Region:Asia

Author(s):Dev

Product Code:KRAD1734

Pages:89

Published On:November 2025

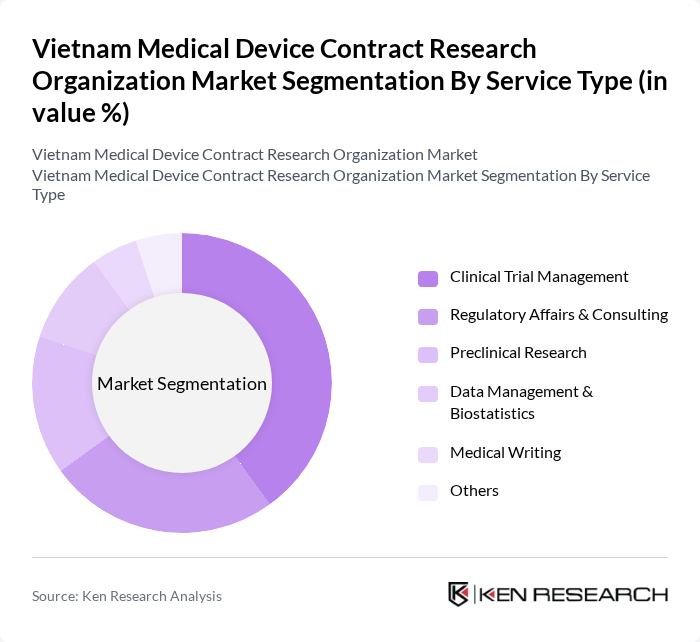

By Service Type:The service type segmentation includes various categories that cater to the diverse needs of the medical device industry. The primary subsegments are Clinical Trial Management, Regulatory Affairs & Consulting, Preclinical Research, Data Management & Biostatistics, Medical Writing, and Others. Among these, Clinical Trial Management is the leading subsegment, driven by the increasing number of clinical trials being conducted in Vietnam and the growing demand for efficient management of these trials. The market is also witnessing rising demand for regulatory consulting and data management services, reflecting the complexity of compliance and data requirements in the sector.

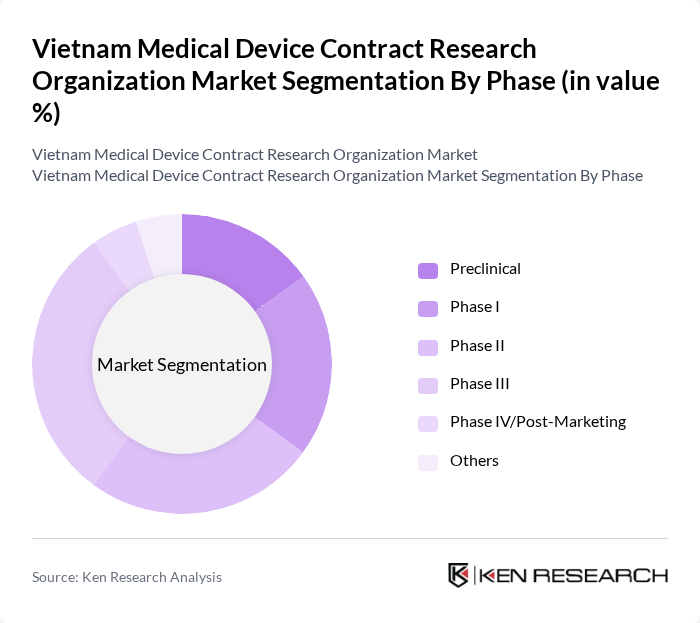

By Phase:The phase segmentation encompasses various stages of clinical trials, including Preclinical, Phase I, Phase II, Phase III, Phase IV/Post-Marketing, and Others. The Phase III segment is particularly dominant, as it represents the critical stage where the efficacy and safety of medical devices are thoroughly evaluated before market approval. This phase is essential for gaining regulatory approval and is thus a focal point for many organizations. The trend towards more complex and late-stage trials is evident as Vietnam becomes a preferred destination for multinational clinical research.

The Vietnam Medical Device Contract Research Organization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vimedimex, Medtronic Vietnam, GE Healthcare Vietnam, Siemens Healthineers Vietnam, Roche Vietnam, Abbott Laboratories Vietnam, Johnson & Johnson Vietnam, Philips Healthcare Vietnam, B. Braun Vietnam, Stryker Vietnam, Boston Scientific Vietnam, Baxter Vietnam, Olympus Vietnam, Terumo Vietnam, Zimmer Biomet Vietnam, ClinChoice Vietnam, Syneos Health Vietnam, ICON plc Vietnam, Parexel Vietnam, IQVIA Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam Medical Device Contract Research Organization market appears promising, driven by technological advancements and increasing healthcare investments. The integration of digital health solutions and artificial intelligence in medical devices is expected to enhance patient care and operational efficiency. Additionally, the government's commitment to improving healthcare infrastructure will likely create a conducive environment for innovation and collaboration, fostering growth in the sector. As the market evolves, adaptability and strategic partnerships will be crucial for success.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Clinical Trial Management Regulatory Affairs & Consulting Preclinical Research Data Management & Biostatistics Medical Writing Others |

| By Phase | Preclinical Phase I Phase II Phase III Phase IV/Post-Marketing Others |

| By Device Type | Diagnostic Devices Therapeutic Devices Monitoring Devices Surgical Instruments Others |

| By End-User | Medical Device Manufacturers Pharmaceutical Companies Hospitals & Clinics Research Institutions Others |

| By Application | Cardiovascular Orthopedic Neurology Respiratory Others |

| By Regulatory Compliance | ISO Certification CE Marking FDA Approval Local Regulatory Compliance Others |

| By Market Maturity | Emerging Market Growth Market Mature Market Declining Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diagnostic Equipment Manufacturers | 60 | Product Managers, R&D Directors |

| Therapeutic Device Distributors | 50 | Sales Managers, Distribution Heads |

| Surgical Instrument Suppliers | 40 | Procurement Officers, Operations Managers |

| Healthcare Facility Administrators | 70 | Facility Managers, Purchasing Agents |

| Regulatory Affairs Experts | 40 | Compliance Officers, Regulatory Managers |

The Vietnam Medical Device Contract Research Organization market is valued at approximately USD 430 million, reflecting significant growth driven by increasing demand for medical devices, advancements in healthcare technology, and a focus on clinical trials and regulatory compliance.