Vietnam Digital Therapeutics Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD2584

November 2024

82

About the Report

Vietnam Digital Therapeutic Market Overview

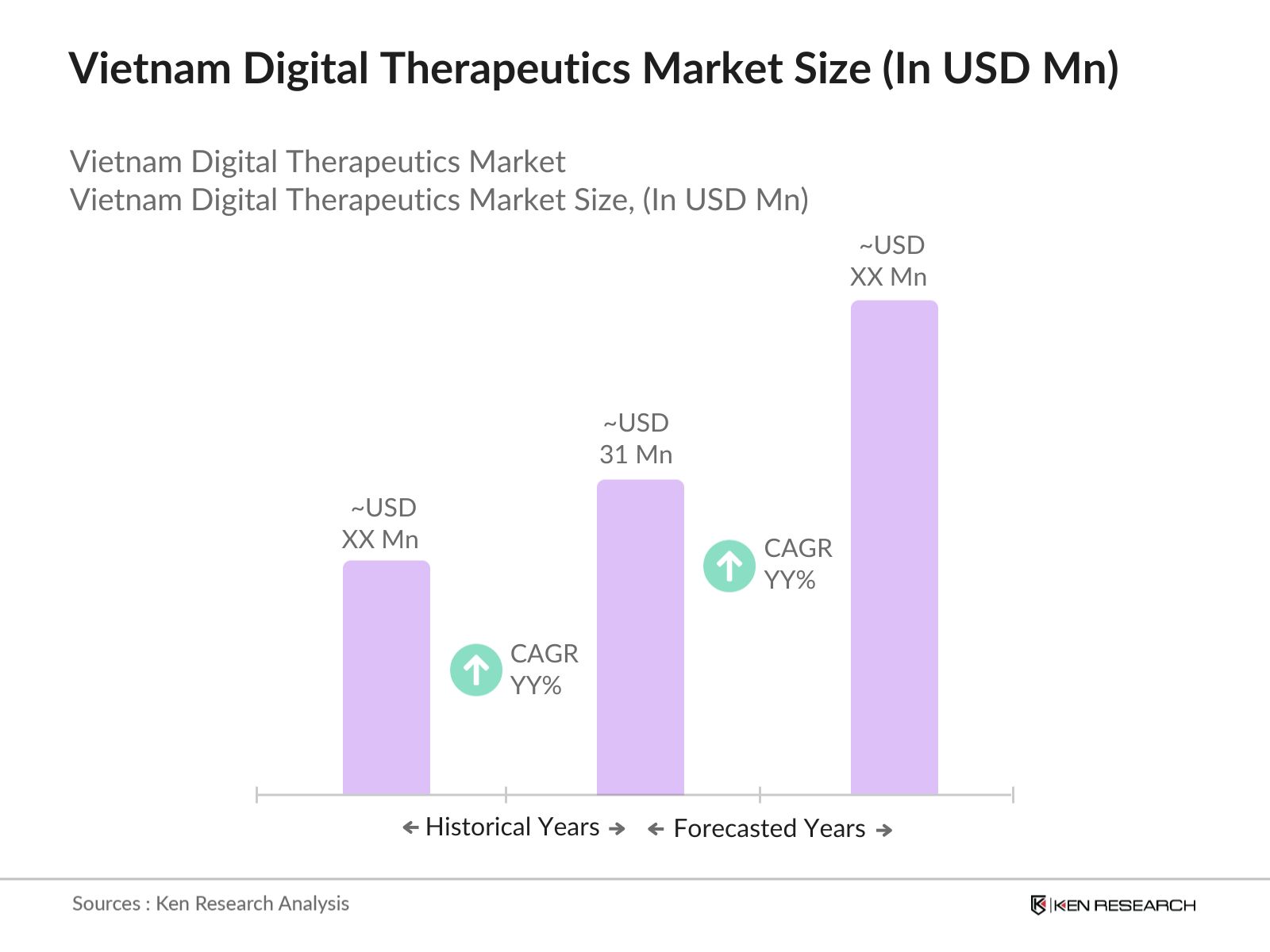

- The Vietnam digital therapeutics market was valued at USD 31 million, driven by increasing demand for personalized healthcare solutions, the rise in chronic diseases, and growing investments in digital health technologies.

- Key players in the Vietnam digital therapeutics market include WellDoc Inc., Omada Health, Pear Therapeutics, Click Therapeutics, and Voluntis. These companies have established a strong presence in Vietnam, leveraging the country's growing adoption of digital health technologies and the government's push for healthcare innovation.

- Click Therapeutics is revitalizing the prescription digital therapeutics market by acquiring assets from Better Therapeutics, which recently faced layoffs and strategic reevaluation. This acquisition includes FDA-authorized treatments for diabetes and metabolic disorders, enhancing Click's offerings in obesity management and cardiometabolic care.

- Hanoi emerged as the leading region in the Vietnam digital therapeutics market due to its high population density, healthcare infrastructure, and the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions.

Vietnam Digital Therapeutic Market Segmentation

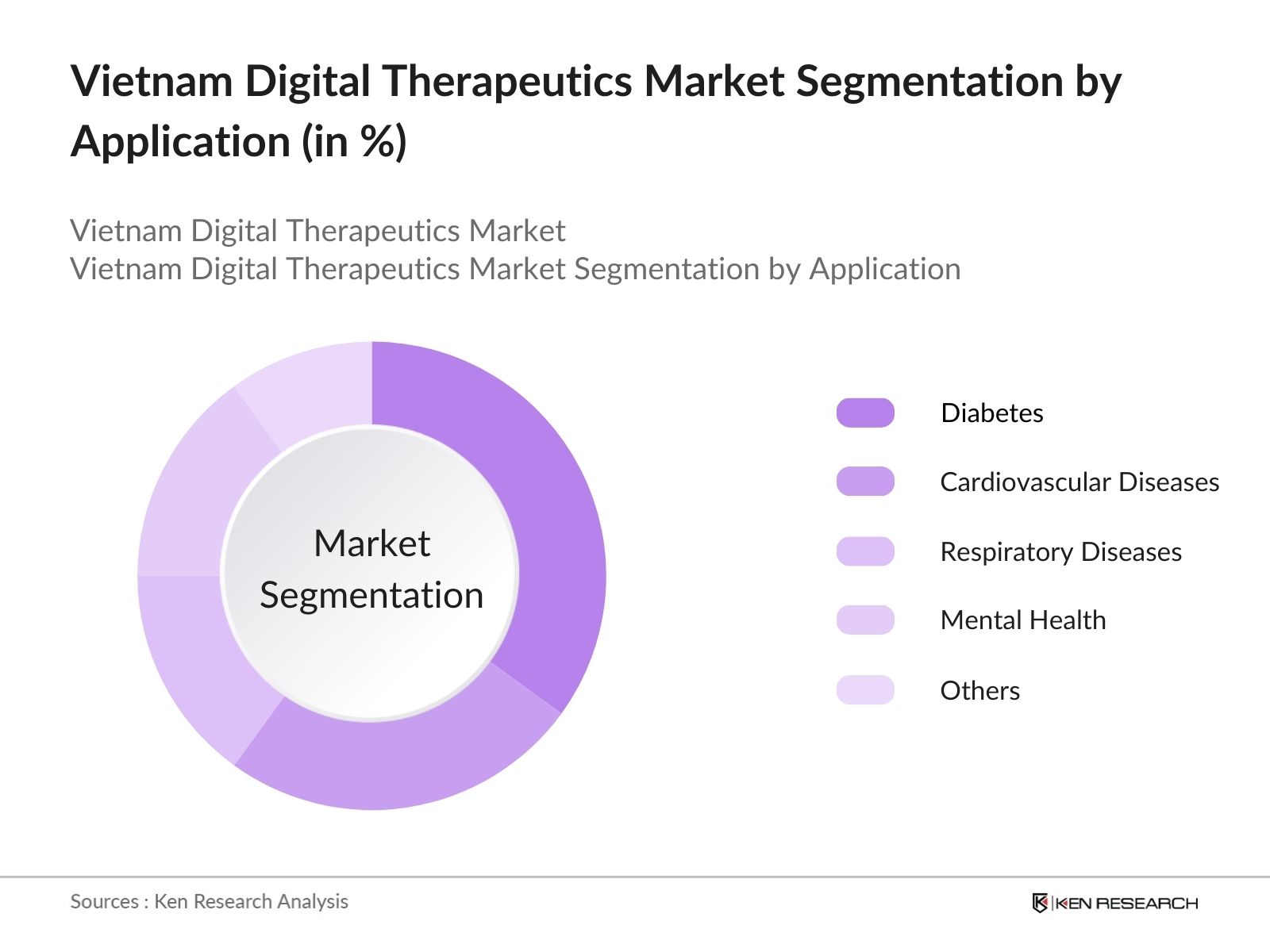

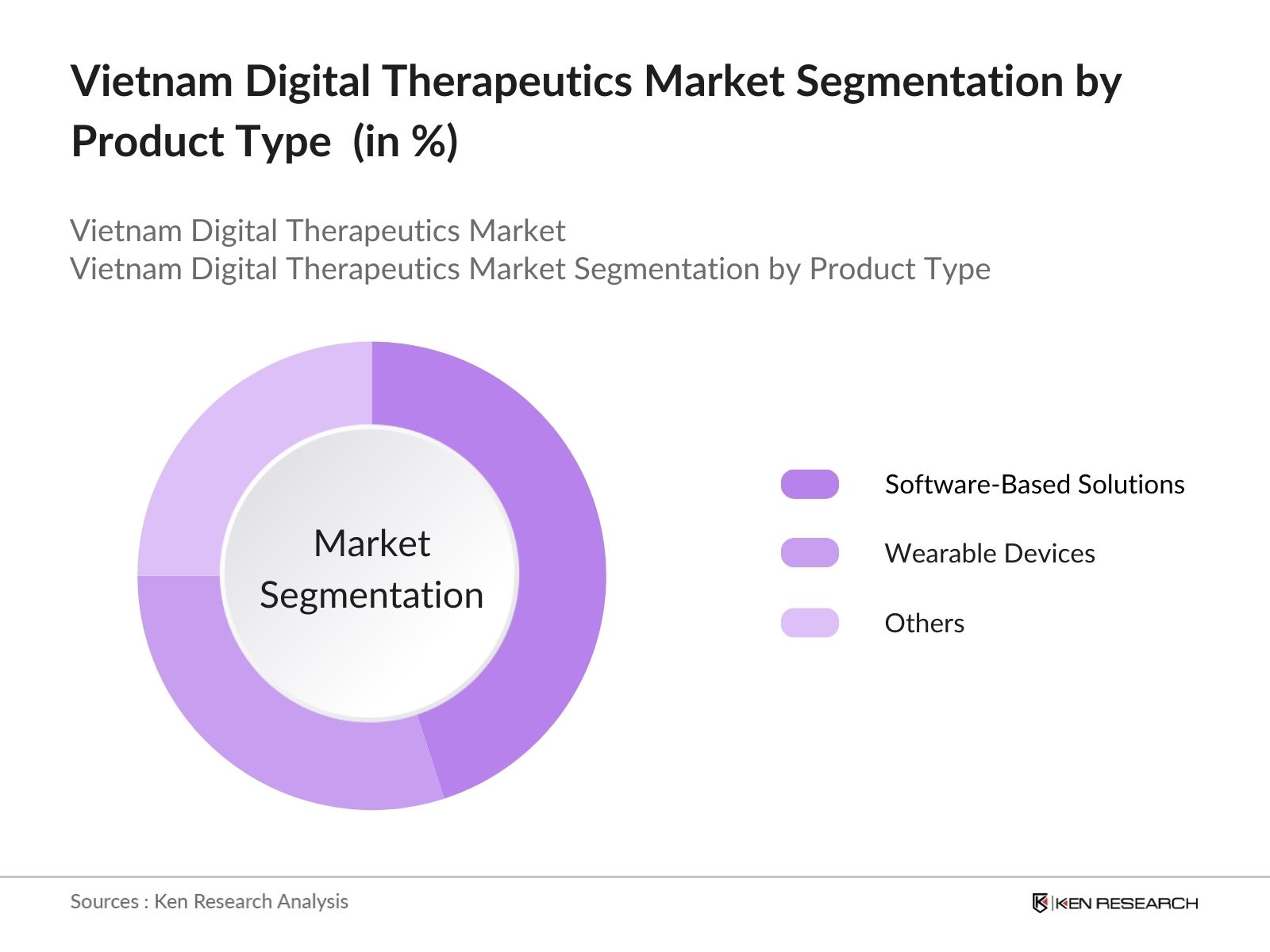

The Vietnam Digital Therapeutics Market is segmented by application, product type, and region.

- By Application: The market is segmented into diabetes, cardiovascular diseases, respiratory diseases, mental health, and others (smoking cessation, obesity). Diabetes dominated the market due to the rising prevalence of the condition and the adoption of digital tools for disease management.

- By Product Type: The market is segmented into software-based solutions, wearable devices, and others. Software-based solutions held the largest market share, as they offer easy-to-access and affordable treatment options for chronic disease management.

- By Region: The market is segmented into North, South, East, and West. The Northern region dominated the market due to its well-developed healthcare infrastructure and government initiatives to promote digital health.

Vietnam Digital Therapeutic Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

WellDoc Inc. |

2005 |

Columbia, Maryland, USA |

|

Omada Health |

2011 |

San Francisco, California, USA |

|

Pear Therapeutics |

2013 |

Boston, Massachusetts, USA |

|

Click Therapeutics |

2013 |

New York, New York, USA |

|

Voluntis |

2001 |

Paris, France |

- Voluntis: Biocon Biologics and Voluntis have announced a global collaboration to develop digital therapeutics for insulin management. This partnership aims to enhance patient outcomes through innovative technology, addressing the growing diabetes epidemic, which affects over 537 million adults worldwide as of 2021.

- Akili Interactive: Akili Interactive, a developer of ADHD-focused digital therapeutics, will be taken private after being sold to Virtual Therapeutics for $34 million, representing an 85% premium over its stock value. Akili's revenue fell to $383,000 in Q1 2024, down from $749,000.

Vietnam Digital Therapeutic Market Analysis

Vietnam Digital Therapeutic Market Growth Drivers:

- Increase in Chronic Diseases: The rise in chronic diseases in Vietnam is substantial, with diabetes affecting approximately 3.8 million individuals in 2023. This increase in prevalence necessitates innovative solutions for management, including digital therapeutics, to improve patient outcomes and reduce the burden on healthcare facilities.

- Expansion of Remote Monitoring Technologies: Wearable health technologies are gaining traction, with a notable increase in their integration into healthcare systems. These devices enable real-time monitoring of health metrics, facilitating timely interventions and personalized care plans, which are crucial in managing chronic conditions effectively.

- Growing Digital Health Adoption: Vietnam's smartphone penetration reached 68% in 2023, coupled with improved internet connectivity. This technological advancement fosters the adoption of digital health solutions, allowing individuals to access healthcare services conveniently and efficiently, thereby transforming patient engagement and management.

Vietnam Digital Therapeutic Market Challenges:

- High Cost of Advanced Technologies: The prohibitive cost of digital therapeutics substantially impacts rural populations in Vietnam, where only 15% had access to these solutions in 2023. This limited accessibility underscores the need for affordable healthcare technologies to bridge the gap and enhance health outcomes in underserved areas.

- Data Privacy and Security Concerns: Data privacy concerns are paramount in digital health, with a notable increase in cybersecurity threats. In the U.S., healthcare data breaches reached an all-time high in 2021, highlighting vulnerabilities and the urgent need for robust security measures to protect sensitive patient information from unauthorized access and misuse.

Vietnam Digital Therapeutic Market Government Initiatives:

- National Digital Transformation Strategy: Decision No. 749/QD-TTg prioritizes healthcare as a key sector for digital transformation, aiming to integrate advanced technologies into the healthcare system to improve service delivery and patient outcomes. This decision supports the development of digital health solutions and encourages investment in the sector.

- E-Health Adoption Agenda: Decision No. 4888/QD-BYT outlines a national agenda for e-health adoption, focusing on the implementation of electronic health records and telemedicine services. This initiative aims to enhance healthcare accessibility and efficiency, particularly in rural areas, by leveraging digital platforms for patient management and care delivery.

Vietnam Digital Therapeutic Future Market Outlook

The Vietnam Digital Therapeutics Market is expected to grow over the next five years, driven by the rising incidence of chronic diseases and increased healthcare spending. The market is likely to see a surge in demand for mental health-related digital therapeutics, with software-based solutions leading the growth.

Future Market Trends

- Increased Focus on Mental Health: Over the next five years, as awareness of mental health issues continues to rise in Vietnam, digital therapeutic solutions for managing conditions like depression and anxiety will gain prominence. This shift will lead to increased demand for accessible and effective digital interventions to support mental well-being.

- AI and Machine Learning Integration: Over the next five years, the integration of AI and machine learning into digital therapeutics is expected to drive market growth in Vietnam. These technologies will enable personalized treatment plans by analyzing patient data, enhancing the effectiveness of digital solutions and improving patient engagement and adherence.

Scope of the Report

|

By Application |

Diabetes Cardiovascular Diseases Respiratory Diseases Mental Health Others |

|

By Product Type |

Software-Based Solutions Wearable Devices Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Digital Therapeutics Manufacturers

Health Tech Startups

Healthcare Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Table of Contents

1. Vietnam Digital Therapeutics Market Overview

1.1 Definition and Scope of the Vietnam Digital Therapeutics Market

1.2 Market Taxonomy (Application, Product Type, Region)

1.3 Market Growth Rate and Trends

1.4 Market Drivers (Chronic Disease Growth, Digital Health Adoption, Personalized Healthcare)

1.5 Market Restraints (High Technology Costs, Data Privacy Concerns)

2. Vietnam Digital Therapeutics Market Size (in USD Million)

2.1 Historical Market Size Analysis (2018-2023)

2.2 Year-on-Year Growth Analysis

2.3 Forecast Market Size and Growth Projections (2023-2028)

2.4 Key Market Milestones and Developments

3. Vietnam Digital Therapeutics Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Chronic Diseases

3.1.2 Expansion of Remote Monitoring Technologies

3.1.3 Government Healthcare Initiatives Supporting Digital Health

3.2 Market Challenges

3.2.1 High Costs of Advanced Technologies

3.2.2 Data Privacy and Security Concerns

3.2.3 Limited Accessibility in Rural Areas

3.3 Opportunities

3.3.1 Increasing Demand for Mental Health Digital Solutions

3.3.2 Growth in AI and Machine Learning Applications

3.4 Market Trends

3.4.1 Rise in Wearable Devices for Health Monitoring

3.4.2 Integration of AI in Personalized Treatment Plans

4. Vietnam Digital Therapeutics Market Segmentation

4.1 By Application (in Value %)

4.1.1 Diabetes

4.1.2 Cardiovascular Diseases

4.1.3 Respiratory Diseases

4.1.4 Mental Health

4.1.5 Others (Smoking Cessation, Obesity)

4.2 By Product Type (in Value %)

4.2.1 Software-Based Solutions

4.2.2 Wearable Devices

4.2.3 Others

4.3 By Region (in Value %)

4.3.1 North Vietnam

4.3.2 South Vietnam

4.3.3 East Vietnam

4.3.4 West Vietnam

5. Vietnam Digital Therapeutics Competitive Landscape

5.1 Competitive Market Share Analysis

5.2 Company Profiles

5.2.1 WellDoc Inc. (Established 2005, Headquarters: Columbia, Maryland, USA)

5.2.2 Omada Health (Established 2011, Headquarters: San Francisco, California, USA)

5.2.3 Pear Therapeutics (Established 2013, Headquarters: Boston, Massachusetts, USA)

5.2.4 Click Therapeutics (Established 2013, Headquarters: New York, New York, USA)

5.2.5 Voluntis (Established 2001, Headquarters: Paris, France)

5.2.6 Akili Interactive (Established 2011, Headquarters: Boston, Massachusetts, USA)

5.2.7 Propeller Health (Established 2010, Headquarters: Madison, Wisconsin, USA)

5.2.8 Big Health (Established 2013, Headquarters: San Francisco, California, USA)

5.2.9 Livongo (Established 2014, Headquarters: Mountain View, California, USA)

5.2.10 Biofourmis (Established 2015, Headquarters: Boston, Massachusetts, USA)

5.2.11 Happify Health (Established 2012, Headquarters: New York, New York, USA)

5.2.12 Noom (Established 2008, Headquarters: New York, New York, USA)

5.2.13 Virta Health (Established 2014, Headquarters: San Francisco, California, USA)

5.2.14 2Morrow Inc. (Established 2011, Headquarters: Seattle, Washington, USA)

5.2.15 MindMaze (Established 2012, Headquarters: Lausanne, Switzerland)

5.3 Strategic Initiatives and Investments

5.4 Recent Mergers and Acquisitions

5.5 Technological Innovations and R&D Investments

6. Vietnam Digital Therapeutics Market Government Regulations and Initiatives

6.1 National Digital Transformation Strategy (Decision No. 749/QD-TTg)

6.2 E-Health Adoption Agenda (Decision No. 4888/QD-BYT)

6.3 Government Support for Remote Monitoring and Digital Health

7. Vietnam Digital Therapeutics Market Future Market Size and Segmentation

7.1 Market Segmentation by Application (2023-2028)

7.2 Market Segmentation by Product Type (2023-2028)

7.3 Market Segmentation by Region (2023-2028)

7.4 Future Market Trends (Mental Health, AI and Machine Learning Integration)

8. Vietnam Digital Therapeutics Market Technological Advancements

8.1 AI and Machine Learning Integration in Digital Therapeutics

8.2 Innovations in Wearable Devices and Remote Monitoring

8.3 Personalized Healthcare Solutions through Advanced Software Platforms

9. Vietnam Digital Therapeutics Market Investment and Funding Landscape

9.1 Key Investments in Digital Therapeutics

9.2 Mergers and Acquisitions in the Vietnam Digital Health Market

9.3 Government Grants and Incentives for Digital Health Solutions

9.4 Private Equity and Venture Capital Funding in Digital Therapeutics

10. Vietnam Digital Therapeutics Market SWOT Analysis

10.1 Strengths (Growing Digital Health Adoption, Increasing Chronic Disease Prevalence)

10.2 Weaknesses (High Technology Costs, Limited Accessibility in Rural Areas)

10.3 Opportunities (Expansion of AI Solutions, Growth in Mental Health Digital Solutions)

10.4 Threats (Data Privacy and Cybersecurity Issues, Technology Costs)

11. Analysts Recommendations

11.1 Strategic Market Entry and Expansion Opportunities

11.2 Collaboration with Digital Health Startups and Healthcare Providers

11.3 Innovative Product Development (AI and Mental Health Solutions)

11.4 Market Positioning Strategies for Key Players

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the Vietnam Digital Therapeutic market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek opeDigital Therapeutictional and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple Digital Therapeutics Manufacturers and healthcare providers to understand product segments, sales trends, consumer preferences, and other parameters. This approach supports us in validating the statistics derived from the bottom-up approach of these Digital Therapeutics Manufacturers and healthcare providers.

Frequently Asked Questions

01. How big is the Vietnam Digital Therapeutic Market?

The Vietnam Digital Therapeutics Market was valued at USD 31 million in 2023, driven by increasing demand for digital healthcare solutions, chronic disease management, and government initiatives promoting digital health adoption in Vietnam.

02. Who are the major players in the Vietnam Digital Therapeutic market?

Key players in the Vietnam Digital Therapeutics Market include WellDoc Inc., Omada Health, Pear Therapeutics, Click Therapeutics, and Voluntis, contributing to market growth with innovative digital health solutions tailored for chronic disease management and mental health.

03. What are the growth drivers of the Vietnam Digital Therapeutic market?

The Vietnam Digital Therapeutics Market growth is driven by rising chronic diseases, government healthcare initiatives, and the growing adoption of digital healthcare technologies for personalized treatments and real-time patient monitoring.

04. What are the Vietnam Digital Therapeutic market challenges?

Key challenges in the Vietnam Digital Therapeutics Market include the high cost of advanced technologies and concerns about data privacy, which may slow widespread adoption, especially in rural areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.