Vietnam Home Healthcare Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD5051

December 2024

91

About the Report

Vietnam Home Healthcare Market Overview

- The Vietnam home healthcare market is valued at USD 2 billion, driven by a growing aging population and an increase in chronic diseases like diabetes, cardiovascular conditions, and respiratory disorders. The rise of telehealth services and the government's focus on healthcare infrastructure development further drive market expansion. Additionally, an increasing demand for cost-effective healthcare services has pushed more patients towards home care, which is also supported by advancements in healthcare technologies such as wearable monitoring devices. These factors together have bolstered market growth over the past five years.

- Dominant cities in the Vietnam home healthcare market include Hanoi and Ho Chi Minh City. These cities lead due to their advanced healthcare infrastructure, higher disposable incomes, and the availability of skilled medical professionals. In addition, these urban areas have a higher adoption rate of technology-driven healthcare solutions such as remote monitoring devices and telemedicine platforms, making them central to the home healthcare industry's growth. These cities also see a greater level of private and government investment in healthcare services, positioning them as leaders in the sector.

- The Vietnam Health Insurance Law, updated in 2024, plays a crucial role in shaping the home healthcare market. The law mandates that public health insurance partially covers home-based care for certain chronic conditions. This legal framework encourages the development of home healthcare services, but coverage remains limited, particularly for advanced medical equipment and treatments. Efforts are underway to expand the scope of services covered under the health insurance law to include more comprehensive home-based care options.

Vietnam Home Healthcare Market Segmentation

The Vietnam home healthcare market is segmented by service type and by device type.

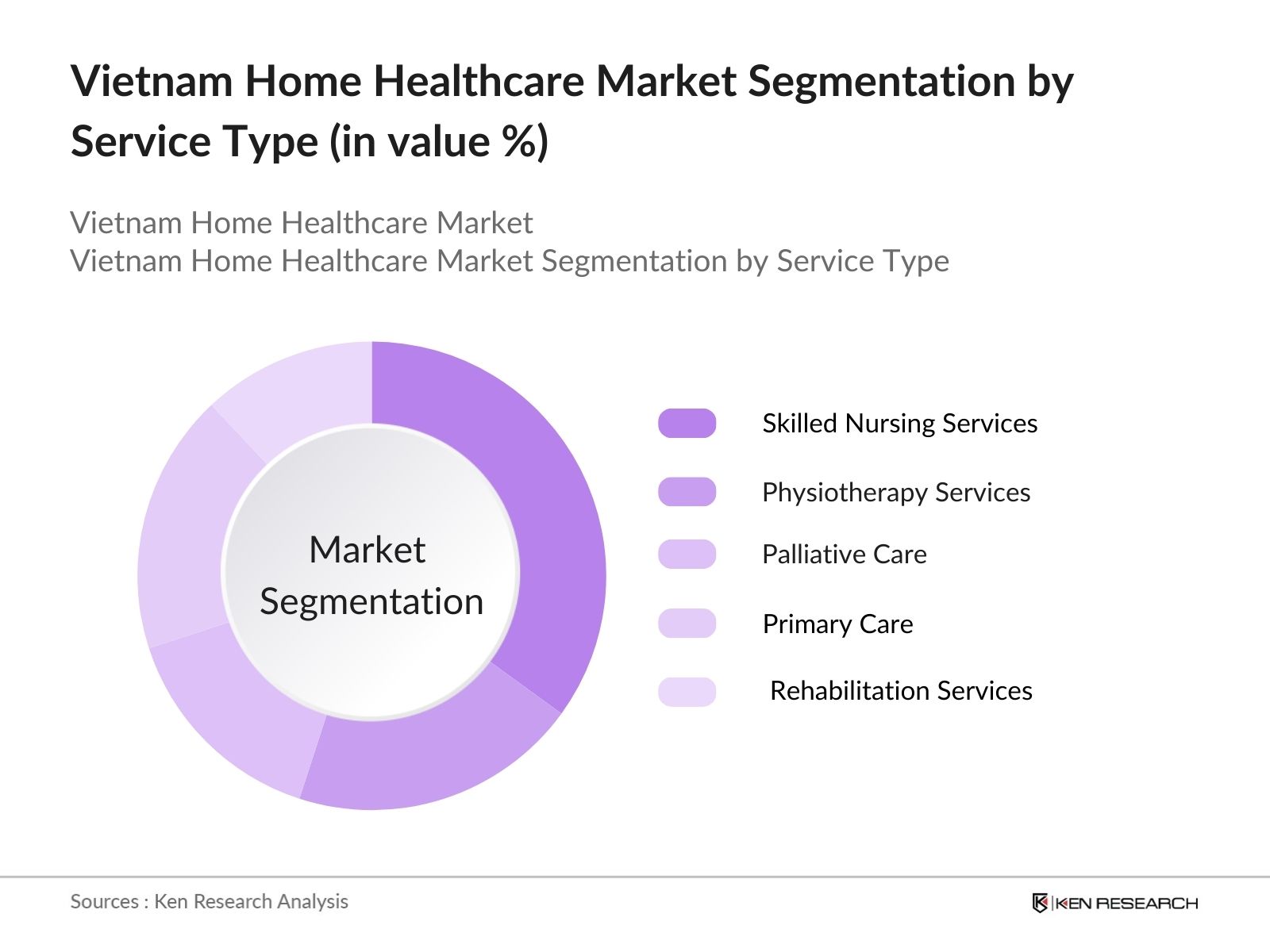

- By Service Type: The market is segmented by service type into skilled nursing services, physiotherapy services, palliative care, primary care, and rehabilitation services. Among these, skilled nursing services dominate due to the rising number of patients requiring post-operative care and long-term care for chronic conditions. The segment benefits from the increasing preference for home care over hospitalization due to cost savings and personalized attention. Patients with conditions such as stroke or diabetes particularly opt for home-based skilled nursing services because it provides specialized care within the comfort of their homes, avoiding the higher costs of hospital stays.

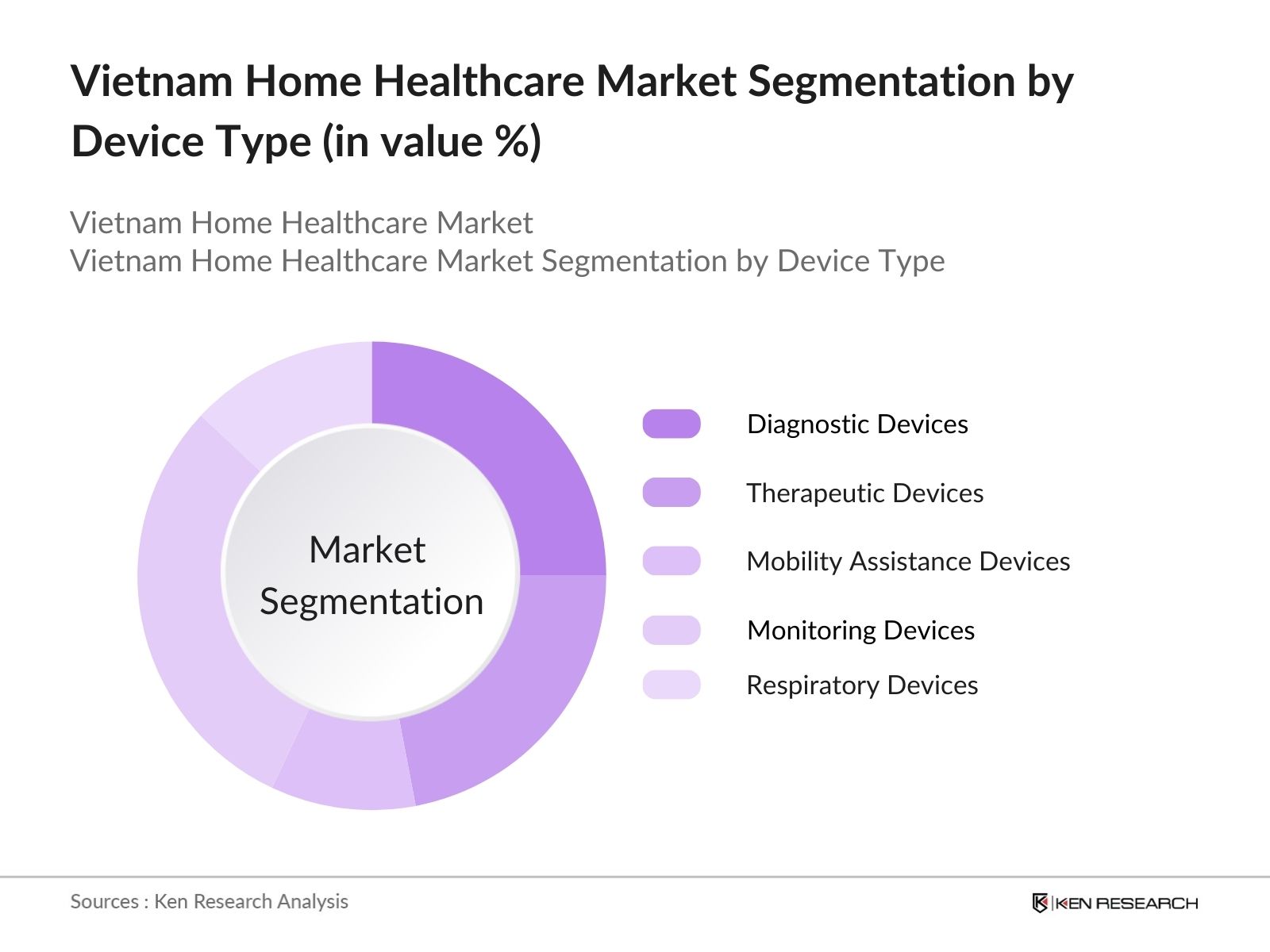

- By Device Type: The market is further segmented by device type into diagnostic devices, therapeutic devices, mobility assistance devices, monitoring devices, and respiratory devices. Monitoring devices dominate the market, driven by the increasing need for continuous health monitoring among patients suffering from chronic diseases like hypertension, diabetes, and heart conditions. Wearable health devices that track vital statistics, such as heart rate and glucose levels, are in high demand, especially with the expansion of telehealth services. These devices allow patients and healthcare providers to track health conditions in real-time, reducing hospital visits and enhancing personalized care.

Vietnam Home Healthcare Competitive Landscape

The Vietnam home healthcare market is dominated by key players including Medcare Vietnam, Katalon Healthcare, and Philips Healthcare Vietnam. These companies, along with international healthcare firms, have significantly shaped the market through strategic investments in technology and service diversification. Local companies like Vinmec International Hospital have formed collaborations with international healthcare brands, driving innovation in the sector. The competitive landscape is defined by service quality, partnerships with government and private entities, and a focus on expanding home care services to rural areas.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Market Presence |

Service Portfolio |

|

Medcare Vietnam |

2005 |

Ho Chi Minh City |

|||

|

Katalon Healthcare |

2010 |

Hanoi |

|||

|

Philips Healthcare Vietnam |

2012 |

Hanoi |

|||

|

Vinmec International Hosp. |

2013 |

Hanoi |

|||

|

Siemens Healthineers Vietnam |

2010 |

Ho Chi Minh City |

Vietnam Home Healthcare Industry Analysis

Growth Drivers

- Aging Population: Vietnam's aging population is a major growth driver for the home healthcare market. In 2024, 12 million people are aged 60 and above, accounting for nearly 12% of the total population. The Vietnam General Statistics Office projects this number will rise steadily due to increasing life expectancy, currently at 75.4 years, according to the World Bank. The elderly population is more prone to chronic illnesses such as cardiovascular diseases and diabetes, necessitating home-based care solutions. The growing demand for elderly care services is expected to sustain the growth of the home healthcare market in Vietnam.

- Rising Prevalence of Chronic Diseases: Chronic diseases are becoming more prevalent in Vietnam, creating a need for home healthcare services. According to the Vietnam Ministry of Health, in 2024, around 10 million people suffer from non-communicable diseases, such as diabetes, hypertension, and cardiovascular conditions. Chronic illnesses account for 77% of all deaths in Vietnam. Home-based healthcare solutions help in continuous monitoring and treatment, reducing hospital readmissions and easing the burden on public healthcare facilities. This significant demand for disease management from home has been driving the expansion of the home healthcare market in the country.

- Increased Government Healthcare Expenditure: The Vietnamese government's increased healthcare expenditure is directly influencing the home healthcare market. In 2024, Vietnam allocated VND 300 trillion (USD 12.5 billion) to healthcare, representing a significant increase over previous years. The budget includes funding for initiatives that promote home-based healthcare services, as outlined in the government's "National Strategy on Elderly Health Care." These initiatives aim to reduce hospital congestion and shift the burden of chronic disease management to home settings. Increased government support has played a pivotal role in expanding the availability of home healthcare services.

Market Challenges

- Lack of Skilled Healthcare Providers: A major challenge facing the home healthcare market in Vietnam is the shortage of skilled healthcare professionals. Vietnam has around 8 healthcare workers per 10,000 people, significantly lower than the global average of 23. The World Health Organization (WHO) highlights that Vietnam needs to train and retain a larger workforce to meet the increasing demand for home care services. The lack of specialized training in geriatric and chronic disease management exacerbates this challenge, impacting the quality of care provided in home healthcare settings.

- Limited Insurance Coverage: Despite the increasing demand for home healthcare services, insurance coverage for these services remains limited in Vietnam. Only a small proportion of the population has access to health insurance plans that cover home-based care. This limits the adoption of home healthcare solutions, as patients must pay out of pocket for many essential services. The Vietnam Health Insurance Law offers limited coverage for home-based treatment, and efforts to expand insurance schemes to encompass these services are still ongoing. This gap in coverage presents a significant barrier to the growth of the home healthcare market.

Vietnam Home Healthcare Future Outlook

The Vietnam home healthcare market is expected to witness substantial growth in the coming years, driven by increased government support, advancements in healthcare technology, and the rising prevalence of chronic diseases. Furthermore, the increasing acceptance of telemedicine and wearable health monitoring devices will continue to reshape the market, allowing for more efficient and personalized care. The expansion of services into rural areas is also anticipated to contribute to market growth, addressing the demand for affordable and accessible healthcare in underserved regions.

Market Opportunities

- Growth in Telemedicine and Remote Monitoring Technologies: Telemedicine and remote patient monitoring technologies are providing significant opportunities for the expansion of home healthcare services in Vietnam. The government, through the Ministry of Health, has actively promoted telehealth services, and by 2024, around 200 hospitals across Vietnam are connected through telemedicine platforms. Remote monitoring solutions for chronic diseases, such as blood pressure monitors and glucose trackers, are becoming increasingly popular, with over 1 million patients using telemonitoring services to manage their conditions. This rise in telehealth adoption is creating new growth opportunities in the home healthcare sector.

- Collaborations Between Healthcare Providers and Tech Companies: Collaborations between healthcare providers and technology companies are creating a fertile ground for innovation in Vietnams home healthcare market. Tech companies like Viettel and FPT have partnered with healthcare providers to develop platforms that integrate wearable devices and patient data monitoring, improving the quality of care delivered at home. These partnerships have resulted in the implementation of over 50 digital health initiatives nationwide, driving the expansion of home healthcare services, particularly for chronic disease management and elderly care.

Scope of the Report

|

Skilled Nursing Services Physiotherapy Services Palliative Care Primary Care Rehabilitation Services |

|

|

By Device Type |

Diagnostic Devices Therapeutic Devices Mobility Assistance Devices Monitoring Devices Respiratory Devices |

|

By Mode of Care |

Hospital-Based Home Healthcare |

|

By End-User |

Elderly Population |

|

By Region |

North East West South |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of Health, Vietnam Social Security)

Healthcare Providers (Private and Public Hospitals)

Home Healthcare Service Providers

Telemedicine Companies

Health Insurance Companies

Medical Device Manufacturers

Investments and Venture Capitalist Firms

Pharmaceutical Companies

Companies

Players Mention in the Report:

Medcare Vietnam

Katalon Healthcare

FPT Healthcare Solutions

Hoang Long Clinic

Siemens Healthineers Vietnam

Vinmec International Hospital

Philips Healthcare Vietnam

Vietmedical

Tan Thanh Healthcare Group

Homecare24h

Pfizer Vietnam

O2 Medical Vietnam

Sun Healthcare Vietnam

Abbott Laboratories Vietnam

Roche Vietnam

Table of Contents

1. Vietnam Home Healthcare Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Historical, and Current)

1.4. Market Segmentation Overview

2. Vietnam Home Healthcare Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Home Healthcare Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population

3.1.2. Rising Prevalence of Chronic Diseases

3.1.3. Increased Government Healthcare Expenditure

3.1.4. Shift Towards Home-based Care Solutions

3.2. Market Challenges

3.2.1. Lack of Skilled Healthcare Providers

3.2.2. Limited Insurance Coverage

3.2.3. High Cost of Home Healthcare Devices

3.3. Opportunities

3.3.1. Growth in Telemedicine and Remote Monitoring Technologies

3.3.2. Collaborations Between Healthcare Providers and Tech Companies

3.3.3. Expansion into Rural Areas (Accessibility Improvement)

3.4. Trends

3.4.1. Adoption of Smart Home Healthcare Solutions

3.4.2. Integration of Wearable Devices for Patient Monitoring

3.4.3. Increasing Focus on Personalization and Customization of Healthcare Services

3.5. Government Regulation

3.5.1. Vietnam Health Insurance Law

3.5.2. Ministry of Health Policies on Home-based Care

3.5.3. Regulatory Compliance for Medical Devices and Services

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Vietnam Home Healthcare Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Skilled Nursing Services

4.1.2. Physiotherapy Services

4.1.3. Palliative Care

4.1.4. Primary Care

4.1.5. Rehabilitation Services

4.2. By Device Type (In Value %)

4.2.1. Diagnostic Devices

4.2.2. Therapeutic Devices

4.2.3. Mobility Assistance Devices

4.2.4. Monitoring Devices

4.2.5. Respiratory Devices

4.3. By Mode of Care (In Value %)

4.3.1. Hospital-Based Home Healthcare

4.3.2. Physician-Led Home Care

4.3.3. Independent Home Healthcare Providers

4.4. By End-User (In Value %)

4.4.1. Elderly Population

4.4.2. Adults with Chronic Diseases

4.4.3. Post-Surgical Patients

4.4.4. Pediatric Patients

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. Vietnam Home Healthcare Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Medcare Vietnam

5.1.2. Katalon Healthcare

5.1.3. FPT Healthcare Solutions

5.1.4. Hoang Long Clinic

5.1.5. Siemens Healthineers Vietnam

5.1.6. Vinmec International Hospital

5.1.7. Philips Healthcare Vietnam

5.1.8. Vietmedical

5.1.9. Tan Thanh Healthcare Group

5.1.10. Homecare24h

5.1.11. Pfizer Vietnam

5.1.12. O2 Medical Vietnam

5.1.13. Sun Healthcare Vietnam

5.1.14. Abbott Laboratories Vietnam

5.1.15. Roche Vietnam

5.2. Cross Comparison Parameters (Revenue, Market Presence, Service Portfolio, Headquarters, Partnerships, Key Technological Offerings, Client Base, Brand Equity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Home Healthcare Market Regulatory Framework

6.1. Home Healthcare Licensing Standards

6.2. Medical Device Certification Processes

6.3. Patient Data Protection and Privacy Regulations

7. Vietnam Home Healthcare Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Home Healthcare Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Device Type (In Value %)

8.3. By Mode of Care (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Vietnam Home Healthcare Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying critical stakeholders in the Vietnam home healthcare market, including service providers, healthcare technology companies, and government agencies. Extensive desk research is conducted to gather relevant industry data from proprietary databases, government publications, and credible secondary sources.

Step 2: Market Analysis and Construction

In this step, historical data from reputable sources is used to construct market models. These models include an analysis of healthcare service utilization, technology adoption rates, and the impact of government regulations. The outcome is a robust estimate of market size and growth trends.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated by consulting with industry experts and stakeholders. These consultations are conducted through computer-assisted interviews and ensure the accuracy of the market forecasts.

Step 4: Research Synthesis and Final Output

The final step synthesizes insights from market research and expert consultations. This includes cross-referencing data from healthcare providers, telemedicine companies, and medical device manufacturers to ensure a comprehensive market analysis that supports business decision-making.

Frequently Asked Questions

01. How big is the Vietnam Home Healthcare Market?

The Vietnam home healthcare market is valued at USD 2 billion, driven by rising demand for personalized and cost-effective care, advancements in healthcare technologies, and government support for home-based care services.

02. What are the challenges in the Vietnam Home Healthcare Market?

Challenges in Vietnam home healthcare market include the limited availability of skilled healthcare providers, lack of comprehensive insurance coverage for home care services, and high costs associated with advanced home healthcare devices.

03. Who are the major players in the Vietnam Home Healthcare Market?

Key players in the Vietnam home healthcare market include Medcare Vietnam, Katalon Healthcare, Philips Healthcare Vietnam, Vinmec International Hospital, and Siemens Healthineers Vietnam, who dominate through their extensive service portfolios and technological innovations.

04. What are the growth drivers of the Vietnam Home Healthcare Market?

Growth drivers in Vietnam home healthcare market include an aging population, rising prevalence of chronic diseases, and technological advancements such as telemedicine and remote patient monitoring, which have increased the accessibility and efficiency of home healthcare.

05. What segments dominate the Vietnam Home Healthcare Market?

Skilled nursing services and monitoring devices are the dominant segments, driven by increased demand for long-term care for chronic diseases and the growing adoption of health monitoring technologies in home care settings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.