Region:Asia

Author(s):Rebecca

Product Code:KRAD4353

Pages:93

Published On:December 2025

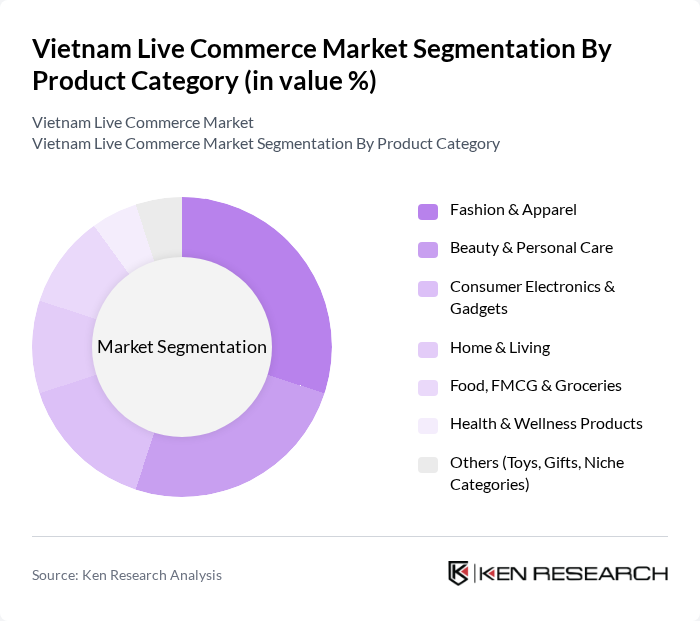

By Product Category:The product categories in the live commerce market include Fashion & Apparel, Beauty & Personal Care, Consumer Electronics & Gadgets, Home & Living, Food, FMCG & Groceries, Health & Wellness Products, and Others (Toys, Gifts, Niche Categories). Each of these categories caters to different consumer needs and preferences, with Fashion & Apparel and Beauty & Personal Care being particularly popular due to their visual appeal and the influence of social media trends.

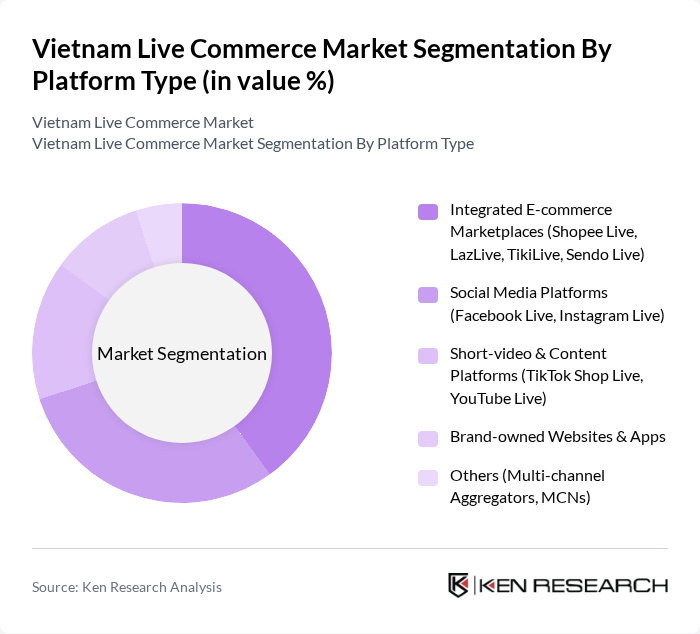

By Platform Type:The live commerce market is segmented by platform type, including Integrated E-commerce Marketplaces, Social Media Platforms, Short-video & Content Platforms, Brand-owned Websites & Apps, and Others (Multi-channel Aggregators, MCNs). Integrated e-commerce marketplaces are leading the segment due to their established user bases and seamless shopping experiences, while social media platforms are gaining traction for their interactive features and community engagement.

The Vietnam Live Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shopee Vietnam (Shopee Live), Lazada Vietnam (LazLive), TikTok Shop Vietnam, Tiki Corporation (TikiLive), Sendo (Sendo Live), Facebook Vietnam (Facebook Live Commerce Ecosystem), Zalo (Zalo Live & Social Commerce), VinShop (Masan Group), Th? Gi?i Di ??ng (Mobile World Group), ?i?n Máy Xanh, Bách Hóa Xanh, PNJ (Phú Nhu?n Jewelry), Con C?ng, AEON Vietnam, MM Mega Market Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's live commerce market appears promising, driven by technological advancements and evolving consumer preferences. As mobile commerce continues to grow, businesses are likely to adopt innovative strategies to enhance customer engagement. The integration of AI and data analytics will enable personalized shopping experiences, while the rise of hybrid shopping models will cater to diverse consumer needs. Companies that prioritize sustainability and ethical practices are expected to resonate more with the environmentally conscious consumer base, further shaping market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Fashion & Apparel Beauty & Personal Care Consumer Electronics & Gadgets Home & Living Food, FMCG & Groceries Health & Wellness Products Others (Toys, Gifts, Niche Categories) |

| By Platform Type | Integrated E-commerce Marketplaces (Shopee Live, LazLive, TikiLive, Sendo Live) Social Media Platforms (Facebook Live, Instagram Live) Short-video & Content Platforms (TikTok Shop Live, YouTube Live) Brand-owned Websites & Apps Others (Multi-channel Aggregators, MCNs) |

| By Seller Type | Individual Streamers/KOLs/KOCs Small & Medium Online Merchants Large Retailers & Brands Cross-border Sellers Others |

| By Revenue Model | Commission-based Marketplace Model Agency & Service Fee Model (MCNs, Live Commerce Agencies) Advertising & Sponsored Live Streams Virtual Gifts & Tipping Others |

| By Consumer Demographics | Gen Z (Under 25 Years) Young Adults (25–34 Years) Middle-aged Consumers (35–44 Years) Years & Above Others |

| By City Tier | Tier 1 Cities (Hanoi, Ho Chi Minh City) Tier 2 Cities Tier 3 Cities & Rural Areas Others |

| By User Engagement Behavior | View-only Users Deal-seekers & Flash-sale Buyers Community & Fan-based Shoppers High-frequency/Power Shoppers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Engagement in Live Commerce | 150 | Active Online Shoppers, Social Media Users |

| Brand Participation in Live Commerce | 100 | Marketing Managers, E-commerce Directors |

| Influencer Impact on Live Commerce | 80 | Content Creators, Social Media Influencers |

| Platform Performance Metrics | 70 | Product Managers, Data Analysts |

| Consumer Preferences and Trends | 120 | Market Researchers, Consumer Behavior Analysts |

The Vietnam Live Commerce Market is valued at approximately USD 4 billion, driven by increased smartphone penetration, internet connectivity, and a shift in consumer behavior towards online shopping, particularly through social media and integrated e-commerce platforms.