Vietnam Electric Motor Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3385

November 2024

86

About the Report

Vietnam Electric Motor Market Overview

- The Vietnam Electric Motor market is valued at USD 2 billion, driven by rising industrialization and an increasing demand for automation across various sectors. Government incentives, particularly in sectors like electric vehicles and renewable energy, play a pivotal role in fostering market growth. Additionally, the integration of energy-efficient solutions aligns with the national strategy to minimize carbon emissions and improve industrial efficiency, further pushing the demand for electric motors.

- Vietnams major industrial regions, such as the Red River Delta and the Southeast, lead the electric motor market. Their dominance is attributed to established manufacturing infrastructure, skilled workforce, and strategic governmental initiatives encouraging green industrial practices. These regions have drawn significant investments from both local and international companies, leveraging their advanced infrastructure to support large-scale production and distribution.

- Vietnam enforces strict energy efficiency standards under its National Energy Efficiency Program (VNEEP), requiring industrial motors to meet specific efficiency benchmarks. The Ministry of Industry and Trade states that over 10,000 industrial units adhered to these standards in 2024, resulting in decreased energy consumption and increased demand for compliant motors. These standards are crucial for suppliers aiming to participate in Vietnams industrial market.

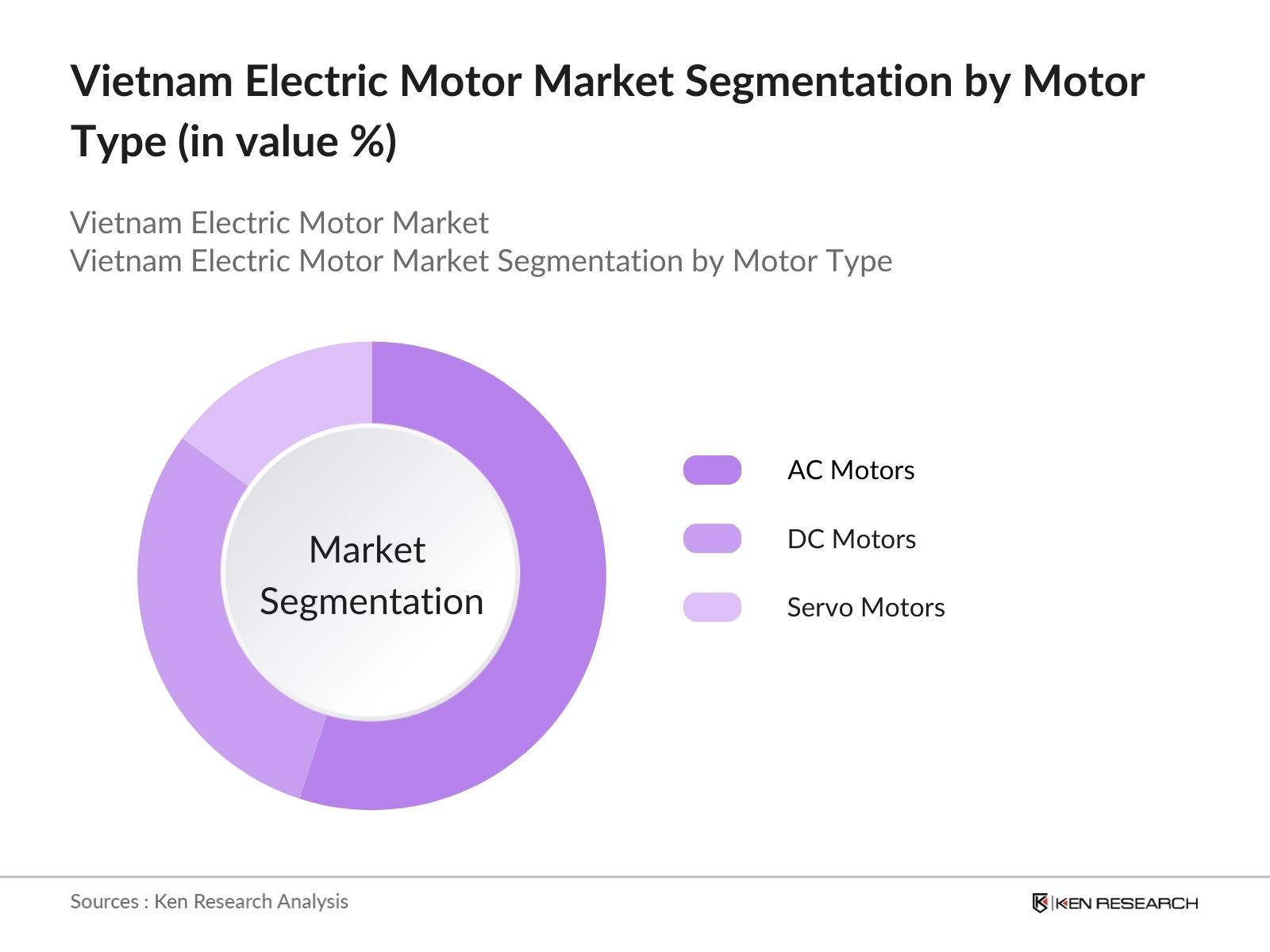

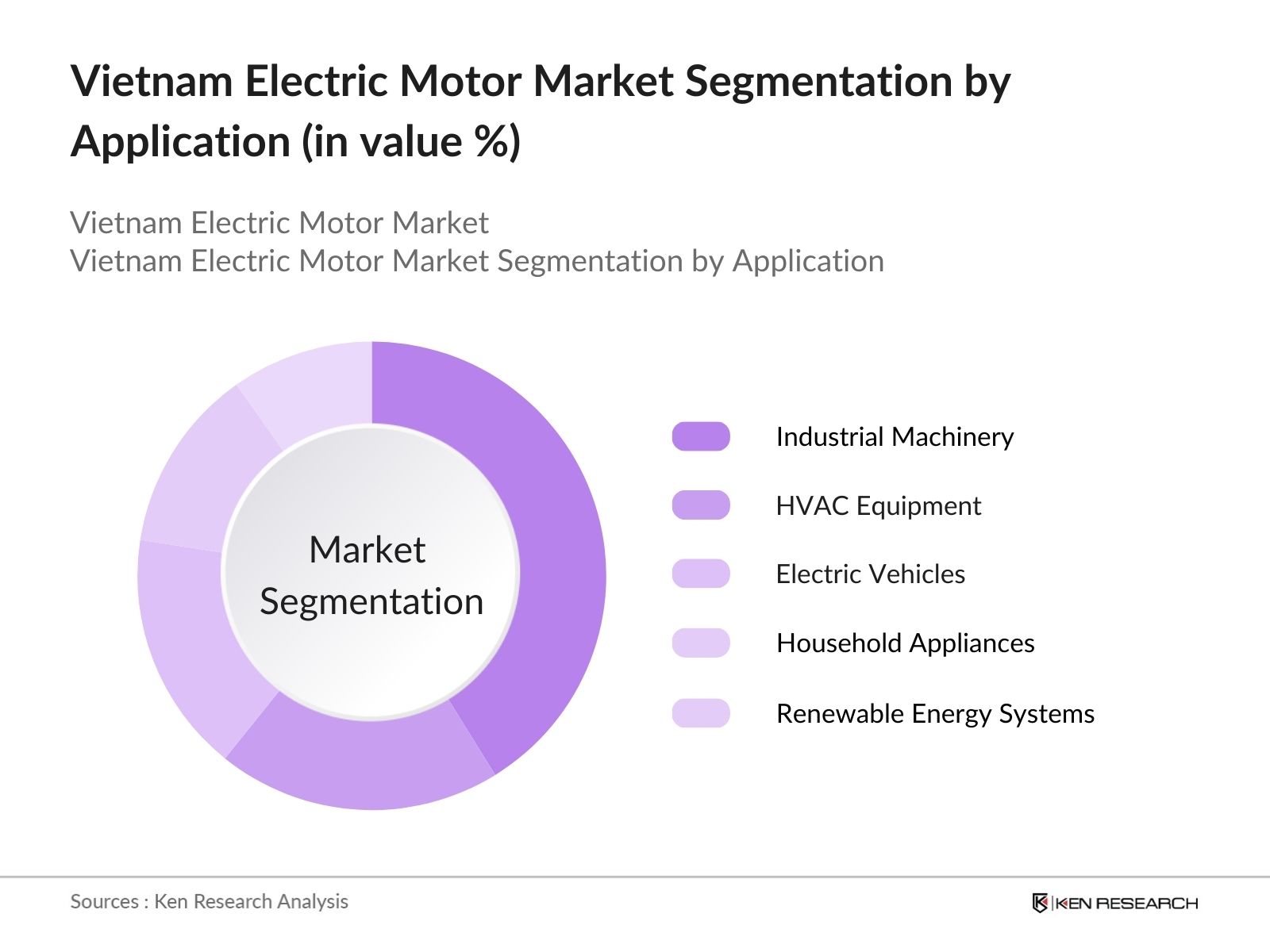

Vietnam Electric Motor Market Segmentation

The Vietnam Electric Motor market is segmented by motor type and by application.

- By Motor Type: The Vietnam Electric Motor market is segmented by motor type into AC Motors, DC Motors, and Servo Motors. AC motors hold a dominant position due to their widespread use in industrial applications, HVAC systems, and household appliances. Their reliability, cost-effectiveness, and compatibility with diverse applications make them the preferred choice across various sectors, particularly as industries prioritize operational efficiency and scalability.

- By Application: Segmented by application, the Vietnam Electric Motor market includes Industrial Machinery, HVAC Equipment, Electric Vehicles, Household Appliances, and Renewable Energy Systems. Industrial machinery applications lead due to the growing demand for automation, which enhances productivity and operational control. As industries expand to meet both domestic and export demands, motors in machinery applications become indispensable, reflecting the sector's sustained expansion and industrial investments.

Vietnam Electric Motor Market Competitive Landscape

The Vietnam Electric Motor market is primarily consolidated, with key players like ABB Ltd., Siemens AG, and WEG Industries leading the competition. These companies' technological advancements and investment in R&D for energy-efficient solutions underscore their influential presence in the market, alongside local players that support infrastructure and industrial growth.

Vietnam Electric Motor Market Analysis

Growth Drivers

- Industrial Automation: The rise in industrial automation in Vietnam has boosted demand for electric motors, which are essential for automated machinery. The General Statistics Office of Vietnam noted that industrial production in 2024 showed strong growth, particularly in the machinery and equipment sector, which recorded a value increase of 20% in early 2024. With ongoing infrastructure developments, Vietnam plans to expand industrial parks across northern and southern regions, adding thousands of automated systems powered by electric motors, especially in electronics and textile manufacturing. This shift has necessitated more motors suitable for precision and high-frequency operations.

- Expansion in Manufacturing Sector: Vietnams manufacturing sector expanded robustly, driven by increased foreign investments, particularly in electronics and textiles, resulting in a higher demand for electric motors. The Ministry of Planning and Investment reports that foreign direct investment (FDI) reached $28 billion in 2023, mainly in the electronics and automotive sectors. The trend is expected to continue through 2024, fueling demand for highly efficient motors in production plants. Such investments highlight Vietnams strategic role in regional manufacturing, making electric motors pivotal for sector operations.

- Increase in Renewable Energy Adoption: Vietnams renewable energy adoption has surged, with solar and wind projects needing advanced electric motors for energy generation and storage systems. The Ministry of Industry and Trade (MOIT) reported 14 GW of renewable energy capacity, highlighting the countrys ambitious goals for a low-emission economy. Electric motors, essential in converting and optimizing renewable power, play a critical role in these projects, especially with Vietnams focus on reducing fossil fuel dependency.

Market Challenges

- High Initial Investment Cost One primary barrier in adopting high-efficiency electric motors is the high upfront cost. Despite the long-term savings associated with energy-efficient motors, initial costs for sophisticated models remain prohibitive for small and medium-sized enterprises (SMEs). Vietnam's Ministry of Finance reported that SMEs, which make up 97% of the countrys enterprises, face limited financing options, impacting their ability to invest in new technology like energy-efficient motors.

- Dependence on Imports for Key Components Vietnam relies heavily on imported components for electric motors, particularly precision parts like bearings and sensors, mainly sourced from Japan, Korea, and China. The Vietnam Customs Department reported that in 2024, the import value of electric motor parts reached $800 million. This dependency exposes the market to international price fluctuations and supply chain disruptions, posing a challenge for local manufacturers striving to compete with imported finished products.

Vietnam Electric Motor Market Future Outlook

Over the next five years, the Vietnam Electric Motor market is poised for accelerated growth, driven by increasing industrial automation, advancements in motor technology, and supportive government policies. The anticipated growth trajectory aligns with the national agenda on green energy and sustainable industrial practices, projecting Vietnam as a significant player in the electric motor manufacturing landscape.

Market Opportunities

- Technological Advancements in Electric Motors: Technological innovation in electric motors, including brushless and direct-drive models, presents new opportunities in the Vietnamese market. The Ministry of Science and Technology reports that local companies are now increasingly focusing on research and development, with a $100 million investment in motor technology initiatives in 2024. This focus on technological innovation in the sector aligns with Vietnams aim to enhance productivity and energy efficiency, catering to industries such as electronics and automation.

- Demand in Electric Vehicles (EV) Sector: The EV sector in Vietnam is expanding, with significant implications for electric motor demand. VinFast, the leading local EV manufacturer, announced plans to increase EV production, which directly raises demand for electric motors. With 35,000 EVs projected to be on Vietnamese roads by year-end 2024, according to the Ministry of Transport, there is an escalating requirement for high-performance motors tailored for EVs. This growth in the EV sector opens opportunities for motor manufacturers to cater specifically to automotive applications.

Scope of the Report

|

AC Motors DC Motors Servo Motors

|

|

|

By Power Output |

Fractional Horsepower Motors |

|

By Application |

Industrial Machinery |

|

By End-User Industry |

Manufacturing Automotive Energy and Utilities |

|

By Region |

North East West South |

Products

Key Target Audience

Electric Motor Manufacturers

Automotive and Industrial Machinery Companies

Renewable Energy Sector

Government and Regulatory Bodies (e.g., Ministry of Industry and Trade, Vietnam Electricity Corporation)

Investors and Venture Capitalist Firms

Banks and Financial Institutes

Manufacturing and Industrial Parks

Transportation and Logistics Sector

HVAC Equipment Manufacturers

Companies

Players Mention in the Report:

ABB Ltd.

Siemens AG

WEG Industries

Toshiba Corporation

Nidec Corporation

Mitsubishi Electric Corporation

Hyundai Electric & Energy Systems

Regal Beloit Corporation

Emerson Electric Co.

Franklin Electric Co.

Bosch Rexroth AG

Cummins Inc.

Schneider Electric SE

Wolong Electric Group

Teco Electric & Machinery Co.

Table of Contents

1. Vietnam Electric Motor Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Vietnam Electric Motor Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Vietnam Electric Motor Market Analysis

3.1 Growth Drivers

- Industrial Automation

- Expansion in Manufacturing Sector

- Increase in Renewable Energy Adoption

- Government Incentives and Policies

3.2 Market Challenges

- High Initial Investment Cost

- Dependence on Imports for Key Components

- Skilled Workforce Shortage

3.3 Opportunities

- Technological Advancements in Electric Motors

- Demand in Electric Vehicles (EV) Sector

- Growth of Green Building Initiatives

3.4 Trends

- Adoption of IoT in Motor Monitoring

- Shift Towards Energy-Efficient Motors

- Rise in Localized Manufacturing

3.5 Government Regulations

- Energy Efficiency Standards

- Emission Reduction Targets

- Supportive Policies for Renewable Energy

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Analysis

4. Vietnam Electric Motor Market Segmentation

4.1 By Motor Type (In Value %) - AC Motors

- DC Motors

- Servo Motors

4.2 By Power Output (In Value %) - Fractional Horsepower Motors

- Integral Horsepower Motors

4.3 By Application (In Value %) - Industrial Machinery

- HVAC Equipment

- Electric Vehicles

- Household Appliances

- Renewable Energy Systems

4.4 By End-User Industry (In Value %) - Manufacturing

- Automotive

- Residential

- Energy and Utilities

- Transportation

4.5 By Region (In Value %)

- West

- East - North- South

5. Vietnam Electric Motor Market Competitive Analysis

5.1 Detailed Profiles of Major Companies - ABB Ltd.

- Siemens AG

- WEG Industries

- Toshiba Corporation

- Nidec Corporation

- Hyundai Electric & Energy Systems

- Mitsubishi Electric Corporation

- Regal Beloit Corporation

- Teco Electric & Machinery Co.

- Emerson Electric Co.

- Franklin Electric Co.

- Bosch Rexroth AG

- Cummins Inc.

- Schneider Electric SE

- Wolong Electric Group

5.2 Cross Comparison Parameters (Market Presence, Product Portfolio, Innovation Capabilities, Market Share, Sales Revenue, Manufacturing Capacity, Regional Reach, Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Joint Ventures and Collaborations

6. Vietnam Electric Motor Market Regulatory Framework

6.1 Energy Efficiency Certification

6.2 Environmental Compliance Standards

6.3 Import-Export Policies

6.4 Certification Processes and Standards

7. Vietnam Electric Motor Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Vietnam Electric Motor Future Market Segmentation

8.1 By Motor Type (In Value %)

8.2 By Power Output (In Value %)

8.3 By Application (In Value %)

8.4 By End-User Industry (In Value %)

8.5 By Region (In Value %)

9. Vietnam Electric Motor Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Analysis

9.3 Go-to-Market Strategies

9.4 White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

This initial phase entails mapping the Vietnam Electric Motor Market's ecosystem, with extensive desk research to identify the key variables influencing market dynamics, covering stakeholders, product offerings, and regulatory factors.

Step 2: Market Analysis and Construction

We analyze historical data on production, sales, and demand, supported by quantitative models to construct a base for forecasting. Metrics include market penetration rates, and industrial adoption trends.

Step 3: Hypothesis Validation and Expert Consultation

Engaging industry experts through interviews and surveys, we validate market hypotheses, obtaining insights on operational trends, technological advancements, and projected growth areas.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from primary and secondary research to deliver a well-rounded analysis of the Vietnam Electric Motor Market, ensuring data accuracy and market relevance.

Frequently Asked Questions

01. How big is the Vietnam Electric Motor Market?

The Vietnam Electric Motor Market was valued at USD 2 billion, driven by robust industrialization, demand for automation, and supportive government initiatives.

02. What are the challenges in the Vietnam Electric Motor Market?

Challenges in Vietnam Electric Motor Market include high initial costs, dependency on imports for key components, and a shortage of skilled workforce in advanced motor technology and energy-efficient systems.

03. Who are the major players in the Vietnam Electric Motor Market?

Key players in Vietnam Electric Motor Market include ABB Ltd., Siemens AG, WEG Industries, and Toshiba Corporation, all of which maintain significant influence due to their extensive product portfolios and R&D capacities.

04. What are the growth drivers of the Vietnam Electric Motor Market?

The Vietnam Electric Motor Market is propelled by factors such as government incentives for sustainable manufacturing, increasing demand for energy-efficient motors, and the expansion of the electric vehicle industry.

05. How does government policy impact the Vietnam Electric Motor Market?

Government policies in Vietnam support green energy and efficiency standards, which drive the adoption of electric motors across various sectors, creating favorable conditions for market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.