Region:Asia

Author(s):Geetanshi

Product Code:KRAA4542

Pages:89

Published On:September 2025

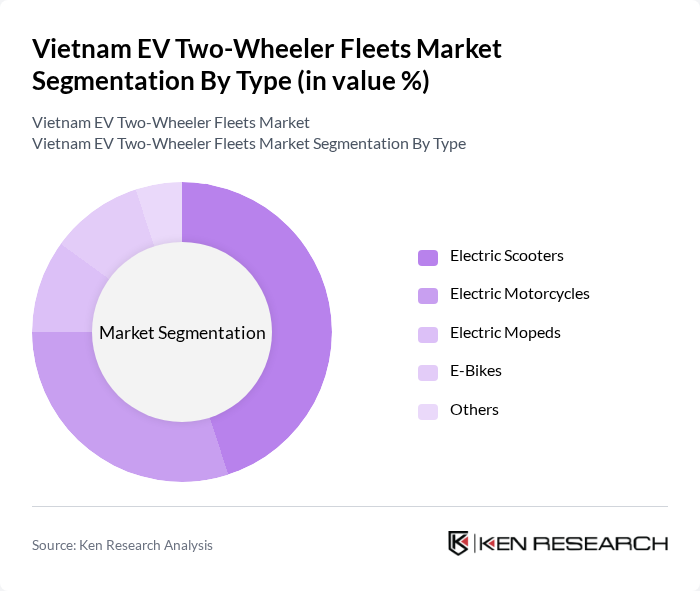

By Type:The market is segmented into various types of electric two-wheelers, including Electric Scooters, Electric Motorcycles, Electric Mopeds, E-Bikes, and Others. Among these,Electric Scootersare leading the market due to their popularity among urban commuters seeking convenient and cost-effective transportation options. The lightweight design and ease of use make them particularly appealing to younger consumers and city dwellers. Electric Motorcycles also hold a significant share, catering to those looking for higher performance and longer ranges.

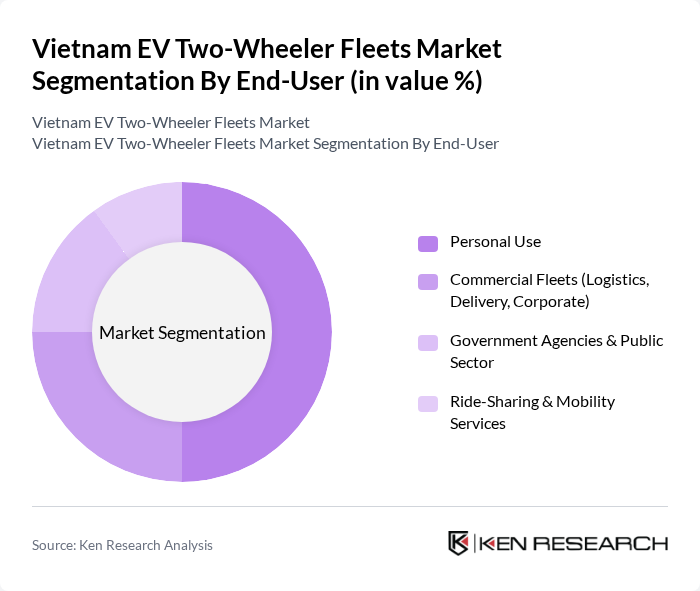

By End-User:The end-user segmentation includes Personal Use, Commercial Fleets (Logistics, Delivery, Corporate), Government Agencies & Public Sector, and Ride-Sharing & Mobility Services. ThePersonal Usesegment is currently the largest, driven by the increasing number of individuals opting for electric two-wheelers as a sustainable alternative to traditional gasoline-powered vehicles. The convenience and cost savings associated with electric scooters and motorcycles make them particularly attractive for daily commuting.

The Vietnam EV Two-Wheeler Fleets Market is characterized by a dynamic mix of regional and international players. Leading participants such as VinFast, Pega (formerly HKbike), Dat Bike, Yadea Vietnam, Anbico, Detech, Honda Vietnam, Yamaha Motor Vietnam, SYM Vietnam, Son Ha EV, Selex Motors, Dibao Vietnam, Gojek Vietnam, Grab Vietnam, FastGo Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam EV two-wheeler fleet market appears promising, driven by increasing urbanization and supportive government policies. As the urban population grows, the demand for efficient and sustainable transportation solutions will rise. Additionally, advancements in battery technology and charging infrastructure are expected to enhance the viability of electric two-wheelers. With ongoing government support and rising environmental awareness, the market is poised for significant expansion, creating a favorable environment for both manufacturers and consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Scooters Electric Motorcycles Electric Mopeds E-Bikes Others |

| By End-User | Personal Use Commercial Fleets (Logistics, Delivery, Corporate) Government Agencies & Public Sector Ride-Sharing & Mobility Services |

| By Distribution Channel | Direct Sales Online Sales Dealerships Leasing & Subscription Others |

| By Battery Type | Lithium-Ion Batteries Lead-Acid Batteries Nickel-Metal Hydride (NiMH) Batteries Others |

| By Charging Type | Fast Charging Standard Charging Battery Swapping Others |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment |

| By Policy Support | Subsidies Tax Exemptions Incentives for Charging Infrastructure |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Operators in Urban Areas | 100 | Fleet Managers, Operations Directors |

| Manufacturers of Electric Two-Wheelers | 60 | Product Development Managers, Sales Executives |

| Government Policy Makers | 40 | Transport Policy Analysts, Environmental Officers |

| Consumers of Electric Two-Wheelers | 120 | General Consumers, Early Adopters |

| Charging Infrastructure Providers | 50 | Business Development Managers, Technical Directors |

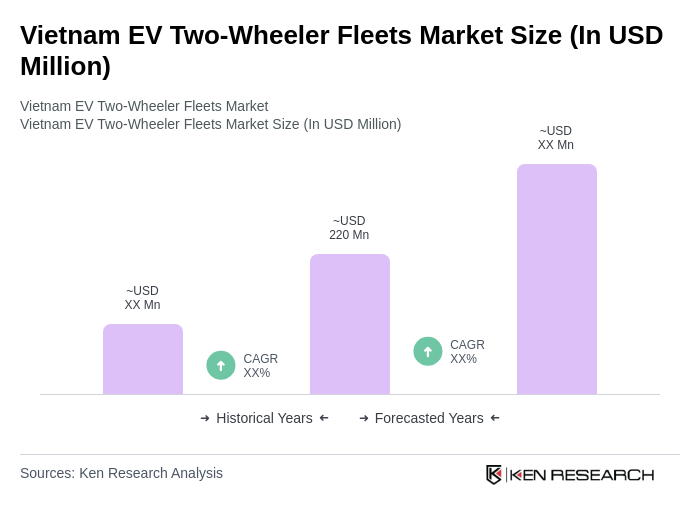

The Vietnam EV Two-Wheeler Fleets Market is valued at approximately USD 220 million, reflecting significant growth driven by urbanization, government incentives, and increased consumer awareness of environmental sustainability.