Vietnam Footwear Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9577

December 2024

81

About the Report

Vietnam Footwear Market Overview

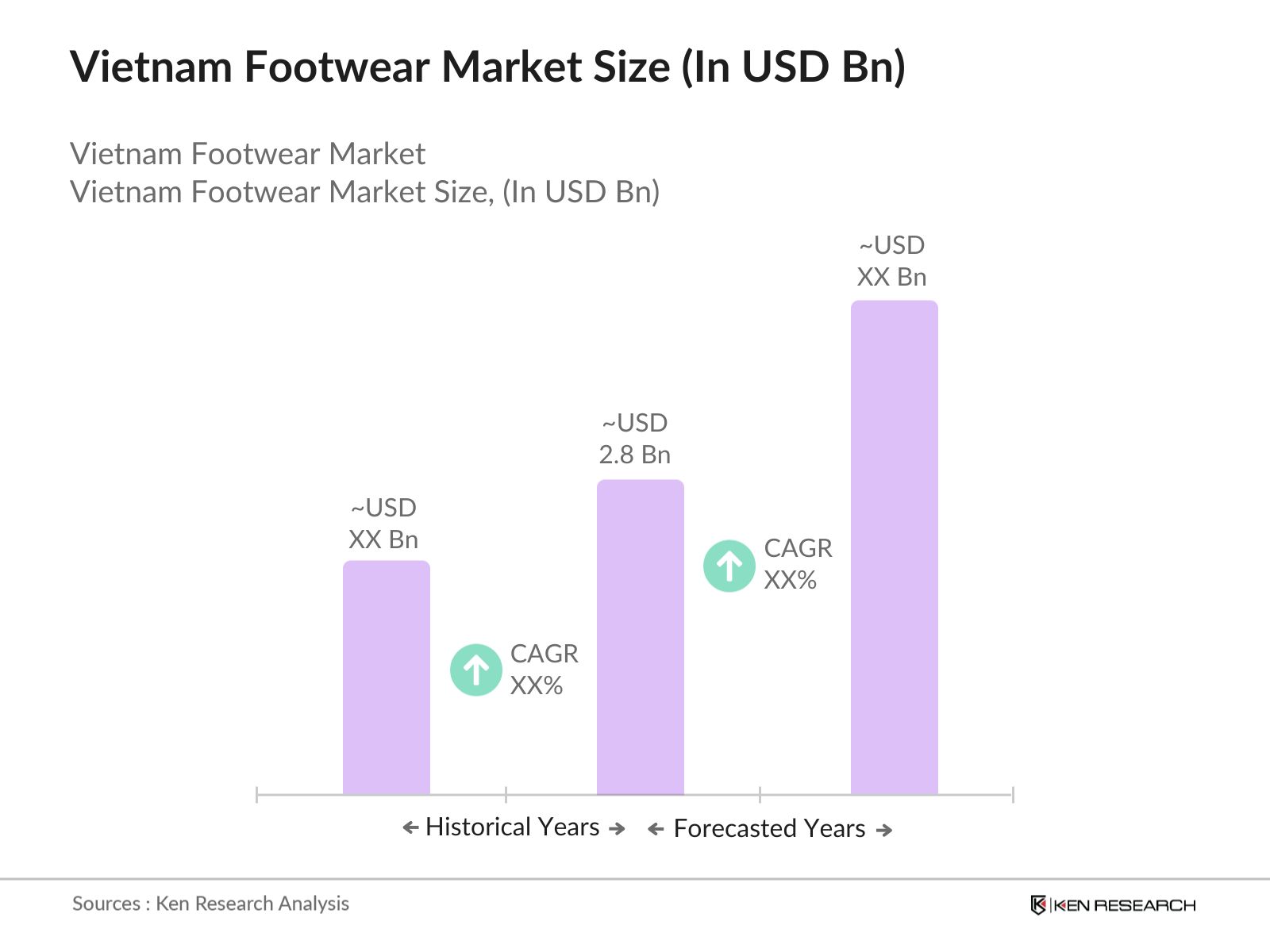

- The Vietnam footwear market is valued at USD 2.8 billion, driven by both domestic and international demand. The market's growth is fueled by Vietnams robust manufacturing capabilities, low production costs, and increased exports to major markets such as the US and Europe. The steady rise in disposable incomes and growing consumer interest in fashion and sportswear also contribute to the markets expansion, creating a favorable environment for footwear companies to flourish in Vietnam.

- The cities of Ho Chi Minh City and Hanoi dominate the footwear market in Vietnam due to their large consumer bases, extensive distribution networks, and strong retail infrastructures. Ho Chi Minh City serves as the main hub for manufacturing and export, owing to its proximity to the major ports, well-established supply chains, and access to skilled labor. Hanoi, being the capital, also plays a key role in driving domestic consumption with its growing urban population and rising consumer spending.

- Vietnamese labor laws, particularly in the manufacturing sector, are stringent and closely monitored by government bodies. In 2024, the Ministry of Labor, Invalids, and Social Affairs introduced new regulations mandating a minimum wage of VND 7.1 million per month for workers in urban areas. These labor laws have had a direct impact on footwear manufacturers, who must comply with stringent guidelines to avoid penalties and ensure continued access to international markets like the U.S. and Europe.

Vietnam Footwear Market Segmentation

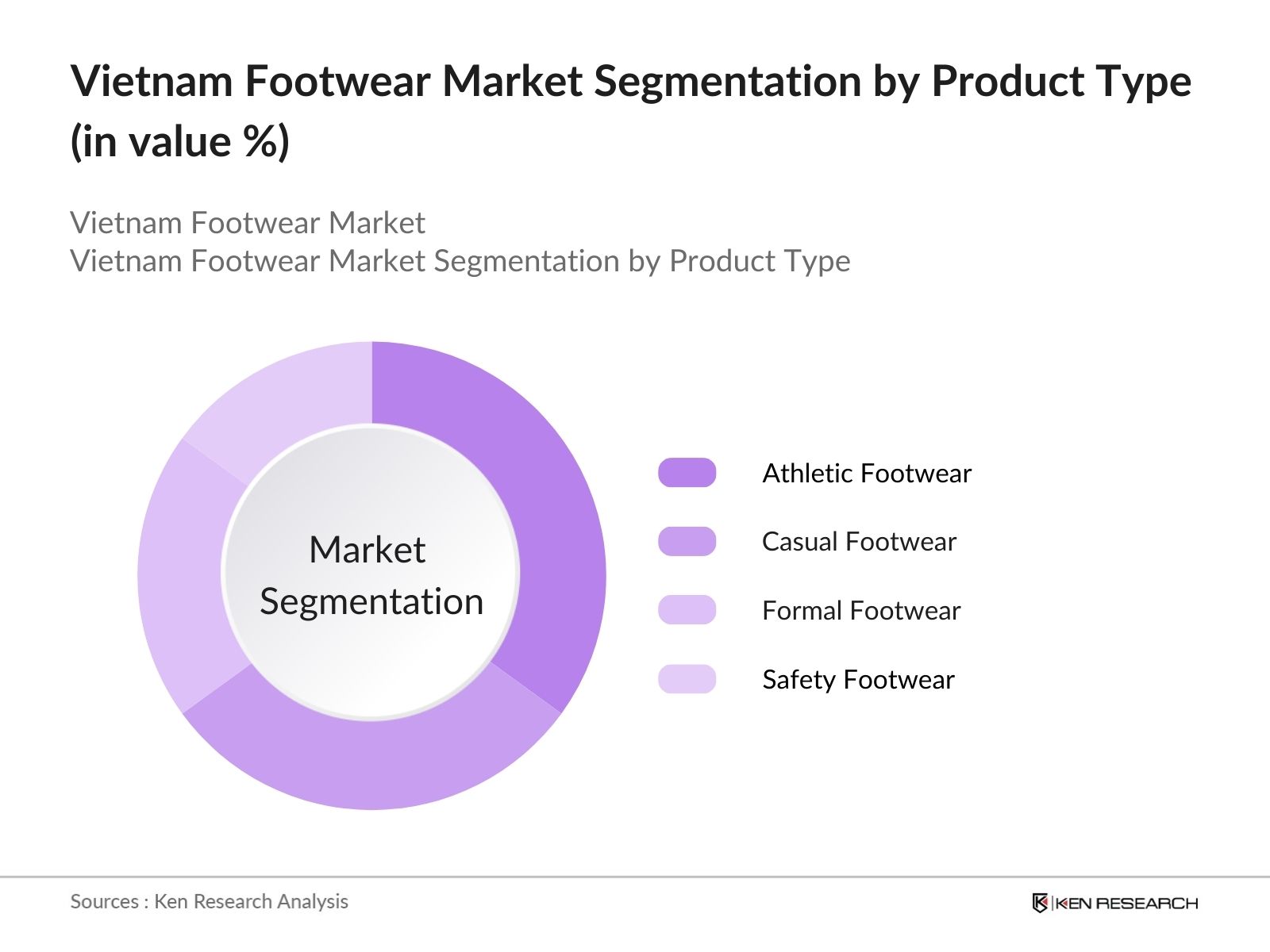

- By Product Type: The market is segmented by product type into athletic footwear, casual footwear, formal footwear, and safety footwear. Recently, athletic footwear has held a dominant share within the product type segmentation due to the increasing popularity of sports and fitness activities in Vietnam. A rising number of gyms and sports facilities have boosted the demand for running shoes and sports-specific footwear. Major sports brands like Nike and Adidas have a strong retail presence in urban areas, further enhancing their market dominance.

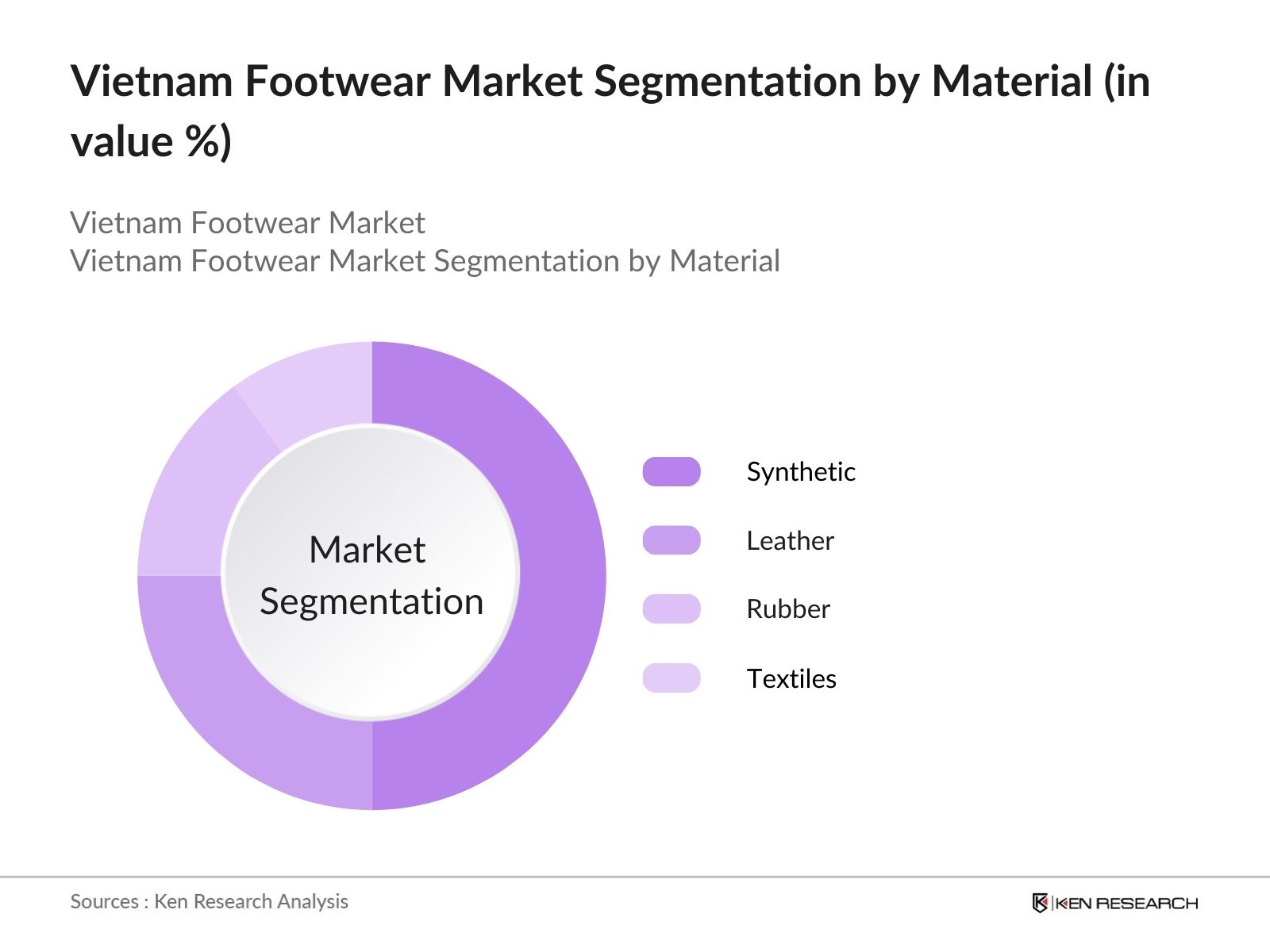

- By Material: The market is also segmented by material into leather, synthetic, rubber, and textiles. Synthetic materials dominate this segment due to their cost-effectiveness, durability, and ease of mass production. The shift towards environmentally sustainable and vegan footwear is further pushing the use of innovative synthetic materials. Additionally, the ability to produce synthetic footwear at scale with minimal resource use makes it a favorable option for both manufacturers and consumers seeking affordable yet stylish footwear.

Vietnam Footwear Market Competitive Landscape

The Vietnam footwear market is dominated by a mix of international giants and local manufacturers. Key players such as Nike and Adidas have capitalized on the country's favorable production environment, while domestic players also hold substantial market presence. These companies are leveraging Vietnam's manufacturing advantages, including lower labor costs and the proximity to raw material suppliers, to meet both domestic demand and export requirements.

|

Company |

Established |

Headquarters |

No. of Employees |

Product Portfolio |

Global Presence |

Vietnam Manufacturing Facilities |

Revenue (2023) |

Sustainability Initiatives |

Strategic Partnerships |

|

Nike, Inc. |

1964 |

Beaverton, Oregon |

|||||||

|

Adidas AG |

1949 |

Herzogenaurach, GER |

|||||||

|

Bata Corporation |

1894 |

Lausanne, Switzerland |

|||||||

|

Li-Ning Company |

1990 |

Beijing, China |

|||||||

|

VinGroup (Vinfast Footwear) |

2013 |

Hanoi, Vietnam |

Vietnam Footwear Industry Analysis

Growth Drivers

- Consumer Preferences: The Vietnamese footwear market has seen a growing shift in consumer preferences towards athleisure and comfortable shoes, reflecting changing lifestyles. Vietnam's GDP per capita rose to $4,150 in 2024, contributing to increased spending on premium footwear. Additionally, Vietnam's young population, with a median age of 32, drives demand for trendy and functional footwear products. Footwear exports also remain strong due to favorable trade agreements like CPTPP, where the country's total footwear exports were valued at $23.8 billion in 2024. Government initiatives to support local manufacturing further bolster this sectors growth.

- Export Demand: Vietnam is the third-largest footwear exporter globally, with total exports reaching $23.8 billion in 2024, mainly to the U.S. and European markets. Export demand is fueled by the countrys strategic participation in multilateral trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which reduces tariffs on footwear products. In addition, 12.7% of all Vietnamese exports in 2024 came from the footwear industry, highlighting its crucial role in the countrys economy. This export growth is supported by rising demand for high-quality, affordable products from global consumers.

- Rising Disposable Income: Rising disposable income in Vietnam is another key driver for footwear consumption. In 2024, Vietnam's average household disposable income increased to $9,520, allowing consumers to spend more on non-essential products, including higher-quality footwear. This surge in purchasing power, particularly among urban populations in cities like Hanoi and Ho Chi Minh, has led to a growing demand for both international and domestic footwear brands. This shift towards higher spending also aligns with a broader movement towards fashion-conscious consumer behavior in Vietnam.

Market Challenges

- Rising Production Costs: Labor costs in Vietnam have increased, impacting the profitability of footwear manufacturers. In 2024, the average monthly wage for a worker in the manufacturing sector rose to VND 7.1 million, or around $297. Moreover, electricity prices have also seen an increase, affecting production costs. Rising prices of raw materials such as rubber and synthetic leather have further strained profit margins. These cost escalations are pushing manufacturers to explore automation and outsourcing to manage operational expenses effectively.

- Global Supply Chain Disruptions: Vietnamese footwear manufacturers have faced challenges from global supply chain disruptions, particularly during the pandemic. In 2024, the cost of importing essential materials like rubber and fabric from China increased due to transportation delays and rising freight charges. The average shipping cost from China to Vietnam rose by 23%, further squeezing profit margins. Moreover, disruptions in the availability of these materials have caused production delays, forcing some manufacturers to shift production schedules or seek alternative suppliers.

Vietnam Footwear Market Future Outlook

Over the next few years, the Vietnam footwear market is poised for continued growth, driven by rising consumer demand for both fashion and functional footwear. The growing influence of e-commerce, coupled with advancements in supply chain management, will further streamline production and distribution channels. Additionally, sustainability initiatives and government-backed programs aimed at boosting domestic production and exports are likely to attract more foreign investments and expand Vietnam's global market presence.

Market Opportunities

- Expansion of E-Commerce: The rise of e-commerce presents a growth opportunity for the Vietnamese footwear market. In 2024, Vietnams e-commerce market was valued at $16.4 billion, with footwear being a key product category. Platforms such as Tiki and Shopee have expanded their footprint, offering brands greater reach to online consumers. The growth of mobile internet usage, with 72% of the population using smartphones in 2024, has fueled the rise of digital shopping. This shift offers domestic and international footwear brands new avenues for sales without the need for physical retail presence.

- Customization and Sustainable Footwear: There is growing consumer interest in customized and sustainable footwear. In 2024, around 40% of Vietnamese consumers expressed a preference for eco-friendly and customized shoes, according to data from the Ministry of Industry and Trade. Brands are increasingly adopting sustainable materials like organic cotton and recycled rubber to meet this demand. In addition, localized customization options such as color and material preferences are gaining popularity among Vietnams urban middle class, presenting a new growth area for both local and foreign brands in the country.

Scope of the Report

Products

Key Target Audience

Footwear Manufacturers

Exporters and Importers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Industry and Trade)

Online Retail Platforms

Footwear Component Suppliers

International Trade Associations

Banks and Financial Institutes

Companies

Major Players in the Vietnam Footwear Market

Nike, Inc.

Adidas AG

Bata Corporation

Puma SE

Skechers USA, Inc.

Li-Ning Company

VinGroup (Vinfast Footwear)

Ecco Sko A/S

Vans, Inc.

New Balance Athletics, Inc.

Converse, Inc.

Anta Sports Products Limited

Woodland Worldwide

Under Armour, Inc.

Aldo Group

Table of Contents

Vietnam Footwear Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Vietnam Footwear Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Vietnam Footwear Market Analysis

3.1. Growth Drivers (Urbanization, Middle-Class Expansion, Export Growth, FDI in Manufacturing)

3.2. Market Challenges (Supply Chain Disruptions, Rising Labor Costs, Competition from Regional Players)

3.3. Opportunities (Sustainability Trends, Growing E-commerce Adoption, Investment in Manufacturing Technology)

3.4. Trends (Sustainable Footwear Materials, Digital Transformation in Retail, Shift to High-Value-Added Products)

3.5. Government Regulations (Trade Agreements, Labor Policies, Environmental Standards)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

Vietnam Footwear Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Leather Footwear

4.1.2. Sports Footwear

4.1.3. Non-Leather Footwear

4.1.4. Safety Footwear

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Offline Retail

4.2.3. Specialty Stores

4.3. By Material Type (In Value %)

4.3.1. Synthetic Material

4.3.2. Leather

4.3.3. Rubber

4.3.4. Recycled Materials

4.4. By End User (In Value %)

4.4.1. Men

4.4.2. Women

4.4.3. Kids

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

Vietnam Footwear Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Pou Chen Corporation

5.1.2. VinGroup

5.1.3. Nike Inc.

5.1.4. Adidas AG

5.1.5. Biti's

5.1.6. Skechers USA, Inc.

5.1.7. Li-Ning Company Limited

5.1.8. Xtep International Holdings

5.1.9. ASICS Corporation

5.1.10. Reebok International Limited

5.1.11. Fila

5.1.12. New Balance Athletics, Inc.

5.1.13. Bata

5.1.14. Timberland

5.1.15. Converse

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Manufacturing Capabilities, Revenue, Product Lines, Export Volume, Brand Presence, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Vietnam Footwear Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Labor and Manufacturing Policies

6.4. Trade Policies and Import-Export Tariffs

Vietnam Footwear Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Vietnam Footwear Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Material Type (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

Vietnam Footwear Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Footwear Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Vietnam Footwear Market is compiled and analyzed. This includes assessing market penetration, the ratio of production facilities to demand, and the resultant revenue generation. Furthermore, an evaluation of quality standards and customer preferences is conducted to ensure the reliability of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts. These consultations provide valuable operational and financial insights from companies in Vietnam, helping refine the market data. The data is validated through primary interviews with key market players and stakeholders, ensuring accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves engagement with multiple footwear manufacturers to acquire insights into production trends, demand fluctuations, and export dynamics. This interaction serves to verify and complement the bottom-up approach, ensuring a comprehensive and validated analysis of the Vietnam Footwear Market.

Frequently Asked Questions

How big is the Vietnam Footwear Market?

The Vietnam footwear market is valued at USD 2.8 billion, driven by rising consumer demand, strong manufacturing capabilities, and an expanding export base.

What are the challenges in the Vietnam Footwear Market?

Challenges in Vietnam footwear market include rising production costs due to increasing labor wages, global supply chain disruptions affecting raw material availability, and stringent international trade regulations.

Who are the major players in the Vietnam Footwear Market?

Key players in Vietnam footwear market include Nike, Adidas, Bata, Li-Ning, and VinGroup. These companies dominate due to their extensive manufacturing capabilities, well-established distribution networks, and brand recognition.

What are the growth drivers of the Vietnam Footwear Market?

The Vietnam footwear market is propelled by increasing consumer interest in fitness, rising disposable incomes, the growth of e-commerce platforms, and Vietnam's role as a major manufacturing hub for global footwear brands.

What are the dominant product segments in the Vietnam Footwear Market?

Athletic footwear holds a dominant Vietnam footwear market share, driven by the increasing popularity of sports activities and consumer preference for casual sportswear.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.