Region:Asia

Author(s):Shubham

Product Code:KRAA8493

Pages:86

Published On:November 2025

By Type:The eco-friendly furniture market can be segmented into various types, including Solid Wood Furniture, Bamboo & Rattan Furniture, Recycled Material Furniture, Biodegradable & Bio-based Furniture, and Modular & Multi-functional Furniture. Each of these subsegments caters to different consumer preferences and environmental considerations. Solid wood furniture remains popular due to its durability and aesthetic appeal, while bamboo and rattan furniture are favored for their sustainability and lightweight properties. Recycled material furniture is gaining traction as consumers become more environmentally conscious, and biodegradable options are increasingly sought after for their minimal environmental impact. Modular and multi-functional furniture is also on the rise, appealing to urban dwellers seeking space-saving solutions. Plastic and polymer furniture, growing at 7.9% CAGR, illustrates the convergence of lightweight design, durability, and recyclability, with manufacturers trialing bio-resins and post-consumer recycled plastics.

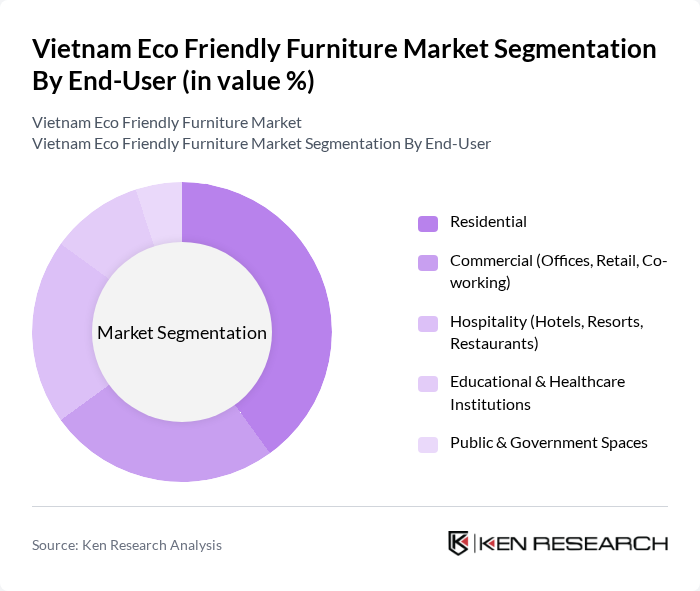

By End-User:The end-user segmentation of the eco-friendly furniture market includes Residential, Commercial (Offices, Retail, Co-working), Hospitality (Hotels, Resorts, Restaurants), Educational & Healthcare Institutions, and Public & Government Spaces. The residential segment is the largest, driven by increasing consumer demand for sustainable living solutions. Commercial spaces are also adopting eco-friendly furniture to enhance their corporate social responsibility image. The hospitality sector is increasingly focusing on sustainability to attract eco-conscious travelers, while educational and healthcare institutions are prioritizing environmentally friendly options to promote health and well-being. Public spaces are also incorporating eco-friendly furniture to align with government sustainability initiatives. The tourism industry growth has stimulated massively increasing demand for furniture in hotels, restaurants, and resorts, creating significant opportunities for eco-friendly manufacturers.

The Vietnam Eco Friendly Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Scanteak Vietnam, Green Furniture Co., Ltd., An Phuoc Furniture, Hòa Phát Furniture, Minh Duong Furniture Corporation, Vietwood Co., Ltd., Duy Tan Plastics Corporation, H?u Liên Asia Corporation, Th?ng Long Furniture, Nhà Xinh (AA Corporation), M??ng Thanh Furniture, Hoàng Anh Gia Lai Furniture, Phú Tài Furniture, Vietnam Wood Industry Corporation (Vinafor), and Eco Vietnam Furniture contribute to innovation, geographic expansion, and service delivery in this space. Vietnam has established itself as the world's second-largest furniture exporter, with exports valued at nearly USD 17.6 billion, with the United States accounting for approximately 60% of Vietnam's total furniture exports.

The future of the Vietnam eco-friendly furniture market appears promising, driven by increasing consumer demand for sustainable products and supportive government policies. As urbanization continues, the integration of eco-friendly furniture into residential and commercial spaces is expected to rise. Additionally, advancements in technology and material innovation will likely enhance product offerings, making sustainable options more accessible and appealing to a broader audience, thus fostering market expansion in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid Wood Furniture Bamboo & Rattan Furniture Recycled Material Furniture Biodegradable & Bio-based Furniture Modular & Multi-functional Furniture |

| By End-User | Residential Commercial (Offices, Retail, Co-working) Hospitality (Hotels, Resorts, Restaurants) Educational & Healthcare Institutions Public & Government Spaces |

| By Material | FSC-Certified Wood Bamboo & Rattan Recycled Plastics & Metals Organic Fabrics & Upholstery Composite & Hybrid Eco-materials |

| By Design Style | Modern Minimalist Traditional Vietnamese Rustic & Natural Contemporary/Scandinavian Custom/Artisan |

| By Distribution Channel | Online Retail/E-commerce Specialty Eco-Friendly Stores Direct-to-Consumer (D2C) Wholesale/Export Traditional Furniture Retailers |

| By Price Range | Budget Mid-Range Premium Luxury Custom |

| By Customer Segment | Individual Consumers Corporates & SMEs Government Agencies NGOs & International Organizations Real Estate & Developers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Eco-Friendly Furniture Sales | 100 | Store Managers, Sales Representatives |

| Consumer Preferences for Sustainable Products | 150 | Homeowners, Interior Design Enthusiasts |

| Manufacturing Insights on Eco-Friendly Materials | 80 | Production Managers, Material Sourcing Specialists |

| Market Trends from Interior Designers | 60 | Interior Designers, Architects |

| Government Policy Impact on Eco-Friendly Furniture | 40 | Policy Makers, Environmental Consultants |

The Vietnam Eco Friendly Furniture Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing consumer awareness of sustainability and government initiatives promoting eco-friendly products.