Region:Asia

Author(s):Geetanshi

Product Code:KRAA3240

Pages:88

Published On:September 2025

By Type:The market is segmented into B2C (Business to Consumer), C2C (Consumer to Consumer), B2B (Business to Business), Social Commerce, Mobile Commerce, Subscription Services, and Others. B2C dominates due to the popularity of online retail platforms, while C2C and Social Commerce are rapidly expanding through social media and peer-to-peer platforms. Mobile Commerce is gaining traction as mobile payment adoption rises and consumers increasingly shop via smartphones. Subscription Services and other emerging models are also contributing to market diversity .

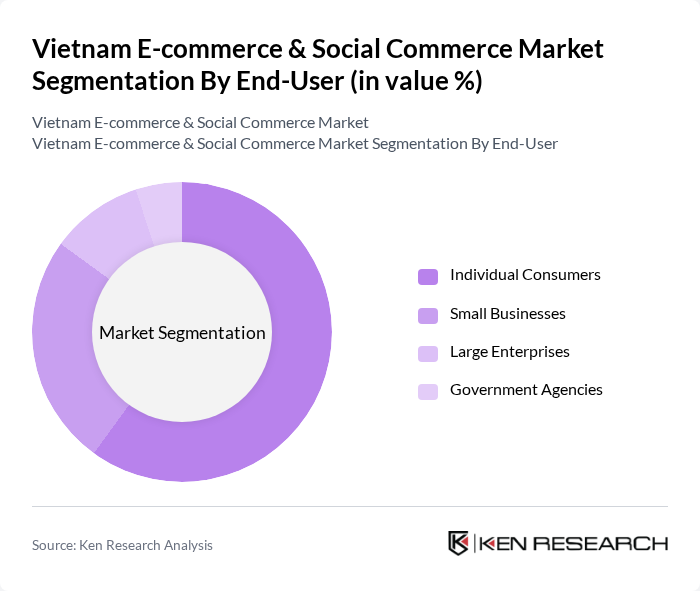

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Large Enterprises, and Government Agencies. Individual consumers account for the majority share, reflecting the strong adoption of online shopping among the general population. Small businesses are increasingly leveraging e-commerce platforms for market access, while large enterprises and government agencies use digital channels for procurement and service delivery .

The Vietnam E-commerce & Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tiki Corporation, Shopee Vietnam, Lazada Vietnam, Sendo (Sen Do Technology JSC), FPT Retail, Thegioididong.com (Mobile World Investment Corporation), Vingroup (VinShop, Adayroi - legacy), MoMo (M_Service JSC), ZaloPay (VNG Corporation), Grab Vietnam, Viettel Post (Viettel Post Joint Stock Corporation), TikTok Shop Vietnam, Nguyen Kim Trading Joint Stock Company, FPT Shop, Voso.vn (Viettel Post E-commerce Platform) contribute to innovation, geographic expansion, and service delivery in this space .

The Vietnam e-commerce and social commerce market is poised for significant transformation, driven by technological advancements and changing consumer behaviors. The integration of AI and big data analytics is expected to enhance personalized shopping experiences, while the rise of influencer marketing will further engage consumers. Additionally, the shift towards sustainable practices will resonate with the growing environmentally conscious consumer base, creating a more responsible e-commerce landscape. These trends will shape the future of the market, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C (Business to Consumer) C2C (Consumer to Consumer) B2B (Business to Business) Social Commerce Mobile Commerce Subscription Services Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises Government Agencies |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms Mobile Apps |

| By Product Category | Fashion and Apparel Electronics and Gadgets Home and Living Beauty and Personal Care Food and Beverage Health and Wellness Household Consumables |

| By Payment Method | Credit/Debit Cards E-wallets Bank Transfers Cash on Delivery Buy Now, Pay Later (BNPL) |

| By Customer Demographics | Age Groups (Gen Z, Millennials, Gen X, Boomers) Income Levels Urban vs Rural Shopping Frequency (Heavy, Moderate, Light Shoppers) |

| By Marketing Channel | Social Media Advertising Search Engine Marketing Email Marketing Influencer Collaborations Livestream Commerce |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General E-commerce Users | 120 | Online Shoppers, Frequent Buyers |

| Social Commerce Participants | 80 | Social Media Users, Influencers |

| SME E-commerce Operators | 60 | Business Owners, E-commerce Managers |

| Logistics and Delivery Service Providers | 50 | Operations Managers, Logistics Coordinators |

| Digital Payment Solution Users | 40 | Finance Managers, Payment System Users |

The Vietnam E-commerce and Social Commerce Market is valued at approximately USD 25 billion, driven by increased internet penetration, smartphone usage, and a growing middle class, with significant growth accelerated by the COVID-19 pandemic.