Region:Asia

Author(s):Rebecca

Product Code:KRAB1760

Pages:90

Published On:October 2025

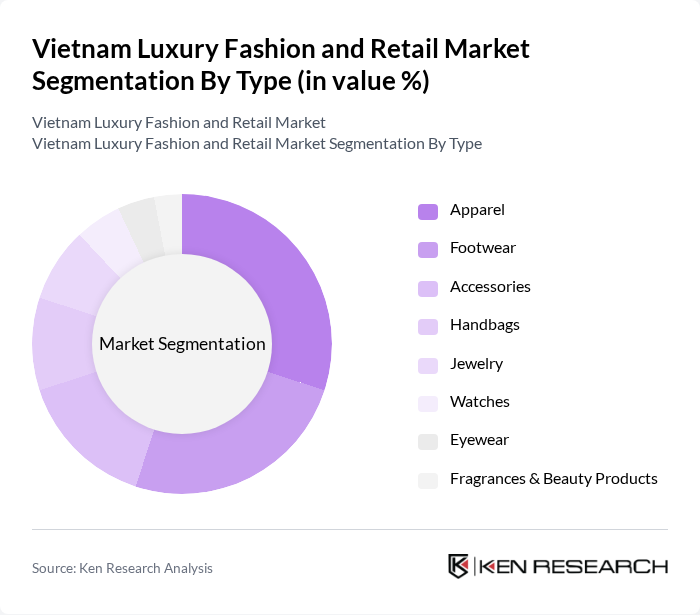

By Type:The luxury fashion market can be segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, eyewear, and fragrances & beauty products. Each of these segments caters to different consumer preferences and trends, with apparel and footwear being the most dominant due to their essential nature in luxury fashion .

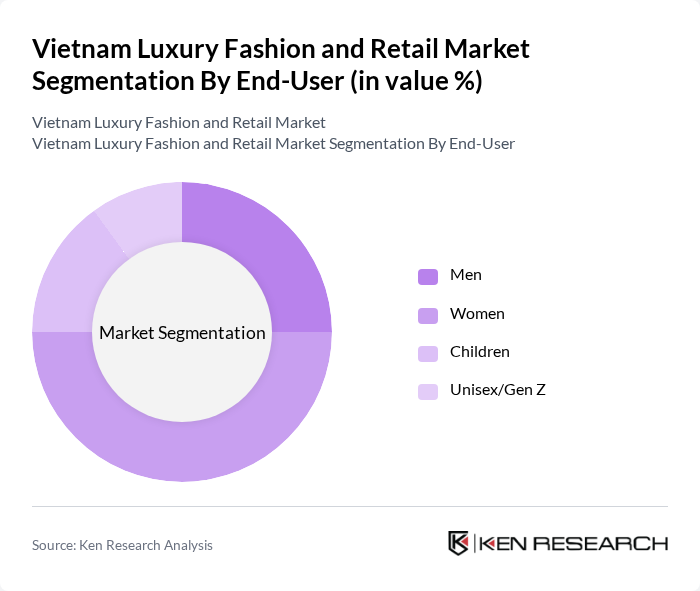

By End-User:The market can also be segmented by end-user demographics, including men, women, children, and unisex/Gen Z. Women represent the largest segment, driven by their increasing purchasing power and interest in luxury fashion, while the unisex/Gen Z segment is rapidly growing due to changing consumer attitudes towards gender and fashion .

The Vietnam Luxury Fashion and Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Chanel, Prada, Burberry, Dior, Versace, Fendi, Hermès, Salvatore Ferragamo, Bvlgari, Valentino, Balenciaga, Givenchy, Off-White, Rolex, Tiffany & Co., Cartier, Bobui Saigon, Runway Vietnam, DAFC (Dong Anh Fashion Corporation), ACFC (Au Chau Fashion & Cosmetics Company), PNJ (Phu Nhuan Jewelry), Elise Fashion, IVY moda contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam luxury fashion market is poised for substantial growth, driven by increasing disposable incomes and a burgeoning urban population. As e-commerce continues to expand, luxury brands will likely enhance their online presence, catering to tech-savvy consumers. Additionally, the demand for personalized shopping experiences and sustainable fashion will shape future offerings. Brands that adapt to these trends while maintaining quality and exclusivity will thrive in this dynamic market landscape, ensuring long-term success and consumer loyalty.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Handbags Jewelry Watches Eyewear Fragrances & Beauty Products |

| By End-User | Men Women Children Unisex/Gen Z |

| By Sales Channel | Online Retail (E-commerce, Social Commerce) Offline Retail (Flagship Stores, Boutiques) Luxury Department Stores Duty-Free & Airport Retail |

| By Price Range | Premium High-End Ultra-Luxury |

| By Brand Origin | Domestic Brands International Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Urban vs. Rural |

| By Occasion | Casual Wear Formal Wear Special Events Everyday Use Gifting |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchases | 120 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessories Market | 90 | Luxury Brand Managers, Retail Buyers |

| Footwear Trends in Luxury Fashion | 60 | Footwear Designers, Retail Store Managers |

| Consumer Preferences in Luxury Retail | 100 | Market Analysts, Consumer Behavior Researchers |

| Impact of E-commerce on Luxury Sales | 70 | E-commerce Managers, Digital Marketing Specialists |

The Vietnam Luxury Fashion and Retail Market is valued at approximately USD 2.3 billion, driven by rising disposable incomes and a growing middle class interested in luxury brands, particularly in urban areas.