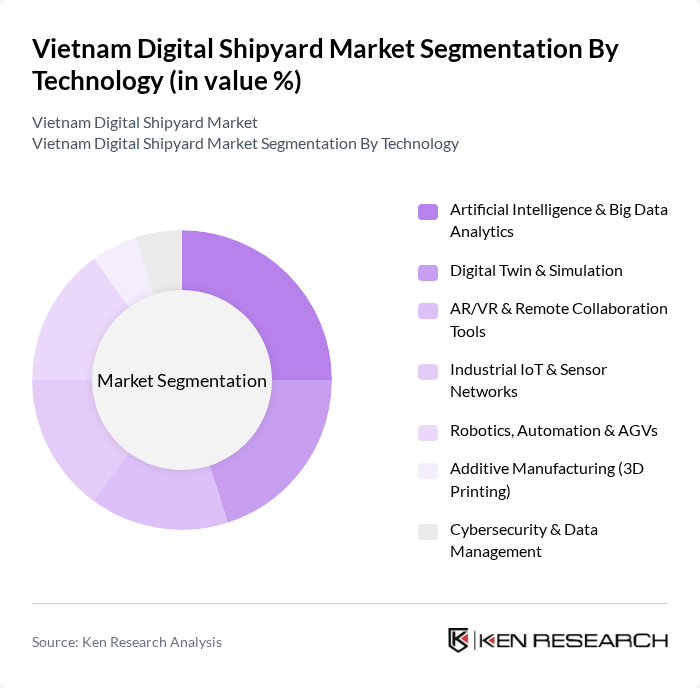

By Technology:The technology segmentation encompasses various advanced technologies such as Artificial Intelligence & Big Data Analytics, Digital Twin & Simulation, AR/VR & Remote Collaboration Tools, Industrial IoT & Sensor Networks, Robotics, Automation & AGVs, Additive Manufacturing (3D Printing), and Cybersecurity & Data Management, which are consistent with global digital shipyard technology stacks. The increasing focus on automation, real?time production monitoring, and data-driven decision-making in Vietnamese yards is propelling the adoption of CAD/CAE platforms, integrated PLM, IIoT-based asset tracking, and simulation tools, with early pilot use of AR/VR for training and remote inspections and growing attention to cybersecurity as more shipyard operations become connected.

The Vietnam Digital Shipyard Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hyundai Vietnam Shipbuilding Co., Ltd. (HVS), Damen Song Cam Shipyard Co., Ltd., Zamil Offshore Services Co. – Vietnam Operations, Saigon Newport Corporation, SBIC – Shipbuilding Industry Corporation (formerly Vinashin), Ha Long Shipyard (SBIC), Pha Rung Shipyard (SBIC), Song Thu Corporation (Ministry of National Defence), Corporation for the Development of Shipbuilding Industry (LILAMA – Shipbuilding Units), VARD Vung Tau Ltd., Petrovietnam Technical Services Corporation (PTSC), Vietnam National Shipping Lines (VIMC, formerly Vinalines), Saigon Shipbuilding and Marine Industry Company (SSMI), Bach Dang Shipbuilding Industry Corporation, Viettel High Technology Industries Corporation (Maritime Digital Solutions) contribute to innovation, geographic expansion, and service delivery in this space through gradual integration of digital design platforms, project management systems, and smart yard solutions.

The future of the Vietnam digital shipyard market appears promising, driven by ongoing government support and increasing investments in technology. As the industry embraces automation and digital transformation, the integration of advanced technologies such as AI and IoT will enhance operational efficiency. Furthermore, the shift towards sustainable practices will likely attract new investments, positioning Vietnam as a leader in eco-friendly shipbuilding. The focus on cybersecurity will also become paramount, ensuring the protection of digital assets and fostering trust in maritime operations.

| Segment | Sub-Segments |

|---|---|

| By Shipyard Type | Commercial Shipyards Military / Naval Shipyards |

| By Technology | Artificial Intelligence & Big Data Analytics Digital Twin & Simulation AR/VR & Remote Collaboration Tools Industrial IoT & Sensor Networks Robotics, Automation & AGVs Additive Manufacturing (3D Printing) Cybersecurity & Data Management |

| By Process | Research, Design & Engineering Production Planning & Manufacturing Yard Operations & Material Handling Inspection, Maintenance & Repair Lifecycle Support & Upgrades |

| By Capacity | Small Shipyards (<10,000 DWT) Medium Shipyards (10,000–50,000 DWT) Large Shipyards (>50,000 DWT) |

| By End-User | Shipbuilding & Repair Companies Port & Dock / Yard Operators Defense & Coast Guard Establishments Offshore & Energy Sector Operators System Integrators & Engineering Service Providers |

| By Solution | Software Platforms (PLM, CAD/CAM, MES, ERP) Hardware & Automation Systems Integrated Turnkey Systems Services (Consulting, Integration, Training, Support) |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Shipbuilding | 100 | Shipyard Managers, Production Supervisors |

| Military Vessel Construction | 50 | Defense Procurement Officers, Project Managers |

| Leisure Craft Manufacturing | 40 | Design Engineers, Marketing Managers |

| Digital Technology Integration | 80 | IT Managers, Digital Transformation Leads |

| Supply Chain Management in Shipbuilding | 60 | Logistics Coordinators, Procurement Specialists |

The Vietnam Digital Shipyard Market is valued at approximately USD 70 million, reflecting the country's growing share in the global digital shipyard sector, driven by advancements in technology and modernization efforts in shipbuilding processes.