Vietnam Online Loan & P2P Lending Market Overview

- The Vietnam Online Loan & P2P Lending Market is valued at USD 1.2 billion, based on a five-year historical analysis. Growth is primarily driven by increasing demand for quick and accessible financial solutions among consumers and small businesses, as well as the rapid expansion of digital platforms facilitating lending processes. The market has experienced a notable rise in participation from both borrowers and lenders, reflecting a broad shift toward online financial services and alternative credit channels. Key drivers include rising smartphone penetration, government support for digital finance, and the emergence of new fintech models that streamline lending and improve access for underserved populations .

- Key cities such as Ho Chi Minh City and Hanoi continue to dominate the market due to their high population density, robust economic activity, and advanced technological adoption. These urban centers benefit from a growing middle class and a vibrant startup ecosystem, which foster innovation in financial services. The concentration of financial institutions, fintech companies, and digital infrastructure in these areas further enhances their leadership in the online loan and P2P lending landscape .

- In 2023, the Vietnamese government introduced a regulatory framework to enhance consumer protection in the online lending sector. The framework, formalized under Decree No. 19/2023/ND-CP issued by the State Bank of Vietnam, mandates transparency in lending practices, sets limits on interest rates, and establishes a licensing system for online lenders. These measures are designed to promote responsible lending, safeguard borrowers from predatory practices, and ensure compliance with operational standards, thereby fostering a more sustainable and secure lending environment .

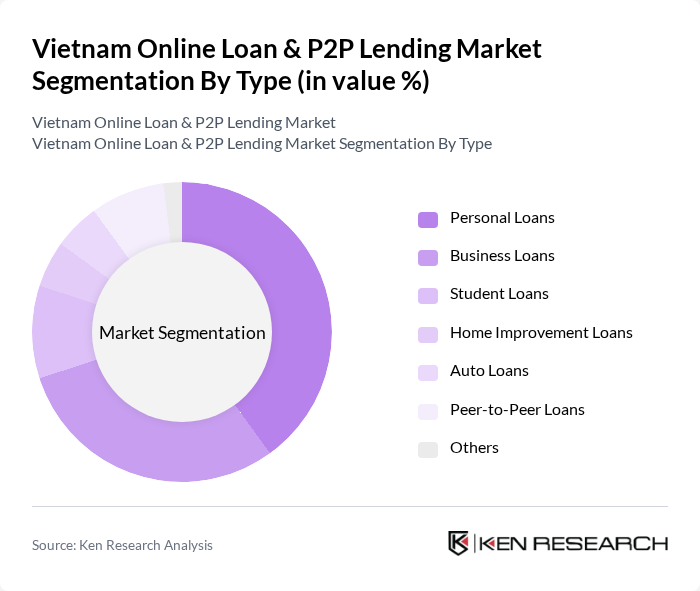

Vietnam Online Loan & P2P Lending Market Segmentation

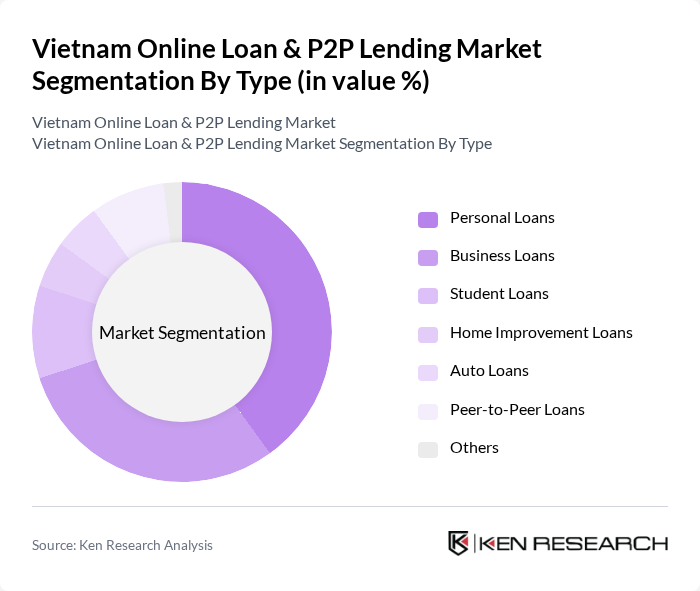

By Type:The market is segmented into Personal Loans, Business Loans, Student Loans, Home Improvement Loans, Auto Loans, Peer-to-Peer Loans, and Others. Personal Loans remain the most dominant segment, driven by increasing demand for individual financing solutions for personal expenses, emergencies, and consumption. Business Loans follow closely, as small and medium enterprises seek funding for operational costs and expansion. The ongoing digitalization of financial services has also accelerated the growth of Peer-to-Peer Loans, which offer competitive rates and flexible terms, appealing to both borrowers and lenders seeking alternatives to traditional banking channels .

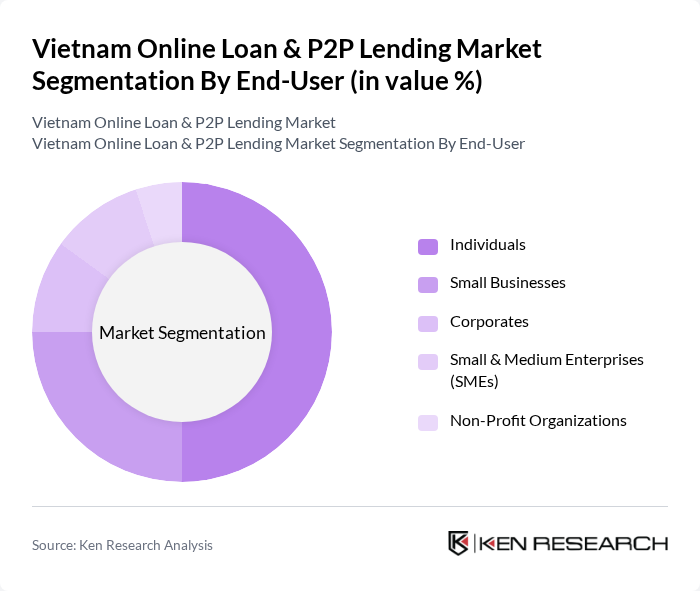

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, Small & Medium Enterprises (SMEs), and Non-Profit Organizations. Individuals represent the largest segment, seeking loans for personal needs such as education, healthcare, and consumption. Small Businesses and SMEs are significant contributors, requiring funding for operational expenses and growth initiatives. The increasing digital literacy and smartphone adoption among these groups have facilitated broader access to online lending platforms, driving market expansion .

Vietnam Online Loan & P2P Lending Market Competitive Landscape

The Vietnam Online Loan & P2P Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo, Tima, VayMuon, Trusting Social, Lendbiz, Finhay, VNDIRECT, Mcredit, Home Credit Vietnam, FE Credit, VPBank, BIDV, Agribank, Sacombank, TPBank, VietinBank, Moca, ZaloPay contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Online Loan & P2P Lending Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Vietnam's smartphone penetration rate is projected to reach 85%, with approximately 80 million smartphone users. This surge facilitates easier access to online loan platforms, enabling consumers to apply for loans directly from their devices. The World Bank reports that mobile internet usage has increased by 30% in the last two years, further driving the adoption of digital lending solutions among the tech-savvy population.

- Rising Demand for Quick Access to Credit:In future, the demand for quick credit solutions is expected to rise, with an estimated 40% of Vietnamese adults seeking instant loans. The average loan processing time has decreased to under 24 hours, making online lending an attractive option. According to the State Bank of Vietnam, the total outstanding loans in the consumer finance sector reached 1.5 trillion VND, reflecting a growing appetite for accessible credit.

- Growth of Digital Payment Systems:Vietnam's digital payment transactions are projected to exceed 1.2 billion in future, driven by the increasing adoption of e-wallets and online banking. The government aims to promote cashless transactions, with a target of 50% of all payments being digital by future. This shift supports the online lending ecosystem, as seamless payment options enhance the user experience and encourage more borrowers to engage with digital loan platforms.

Market Challenges

- Regulatory Compliance Issues:The online lending sector in Vietnam faces significant regulatory hurdles, with over 60% of lenders struggling to meet compliance requirements. The government has implemented stringent licensing regulations, which have resulted in delays for new entrants. As of future, only 30% of P2P lenders have obtained the necessary licenses, limiting market growth and creating barriers for potential investors looking to enter the space.

- High Default Rates:The average default rate in Vietnam's online lending market is estimated at 15%, posing a significant risk to lenders. Economic fluctuations and limited credit histories contribute to this challenge, making it difficult for lenders to assess borrower risk accurately. The high default rates not only impact profitability but also deter potential investors from entering the market, stifling growth opportunities.

Vietnam Online Loan & P2P Lending Market Future Outlook

The future of Vietnam's online loan and P2P lending market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more individuals are likely to embrace online lending solutions. Additionally, the integration of AI and big data analytics will enhance credit scoring models, allowing lenders to make informed decisions. The government's supportive policies aimed at fostering financial inclusion will further stimulate market growth, creating a conducive environment for innovation and competition. Vietnam's GDP growth is projected at 6.6% in future, supported by strong export performance and manufacturing growth, which provides a favorable economic environment for the lending sector.

Market Opportunities

- Expansion into Rural Areas:With approximately 70% of Vietnam's population residing in rural regions, there is a significant opportunity for online lenders to tap into this underserved market. By offering tailored loan products that cater to the unique needs of rural borrowers, lenders can increase their customer base and drive financial inclusion in these areas.

- Development of Tailored Loan Products:The demand for customized loan products is on the rise, with 60% of consumers expressing interest in loans designed for specific purposes, such as education or agriculture. By leveraging data analytics, lenders can create targeted offerings that meet the diverse needs of borrowers, enhancing customer satisfaction and loyalty while driving growth in the sector.