Region:Asia

Author(s):Geetanshi

Product Code:KRAD7920

Pages:81

Published On:December 2025

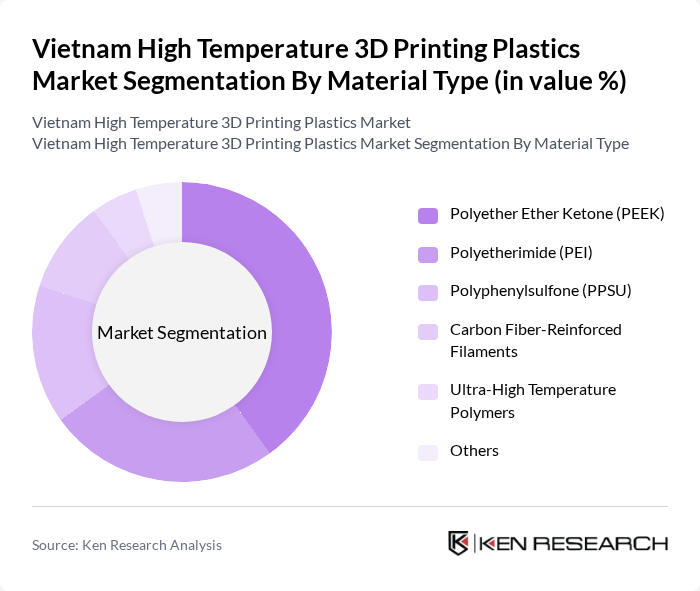

By Material Type:The material types used in high-temperature 3D printing plastics include various advanced polymers that offer unique properties suitable for demanding applications. The leading sub-segment is Polyether Ether Ketone (PEEK), known for its exceptional thermal stability and mechanical strength, making it ideal for aerospace and medical applications. Other materials like Polyetherimide (PEI) and Polyphenylsulfone (PPSU) are also gaining traction due to their excellent chemical resistance and high-performance characteristics.

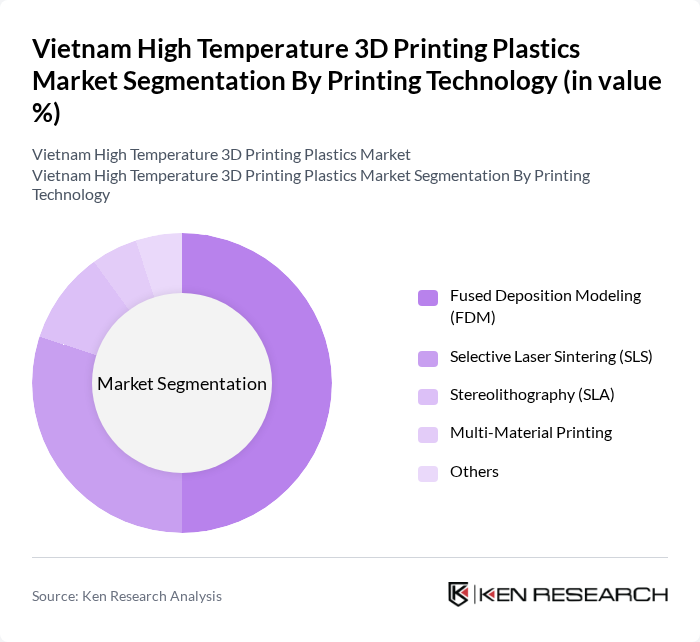

By Printing Technology:The printing technologies employed in high-temperature 3D printing plastics include various methods that cater to different material types and application requirements. Fused Deposition Modeling (FDM) is the most widely used technology due to its versatility and cost-effectiveness. Selective Laser Sintering (SLS) is also prominent, particularly for producing complex geometries with high precision. Stereolithography (SLA) and Multi-Material Printing are emerging technologies that offer unique advantages in specific applications.

The Vietnam High Temperature 3D Printing Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3D Systems Corporation, Stratasys Ltd., EOS GmbH, Materialise NV, HP Inc. (3D Printing Division), BASF SE, Arkema S.A., SABIC, Victrex plc, Solvay S.A., Mitsubishi Chemical Corporation, Covestro AG, Dow Inc., Formlabs Inc., Nexa3D, Evonik Industries AG, Huntsman Corporation contribute to innovation, geographic expansion, and service delivery in this space.

As Vietnam's economy continues to expand, the high-temperature 3D printing plastics market is poised for significant growth. The increasing focus on innovation and sustainability will drive manufacturers to explore advanced materials and technologies. In future, the integration of AI and IoT in manufacturing processes is expected to enhance efficiency and customization capabilities. Additionally, collaboration between industry players and educational institutions will foster research and development, paving the way for new applications and improved material performance in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Polyether Ether Ketone (PEEK) Polyetherimide (PEI) Polyphenylsulfone (PPSU) Carbon Fiber-Reinforced Filaments Ultra-High Temperature Polymers Others |

| By Printing Technology | Fused Deposition Modeling (FDM) Selective Laser Sintering (SLS) Stereolithography (SLA) Multi-Material Printing Others |

| By End-User Industry | Aerospace & Defence Automotive Medical Devices & Healthcare Electronics Industrial Manufacturing Others |

| By Application | Rapid Prototyping Tooling & Fixtures End-Use Production Parts Custom Medical Implants Others |

| By Distribution Channel | Direct Sales to OEMs Authorized Distributors Online Platforms Material Suppliers & Resellers Others |

| By Geographic Region | Northern Vietnam (Hanoi, Hai Phong) Southern Vietnam (Ho Chi Minh City, Can Tho) Central Vietnam (Da Nang, Hue) Others |

| By Material Properties | Heat Resistance (>200°C) Chemical Resistance Mechanical Strength & Durability Lightweight & Corrosion-Resistant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Component Manufacturers | 45 | Production Managers, Quality Assurance Engineers |

| Automotive Parts Producers | 40 | Supply Chain Managers, Design Engineers |

| Healthcare Device Manufacturers | 35 | Regulatory Affairs Specialists, Product Development Managers |

| Consumer Goods Producers | 30 | Marketing Managers, Product Line Managers |

| Research Institutions and Universities | 25 | Academic Researchers, Lab Managers |

The Vietnam High Temperature 3D Printing Plastics Market is valued at approximately USD 15 million, reflecting a five-year historical analysis that highlights the increasing adoption of advanced manufacturing technologies across various industries.