Region:Asia

Author(s):Rebecca

Product Code:KRAC2612

Pages:98

Published On:October 2025

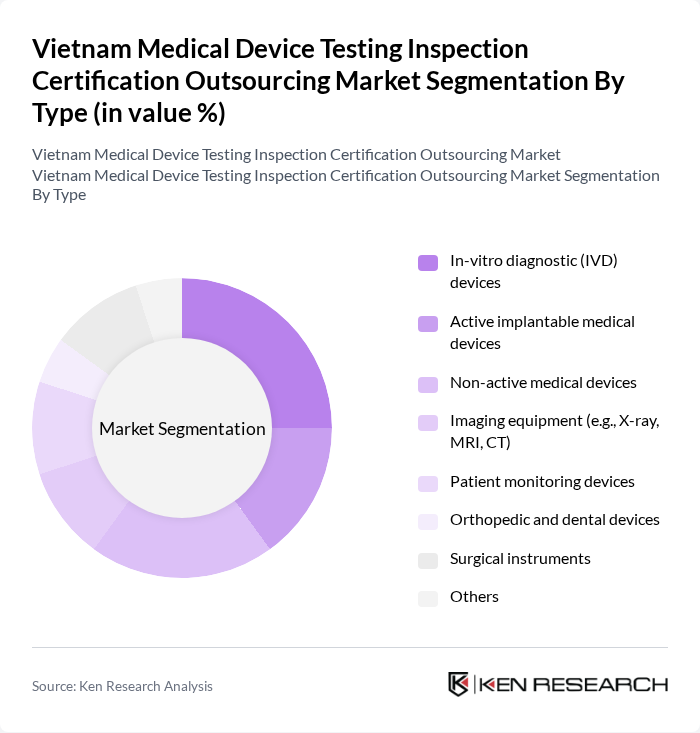

By Type:The market can be segmented into various types of medical devices, including In-vitro diagnostic (IVD) devices, Active implantable medical devices, Non-active medical devices, Imaging equipment (e.g., X-ray, MRI, CT), Patient monitoring devices, Orthopedic and dental devices, Surgical instruments, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics. Diagnostic imaging equipment holds a leading share due to significant investments in hospital modernization and the rising burden of non-communicable diseases .

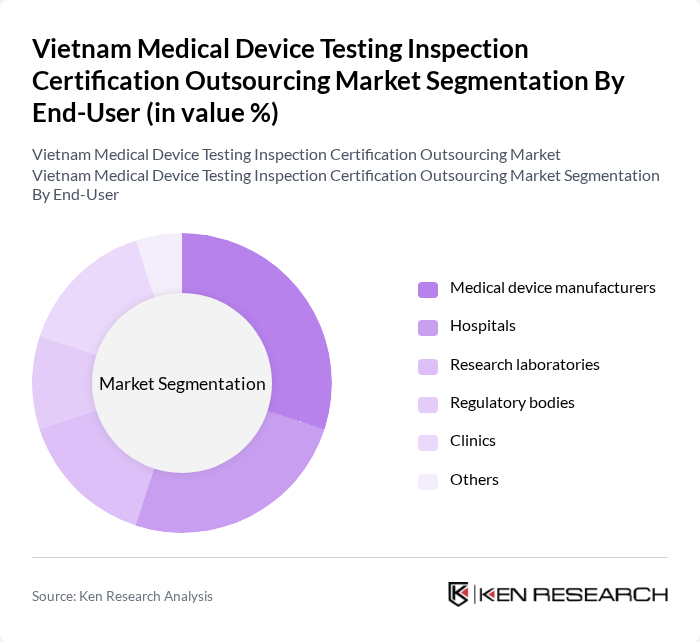

By End-User:The end-user segmentation includes Medical device manufacturers, Hospitals, Research laboratories, Regulatory bodies, Clinics, and Others. Each of these segments has unique requirements and contributes differently to the market. Hospitals and clinics represent the largest end-user group, reflecting their structured procurement budgets, capacity expansion, and dominance in Vietnam’s healthcare system .

The Vietnam Medical Device Testing Inspection Certification Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS S.A., TÜV SÜD AG, Intertek Group plc, Bureau Veritas S.A., DNV GL AS, UL LLC, Eurofins Scientific SE, QIMA Ltd., BSI Group, NAMSA, Nelson Labs, Toxikon Corporation, Applus+ Laboratories, Element Materials Technology, NSF International contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam medical device testing inspection certification outsourcing market is poised for significant growth, driven by increasing healthcare investments and a rising emphasis on quality assurance. As manufacturers adapt to stringent regulations, the demand for specialized testing services will likely escalate. Additionally, advancements in technology, such as AI integration, will enhance testing efficiency. The collaboration between local firms and international certification bodies will further strengthen the market, ensuring compliance and fostering innovation in medical device development.

| Segment | Sub-Segments |

|---|---|

| By Type | In-vitro diagnostic (IVD) devices Active implantable medical devices Non-active medical devices Imaging equipment (e.g., X-ray, MRI, CT) Patient monitoring devices Orthopedic and dental devices Surgical instruments Others |

| By End-User | Medical device manufacturers Hospitals Research laboratories Regulatory bodies Clinics Others |

| By Application | Biocompatibility testing Sterilization validation Electrical safety testing Performance and functional testing Packaging integrity testing Others |

| By Certification Type | ISO 13485 certification CE marking FDA approval ASEAN Medical Device Directive (AMDD) compliance Others |

| By Service Type | Testing services Inspection services Certification services Regulatory consulting services Others |

| By Distribution Channel | Direct contracts Online platforms Distributors/agents Others |

| By Price Range | Low-cost services Mid-range services Premium services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 100 | Regulatory Affairs Managers, Quality Control Officers |

| Testing Laboratories | 60 | Laboratory Directors, Compliance Managers |

| Healthcare Providers | 50 | Clinical Engineers, Procurement Managers |

| Regulatory Bodies | 40 | Policy Makers, Health Inspectors |

| Industry Associations | 40 | Executive Directors, Research Analysts |

The Vietnam Medical Device Testing Inspection Certification Outsourcing Market is valued at approximately USD 1.55 billion, reflecting significant growth driven by increasing demand for high-quality medical devices and stringent regulatory requirements.