Region:Asia

Author(s):Rebecca

Product Code:KRAA9432

Pages:80

Published On:November 2025

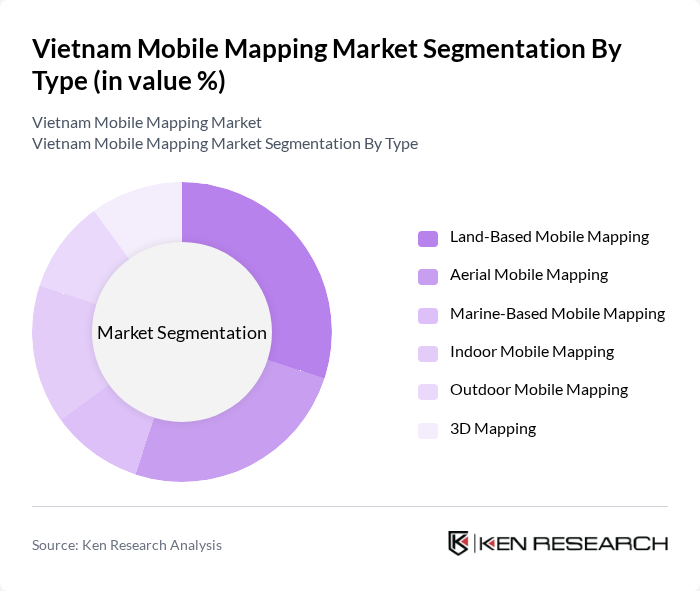

By Type:The mobile mapping market in Vietnam is segmented into Land-Based Mobile Mapping, Aerial Mobile Mapping, Marine-Based Mobile Mapping, Indoor Mobile Mapping, Outdoor Mobile Mapping, and 3D Mapping. Land-Based Mobile Mapping is widely used for road surveys, asset management, and urban infrastructure planning. Aerial Mobile Mapping leverages drones and UAVs for large-scale topographic mapping and environmental monitoring. Marine-Based Mobile Mapping supports hydrographic surveys and port infrastructure projects. Indoor Mobile Mapping is increasingly adopted for facility management and smart building applications, while Outdoor Mobile Mapping serves public safety and disaster response. 3D Mapping is gaining traction in construction, real estate, and urban modeling .

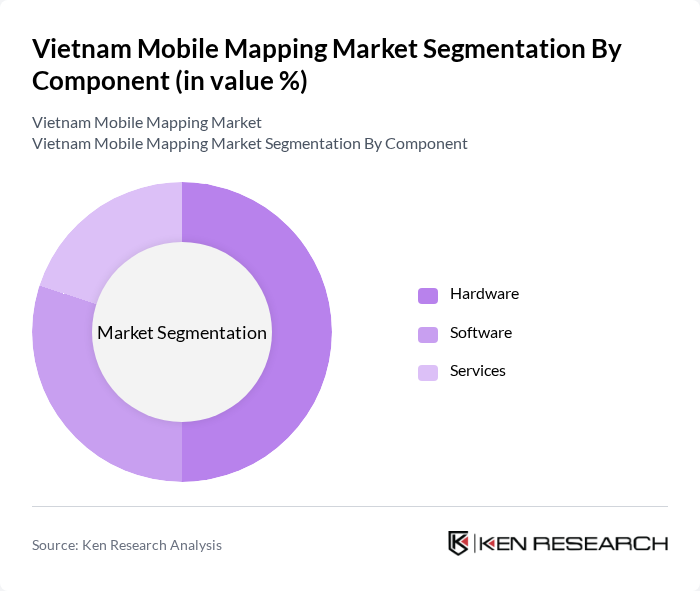

By Component:The mobile mapping market is also segmented by components: Hardware, Software, and Services. Hardware includes GNSS receivers, LiDAR scanners, cameras, and mobile platforms, which are essential for data acquisition. Software encompasses data processing, visualization, and analytics platforms that enable efficient management and interpretation of geographic information. Services comprise consulting, system integration, training, and maintenance, supporting end-users in deploying and optimizing mobile mapping solutions .

The Vietnam Mobile Mapping Market is characterized by a dynamic mix of regional and international players. Leading participants such as Topcon Corporation, Leica Geosystems AG, Trimble Inc., RIEGL Laser Measurement Systems GmbH, GeoSLAM Ltd., Fugro N.V., Hexagon AB, Esri, Autodesk, Inc., VMT Solutions Co., Ltd., Vexcel Imaging, 3D Laser Mapping, Vietmap Company Limited, Maptek, COWI A/S contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam mobile mapping market is poised for significant growth, driven by technological advancements and increasing government support for smart city initiatives. As urbanization accelerates, the demand for accurate geospatial data will continue to rise, prompting businesses to adopt innovative mapping solutions. Furthermore, the integration of artificial intelligence and machine learning into mapping processes is expected to enhance data analysis capabilities, making mobile mapping an essential tool for urban planning and infrastructure development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Land-Based Mobile Mapping Aerial Mobile Mapping Marine-Based Mobile Mapping Indoor Mobile Mapping Outdoor Mobile Mapping D Mapping |

| By Component | Hardware Software Services |

| By Application | Road Surveys Topographic Mapping D Modeling Asset Management Emergency Response Planning Internet Applications Others |

| By End-User | Government Agencies Construction and Engineering Transportation and Logistics Utilities Telecommunications Agriculture Real Estate Others |

| By Industry Vertical | Oil and Gas Manufacturing Energy and Utilities Transportation Commercial Individual Others |

| By Technology | GNSS Technology Photogrammetry Laser Scanning (LiDAR) Imaging Devices Positioning Devices Sensors Others |

| By Data Type | Raster Data Vector Data D Models Real-Time Data Point Clouds Digital Elevation Models (DEMs) Digital Surface Models (DSMs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Planning Applications | 100 | City Planners, Urban Development Officials |

| Transportation Sector Usage | 80 | Logistics Managers, Transportation Coordinators |

| Agricultural Mapping Solutions | 60 | Agronomists, Farm Managers |

| Consumer Mobile Mapping Adoption | 90 | General Consumers, Tech Enthusiasts |

| Government Infrastructure Projects | 50 | Government Officials, Project Managers |

The Vietnam Mobile Mapping Market is valued at approximately USD 120 million, driven by the increasing demand for accurate geographic data in urban planning, infrastructure development, and transportation management.