Vietnam Mobile Payments Market Outlook to 2030

Region:Asia

Author(s):Shivani

Product Code:KROD4360

October 2024

90

About the Report

Vietnam Mobile Payments Market Overview

- The Vietnam mobile payments market is valued at USD 718.43 billion, based on a five-year historical analysis. This significant valuation is driven by a multitude of factors, most notably the rapid adoption of smartphones and the countrys digital transformation. The growing emphasis on cashless transactions, along with the increasing presence of fintech startups, has played a key role in boosting mobile payment volume.

- Cities such as Hanoi and Ho Chi Minh City are dominant in the Vietnam mobile payments market. These urban areas lead due to their high concentration of tech-savvy consumers, the availability of robust digital infrastructure, and the expanding e-commerce ecosystem. Additionally, the widespread acceptance of digital wallets like Momo and ZaloPay in these regions underpins their leadership in the market.

- The Vietnamese government aims to achieve full interoperability across payment platforms by 2025 under the National Payment Strategy. In 2023, the State Bank of Vietnam implemented payment standards to harmonize cross-platform transactions, which has already enabled 500,000 interoperable transactions across digital wallets. This strategy is set to enhance payment efficiency and foster collaboration between fintech providers.

Vietnam Mobile Payments Market Segmentation

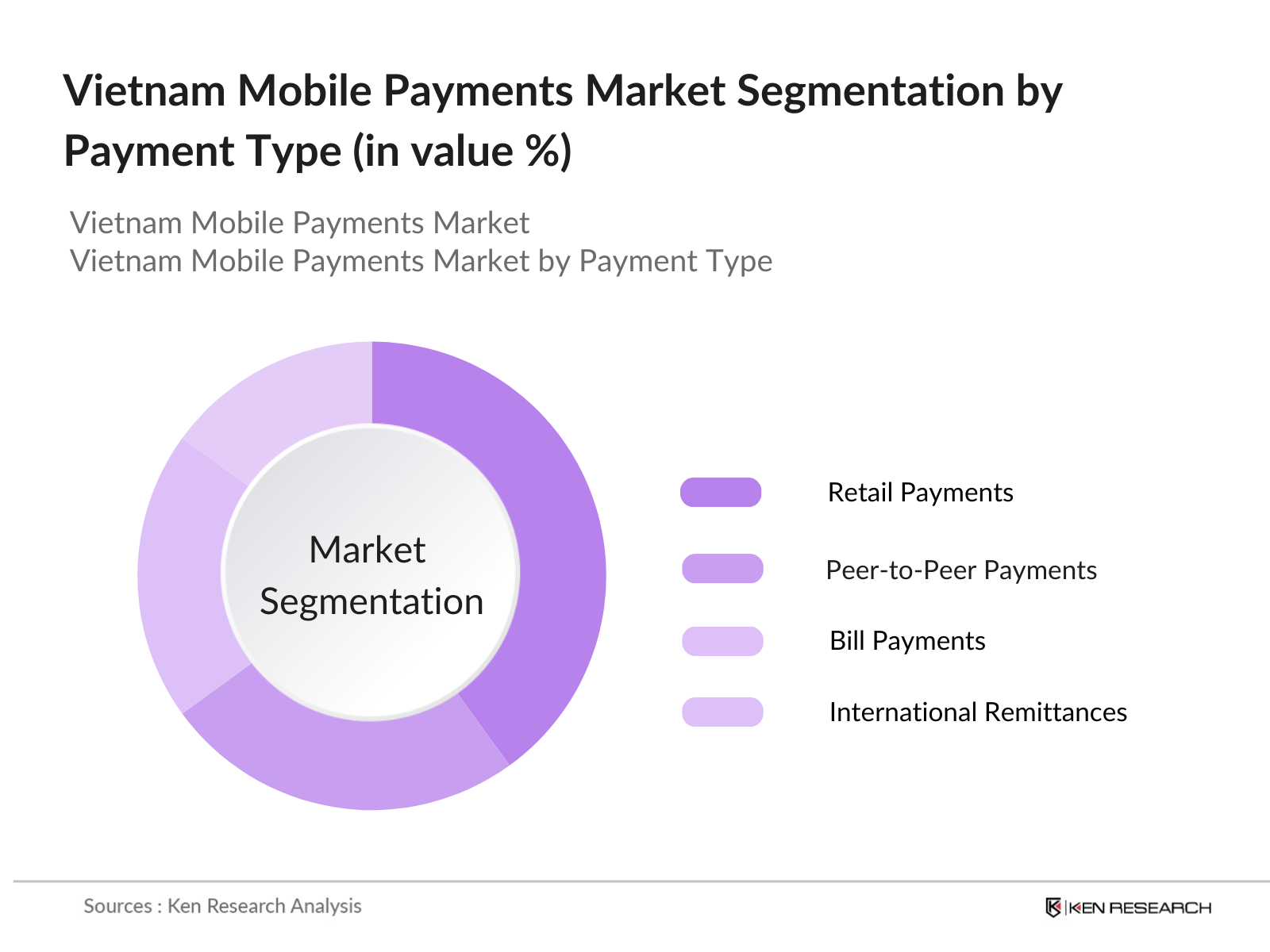

By Payment Type: Vietnams mobile payments market is segmented by payment type into peer-to-peer payments, retail payments, bill payments, and international remittances. Recently, retail payments have a dominant market share under the segmentation by payment type, owing to the rise in e-commerce platforms and the increasing reliance on digital wallets for daily transactions. The simplicity and convenience offered by mobile payment methods in retail settings have resonated strongly with consumers, especially in urban areas.

|

Payment Type |

Market Share (2023) |

|---|---|

|

Peer-to-Peer Payments |

25% |

|

Retail Payments |

40% |

|

Bill Payments |

20% |

|

International Remittances |

15% |

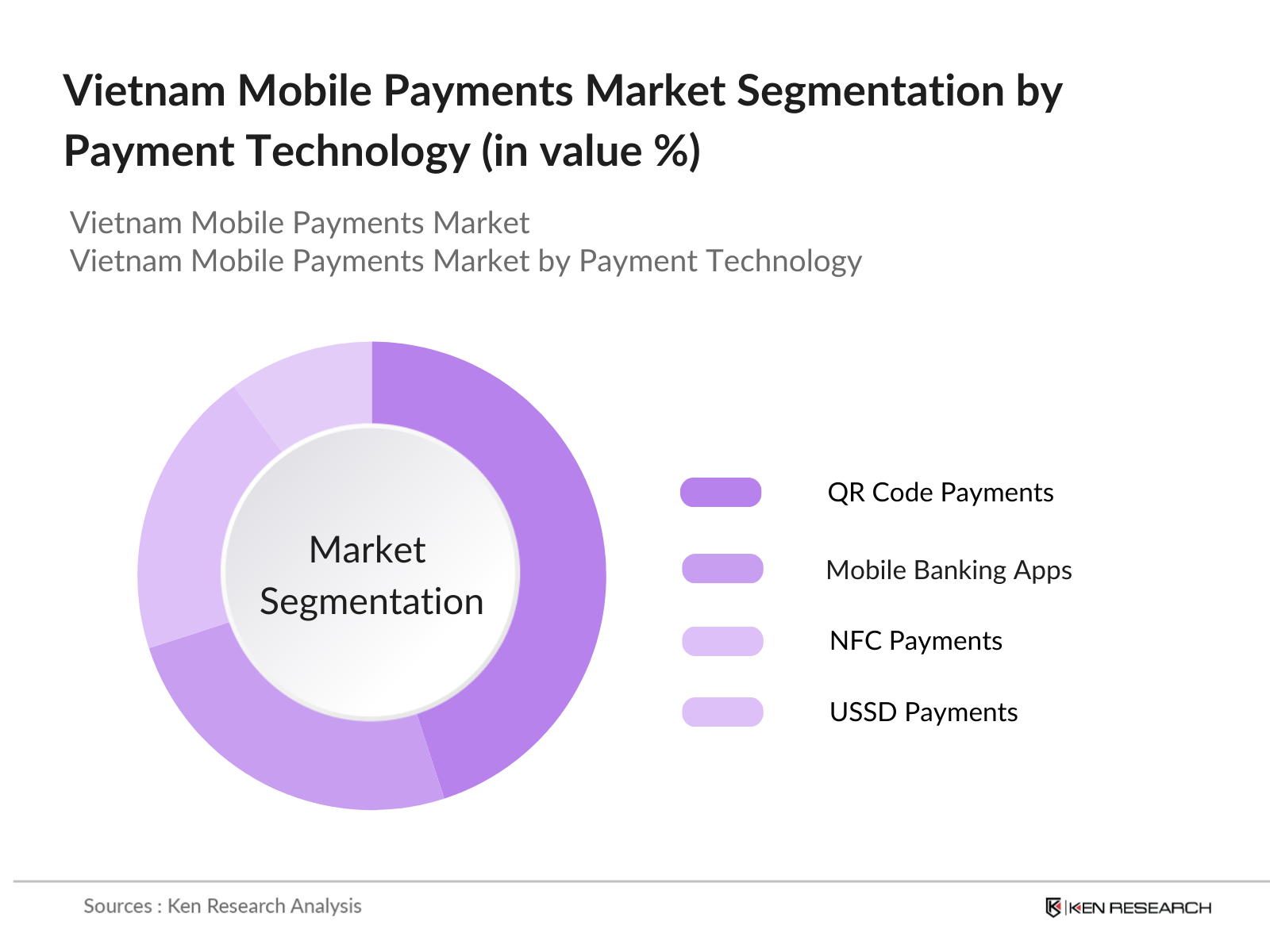

By Payment Technology: The Vietnam mobile payments market is segmented by payment technology into NFC (Near Field Communication) payments, QR code payments, mobile banking apps, and USSD payments. Recently, QR code payments have taken a dominant market share under the segmentation by payment technology, driven by their widespread adoption in both retail and small business settings. The ease of scanning a QR code to make payments, along with the low-cost infrastructure required for merchants, has made this technology particularly popular among consumers and businesses, especially in high-traffic urban areas.

|

Payment Technology |

Market Share (2023) |

|---|---|

|

NFC Payments |

20% |

|

QR Code Payments |

45% |

|

Mobile Banking Apps |

25% |

|

USSD Payments |

10% |

Vietnam Mobile Payments Market Competitive Landscape

The Vietnam mobile payments market is dominated by a few major players, including local platforms such as Momo and ZaloPay, alongside global entrants like GrabPay. This consolidation reflects the significant influence of key companies that leverage their technological prowess and strategic partnerships to expand their consumer base. The competition is fierce, with each company vying for dominance through innovations in payment solutions and enhanced user experience.

|

Company Name |

Establishment Year |

Headquarters |

No. of Users |

Transaction Volume |

Digital Ecosystem Integration |

Security Features |

Partnerships |

Revenue Growth |

|

Momo |

2007 |

Ho Chi Minh City |

30 million |

|||||

|

ZaloPay |

2016 |

Hanoi |

20 million |

|||||

|

VNPay |

2011 |

Hanoi |

15 million |

|||||

|

GrabPay |

2012 |

Singapore |

10 million |

|||||

|

ShopeePay |

2015 |

Singapore |

8 million |

Vietnam Mobile Payments Market Analysis

Market Growth Drivers

- Increased Smartphone Penetration: Smartphone penetration in Vietnam has surged significantly, with over 97 million mobile phone connections recorded in 2023. The expanding availability of affordable smartphones, particularly from brands like Xiaomi and Samsung, has allowed a larger section of the population to access mobile services, directly contributing to the growth of mobile payments. According to the Ministry of Information and Communications (MIC), smartphone usage has grown rapidly due to the expanding 4G and 5G network infrastructure, which has become increasingly available across the country.

- Rise of Cashless Transactions: Vietnam has seen a rise in cashless transactions, with the total number of non-cash payment transactions reaching over 2 billion in 2023, according to the State Bank of Vietnam (SBV). As more consumers and businesses adopt mobile payments, there is a marked shift toward digital financial ecosystems. The SBV's report also highlighted a 35% increase in mobile banking transactions during 2022-2023, signaling strong momentum for mobile payments.

- Government Digitalization Initiatives: Vietnams government has actively promoted digital transformation as part of its National Digital Transformation Program. By 2023, a significant number of government services were available online, driving the adoption of mobile payments for essential services such as taxes, utilities, and public transportation. The government's Cashless Vietnam initiative focuses on reducing the reliance on cash, further accelerating the mobile payments market. The National Digital Payments Strategy aims to improve interoperability and ease of use across digital payment platforms, fostering an environment conducive to mobile payment adoption.

Market Challenges:

- Data Privacy and Cybersecurity Concerns: Despite the rise in mobile payments, Vietnam reported 1,050 cybersecurity incidents in 2023, with many targeting financial platforms. The Vietnam Computer Emergency Response Team (VNCERT) noted that the growing frequency of cyberattacks is creating trust issues among consumers. Mobile payment providers need to invest heavily in enhancing data security and ensuring compliance with cybersecurity standards, as regulatory measures intensify

- Fragmentation in the Payments Ecosystem: Vietnam's mobile payment ecosystem remains highly fragmented, with over 40 payment apps available, including Momo, ZaloPay, and ViettelPay. This fragmentation has led to interoperability challenges, where users face difficulty making payments across different platforms. The State Bank of Vietnam (SBV) is working on creating a unified national payment platform to mitigate these challenges, but as of 2023, no standard has been fully implemented.

Vietnam Mobile Payments Market Future Outlook

Over the next few years, the Vietnam mobile payments market is expected to experience substantial growth, driven by continuous government initiatives to promote a cashless economy, advances in digital payment technologies, and an increasing number of young consumers adopting mobile wallets. The expansion of 5G networks, enhanced cybersecurity measures, and partnerships between fintech firms and traditional banks are anticipated to further fuel the growth of the market.

Market Opportunities:

- Adoption of Digital Wallets (Momo, ZaloPay): By 2023, Vietnam had 25 million active users on Momo and ZaloPay, representing a surge in the use of digital wallets. The widespread adoption of these wallets has reshaped consumer behavior, with Momo alone handling transactions worth 300 million VND per day in early 2024. Both platforms now dominate mobile payments, making them key drivers of Vietnam's cashless economy.

- Growth of Contactless Payments: Contactless payments grew steadily, supported by 10 million contactless payment cards issued by 2023. Integration with public transport and retail platforms further fueled adoption, with daily transactions increasing threefold since 2022. Contactless payments are now a preferred method in urban areas, supported by infrastructure expansion in Hanoi and Ho Chi Minh City.

Scope of the Report

|

By Payment Type |

Peer-to-Peer Payments Retail Payments Bill Payments International Remittances |

|

By Payment Technology |

NFC Payments QR Code Payments Mobile Banking Apps USSD Payments |

|

By End-User |

Consumers Merchants SMEs Large Enterprises |

|

By Platform |

Android iOS Web-based |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Government and Regulatory Bodies (State Bank of Vietnam, Ministry of Information and Communications)

Payment Service Providers

Mobile Wallet Operators

E-commerce Companies

Telecom Operators

Investment and Venture Capital Firms

Financial Institutions

Technology Providers

Companies

Major Players

-

Momo

ZaloPay

VNPay

ViettelPay

GrabPay

ShopeePay

AirPay

Payoo

Sacombank

TPBank

Agribank

BIDV

HSBC Vietnam

Techcombank

MB Bank

Table of Contents

1. Vietnam Mobile Payments Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Mobile Payments Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones (Fintech integration, Digital transformation in financial services)

3. Vietnam Mobile Payments Market Analysis

3.1. Growth Drivers

3.1.1. Increased Smartphone Penetration

3.1.2. Rise of Cashless Transactions

3.1.3. Government Digitalization Initiatives

3.1.4. Expansion of E-commerce Platforms

3.2. Market Challenges

3.2.1. Data Privacy and Cybersecurity Concerns

3.2.2. Fragmentation in the Payments Ecosystem

3.2.3. Financial Literacy and Digital Inclusion

3.3. Opportunities

3.3.1. Integration with Blockchain and Crypto Payments

3.3.2. Expansion of QR Code Payments

3.3.3. Strategic Partnerships with Global Tech Companies

3.4. Trends

3.4.1. Adoption of Digital Wallets (Momo, ZaloPay)

3.4.2. Growth of Contactless Payments

3.4.3. Rise of Super Apps in Southeast Asia (Grab, GoJek)

3.5. Government Regulations

3.5.1. National Payment Strategy (Payments Interoperability)

3.5.2. Digital Banking Licenses (Banking and Fintech Collaboration)

3.5.3. Policies Encouraging Financial Inclusion

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Mobile Payments Market Segmentation

4.1. By Payment Type (In Value %)

4.1.1. Peer-to-Peer (P2P) Payments

4.1.2. Retail Payments

4.1.3. Bill Payments

4.1.4. International Remittances

4.2. By Payment Technology (In Value %)

4.2.1. NFC (Near Field Communication) Payments

4.2.2. QR Code Payments

4.2.3. Mobile Banking Apps

4.2.4. USSD Payments

4.3. By End-User (In Value %)

4.3.1. Consumers

4.3.2. Merchants

4.3.3. SMEs

4.3.4. Large Enterprises

4.4. By Platform (In Value %)

4.4.1. Android

4.4.2. iOS

4.4.3. Web-based

4.5. By Region (In Value %)

4.5.1. Hanoi

4.5.2. Ho Chi Minh City

4.5.3. Da Nang

4.5.4. Mekong Delta

5. Vietnam Mobile Payments Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. Momo

5.1.2. ZaloPay

5.1.3. VNPay

5.1.4. ViettelPay

5.1.5. GrabPay

5.1.6. ShopeePay

5.1.7. AirPay

5.1.8. Payoo

5.1.9. Sacombank

5.1.10. TPBank

5.1.11. Agribank

5.1.12. BIDV

5.1.13. HSBC Vietnam

5.1.14. Techcombank

5.1.15. MB Bank

5.2 Cross Comparison Parameters (Headquarters, Revenue, No. of Users, Transaction Volume, Digital Ecosystem Integration, Transaction Security Features, Regulatory Compliance, Innovation and Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Mobile Payments Market Regulatory Framework

6.1. Licensing Requirements for Payment Providers

6.2. Security and Compliance Standards (PCI-DSS, PSD2)

6.3. KYC (Know Your Customer) and AML (Anti-Money Laundering) Regulations

7. Vietnam Mobile Payments Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Mobile Payments Future Market Segmentation

8.1. By Payment Type (In Value %)

8.2. By Payment Technology (In Value %)

8.3. By End-User (In Value %)

8.4. By Platform (In Value %)

8.5. By Region (In Value %)

9. Vietnam Mobile Payments Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Strategy

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The first step involved identifying the key stakeholders within the Vietnam mobile payments market through extensive desk research and data gathering. This included analyzing key players, transaction volumes, and technological advancements driving the market.

Step 2: Market Analysis and Construction

This step focused on analyzing historical data related to the adoption of mobile payment systems, evaluating the growth in mobile wallet users, and assessing transaction values. Additionally, the impact of government policies and incentives was studied to provide a comprehensive view of market construction.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from leading fintech companies, banks, and payment platforms were consulted through structured interviews. Their insights were critical in validating hypotheses and confirming market dynamics.

Step 4: Research Synthesis and Final Output

Data from the interviews were synthesized with secondary research to produce the final market analysis. This was followed by a detailed breakdown of segmentation, growth drivers, challenges, and competitive strategies in the market.

Frequently Asked Questions

01. How big is the Vietnam mobile payments market?

The Vietnam mobile payments market, valued at USD 718.43 billion, is being driven by rapid smartphone adoption, fintech innovation, and increasing reliance on cashless transactions.

02. What are the key challenges in the Vietnam mobile payments market?

Key challenges include data privacy concerns, fragmented payments ecosystems, and the need for greater digital literacy across various segments of the population.

03. Who are the major players in the Vietnam mobile payments market?

Leading players in the market include Momo, ZaloPay, VNPay, ViettelPay, and GrabPay, all of which have established strong user bases and partnerships.

04. What are the growth drivers of the Vietnam mobile payments market?

The market is being propelled by government efforts to promote digital financial inclusion, the rising e-commerce sector, and increasing consumer adoption of digital wallets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.