Region:Asia

Author(s):Dev

Product Code:KRAC0374

Pages:85

Published On:August 2025

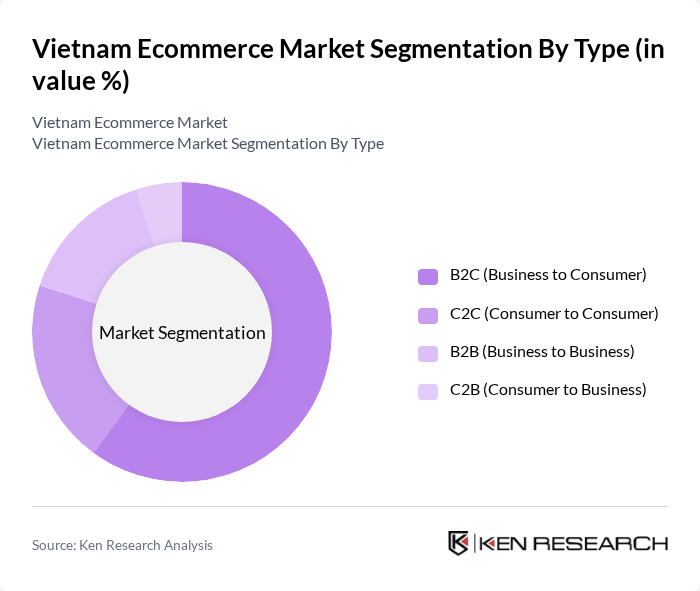

By Type:The ecommerce market can be segmented into four main types: B2C (Business to Consumer), C2C (Consumer to Consumer), B2B (Business to Business), and C2B (Consumer to Business). Each of these segments caters to different consumer needs and business models, with B2C being the most dominant due to the increasing number of online shoppers.

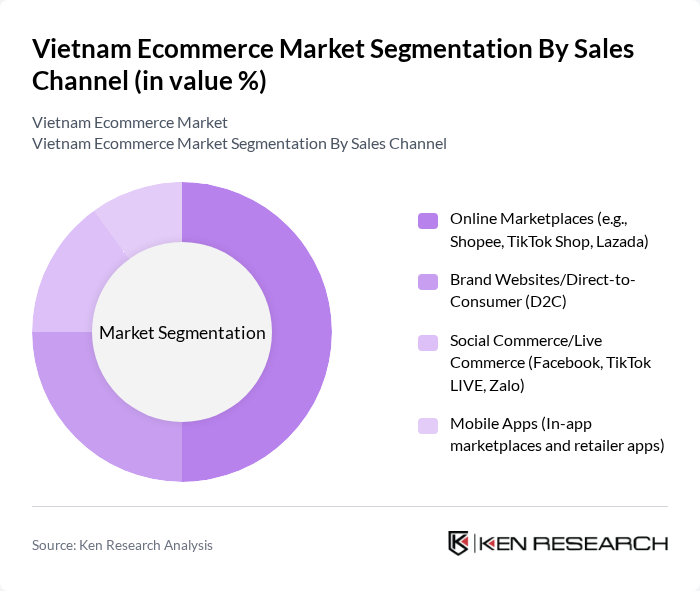

By Sales Channel:The ecommerce market is also segmented by sales channels, which include Online Marketplaces, Brand Websites/Direct-to-Consumer (D2C), Social Commerce/Live Commerce, and Mobile Apps. Online Marketplaces dominate the landscape due to their wide reach and established customer bases, while Social Commerce is rapidly gaining traction among younger consumers.

The Vietnam Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shopee Vietnam, TikTok Shop Vietnam, Lazada Vietnam, Tiki Corporation (Tiki.vn), Sendo (Sendo.vn), The Gioi Di Dong (thegioididong.com) – Mobile World Group, Dien May Xanh (dienmayxanh.com) – Mobile World Group, FPT Shop (FPT Retail), Cho Tot (chotot.com), Voso.vn (Viettel Post), PostMart.vn (Vietnam Post), Fahasa Online (fahasa.com), Coop Online (cooponline.vn) – Saigon Co.op, Aeon ESHOP (eshop.aeon.com.vn), VinID/WinCommerce (Adayroi legacy, VinID app/WinMart online) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As internet penetration and smartphone usage continue to rise, more consumers are expected to engage in online shopping. Additionally, the integration of advanced technologies such as AI and machine learning will enhance personalization and customer experience. Companies that adapt to these trends and invest in logistics and security will likely thrive in this dynamic market landscape, fostering sustainable growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C (Business to Consumer) C2C (Consumer to Consumer) B2B (Business to Business) C2B (Consumer to Business) |

| By Sales Channel | Online Marketplaces (e.g., Shopee, TikTok Shop, Lazada) Brand Websites/Direct-to-Consumer (D2C) Social Commerce/Live Commerce (Facebook, TikTok LIVE, Zalo) Mobile Apps (In-app marketplaces and retailer apps) |

| By Product Category | Fashion and Apparel Consumer Electronics & Mobile Home & Living/Appliances Health, Beauty & Personal Care Grocery & FMCG Mother & Baby Food & Beverage |

| By Payment Method | Credit/Debit Cards E-wallets (MoMo, ZaloPay, ShopeePay, Viettel Money) Cash on Delivery (COD) Bank Transfers/IBFT Buy Now, Pay Later (BNPL) |

| By Consumer Demographics | Age Groups (Gen Z, Millennials, Gen X) Income Levels Urban vs Rural Tier-1 vs Tier-2/3 Cities (Hanoi, HCMC vs other provinces) |

| By Delivery Method | Standard Delivery Express/Same-day Delivery Click and Collect/Locker Pickup Cross-border Shipping |

| By Customer Loyalty Programs | Membership/Subscription (e.g., Shopee Membership, TikiNOW) Reward Points/Coin Cashback Referral/Influencer Bonuses Free-shipping Vouchers & Bundled Promotions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 140 | Online Shoppers, Tech Enthusiasts |

| Fashion and Apparel Sales | 120 | Fashion Consumers, Retail Buyers |

| Grocery Delivery Services | 100 | Household Decision Makers, Busy Professionals |

| SME E-commerce Adoption | 80 | Business Owners, E-commerce Managers |

| Logistics and Delivery Challenges | 90 | Logistics Coordinators, Supply Chain Managers |

The Vietnam Ecommerce Market is valued at approximately USD 25 billion, driven by factors such as increased internet penetration, digital payment adoption, and a young, tech-savvy population favoring online shopping.