Region:Asia

Author(s):Geetanshi

Product Code:KRAD7166

Pages:98

Published On:December 2025

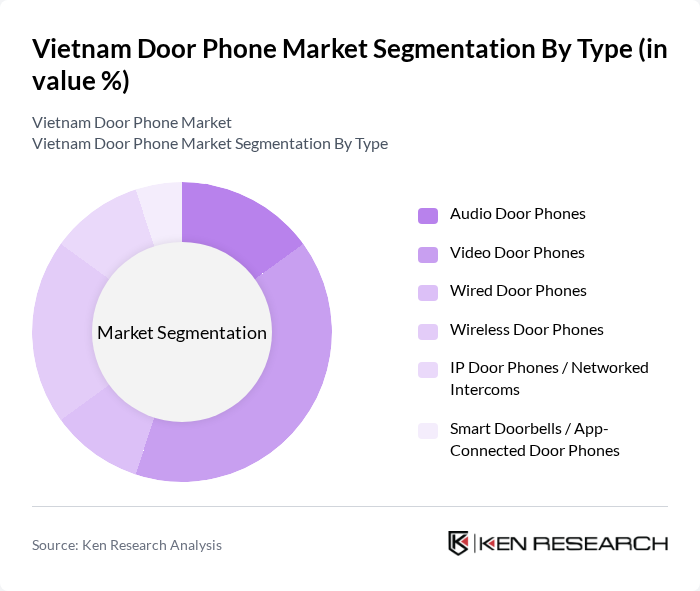

By Type:The market can be segmented into various types of door phone systems, including audio door phones, video door phones, wired door phones, wireless door phones, IP door phones/networked intercoms, and smart doorbells/app-connected door phones, which mirrors the typical global segmentation of the door phone industry. Among these, video door phones are gaining significant traction due to their enhanced security features, integration with CCTV and access control, and user-friendly interfaces, consistent with global market trends where video door phones are the fastest-growing segment. The increasing consumer preference for visual identification, smartphone-based remote access, and smart home integration is driving the growth of this segment in Vietnam’s urban residential and commercial projects, in line with broader Asia–Pacific adoption of smart and IP-based door phone solutions.

By End-User:The end-user segmentation includes residential apartments and condominiums, individual villas and gated communities, commercial offices and retail, hospitality (hotels, serviced apartments), industrial and warehousing facilities, and government, education, and healthcare buildings, which aligns with the primary residential and non?residential segments used in Vietnam’s broader doors and building products markets. The residential segment, particularly apartments and condominiums, is leading the market due to the increasing number of multi-family housing projects in major cities and the growing emphasis on controlled access and visitor management in urban living, reflecting the global pattern where residential applications account for a major share of door phone installations.

The Vietnam Door Phone Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Aiphone Co., Ltd., Commax Co., Ltd., Panasonic Corporation, 2N Telekomunikace a.s., Honeywell International Inc., Samsung Electronics Co., Ltd., Bosch Security Systems GmbH, Legrand Group, Fermax Electrónica S.A.U., VIVOTEK Inc., Grandstream Networks, Inc., Schneider Electric Vietnam, Bkav Smart Home (Bkav Corporation, Vietnam) contribute to innovation, geographic expansion, and service delivery in this space, in line with their established presence in global and Asia–Pacific door phone and video intercom markets.

The Vietnam door phone market is poised for significant growth, driven by urbanization, rising security concerns, and technological advancements. As more consumers seek integrated smart home solutions, the demand for advanced door phone systems will likely increase. Additionally, the government's push for smart home technologies will further stimulate market growth. Companies that focus on educating consumers and reducing installation costs will be well-positioned to capitalize on these trends and expand their market share.

| Segment | Sub-Segments |

|---|---|

| By Type | Audio Door Phones Video Door Phones Wired Door Phones Wireless Door Phones IP Door Phones / Networked Intercoms Smart Doorbells / App-Connected Door Phones |

| By End-User | Residential Apartments & Condominiums Individual Villas & Gated Communities Commercial Offices & Retail Hospitality (Hotels, Serviced Apartments) Industrial & Warehousing Facilities Government, Education & Healthcare Buildings |

| By Region | Northern Vietnam (including Hanoi & Red River Delta) Southern Vietnam (including Ho Chi Minh City & Southeast) Central Vietnam (including Da Nang & Coastal Provinces) |

| By Technology | Analog Door Phone Systems Digital / Bus-based Door Phone Systems IP-based Door Phone Systems Cloud-connected & App-based Solutions |

| By Application | Home Security & Access Control Office & Building Entry Management Multi-dwelling Unit (MDU) Visitor Management Integrated Smart Home / Smart Building Solutions |

| By Sales Channel | Project Sales via System Integrators & Installers Retail & Dealer Network Online / E-commerce Platforms Direct Sales to Developers & Enterprises |

| By Ownership / Procurement Model | One-time Purchase (Capex) Subscription-based / SaaS-enabled Door Phone Services Bundled with Security / Surveillance Packages OEM Supply to Real Estate Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Door Phone Users | 120 | Homeowners, Renters |

| Commercial Property Managers | 100 | Facility Managers, Security Coordinators |

| Retail Sector Installers | 80 | Installation Technicians, Retail Managers |

| Real Estate Developers | 70 | Project Managers, Sales Directors |

| Security System Distributors | 60 | Sales Representatives, Product Managers |

The Vietnam Door Phone Market is valued at approximately USD 165 million, reflecting significant growth driven by urbanization, security concerns, and the adoption of smart home technologies.