Region:Asia

Author(s):Dev

Product Code:KRAA4905

Pages:81

Published On:September 2025

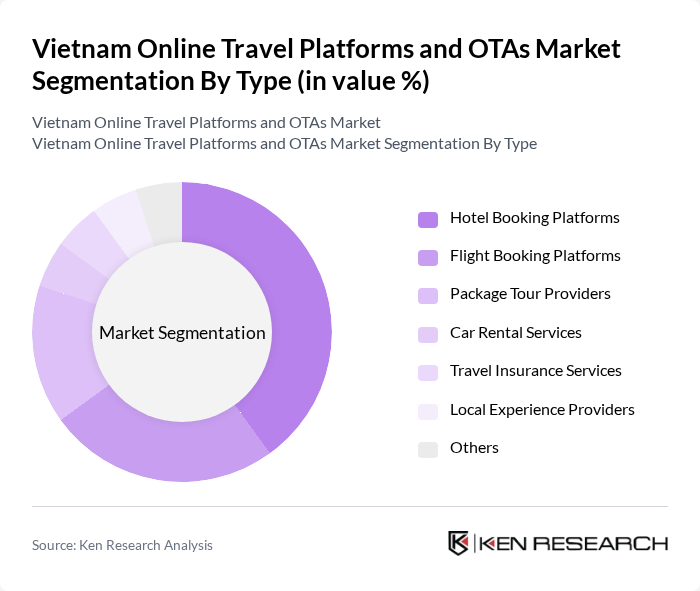

By Type:The market is segmented into various types, including Hotel Booking Platforms, Flight Booking Platforms, Package Tour Providers, Car Rental Services, Travel Insurance Services, Local Experience Providers, and Others. Among these, Hotel Booking Platforms are the most dominant, driven by the increasing number of domestic and international travelers seeking accommodation options. The convenience of online booking and the availability of diverse options contribute to their popularity.

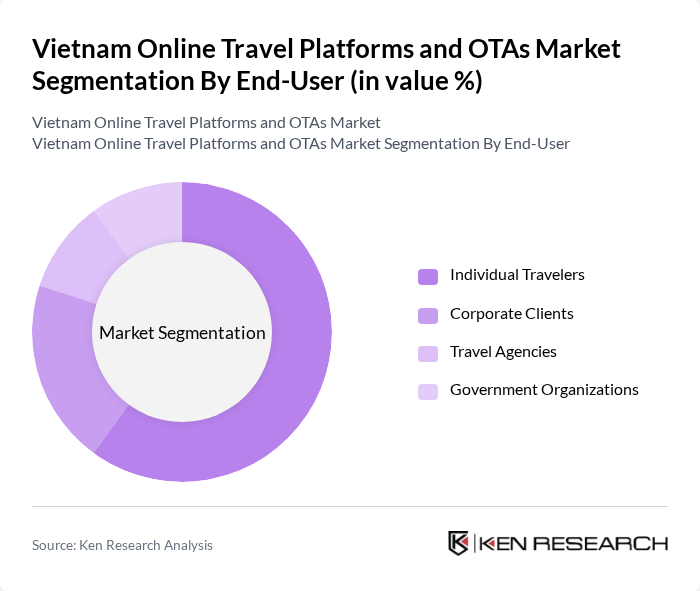

By End-User:The end-user segmentation includes Individual Travelers, Corporate Clients, Travel Agencies, and Government Organizations. Individual Travelers represent the largest segment, driven by the growing trend of personalized travel experiences and the increasing use of mobile applications for booking. This segment's growth is fueled by the rise of social media and online reviews, influencing consumer choices.

The Vietnam Online Travel Platforms and OTAs Market is characterized by a dynamic mix of regional and international players. Leading participants such as VietTravel, Traveloka, Agoda, Booking.com, Expedia, Tugo, Mytour, Vntrip, Chudu24, VietJet Air, Phong Nha Travel, Saigon Tourist, FPT Travel, Vietnam Airlines, TripAdvisor contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam online travel market is poised for significant growth, driven by technological advancements and changing consumer preferences. As mobile payment solutions become more prevalent, the ease of booking travel online will likely increase. Additionally, the rise of personalized travel experiences and eco-tourism will shape the market landscape. Companies that leverage data analytics and AI to enhance customer service will gain a competitive edge, positioning themselves favorably in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Hotel Booking Platforms Flight Booking Platforms Package Tour Providers Car Rental Services Travel Insurance Services Local Experience Providers Others |

| By End-User | Individual Travelers Corporate Clients Travel Agencies Government Organizations |

| By Sales Channel | Direct Online Sales Third-Party Aggregators Mobile Applications Offline Travel Agents |

| By Customer Segment | Leisure Travelers Business Travelers Group Travelers Solo Travelers |

| By Payment Method | Credit/Debit Cards Mobile Wallets Bank Transfers Cash Payments |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Urban Areas Rural Areas |

| By Travel Type | Domestic Travel International Travel Business Travel Adventure Travel |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Travel Users | 150 | Frequent Travelers, Business Travelers |

| International Travel Users | 100 | Leisure Travelers, Expatriates |

| OTA Service Providers | 80 | Product Managers, Marketing Directors |

| Travel Agency Representatives | 70 | Agency Owners, Travel Consultants |

| Tourism Board Officials | 50 | Policy Makers, Tourism Development Managers |

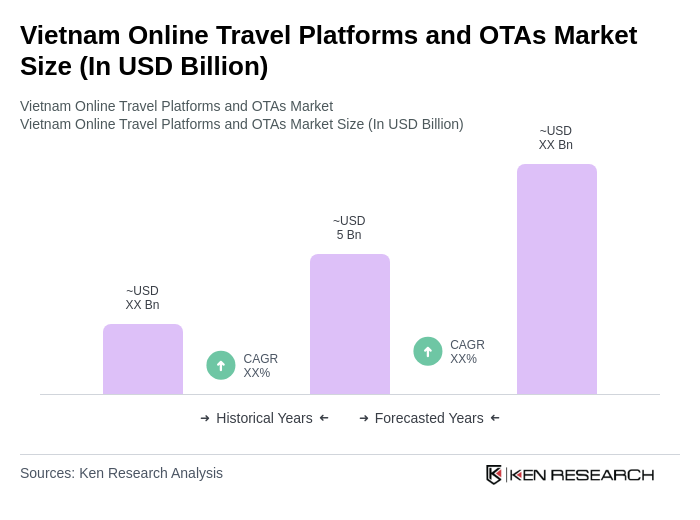

The Vietnam Online Travel Platforms and OTAs market is valued at approximately USD 5 billion, reflecting significant growth driven by increased digital technology adoption and a rise in both domestic and international travel preferences.