Region:Asia

Author(s):Dev

Product Code:KRAA3567

Pages:80

Published On:September 2025

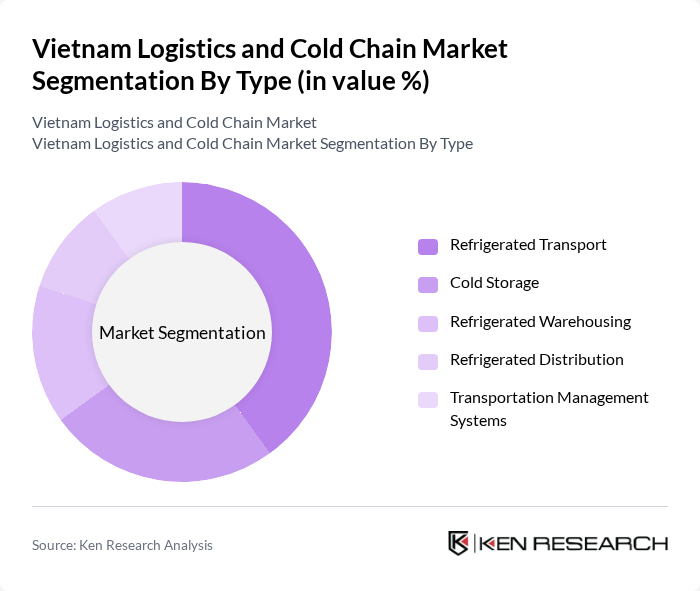

By Type:The market can be segmented into various types, including Refrigerated Transport, Cold Storage, Refrigerated Warehousing, Refrigerated Distribution, and Transportation Management Systems. Each of these segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain. Among these, Refrigerated Transport is currently the leading segment, driven by the increasing demand for fresh produce and pharmaceuticals, which require reliable transportation solutions. The rapid growth of e-commerce and increasing demand for fresh food deliveries have further solidified the importance of refrigerated transport in the market.

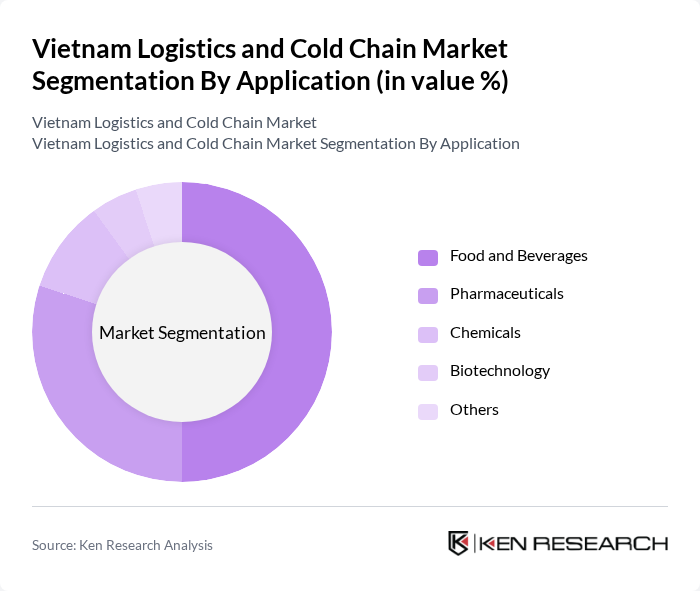

By Application:The applications of logistics and cold chain services are diverse, including Food and Beverages, Pharmaceuticals, Chemicals, Biotechnology, and Others. The Food and Beverages segment is the most significant, driven by the rising consumer demand for fresh and safe food products, alongside the growing e-commerce sector that requires efficient delivery systems. The food and beverage sector contributed approximately USD 58 billion to the national economy, showcasing the rising consumer appetite for high-quality food products and the corresponding need for robust cold chain infrastructure.

The Vietnam Logistics and Cold Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as VIETPHAT Group, Cold Storage THANG LOI, TransContinental, Vinamilk, CJ Logistics, DHL Supply Chain, Kuehne + Nagel, DB Schenker, Maersk Logistics, Nippon Express, APL Logistics, Yusen Logistics, Gemadept Corporation, Saigon Newport Corporation, and Vinalines Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's logistics and cold chain market appears promising, driven by increasing consumer demand for fresh and safe food products. As urbanization accelerates, the need for efficient cold chain solutions will intensify. Technological advancements, particularly in IoT and automation, are expected to enhance operational efficiency. Furthermore, government support for infrastructure development will likely create a more conducive environment for investment, fostering growth in the logistics sector and improving overall supply chain resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Refrigerated Warehousing Refrigerated Distribution Transportation Management Systems |

| By Application | Food and Beverages Pharmaceuticals Chemicals Biotechnology Others |

| By Product Category | Fruits and Vegetables Bakery and Confectionary Dairy and Frozen Desserts Meat, Fish and Seafood Drugs and Pharmaceuticals |

| By Temperature Range | Frozen (-18°C to -25°C) Chilled (0°C to 8°C) Controlled Room Temperature (15°C to 25°C) Others |

| By Geography | Ho Chi Minh City Hanoi Da Nang Can Tho Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies for Cold Chain Development Tax Incentives Regulatory Support Training and Development Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain Logistics | 100 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Management | 60 | Quality Assurance Managers, Operations Directors |

| Retail Cold Storage Solutions | 50 | Warehouse Managers, Inventory Control Specialists |

| Technology Providers for Cold Chain | 40 | Product Development Managers, Sales Executives |

| Logistics Regulatory Compliance | 40 | Compliance Officers, Regulatory Affairs Managers |

The Vietnam Logistics and Cold Chain Market is valued at approximately USD 1.3 billion, driven by increasing demand for efficient supply chain solutions, particularly in the food and pharmaceutical sectors, alongside rapid urbanization and industrialization.