Vietnam Musical Instruments Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD10947

November 2024

92

About the Report

Vietnam Musical Instruments Market Overview

- The Vietnam Musical Instruments Market, valued at USD 700 million, has shown consistent growth. This expansion is driven by the increasing popularity of Western music genres, the revival of traditional Vietnamese instruments, and the widespread implementation of music education in schools. The rising income levels among younger populations in Vietnam have also led to higher demand for premium and imported musical instruments, fostering an upward trend in the market.

- Hanoi and Ho Chi Minh City are the dominant regions within Vietnams musical instruments market. This dominance is attributed to the concentration of music institutions, performance venues, and a higher consumer base in these cities. These cities are also hubs for cultural and musical events, which increase the demand for various instruments, from traditional Vietnamese types to high-end Western ones.

- In 2024, the Vietnamese government allocated $50 million for cultural preservation, including the promotion of traditional music. This funding supports programs for workshops, concerts, and festivals that increase the demand for traditional Vietnamese instruments and bolster sales within the domestic market.

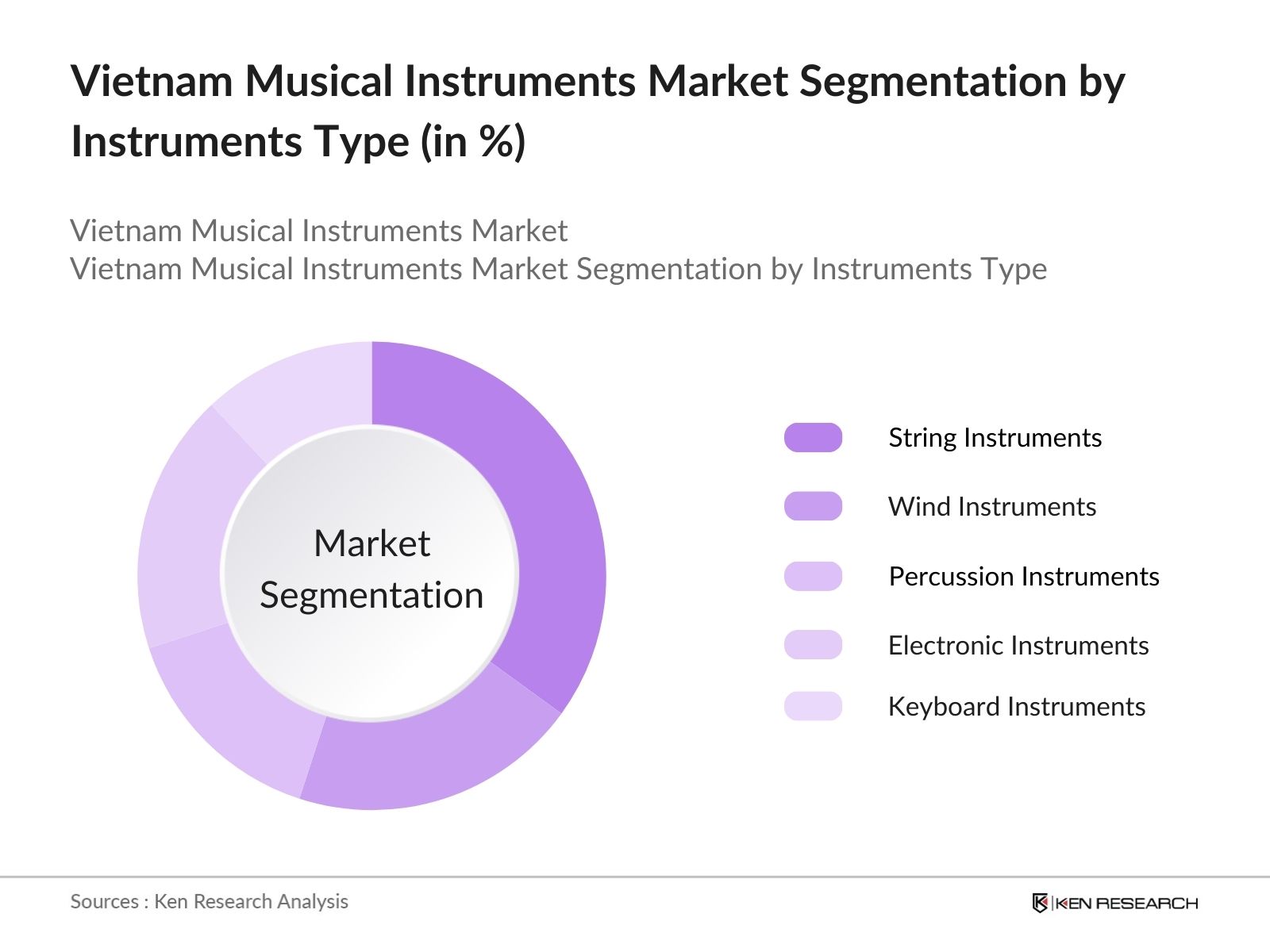

Vietnam Musical Instruments Market Segmentation

By Instrument Type: The market is segmented by instrument type into string instruments, wind instruments, percussion instruments, electronic instruments, and keyboard instruments. String instruments lead in market share, largely due to the popularity of traditional Vietnamese instruments like the n bu and n tranh, which have significant cultural importance. Additionally, Western string instruments, such as guitars, are widely favored among the youth, leading to a robust demand in this category.

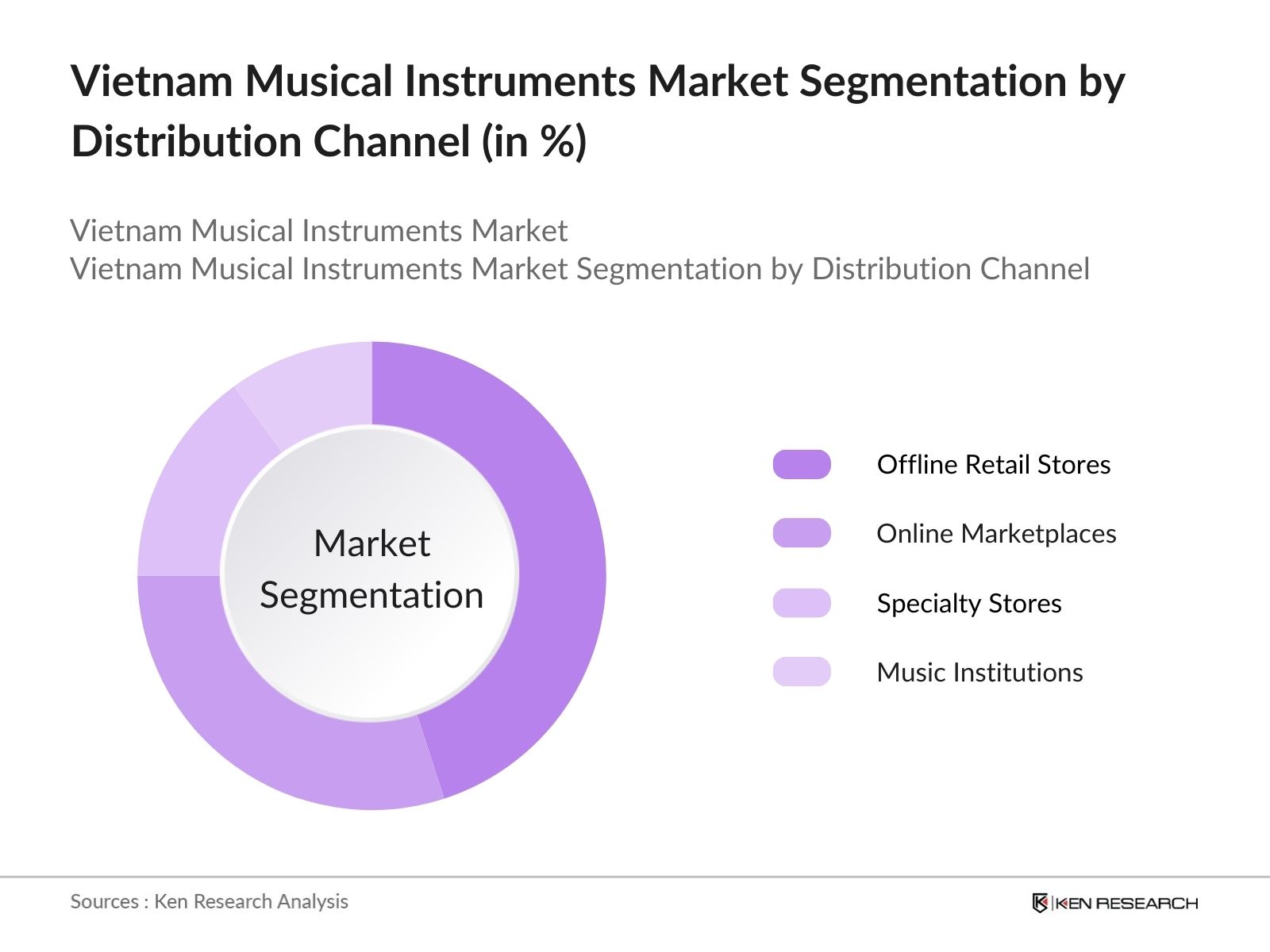

By Distribution Channel: The market is segmented by distribution channels into offline retail stores, online marketplaces, specialty stores, and music schools and institutions. Offline retail stores are the dominant distribution channel, as consumers often prefer to personally test and experience instruments before making a purchase. The presence of dedicated music stores in major cities further drives this segment, despite the growing popularity of online platforms for convenience.

Vietnam Musical Instruments Market Competitive Landscape

The market is dominated by both international and domestic players, each vying for a share of the diverse consumer segments. International brands like Yamaha and Roland are prominent in the electronic and keyboard categories, while domestic brands focus on traditional instruments.

Vietnam Musical Instruments Market Analysis

Market Growth Drivers

- Increasing Music Tourism: Vietnam's tourism industry attracts millions of visitors annually, and with recent government initiatives promoting Vietnamese culture, musical instrument sales have surged to meet tourist demand. In 2024, around 18 million tourists visited the country, many seeking traditional Vietnamese instruments, contributing to a demand increase for local products.

- Rising Popularity of Traditional Vietnamese Music in Education: Vietnams Ministry of Education and Training has integrated traditional music education into school curriculums. By 2024, over 2 million students are enrolled in programs incorporating traditional music, stimulating demand for instruments like the dan bau and dan tranh. This shift, supported by a government budget allocation of $150 million for arts education, drives up production and purchase of these instruments, providing steady growth for the market.

- Growing Demand for Music Entertainment Venues: As of 2024, more than 500 new music entertainment venues and cafes focusing on live traditional music performances have opened in cities such as Hanoi and Ho Chi Minh City. These venues invest in Vietnamese musical instruments, with an average purchase volume of 100 instruments per venue, amounting to thousands of units ordered annually from local manufacturers. This trend is boosting sales and production within the market.

Market Challenges

- High Production Costs Due to Material Scarcity: The musical instrument industry faces increased costs due to the scarcity of specific hardwoods and bamboo needed for traditional instruments, leading to higher production costs. Data from 2024 indicates that the cost of these materials rose by approximately $500 per ton, affecting the profitability and pricing of traditional instruments and posing a barrier for smaller manufacturers.

- Low Standardization Across Manufacturers: A lack of standardization in the production of Vietnamese musical instruments has led to quality discrepancies. In 2024, reports showed that over 30% of traditional instruments did not meet export quality standards, limiting market expansion internationally and leading to product returns valued at $2 million. The inconsistency hinders the competitiveness of Vietnamese instruments in international markets.

Vietnam Musical Instruments Market Future Outlook

Over the coming years, the Vietnam Musical Instruments industry is expected to expand further, supported by the growing music culture and government investments in arts and cultural education.

Future Market Opportunities

- Rise in Demand for Digital and Smart Instruments: Over the next five years, demand for smart and digital Vietnamese instruments is expected to grow, as manufacturers invest in integrating digital features. By 2030, it is projected that Vietnam will produce around 50,000 smart instruments annually, aimed at younger consumers interested in blending traditional music with modern technology.

- Expansion of International Distribution Networks: Vietnamese manufacturers are likely to establish more robust international distribution channels to enhance market reach. By 2030, exports of Vietnamese instruments could reach up to 400,000 units, spurred by global interest in cultural music and government initiatives supporting exports.

Scope of the Report

|

Instrument Type |

String Instruments Wind Instruments Percussion Instruments Electronic Instruments Keyboard Instruments |

|

Distribution Channel |

Offline Retail Stores Online Marketplaces Specialty Stores Music Schools and Institutions |

|

Price Range |

Economy Mid-Range Premium |

|

Application |

Professional Educational Household Commercial (e.g., Music Venues) |

|

Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Music Schools and Educational Institutions

Retailers and Specialty Stores

Online Musical Instrument Marketplaces

Professional Musicians and Performers

Instrument Manufacturers and Assemblers

Government and Regulatory Bodies (Ministry of Culture, Sports and Tourism)

Investors and Venture Capitalist Firms

Music Event Organizers and Studios

Companies

Players Mentioned in the Report:

Yamaha Corporation

Roland Corporation

Kawai Musical Instruments

Casio Electronics Co., Ltd.

Gibson Brands, Inc.

Fender Musical Instruments Corporation

Pearl Musical Instrument Company

Shure Incorporated

Behringer

Taylor Guitars

Table of Contents

- Vietnam Musical Instruments Market Overview

- 1.1 Definition and Scope

- 1.2 Market Taxonomy

- 1.3 Market Growth Rate

- 1.4 Market Segmentation Overview

- Vietnam Musical Instruments Market Size (In USD Mn)

- 2.1 Historical Market Size

- 2.2 Year-On-Year Growth Analysis

- 2.3 Key Market Developments and Milestones

- Vietnam Musical Instruments Market Analysis

- 3.1 Growth Drivers

- 3.1.1 Cultural Relevance and Revival of Traditional Instruments

- 3.1.2 Rising Popularity of Western Music Genres

- 3.1.3 Government Support for Arts and Music Education

- 3.1.4 Increased Disposable Income Among Young Adults

- 3.2 Market Challenges

- 3.2.1 High Import Tariffs on Certain Instruments

- 3.2.2 Lack of Skilled Workforce in Instrument Manufacturing

- 3.2.3 Competition from Low-Cost Imported Instruments

- 3.3 Opportunities

- 3.3.1 Expansion of Music Education in Schools

- 3.3.2 Growth of E-commerce in Musical Instruments Sales

- 3.3.3 Potential for Locally Produced Instruments in ASEAN

- 3.4 Trends

- 3.4.1 Adoption of Digital and Electronic Instruments

- 3.4.2 Increasing Demand for Custom and Handmade Instruments

- 3.4.3 Emergence of Instrument Rental Services

- 3.5 Government Regulation

- 3.5.1 Import and Export Regulations

- 3.5.2 Standards for Safety and Quality Control

- 3.5.3 Government Initiatives to Promote Local Craftsmanship

- 3.6 SWOT Analysis

- 3.7 Stake Ecosystem

- 3.8 Porters Five Forces

- 3.9 Competition Ecosystem

- 3.1 Growth Drivers

- Vietnam Musical Instruments Market Segmentation

- 4.1 By Instrument Type (In Value %)

- 4.1.1 String Instruments

- 4.1.2 Wind Instruments

- 4.1.3 Percussion Instruments

- 4.1.4 Electronic Instruments

- 4.1.5 Keyboard Instruments

- 4.2 By Distribution Channel (In Value %)

- 4.2.1 Offline Retail Stores

- 4.2.2 Online Marketplaces

- 4.2.3 Specialty Stores

- 4.2.4 Music Schools and Institutions

- 4.3 By Price Range (In Value %)

- 4.3.1 Economy

- 4.3.2 Mid-Range

- 4.3.3 Premium

- 4.4 By Application (In Value %)

- 4.4.1 Professional

- 4.4.2 Educational

- 4.4.3 Household

- 4.4.4 Commercial (e.g., Music Venues)

- 4.5 By Region (In Value %)

- 4.5.1 Northern Vietnam

- 4.5.2 Central Vietnam

- 4.5.3 Southern Vietnam

- 4.1 By Instrument Type (In Value %)

- Vietnam Musical Instruments Market Competitive Analysis

- 5.1 Detailed Profiles of Major Companies

- 5.1.1 Yamaha Corporation

- 5.1.2 Roland Corporation

- 5.1.3 Kawai Musical Instruments

- 5.1.4 Casio Electronics Co., Ltd.

- 5.1.5 Gibson Brands, Inc.

- 5.1.6 Fender Musical Instruments Corporation

- 5.1.7 Pearl Musical Instrument Company

- 5.1.8 Shure Incorporated

- 5.1.9 Behringer

- 5.1.10 Taylor Guitars

- 5.1.11 Samick Musical Instruments

- 5.1.12 Steinway & Sons

- 5.1.13 Ibanez Guitars

- 5.1.14 C.F. Martin & Co.

- 5.1.15 DAddario & Company

- 5.2 Cross Comparison Parameters (Production Volume, Distribution Reach, Product Range, Local Manufacturing Partnerships, Pricing Strategy, Innovation in Digital Instruments, Customer Satisfaction Ratings, Revenue from Asian Markets)

- 5.3 Market Share Analysis

- 5.4 Strategic Initiatives

- 5.5 Mergers and Acquisitions

- 5.6 Investment Analysis

- 5.7 Venture Capital Funding

- 5.8 Government Grants

- 5.9 Private Equity Investments

- 5.1 Detailed Profiles of Major Companies

- Vietnam Musical Instruments Market Regulatory Framework

- 6.1 Industry Safety Standards

- 6.2 Compliance Requirements

- 6.3 Certification Processes

- Vietnam Musical Instruments Future Market Size (In USD Mn)

- 7.1 Future Market Size Projections

- 7.2 Key Factors Driving Future Market Growth

- Vietnam Musical Instruments Future Market Segmentation

- 8.1 By Instrument Type (In Value %)

- 8.2 By Distribution Channel (In Value %)

- 8.3 By Price Range (In Value %)

- 8.4 By Application (In Value %)

- 8.5 By Region (In Value %)

- Vietnam Musical Instruments Market Analysts Recommendations

- 9.1 TAM/SAM/SOM Analysis

- 9.2 Customer Cohort Analysis

- 9.3 Marketing Initiatives

- 9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step focuses on identifying and categorizing the critical stakeholders within the Vietnam Musical Instruments Market. Extensive desk research and the use of proprietary databases are utilized to gather information on market dynamics, which provides the foundation for identifying influential market variables.

Step 2: Market Analysis and Construction

In this stage, historical data is collected and analyzed to understand the markets performance over recent years. Market penetration, distribution channels, and instrument preference data are evaluated to estimate revenue and market shares.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are formulated and validated through consultations with experts from various segments, including instrument manufacturers and distributors. These consultations offer valuable insights into market trends and consumer preferences.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating insights from both primary and secondary research to ensure an accurate and comprehensive analysis. Direct interactions with manufacturers help verify data, ensuring the accuracy of the reports findings.

Frequently Asked Questions

1. How big is the Vietnam Musical Instruments Market?

The Vietnam Musical Instruments Market is valued at USD 700 million, with growth influenced by increasing consumer interest in music education and cultural engagement.

2. What are the challenges in the Vietnam Musical Instruments Market?

Challenges in the Vietnam Musical Instruments Market include high import tariffs on certain instruments, competition from low-cost imports, and the lack of local manufacturing for specific categories.

3. Who are the major players in the Vietnam Musical Instruments Market?

Key players in the Vietnam Musical Instruments Market include Yamaha, Roland, Kawai, Casio, and Fender. These companies dominate due to their brand reputation, diverse product offerings, and strong distribution networks.

4. What are the growth drivers in the Vietnam Musical Instruments Market?

Growth in the Vietnam Musical Instruments Market is driven by the increasing interest in music education, rising disposable incomes, and the influence of Western music, which boosts demand for both traditional and modern instruments

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.